Global End-of-line Packaging Market Size, Share, Growth Analysis Report - Forecast 2034

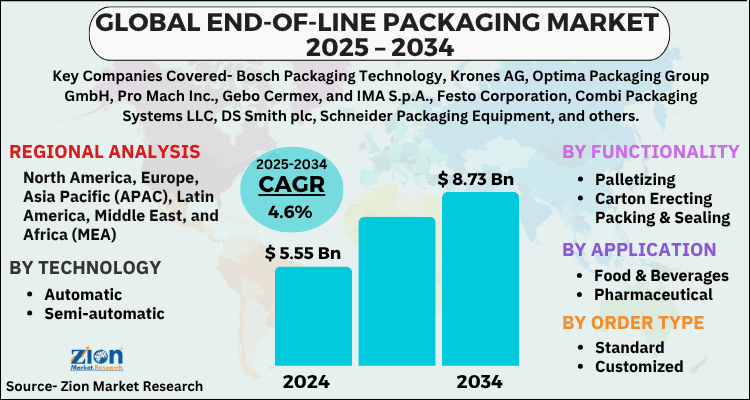

End-of-line Packaging Market By Technology (Automatic, Semi-automatic), By Functionality (Palletizing, Carton Erecting Packing & Sealing, Stretch Wrapping, Labelling), End-use Industry (Food & Beverages, Pharmaceutical, Electronics & Semiconductor, Automotive, Others (Chemical Products and Consumer Products)), Order type (Customized, Standard), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

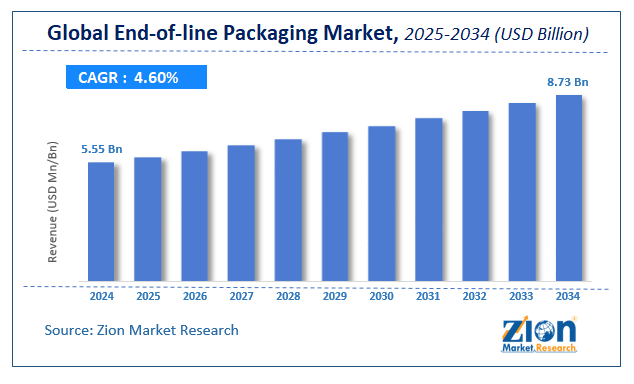

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.55 Billion | USD 8.73 Billion | 4.6% | 2024 |

End-of-line Packaging Market: Industry Perspective

The global end-of-line packaging market size was worth around USD 5.55 Billion in 2024 and is predicted to grow to around USD 8.73 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.6% between 2025 and 2034. The report analyzes the global end-of-line packaging market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the end-of-line packaging industry.

The report analyzes the end-of-line packaging market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the end-of-line packaging market.

End-of-line Packaging Market: Overview

Automation has been a major trend in the industrial sector over the past few years and this trend is only expected to be further bolstered over the forecast period and predicted to drive end-of-line packaging market potential as well. End-of-line packaging systems are crucial in skilled labor management and are responsible for the manufacturing of products at a faster rate and hence increasing the productivity of the global industry.

End-of-line packaging is crucial in an industrial environment and boosts the productivity of the company, hence this factor is expected to major boost end-of-line packaging market growth through 2028. High costs and low adoption in emerging economies are expected to restrain end-of-line packaging market growth over the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global end-of-line packaging market is estimated to grow annually at a CAGR of around 4.6% over the forecast period (2025-2034).

- Regarding revenue, the global end-of-line packaging market size was valued at around USD 5.55 Billion in 2024 and is projected to reach USD 8.73 Billion by 2034.

- The end-of-line packaging market is projected to grow at a significant rate due to rising demand for cost-effective and efficient packaging solutions, increasing automation in manufacturing, growing adoption in e-commerce and FMCG sectors, and advancements in robotics and AI-based packaging technologies.

- Based on Technology, the Automatic segment is expected to lead the global market.

- On the basis of Functionality, the Palletizing segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-use Industry, the Food & Beverages segment is projected to swipe the largest market share.

- By Order type, the Customized segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

End-of-line Packaging Market: Growth Drivers

The promise of Cost-efficiency to Drive End-of-line Packaging Demand

End-of-line packaging enables automation and increases the overall productivity of the company by reducing delivery time. Deployment of end-of-line packaging systems also allows the facilities to employ skilled laborers for other valuable tasks that require more human input and hence increase the overall efficiency of the workforce. The increased use of technologies like AI, deep learning, industrial automation, machine vision, etc., is also expected to favor end-of-line packaging market growth through 2028.

End-of-line Packaging Market: Restraints

Lack of Developed Manufacturing Infrastructure and High Costs of Automation to Hinder Market Growth

End-of-line packaging market growth is anticipated to be hindered by the high costs of automated solutions in the packaging industry. Packaging infrastructure has not developed with increasing technological advancements and this has hampered the overall market potential. Especially in low-income economies where spending potential is limited, the adoption of end-of-line packaging is expected to be constrained and have a hampering effect on the global end-of-line packaging market growth over the forecast period.

Global End-of-line Packaging Market: Segmentation

The global end-of-line packaging market is segregated based on technology, functionality, order type, end-use industry, and region.

By technology, the market is divided into automatic and semi-automatic. The automatic segment is expected to have a bright outlook over the forecast period. The increasing use of automation in the packaging industry and the rising popularity of industry 4.0 trends are major factors that will favor the growth of this segment. The semi-automatic segment is also expected to see an increase in popularity in low-income nations with less spending potential.

On the basis of Functionality, the global end-of-line packaging market is bifurcated into Palletizing, Carton Erecting Packing & Sealing, Stretch Wrapping, Labelling.

In terms of Order type, the global end-of-line packaging market is categorized into Customized, Standard.

By end-use industry, the end-of-line packaging market is segmented into food & beverages, pharmaceutical, electronics & semiconductor, automotive, and others (chemical products and consumer products). Increasing consumption of food and beverage products is expected to drive demand for end-of-line packaging in this industry vertical and the growing population is expected to further bolster the end-of-line packaging market growth. Adoption of end-of-line packaging systems in the pharmaceutical, automotive, electronics, and semiconductor industry verticals is also expected to see a rise in pace by the end of the forecast period.

End-of-line Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | End-of-line Packaging Market |

| Market Size in 2024 | USD 5.55 Billion |

| Market Forecast in 2034 | USD 8.73 Billion |

| Growth Rate | CAGR of 4.6% |

| Number of Pages | 169 |

| Key Companies Covered | Bosch Packaging Technology, Krones AG, Optima Packaging Group GmbH, Pro Mach Inc., Gebo Cermex, and IMA S.p.A., Festo Corporation, Combi Packaging Systems LLC, DS Smith plc, Schneider Packaging Equipment, and others. |

| Segments Covered | By Technology, By Functionality, By End-use Industry, By Order type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

End-of-line Packaging Market: Regional Landscape

Asia Pacific region is anticipated to hold a dominant market share over the forecast period and is projected to emerge as the most lucrative region for end-of-line packaging market growth through 2028. Increasing industrialization, favorable government policies, low cost of manufacturing, and high demand for packaging solutions are expected to be major factors influencing the end-of-line packaging market potential over the forecast period. The extremely lucrative manufacturing sector in China is anticipated to provide the most beneficial setting for end-of-line packaging market growth.

The European end-of-line packaging market is also predicted to have a bright outlook through 2028 and majorly the market in this region is expected to be driven by Germany where automation is trending and hence emerging as a leading market for end-of-line packaging. Moreover, the presence of key end-of-line packaging players in Europe is also expected to boost end-of-line packaging market growth through 2028 in this region.

Recent Developments

- In April 2021 – Pacteon Company a known name in the packaging automation industry announced the acquisition of Phoenix Wrappers Company based in Quebec, Canada. This will expand Pacteon’s packaging line integration capabilities of stretch wrapping technology.

End-of-line Packaging Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the end-of-line packaging market on a global and regional basis.

The global end-of-line packaging market is dominated by players like:

- Bosch Packaging Technology

- Krones AG

- Optima Packaging Group GmbH

- Pro Mach Inc

- Gebo Cermex, and IMA S.p.A.

- Festo Corporation

- Combi Packaging Systems LLC

- DS Smith plc

- Schneider Packaging Equipment

The global end-of-line packaging market is segmented as follows:

By Technology

- Automatic

- Semi-automatic

By Functionality

- Palletizing

- Carton Erecting Packing & Sealing

- Stretch Wrapping

- Labeling

By Application

- Food & Beverages

- Pharmaceutical

- Electronics & Semiconductor

- Automotive

- Others (Chemical Products and Consumer Products)

By Order type

- Standard

- Customized

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automation has been a major trend in the industrial sector over the past few years and this trend is only expected to be further bolstered over the forecast period and predicted to drive end-of-line packaging market potential as well.

The Global end-of-line packaging market is expected to grow due to increasing automation in manufacturing, rising demand for efficient and secure packaging solutions, and the growing need for traceability and sustainability in supply chains.

According to a study, the Global end-of-line packaging market size was worth around USD 5.55 Billion in 2024 and is expected to reach USD 8.73 Billion by 2034.

The Global end-of-line packaging market is expected to grow at a CAGR of 4.6% during the forecast period.

Asia-Pacific is expected to dominate the end-of-line packaging market over the forecast period.

Leading players in the Global end-of-line packaging market include Bosch Packaging Technology, Krones AG, Optima Packaging Group GmbH, Pro Mach Inc., Gebo Cermex, and IMA S.p.A., Festo Corporation, Combi Packaging Systems LLC, DS Smith plc, Schneider Packaging Equipment, among others.

The report explores crucial aspects of the end-of-line packaging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed