Packaging Robot Market Size, Share, Growth Report 2032

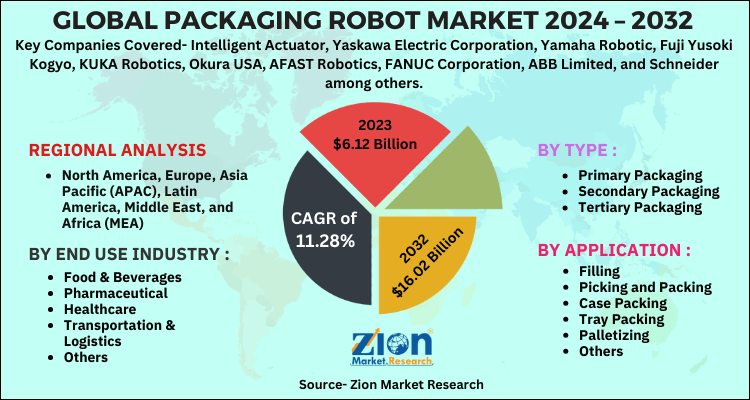

Packaging Robot Market by Type (Primary Packaging, Secondary Packaging, and Tertiary Packaging), by Application (Filling, Picking and Packing, Case Packing, Tray Packing, and Palletizing, and Others), by End Use Industry (Food & Beverages, Pharmaceutical, Healthcare, Transportation & Logistics, Retail, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.12 Billion | USD 16.02 Billion | 11.28% | 2023 |

Packaging Robot Market Insights

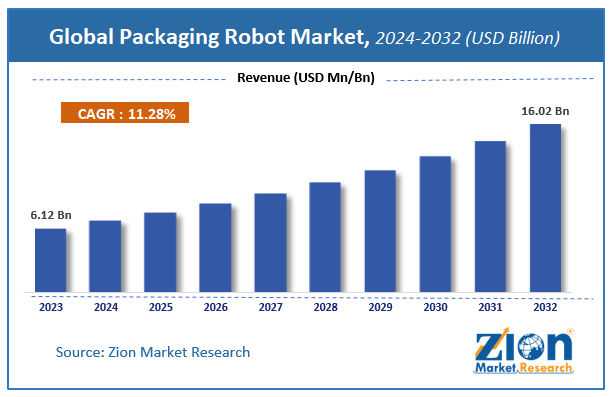

According to a report from Zion Market Research, the global Packaging Robot Market was valued at USD 6.12 Billion in 2023 and is projected to hit USD 16.02 Billion by 2032, with a compound annual growth rate (CAGR) of 11.28% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Packaging Robot Market industry over the next decade.

Market Overview

Robots in automated packaging systems use an intelligent vision system to identify the shape and position of the work pieces to be packed from the material conveying line and then send them to the to-be-handled region. Packaging robots are typically used to unlock, load, deliver, palletize, seal, code, and/or mark products, among other activities. Technological advancements coupled with companies' increasing emphasis on offering creative packaging are projected to provide industry participants with growth opportunities. Manufacturers are also focusing on integrating artificial intelligence (AI) technology platform to maximize productivity and optimize safety. In the packaging industry, the trend has been towards adoption of sustainable and environment friendly packaging, smart packaging among others.

Growth Factors

In recent years, technological developments have provided for significant advancements in robotics technology, including better sensors, simpler programming, automated unified controls, a growing range of end-of-arm tooling, and rapid improvements in artificial intelligence technology. As a result, the demand for automated robot packaging systems for proficient management of operations at distribution centers has increased.

The role of packaging has changed over the years. In addition to the functional use of packaging to provide physical protection, information, and convenience in distribution, now packaging is used by companies to market their products. Hence, in recent years, quite importance is given to the attractiveness and customized packaging as it is one of the ways companies can attract customers.

Packaging Robot Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Packaging Robot Market |

| Market Size in 2023 | USD 6.12 Billion |

| Market Forecast in 2032 | USD 16.02 Billion |

| Growth Rate | CAGR of 11.28% |

| Number of Pages | 150 |

| Key Companies Covered | Intelligent Actuator, Yaskawa Electric Corporation, Yamaha Robotic, Fuji Yusoki Kogyo, KUKA Robotics, Okura USA, AFAST Robotics, FANUC Corporation, ABB Limited, and Schneider among others |

| Segments Covered | By Type, By Application, By End Use Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

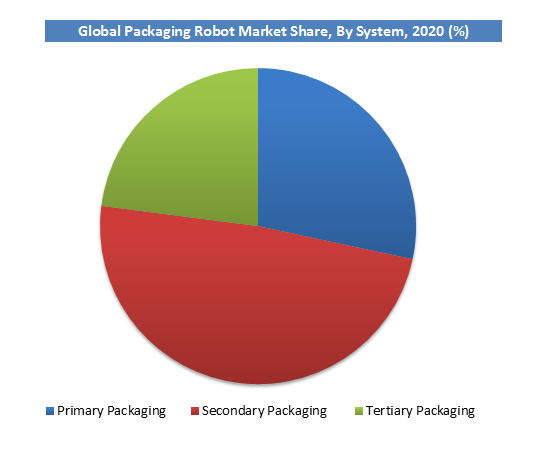

Packaging Type Segment Analysis Preview

The secondary packaging segment will grow at a CAGR of over 6% from 2021 to 2028. This can be attributed to ease in employing of robots at end of line, instead of in food handling, for instance, where wash down concerns remain. Packaging robots can tackle problems such as hard-to-handle materials, multiple axis manipulation, fluctuating throughput speeds, and tight plant layouts in secondary packaging applications which include shrink wrapping or case packaging. Brands that want to be seen in stores are spending time on secondary packaging. This is particularly true when it comes to food and beverage packaging.

End Use Industry Segment Analysis Preview

The pharmaceutical segment will grow at a CAGR of around 10% from 2021 to 2028. Demand for personalized packaging configurations, as well as advantages of robotics in pharmaceutical manufacturing such as high speed, precision, ability to monitor and trace, error-free service, less injuries, and improved floor space usage, would lead to the picking and packaging segment's large share. In the food and beverage industry, companies have deployed delta, or six-axis, robots with advanced sensors for material processing, sealing, packing, and palletizing in small footprints. Vision-guided robots are used for easy and effective performing routine activities like bottle carrying, bin selection, and tray filling.

Regional Analysis Preview

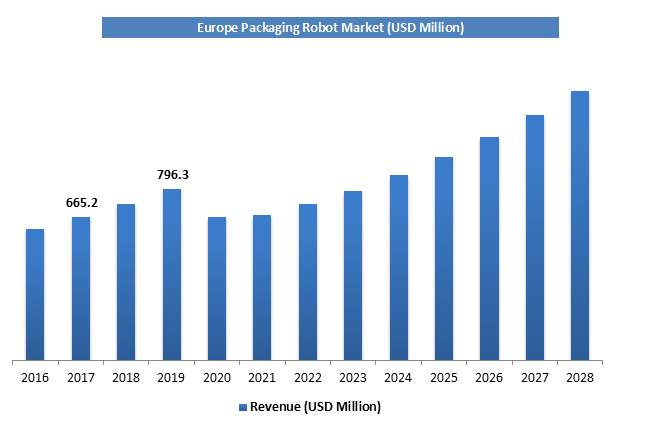

The European region held a share of over 22% in 2020. This can be attributed to the increasing usage of automation in countries such as Germany, U.K., and France in this region who contribute to a considerable amount of consumption of robotic systems. Moreover, the increasing usage of automated solutions in logistics sector is expected to generate huge demand for the market in this region.

The Asia Pacific region is projected to grow at a CAGR of around 11% over the forecast period. The rapid production of robotic systems by Chinese and Japanese companies is expected to increase demand and consumption for service robots in the area. Asian institutions and businesses are gaining considerable financial and regulatory funding from policymakers in order to implement these innovations in personal and professional settings.

Key Market Players & Competitive Landscape

Some of key players in packaging robot market are:

- Intelligent Actuator

- Yaskawa Electric Corporation

- Yamaha Robotic

- Fuji Yusoki Kogyo

- KUKA Robotics

- Okura USA

- AFAST Robotics

- FANUC Corporation

- ABB Limited

- Schneider among others.

Packaging robotic manufacturing companies are now using new emerging technologies. End-of-arm tool firms like Schmalz and Piab have supported 3D printing of end-of-arm equipment that can quickly convert to various formats that robots can run in packaging.

The global packaging robot market is segmented as follows:

By Type

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Application

- Filling

- Picking and Packing

- Case Packing

- Tray Packing

- Palletizing

- Others

By End Use Industry

- Food & Beverages

- Pharmaceutical

- Healthcare

- Transportation & Logistics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Global packaging robot market was valued at USD 6.12 Billion in 2023.

Packaging Robot Market size worth at USD 6.12 Billion in 2023 & projected to USD 16.02 Billion by 2032, with a CAGR of around 11.28% between 2024-2032.

The Global packaging robot market is expected to reach USD 16.02 Billion by 2032, with a CAGR of around 11.28% between 2024-2032.

Some of the key factors driving the Global packaging robot market growth are technological advancements and companies' increasing emphasis on offering creative packaging to attract a vast population of customers.

Asia Pacific region held a substantial share of the XX market in 2023. This is attributable to a rapid production of robotic systems by Chinese and Japanese companies among others. Europe region is projected to grow at a significant rate owing to the rising demand for XX in developing economies such as Germany.

Some of the major companies operating in the Packaging Robot market are Intelligent Actuator, Yaskawa Electric Corporation, Yamaha Robotic, Fuji Yusoki Kogyo, KUKA Robotics, Okura USA, AFAST Robotics, FANUC Corporation, ABB Limited, and Schneider, among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed