Europe precision medicine Market Size, Share, Growth Analysis Report - Forecast 2034

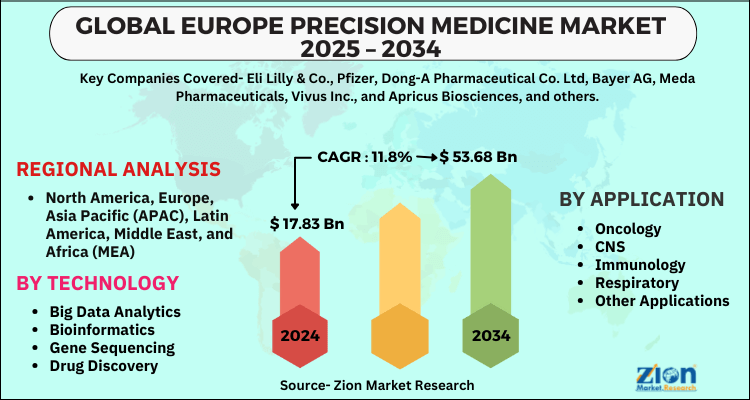

Europe precision medicine Market By Technology (Big Data Analytics, Bioinformatics, Gene Sequencing, Drug Discovery, Companion Diagnostics, Other Technologies), By Application (Oncology, CNS, Immunology, Respiratory, Other Applications), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

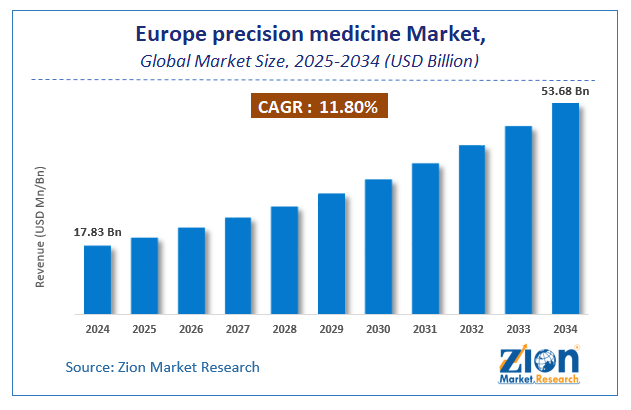

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.83 Billion | USD 53.68 Billion | 11.8% | 2024 |

Europe precision medicine Market Size

The europe precision medicine market size was worth around USD 17.83 Billion in 2024 and is predicted to grow to around USD 53.68 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 11.8% between 2025 and 2034. The report analyzes the europe precision medicine market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the europe precision medicine industry.

Europe precision medicine Market: Overview

Precision medicine has gained popularity across the world and this trend is anticipated to be prominent in the European region as well. –Increasing prevalence of chronic diseases, rising geriatric population, high research and development activity, and presence of key precision medicine manufacturers are some of the major factors that drive the Europe precision medicine market potential.

Increasing investments in healthcare infrastructure will further bolster the Europe precision medicine market potential in the long run. Rising instances of cancer are also projected to provide an impetus to the Europe precision medicine market growth through 2028. However, the high costs associated with maintenance and installation of precision medical devices are expected to have a hindering effect on the Europe precision medicine market growth over the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the europe precision medicine market is estimated to grow annually at a CAGR of around 11.8% over the forecast period (2025-2034).

- Regarding revenue, the europe precision medicine market size was valued at around USD 17.83 Billion in 2024 and is projected to reach USD 53.68 Billion by 2034.

- The europe precision medicine market is projected to grow at a significant rate due to increasing government initiatives and funding for personalized healthcare, advancements in genomic sequencing and data analytics, and the growing focus on targeted therapies for chronic diseases.

- Based on Technology, the Big Data Analytics segment is expected to lead the europe market.

- On the basis of Application, the Oncology segment is growing at a high rate and will continue to dominate the europe market.

- Based on region, Europe is predicted to dominate the europe market during the forecast period.

Europe precision medicine Market: Growth Drivers

Increasing Research and Development Activity

There have been substantial advancements in the europe healthcare industry and this trend is anticipated to boost the Europe precision medicine market potential over the forecast period. As the prevalence of chronic diseases is increasing and the demand for better treatment and diagnosis as well, the Europe precision medicine market is expected to see high demand. Increasing investments in research and development by healthcare companies and governments alike are expected to be prominent trends driving the Europe precision medicine market potential through 2028.

Europe precision medicine Market: Restraints

High Installation and Maintenance Costs to Hamper growth

Precision medicine requires special equipment which is high in cost and is also costly to install and maintain and this factor alone is anticipated to have a major hindering effect on the Europe precision medicine market growth over the forecast period. Europe precision medicine companies are focusing on finding more affordable solutions to boost the adoption of precision medicine in Europe.

Europe precision medicine Market: Segmentation Analysis

The europe precision medicine market is segmented based on Technology, Application, and region.

Based on Technology, the europe precision medicine market is divided into Big Data Analytics, Bioinformatics, Gene Sequencing, Drug Discovery, Companion Diagnostics, Other Technologies.

On the basis of Application, the europe precision medicine market is bifurcated into Oncology, CNS, Immunology, Respiratory, Other Applications.

Europe precision medicine Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Europe precision medicine Market |

| Market Size in 2024 | USD 17.83 Billion |

| Market Forecast in 2034 | USD 53.68 Billion |

| Growth Rate | CAGR of 11.8% |

| Number of Pages | 175 |

| Key Companies Covered | Eli Lilly & Co., Pfizer, Dong-A Pharmaceutical Co. Ltd, Bayer AG, Meda Pharmaceuticals, Vivus Inc., and Apricus Biosciences, and others. |

| Segments Covered | By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In November 2016 – International Consortium for Personalized Medicine, ICPerMed was launched by European and international members to advance research and bolster the use of personalized medicine in the European region and across the world.

Europe precision medicine Market: Regional Landscape

Europe is anticipated to see high demand for precision medicine owing to rising investments in the healthcare sector to advance healthcare facilities and provide better treatment opportunities. Increasing support from government initiatives to boost the adoption of precision medicine will also majorly influence Europe’s precision medicine market potential through 2028. The United Kingdom holds a major market share in the Europe precision medicine industry landscape and is expected to maintain this stance over the forecast period as well. Increasing research activity and the rising use of genome analysis are other factors that will drive the market potential in the United Kingdom through 2028. France, Germany, Spain, and Italy are also expected to be highly lucrative markets owing to increasing investments in the advancement of healthcare infrastructure. Increasing demand for better treatment and diagnosis will be a major trend prevalent in all countries in Europe.

Europe precision medicine Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the europe precision medicine market on a global and regional basis.

The europe precision medicine market is dominated by players like:

- Eli Lilly & Co.

- Pfizer

- Dong-A Pharmaceutical Co. Ltd

- Bayer AG

- Meda Pharmaceuticals

- Vivus Inc.

- and Apricus Biosciences

The europe precision medicine market is segmented as follows;

By Technology

- Big Data Analytics

- Bioinformatics

- Gene Sequencing

- Drug Discovery

- Companion Diagnostics

- Other Technologies

By Application

- Oncology

- CNS

- Immunology

- Respiratory

- Other Applications

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The europe precision medicine market is expected to grow due to growing prevalence of chronic diseases, increasing demand for targeted therapies, rising healthcare investments, and supportive government initiatives for personalized medicine.

According to a study, the europe precision medicine market size was worth around USD 17.83 Billion in 2024 and is expected to reach USD 53.68 Billion by 2034.

The europe precision medicine market is expected to grow at a CAGR of 11.8% during the forecast period.

Europe is expected to dominate the europe precision medicine market over the forecast period.

Leading players in the europe precision medicine market include Eli Lilly & Co., Pfizer, Dong-A Pharmaceutical Co. Ltd, Bayer AG, Meda Pharmaceuticals, Vivus Inc., and Apricus Biosciences, among others.

The report explores crucial aspects of the europe precision medicine market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed