Fast Moving Consumer Goods (FMCG) Market Size, Share, Report 2034

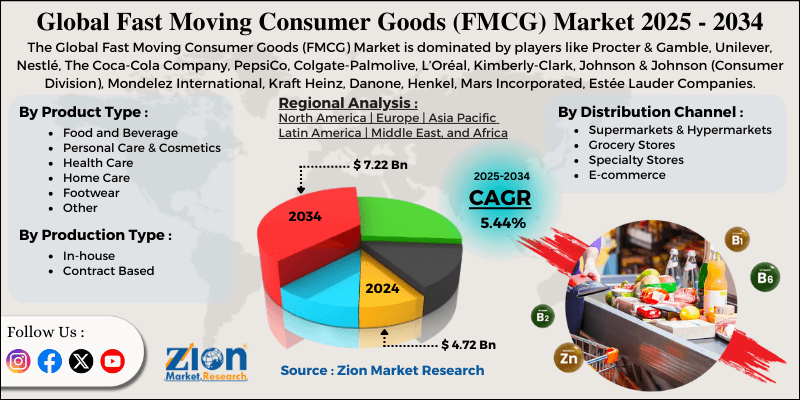

Fast Moving Consumer Goods (FMCG) Market By Product Type (Food and Beverage, Personal Care and Cosmetics, Health Care, Home Care, Footwear, and Other), By Production Type (In-house, Contract Based), By Distribution Channel (Supermarkets and Hypermarkets, Grocery Stores, Specialty Stores, E-commerce, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

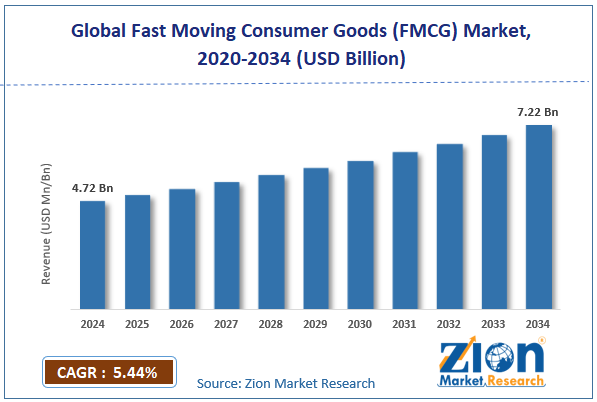

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.72 Billion | USD 7.22 Billion | 5.44% | 2024 |

Fast Moving Consumer Goods (FMCG) Industry Perspective:

What will be the size of the global fast moving consumer goods (FMCG) market during the forecast period?

The global fast moving consumer goods (FMCG) market size was around USD 4.72 billion in 2024 and is projected to reach USD 7.22 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.44% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global fast moving consumer goods (FMCG) market is estimated to grow annually at a CAGR of around 5.44% over the forecast period (2025-2034)

- In terms of revenue, the global fast moving consumer goods (FMCG) market was valued at around USD 4.72 billion in 2024 and is projected to reach USD 7.22 billion by 2034.

- The fast moving consumer goods (FMCG) market is projected to grow significantly, driven by rising disposable incomes, younger consumer demographics, and product premiumization.

- Based on product type, the food and beverage segment is expected to lead the market, while the personal care and cosmetics segment is expected to grow considerably.

- Based on production type, the in-house segment is the dominating segment, while the contract based segment is projected to witness sizeable revenue over the forecast period.

- Based on the distribution channel, the grocery stores segment is expected to lead the market, followed by the supermarkets and hypermarkets segment.

- By region, Asia Pacific is projected to dominate the global market during the forecast period, followed by North America.

Fast Moving Consumer Goods (FMCG) Market: Overview

Fast-moving consumer goods are everyday-use products that sell quickly at comparatively low prices, such as household cleaning products, toiletries, food and beverages, and personal care items. These goods have short shelf lives, are in high demand, and are frequently purchased by consumers. The global fast moving consumer goods (FMCG) market is poised for notable growth driven by rising disposable incomes, urbanization, lifestyle changes, and population growth. Increasing income levels allow consumers to spend more on premium and branded FMCG products. This augments volume consumption and value growth. Developing countries benefit the most from this trend.

Moreover, urban lifestyles demand hygiene, convenience, and ready-to-use products. This fuels demand for personal care, packaged foods, and household items. Time-saving items gain strong consumer preference. Furthermore, a growing population increases demand for essential consumer goods. FMCG products remain necessitates irrespective of economic conditions. This promises recurring and steady consumption.

Nevertheless, the global market faces constraints due to factors such as intense competition, high price sensitivity, and fluctuating raw-material prices. Several players compete in quality and price segments. This lowers brand differentiation and pricing power. Profit margins stay under constant pressure. Consumers mostly prefer products based on affordability. Frequent price hikes can lead to brand switching. This restricts companies’ ability to pass on growing costs. Likewise, volatility in commodity prices raises production costs. Profitability becomes unpredictable for manufacturers. Long-term pricing strategies grow challenging.

Still, the global fast moving consumer goods (FMCG) industry benefits from several favorable factors, such as the premium product segment, sustainable, eco-friendly products, and health-oriented FMCG products. Consumers increasingly seek aspirational, high-end products. Premium offerings offer better margins for companies. Brand perception holds a significant role in growth. Green products attract eco-conscious consumers. Sustainable packaging boosts brand image. This offers fresh differentiation opportunities. Additionally, the demand for functional and organic products is growing. Health benefits influence purchase decisions strongly. This segment offers substantial growth potential.

Fast Moving Consumer Goods (FMCG) Market: Dynamics

Growth Drivers

How are evolving consumer preferences for health, wellness & sustainability fueling the fast moving consumer goods (FMCG) market?

Modern consumers increasingly prioritize health-centric, eco-friendly products, fueling demand for clean-label, organic, and functional offerings across beverages, food, and personal care. Awareness around wellness continues to transform purchasing behavior, fueling FMCG companies to innovate products that support immunity-boosting, nutritionally fortified, and plant-based trends. Sustainability has evolved from a brand differentiator to an essential expectation, where recyclable packaging and responsible sourcing impact purchase decisions. This inclination is changing product portfolios in worldwide and regional players, leading to stronger premium segment growth and consumer loyalty.

How is the fast moving consumer goods (FMCG) market driven by innovation in supply chain, logistics & technology?

FMCG supply chains are now being reimagined with technologies such as warehouse automation, real-time inventory tracking, and AI-based forecasting to cut costs and improve responsiveness. Tech integrations like predictive analytics and IoT are enhancing delivery precision and demand forecast, aiding brands in tackling climate-related and geopolitical disturbances. Digital traceability and smart logistics also boost quality assurance and transparency in the product lifecycle. As companies scale these advancements, operational efficiency gains are feeding directly into margin resilience and competitive advantage, impacting the global fast moving consumer goods (FMCG) market.

Restraints

Distribution inefficiencies in emerging regions unfavorably impact the market progress

While the rural market shows growth potential, fragmented ecosystems and challenging last-mile logistics restrain product penetration and profitability. Infrastructural gaps, such as inconsistent electricity, poor roads, and underdeveloped cold chains, limit the preservation of quality and the reliable delivery of perishable goods. These inefficiencies raise costs and complicate forecasting, often leading to inventory imbalances. Smaller retailers may also lack digital POS systems, hindering real-time insights and effective replenishment.

Opportunities

How do sustainability-driven business models present favorable prospects for the fast moving consumer goods (FMCG) market development?

While environmental expectations are a limitation, they also unveil opportunities for dominance in sustainability innovation. Refillable packaging, waste-to-value initiatives, and biodegradable materials attract eco-conscious consumers and can secure long-term loyalty. Circular economy associations with recyclers and suppliers generate positive branding and operational efficiencies. Sustainable practices also appeal to ESG-focused investors who seek responsible growth, thereby favoring the fast moving consumer goods (FMCG) industry.

Challenges

Sustainability costs and ROI pressures restrict the market growth

Although sustainability investments are strategically crucial, proving their financial returns remains a challenge, especially in cost-sensitive regions. Higher input costs for eco-friendly or recycled components can strain architecture built on low unit economics. Balancing sustainability goals with affordable pricing demands careful prioritization and advancement. Without a clear ROI, stakeholder support for long-term initiatives may decrease.

Fast Moving Consumer Goods (FMCG) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fast Moving Consumer Goods (FMCG) Market |

| Market Size in 2024 | USD 4.72 Billion |

| Market Forecast in 2034 | USD 7.22 Billion |

| Growth Rate | CAGR of 5.44% |

| Number of Pages | 212 |

| Key Companies Covered | Procter & Gamble, Unilever, Nestlé, The Coca-Cola Company, PepsiCo, Colgate-Palmolive, L’Oréal, Kimberly-Clark, Johnson & Johnson (Consumer Division), Mondelez International, Kraft Heinz, Danone, Henkel, Mars Incorporated, Estée Lauder Companies, and others. |

| Segments Covered | By Product Type, By Production Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fast Moving Consumer Goods (FMCG) Market: Segmentation

The global fast moving consumer goods (FMCG) market is segmented by product type, production type, distribution channel, and region.

Based on product type, the global fast moving consumer goods (FMCG) industry is divided into food and beverage, personal care and cosmetics, health care, home care, footwear, and other categories. The food and beverages segment leads with 55% of the total market due to their essential nature and daily consumption. High demand in all demographics promises repeat purchases and steady sales. The segment comprises packaged foods, beverages, snacks, and convenience foods.

Conversely, personal care and cosmetics rank second with 25% of the market. This is driven by consumer focus on grooming, hygiene, and appearance. Growing disposable incomes and lifestyle awareness drive demand for beauty products, haircare, and skincare. Brand differentiation and innovation play a major role in maintaining industry growth.

Based on production type, the global fast moving consumer goods (FMCG) market is segmented into in-house and contract-based production. The in-house segment dominates with 96% market share, as companies maintain complete control over processes, proprietary formulations, and quality. It promises consistent supply and brand integrity in all products. Large FMCG companies depend on this model for high-volume and critical items.

Nonetheless, the contract-based production segment accounts for 10% of the market, enabling companies to outsource manufacturing to lower costs and expand capacity quickly. It offers flexibility to enter a new market without a large investment in facilities. Several brands use this approach for non-core or regional products.

Based on distribution channel, the global market is segmented into supermarkets and hypermarkets, grocery stores, specialty stores, e-commerce, and others. The grocery segment accounts for 40% of the total market due to its convenience and wide presence for everyday purchases. They cater to frequent, small-quantity buying patterns in both rural and urban areas. Their accessibility makes them the primary choice for important consumer goods.

However, the supermarkets and hypermarkets segment captures 35% of the market, offering a wide variety of products and organized shopping experiences. They appeal to consumers seeking bulk purchases, premium products, and promotions. These channels are especially popular among upper and middle-income shoppers.

Supermarkets and hypermarkets rank second at 35%, offering a wide variety of products and organized shopping experiences. They attract consumers seeking bulk purchases, promotions, and premium products. These channels are especially popular among middle- and upper-income shoppers.

Fast Moving Consumer Goods (FMCG) Market: Regional Analysis

Why is Asia Pacific outperforming other regions in the global Fast Moving Consumer Goods (FMCG) Market?

Asia Pacific is projected to maintain its dominant position with a 7-8% CAGR in the global fast moving consumer goods (FMCG) market, driven by a massive consumer base, rapid urbanization, rising disposable incomes, an expanding middle class, and strong e-commerce and digital adoption. APAC has a large consumer base of billions, mainly in India, China, and Southeast Asia, driving high volumes of fast-moving consumer goods. This wider base keeps the APAC market growing faster than other regions.

Moreover, income levels are rising in APAC, lifting millions into the middle class and boosting spending on everyday consumer goods. As purchasing power increases, consumers buy higher-value and more varied FMCG products. This trend drives both value and volume growth for personal care, food, and household items. Furthermore, e-commerce is speedily expanding in APAC, with online FMCG sales surging significantly and reshaping distribution models. Mobile apps, quick commerce, and social commerce make FMCG products easily accessible even in remote areas. Digital platforms accelerate sales and improve customer reach in multiple markets.

North America maintains its position as the second-largest region, with a 3-4% CAGR in the global fast moving consumer goods (FMCG) industry, driven by a large market share, a developed consumption base, strong consumer purchasing power, premium demand, and an advanced retail and distribution infrastructure. North America accounts for a major share of the global market due to high per-capita consumption of key goods. Consumers consistently purchase beverages, food, personal care, and household items. The US, as the largest contributor, promises a stable and developed market.

Moreover, high disposable incomes allow consumers to buy both premium and basic FMCG products. There is a surging preference for health-oriented, organic, and value-added goods. This fuels higher revenue per-unit and strengthens market value. Additionally, mature retail networks, comprising convenience stores, supermarkets, and e-commerce platforms, promise broad product availability. Efficient logistics and omni-channel distribution improve consumer reach and sales. Online shopping trends further expand convenience and access.

Fast Moving Consumer Goods (FMCG) Market: Competitive Analysis

The leading players in the global fast moving consumer goods (FMCG) market are:

- Procter & Gamble

- Unilever

- Nestlé

- The Coca-Cola Company

- PepsiCo

- Colgate-Palmolive

- L’Oréal

- Kimberly-Clark

- Johnson & Johnson (Consumer Division)

- Mondelez International

- Kraft Heinz

- Danone

- Henkel

- Mars Incorporated

- Estée Lauder Companies

What are the key trends in the global Fast Moving Consumer Goods (FMCG) Market?

Omni‑channel & e‑commerce growth:

Online FMCG sales continue to expand as consumers appreciate convenience, wider product choice, and fast delivery. Retailers are integrating digital and physical channels to offer a smooth shopping experience. Mobile shopping and social commerce are gaining traction.

Personalization & digital engagement:

FMCG brands are leveraging AI and data analytics to tailor marketing and product recommendations to individual consumers. Customized promotions, loyalty apps, and targeted ads increase repeat purchases and engagement. Digital platforms allow direct interaction and strong brand relationships.

The global fast moving consumer goods (FMCG) market is segmented as follows:

By Product Type

- Food and Beverage

- Personal Care and Cosmetics

- Health Care

- Home Care

- Footwear

- Other

By Production Type

- In-house

- Contract Based

By Distribution Channel

- Supermarkets and Hypermarkets

- Grocery Stores

- Specialty Stores

- E-commerce

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Which key factors will influence the fast moving consumer goods (FMCG) market growth over 2025-2034?

What are the emerging trends and innovations impacting the fast moving consumer goods (FMCG) market?

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed