Biodegradable Packaging Material Market Size, Share, Trends, Growth 2034

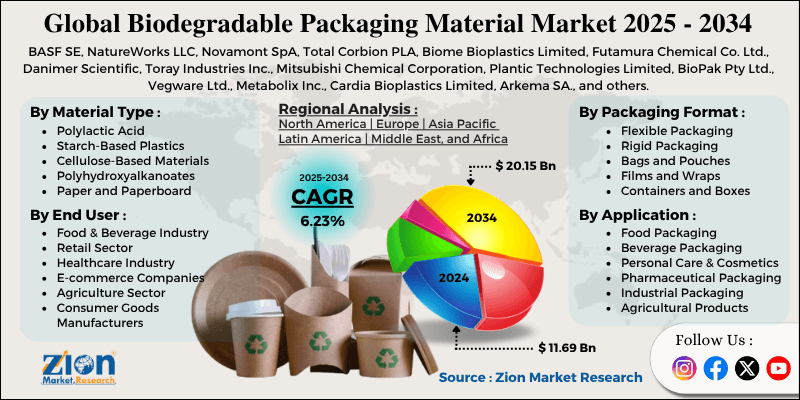

Biodegradable Packaging Material Market By Material Type (Polylactic Acid, Starch-Based Plastics, Cellulose-Based Materials, Polyhydroxyalkanoates, Paper and Paperboard, and Others), By Application (Food Packaging, Beverage Packaging, Personal Care and Cosmetics, Pharmaceutical Packaging, Industrial Packaging, Agricultural Products), By End-User (Food and Beverage Industry, Retail Sector, Healthcare Industry, E-commerce Companies, Agriculture Sector, Consumer Goods Manufacturers), By Packaging Format (Flexible Packaging, Rigid Packaging, Bags and Pouches, Films and Wraps, Containers and Boxes, Labels and Tags), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

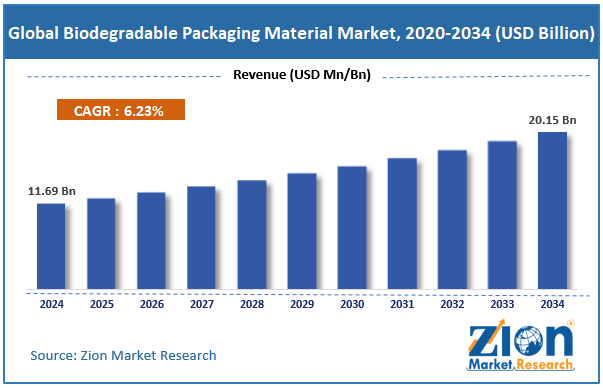

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.69 Billion | USD 20.15 Billion | 6.23% | 2024 |

Biodegradable Packaging Material Industry Perspective:

The global biodegradable packaging material market size was worth approximately USD 11.69 billion in 2024 and is projected to grow to around USD 20.15 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.23% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global biodegradable packaging material market is estimated to grow annually at a CAGR of around 6.23% over the forecast period (2025-2034).

- In terms of revenue, the global biodegradable packaging material market size was valued at approximately USD 11.69 billion in 2024 and is projected to reach USD 20.15 billion by 2034.

- The biodegradable packaging material market is projected to grow significantly due to the increasing environmental awareness, stringent plastic waste regulations, and rising consumer demand for sustainable packaging solutions.

- Based on material type, the polylactic acid segment is expected to lead the biodegradable packaging material market, while the polyhydroxyalkanoates segment is anticipated to experience significant growth.

- Based on application, the food packaging segment is expected to lead the biodegradable packaging material market, while the pharmaceutical packaging segment is anticipated to witness notable growth.

- Based on end-user, the food and beverage industry segment is the dominating segment, while the e-commerce companies segment is projected to witness sizeable revenue over the forecast period.

- Based on packaging format, the flexible packaging segment is expected to lead the market compared to the labels and tags segment.

- Based on region, Europe is projected to dominate the global biodegradable packaging material market during the estimated period, followed by North America.

Biodegradable Packaging Material Market: Overview

Biodegradable packaging materials are packaging solutions made from natural substances that can fully break down through biological processes without harming the environment. They decompose into water, carbon dioxide, and organic matter when exposed to microorganisms, moisture, and oxygen, leaving no toxic residue or microplastics. These materials are often made from renewable sources such as corn starch, sugarcane, cellulose, and plant oils. They are available in various forms, including films, containers, wrapping sheets, and cushioning materials for different product needs. Despite being eco-friendly, they provide essential protective qualities like strength, durability, and moisture resistance during shelf life. Food brands use biodegradable packaging to keep products fresh and support sustainable practices. Retailers prefer compostable bags and containers to reduce plastic waste and strengthen brand image.

The pharmaceutical sector is adopting biodegradable options to reduce its environmental impact, while e-commerce platforms utilize plant-based mailers and fillers to manage the rising issue of packaging waste. Growing government regulations on single-use plastics and increasing consumer awareness about pollution are encouraging the use of biodegradable alternatives.

The increasing environmental concerns and regulatory pressures to reduce plastic waste are expected to drive growth in the biodegradable packaging material market throughout the forecast period.

Biodegradable Packaging Material Market Dynamics

Growth Drivers

Growing environmental awareness and plastic pollution concerns

The biodegradable packaging material market is growing quickly as global awareness about plastic pollution and environmental damage reaches very high levels. Scientific studies show plastic building up in oceans, soil, and even human bodies, motivating consumers to choose sustainable options. Images of sea animals harmed by plastic waste create strong emotional reactions and influence buying behavior toward eco-friendly products. Environmental groups run campaigns against single-use plastics, shaping public opinion and business actions. Schools and colleges teach students about sustainability, creating long-term change in consumer values.

Social media spreads environmental messages widely, making greenwashing difficult and highlighting genuine sustainability efforts. Investors evaluate companies based on their environmental, social, and governance (ESG) performance, encouraging businesses to adopt sustainable practices. Large retail chains announce plastic reduction goals, increasing demand for biodegradable packaging across their supply chains.

How are government regulations and policy initiatives driving the biodegradable packaging material market growth?

The global biodegradable packaging material market is growing strongly as governments worldwide introduce strict rules focused on plastic waste reduction and promoting environmental protection. The European Union has set detailed directives banning many single-use plastic items and setting recycling targets favoring biodegradable options. Countries, including Canada and India, among others, have introduced nationwide bans on specific plastic products. Extended producer responsibility programs make manufacturers responsible for packaging waste, encouraging a shift toward biodegradable choices.

Tax benefits and subsidies support businesses using sustainable packaging solutions, thereby reducing barriers to adoption. Public procurement policies in many regions prioritize suppliers using environmentally friendly packaging materials. Landfill taxes and waste disposal fees make biodegradable packaging more cost-effective compared with traditional plastics. The combined regulatory actions across various levels of government are creating strong market drivers and accelerating the use of biodegradable packaging across industries and regions.

Restraints

How are higher production costs and performance limitations creating restraints for the biodegradable packaging material market?

A major challenge for the biodegradable packaging material market is the high production cost compared with conventional plastics, along with performance limitations in demanding uses. Raw materials for biodegradable packaging typically cost more than those for petroleum-based plastics due to their smaller production volumes and more complex processing requirements. Manufacturing bioplastics often requires special equipment and technical skills, increasing capital investment. Limited production scale prevents economies of scale, which makes conventional plastics cheap. Some biodegradable materials offer lower barrier protection against moisture, oxygen, and oils compared with traditional plastics, reducing suitability for certain products.

Temperature sensitivity affects some bioplastics, causing deformation or quality loss under heat that conventional packaging materials can handle easily. Shelf life issues appear when packaging begins to break down before products reach consumers, especially in humid conditions. Mechanical strength limitations make some biodegradable materials unsuitable for heavy or sharp items needing strong protection. These cost and performance issues create hesitation among manufacturers and require continuous research and development efforts to overcome market barriers.

Opportunities

How is expanding e-commerce and online retail creating new opportunities for the biodegradable packaging material market?

The biodegradable packaging material industry is seeing strong growth opportunities due to the rapid rise of e-commerce and evolving online shopping habits across the world. Online retail generates substantial volumes of packaging waste from shipping boxes, protective fillers, mailers, and cushioning materials, which has heightened environmental concerns among consumers and regulators. People receiving frequent deliveries each week are more aware of packaging waste piling up in their homes, leading to higher demand for eco-friendly options.

E-commerce companies face reputational risk from excessive packaging and are choosing sustainable materials to strengthen brand image and meet consumer expectations. Unboxing experiences shared on social media can create valuable marketing benefits for brands that utilize attractive, eco-friendly packaging, thereby enhancing overall customer satisfaction.

Subscription box services use biodegradable packaging to stand out in a competitive market and appeal to environmentally conscious customers who value sustainability. Returns and exchanges in online shopping require additional packaging, where reusable or biodegradable solutions offer practical and environmental benefits. Packaging return programs and refill models using biodegradable materials are emerging as circular economy solutions for online retail.

Challenges

Limited composting infrastructure and consumer awareness issues

The biodegradable packaging material industry faces major challenges linked to weak waste management infrastructure and limited consumer understanding of proper disposal. Many biodegradable materials need industrial composting facilities with controlled temperature and humidity to break down correctly. Such specialized composting facilities exist in small numbers, especially in developing regions and rural locations. Home composting systems usually lack suitable conditions to break down many commercial biodegradable plastics effectively. Consumers often struggle to tell the difference between truly biodegradable materials and conventional plastics with misleading marketing claims. Confusion over terms such as biodegradable, compostable, and recyclable leads to incorrect disposal in the wrong waste streams.

Biodegradable packaging placed in recycling bins by mistake can contaminate recycling processes and reduce the recovery rates of plastics. Materials ending up in regular landfills may take many years to decompose due to oxygen-poor conditions. Education campaigns require a large investment to reach diverse populations with different levels of environmental awareness. The visual similarity between biodegradable and conventional plastics makes sorting difficult for consumers and waste management staff.

Biodegradable Packaging Material Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Biodegradable Packaging Material Market |

| Market Size in 2024 | USD 11.69 Billion |

| Market Forecast in 2034 | USD 20.15 Billion |

| Growth Rate | CAGR of 6.23% |

| Number of Pages | 217 |

| Key Companies Covered | BASF SE, NatureWorks LLC, Novamont SpA, Total Corbion PLA, Biome Bioplastics Limited, Futamura Chemical Co. Ltd., Danimer Scientific, Toray Industries Inc., Mitsubishi Chemical Corporation, Plantic Technologies Limited, BioPak Pty Ltd., Vegware Ltd., Metabolix Inc., Cardia Bioplastics Limited, Arkema SA., and others. |

| Segments Covered | By Material Type, By Application, By End User, By Packaging Format, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Biodegradable Packaging Material Market: Segmentation

The global biodegradable packaging material market is segmented based on material type, application, end-user, packaging format, and region.

Based on material type, the global biodegradable packaging material industry is classified into polylactic acid, starch-based plastics, cellulose-based materials, polyhydroxyalkanoates, paper and paperboard, and others. Polylactic acid leads the market due to its excellent transparency, good mechanical properties, versatile processing capabilities, and established production infrastructure.

Based on application, the industry is segregated into food packaging, beverage packaging, personal care and cosmetics, pharmaceutical packaging, industrial packaging, and agricultural products. Food packaging leads the market due to the enormous volume of packaged food products, stringent food safety requirements, and consumer demand for fresh and minimally processed foods.

Based on end-user, the global biodegradable packaging material market is divided into the food and beverage industry, retail sector, healthcare industry, e-commerce companies, agriculture sector, and consumer goods manufacturers. The food and beverage industry is expected to lead the market during the forecast period due to its massive packaging requirements, direct consumer-facing position, and regulatory focus on reducing food-related plastic waste.

Based on packaging format, the global market is segmented into flexible packaging, rigid packaging, bags and pouches, films and wraps, containers and boxes, and labels and tags. Flexible packaging holds the largest market share due to its material efficiency, lightweight properties, excellent product protection capabilities, and adaptability to diverse product shapes and sizes across multiple industries.

Biodegradable Packaging Material Market: Regional Analysis

What factors are contributing to Europe's dominance in the global biodegradable packaging material market?

Europe leads the biodegradable packaging material market due to comprehensive environmental rules, a strong culture of sustainability, and advanced waste management systems. The European Union has introduced some of the strictest plastic waste directives worldwide, including bans on many single-use plastic items and ambitious recycling targets. Member countries have created effective extended producer responsibility schemes, encouraging sustainable packaging choices. The region benefits from well-developed industrial composting networks, enabling proper end-of-life processing for biodegradable materials.

Consumer environmental awareness in European markets is very high, influencing buying decisions toward sustainable products. Major European retailers have pledged to remove conventional plastics from their operations, creating a large demand for alternatives. Government subsidies and funding programs support research and development in biodegradable material technologies. The circular economy action plan positions

Europe as a global leader in sustainable packaging innovation. High waste disposal costs make biodegradable options economically attractive even with higher material prices. The Nordic countries demonstrate strong leadership with ambitious zero-waste goals and active consumer participation. Germany and France have introduced detailed packaging regulations influencing broader European practices. The region’s manufacturing strength in chemicals and materials science enables continuous innovation. Growing export markets for European food products require packaging that meets international sustainability expectations, further boosting domestic production capacity.

North America is experiencing substantial growth.

North America is seeing steady growth in the biodegradable packaging material market as businesses and consumers respond to rising environmental pressures and evolving regulations. The United States is implementing more state-level rules to reduce plastic waste, with California and several other states introducing strict legislation. Major brands across the region are strengthening sustainability commitments, driving higher investments in biodegradable packaging solutions.

Consumer awareness of plastic pollution has entered the mainstream, influencing purchasing decisions across diverse demographic groups. The food service sector is rapidly adopting compostable packaging for takeout and delivery as municipalities phase out plastic alternatives. Retailers are facing growing pressure from environmental groups and conscious consumers to eliminate plastic bags and reduce excess packaging. Niche sectors, such as craft beer and specialty beverages, utilize biodegradable packaging to reinforce their sustainability-focused brand values.

Farmers' markets, organic retailers, university campuses, and corporate cafeterias are promoting compostable packaging as part of their environmental identity. The subscription box sector presents new opportunities for biodegradable protective materials and shipping containers. Investment in composting infrastructure is increasing, improving end-of-life processing, although development still lags behind that in Europe.

Recent Market Developments:

- • In May 2025, the GRECO project (a Horizon Europe-funded consortium) announced development of novel PLA-copolymer-based biodegradable and recyclable food-packaging materials.

- In July 2025, Huhtamäki Oyj launched new ice-cream cups made from responsibly sourced paperboard with a bio-based coating, which are home- and industrial-compostable and recyclable.

Biodegradable Packaging Material Market: Competitive Analysis

The leading players in the global biodegradable packaging material market are:

- BASF SE

- NatureWorks LLC

- Novamont SpA

- Total Corbion PLA

- Biome Bioplastics Limited

- Futamura Chemical Co. Ltd.

- Danimer Scientific

- Toray Industries Inc.

- Mitsubishi Chemical Corporation

- Plantic Technologies Limited

- BioPak Pty Ltd.

- Vegware Ltd.

- Metabolix Inc.

- Cardia Bioplastics Limited

- Arkema SA.

The global biodegradable packaging material market is segmented as follows:

By Material Type

- Polylactic Acid

- Starch-Based Plastics

- Cellulose-Based Materials

- Polyhydroxyalkanoates

- Paper and Paperboard

- Others

By Application

- Food Packaging

- Beverage Packaging

- Personal Care and Cosmetics

- Pharmaceutical Packaging

- Industrial Packaging

- Agricultural Products

By End User

- Food and Beverage Industry

- Retail Sector

- Healthcare Industry

- E-commerce Companies

- Agriculture Sector

- Consumer Goods Manufacturers

By Packaging Format

- Flexible Packaging

- Rigid Packaging

- Bags and Pouches

- Films and Wraps

- Containers and Boxes

- Labels and Tags

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Biodegradable packaging materials are packaging solutions made from natural substances that can fully break down through biological processes without harming the environment.

The global biodegradable packaging material market is projected to grow due to increasing environmental awareness, stringent government regulations against plastic waste, rising consumer demand for sustainable products, and expanding applications across food service and e-commerce sectors.

According to a study, the global biodegradable packaging material market size was worth around USD 11.69 billion in 2024 and is predicted to grow to around USD 20.15 billion by 2034.

The CAGR value of the biodegradable packaging material market is expected to be around 6.23% during 2025-2034.

Europe is expected to lead the global biodegradable packaging material market during the forecast period.

The major players profiled in the global biodegradable packaging material market include BASF SE, NatureWorks LLC, Novamont SpA, Total Corbion PLA, Biome Bioplastics Limited, Futamura Chemical Co. Ltd., Danimer Scientific, Toray Industries Inc., Mitsubishi Chemical Corporation, Plantic Technologies Limited, BioPak Pty Ltd., Vegware Ltd., Metabolix Inc., Cardia Bioplastics Limited, and Arkema SA.

The report examines key aspects of the biodegradable packaging material market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

In the biodegradable packaging material market, major players like BASF, NatureWorks, and Novamont are expanding through production capacity increases, strategic partnerships with brand owners, and continuous material innovation while focusing on cost reduction, performance improvement, and consumer education to strengthen global operations.

In the biodegradable packaging material market, consumers are increasingly prioritizing sustainability and demanding plastic-free packaging options. Businesses are responding by adopting biodegradable materials across product lines, investing in transparent communication about environmental benefits, and developing packaging that maintains product protection while minimizing ecological impact.

In the biodegradable packaging material market, advancements such as improved polymer formulations, enhanced barrier properties, better heat resistance, and cost-effective production processes are making biodegradable packaging more competitive with conventional plastics while expanding application possibilities across diverse industries and product categories.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed