Electronic Display Market Size, Share, Industry Analysis Report 2034

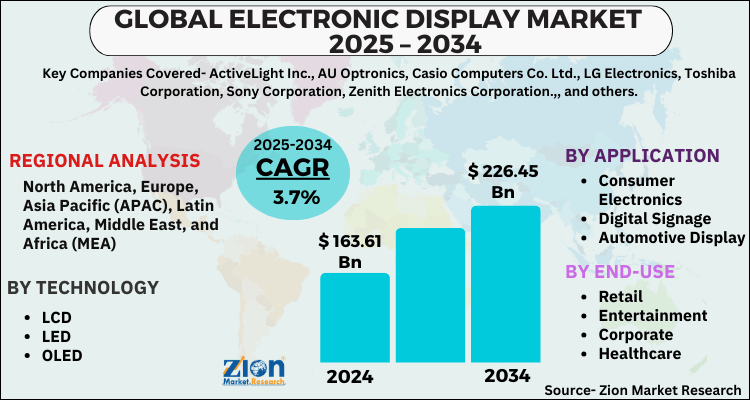

Electronic Display Market By Technology (LCD, LED, OLED, and Others), By Application (Consumer Electronics, Digital Signage, Automotive Display, and Others), By End-Use (Retail, Entertainment, Corporate, Healthcare, and Government), and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2025 - 2034

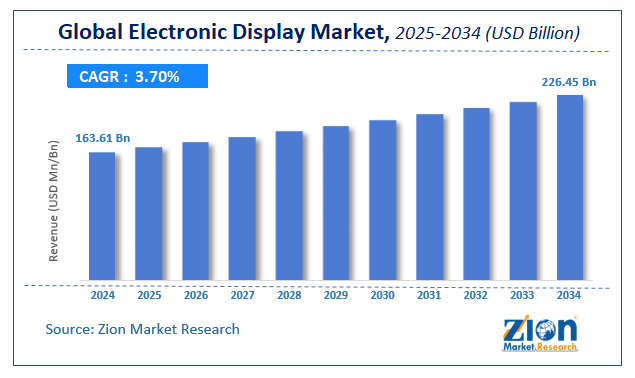

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 163.61 Billion | USD 226.45 Billion | 3.7% | 2024 |

Electronic Display Industry Perspective:

The global electronic display market size was worth around USD 163.61 Billion in 2024 and is predicted to grow to around USD 226.45 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 3.7% between 2025 and 2034. The report analyzes the global electronic display market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the electronic display industry.

Electronic Display Market: Overview

The market is being driven by the increasing use of OLED displays in various applications, the increasing use of LED displays for video walls, TVs, and digital signage applications, the growing demand for interactive displays in various applications, and the rising demand for display-based medical equipment, including ventilators and respirators, as a result of the COVID-19 pandemic. In addition, the growing need for on-the-go information, an increase in the number of electronic readers, and the development of simple-to-use display devices are all boosting demand in the electronic display market.

Due to the low cost of 3G and 4G communications technology, as well as the availability of Wi-Fi in both private and public settings, video streaming has grown in popularity, resulting in new business prospects. The introduction of technologically advanced consumer electronics goods like smartphones, smart tablets, and smart television sets is expected to propel the electronic display industry forward. Moreover, increased digitization in developed countries would generate additional business opportunities for the electronic display industry during the projection period.

Key Insights

- As per the analysis shared by our research analyst, the global electronic display market is estimated to grow annually at a CAGR of around 3.7% over the forecast period (2025-2034).

- Regarding revenue, the global electronic display market size was valued at around USD 163.61 Billion in 2024 and is projected to reach USD 226.45 Billion by 2034.

- The electronic display market is projected to grow at a significant rate due to increasing adoption of oled, led, and flexible displays in consumer electronics, automotive, and healthcare sectors.

- Based on Technology, the LCD segment is expected to lead the global market.

- On the basis of Application, the Consumer Electronics segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-Use, the Retail segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Electronic Display Market: Driver

LED displays are increasingly being used for video walls, TVs, and digital signage applications.

LED displays are a popular sort of display technology for a variety of applications. When compared to other technologies, it has a bigger market share. The LED display business has grown in recent years. One of the most recent breakthroughs in LED displays is the shrinking of the components required to construct an LED screen. LED screens have grown ultra-thin and large due to miniaturization, allowing them to be placed on any surface, inside or outside.

LED applications have grown, owing largely to technological developments such as improved resolution, increased brightness capabilities, product diversity, and the creation of toughened surface LEDs and tiny LEDs. LED displays are also commonly used in digital signage applications such as advertising and digital billboards, which help firms stand out from the crowd.

Electronic Display Market: Restraint

Decline in retail display demand as a result of a significant move toward online advertising and shopping

Now, digital advertising is more intelligent, tailored, and relevant than ever before. Consumers are spending more time online than ever before, and digital advertising is an excellent method to reach them across several devices and channels. As a result, online advertising has grown in popularity in recent years. Furthermore, the ubiquitous availability of the Internet has resulted in explosive growth in digital advertising.

Increased investment in online advertising by large firms such as Facebook and Google is also a major factor driving the increased use of online advertising. Programmatic advertising is gaining traction as well. As a result, the demand for displays, which were previously used to advertise items and brands in shops and commercial establishments, has declined dramatically.

Electronic Display Market: Opportunity

Foldable and flexible displays are becoming more popular.

In recent years, foldable displays have grown popular in tablets, smartphones, and notebook computers. Due to the flexible substrates used to create them, flexible display panels are bendable. Flexible display technology, centered on OLED panels, underpins foldable phones. Flexible OLED display panels for smartphones, television sets, and smartwatches are being mass-produced by companies such as Samsung and LG.

Electronic Display Market: Challenge

COVID-19 creates a stumbling block in the supply chain and production operations.

Many countries have adopted or continue to enforce lockdowns in order to halt the spread of COVID-19. The supply chain of several markets, including the display market, has been affected as a result. Display makers are facing difficulty in manufacturing and supplying their products as a result of supply chain issues.

Due to COVID-19, China is the worst-affected country in terms of display manufacturing. Due to manpower scarcity, a lack of logistics support, and quarantine processes, the company's overall display production has decreased.

Electronic Display Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electronic Display Market |

| Market Size in 2024 | USD 163.61 Billion |

| Market Forecast in 2034 | USD 226.45 Billion |

| Growth Rate | CAGR of 3.7% |

| Number of Pages | 210 |

| Key Companies Covered | ActiveLight Inc., AU Optronics, Casio Computers Co. Ltd., LG Electronics, Toshiba Corporation, Sony Corporation, Zenith Electronics Corporation.,, and others. |

| Segments Covered | By Technology, By Application, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electronic Display Market: Segmentation

The Electronic Display Market is segregated based on Technology, Application, and End-Use.

By Technology, the market is classified into LCD, LED, OLED, and Others. LCD displays have dominated the market in recent years. Due to the expanding applications in consumer electronics products such as TVs and personal computers, the category dominated the overall industry revenue share. Advanced LED and OLED display technologies, on the other hand, are gaining popularity because of their great operating stability and applicability for a wide range of applications. These electronic technologies are commonly employed in digital signage applications as well as smart devices like phones, tablets, and wearables. To differentiate their product offers from rigid LCD and AMOLED displays used in various device applications, manufacturers are progressively migrating from rigid OLED displays to flexible AMOLED displays.

By Application, the market is classified into Consumer Electronics, Digital Signage, Automotive Display, and Others. The consumer electronics application category accounted for more than half of total revenue and is expected to expand steadily over the projection period. The industry is likely to benefit from the widespread adoption of digital signage across various end-use segments. Key advances such as sophisticated digital signage 2.0, which shows data by moving infographics, are widely utilized in the retailing industry, resulting in the enrichment of the business plan and brand through outstanding aesthetics.

Recent Developments

- In 2021, Pervasive Displays expanded its product offering with robust EPDs to address increasing application opportunities. The company received recognition for the creation and deployment of electronic paper displays (EPDs), as well as the debut of the new Armor product, which expanded the spectrum of potential use cases.

- In 2020, The first Onyx screen in Australia was unveiled by Samsung at the HOYTS Entertainment Quarter in Moore Park, Sydney. Samsung's latest 14-meter Onyx Cinema LED screen is featured in the next installment.

Electronic Display Market: Regional Landscape

APAC is predicted to have the greatest share throughout the projection period. Other factors contributing to the region's market growth include an increase in the number of display panel production plants and the rapid adoption of OLED displays. APAC has a low labor cost, which lowers the overall manufacturing costs of display panels. This has enticed a number of corporations to locate new OLED and LCD panel manufacturing units in this region. Consumer electronics, retail, BFSI, healthcare, transportation, and sports and entertainment industries are likely to significantly contribute to the growth of the APAC display market. Furthermore, an increased display device used in many industries, particularly in countries such as China, India, and South Korea, is a key factor supporting the market.

North America is expected to be the most lucrative regional market, with growth anticipated throughout the forecast period. As people's disposable incomes rise and their lives improve, demand for advanced display-based applications is expected to climb gradually. Another aspect that will drive adoption in the region is an increase in smartphone shipments to the region. This will drive growth in the United States in the next years, and the value will only rise as technology advances.

Electronic Display Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the electronic display market on a global and regional basis.

Some of the main competitors dominating the Electronic Display Market include -

- ActiveLight Inc.

- AU Optronics

- Casio Computers Co. Ltd.

- LG Electronics

- Toshiba Corporation

- Sony Corporation

- Zenith Electronics Corporation.

The Electronic Display Market is segmented as follows:

By Technology

- LCD

- LED

- OLED

- Others

By Application

- Consumer Electronics

- Digital Signage

- Automotive Display

- Others

By End-Use

- Retail

- Entertainment

- Corporate

- Healthcare

- Government

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global electronic display market is expected to grow due to increasing adoption of high-definition displays in consumer electronics, automotive, and healthcare sectors.

According to a study, the global electronic display market size was worth around USD 163.61 Billion in 2024 and is expected to reach USD 226.45 Billion by 2034.

The global electronic display market is expected to grow at a CAGR of 3.7% during the forecast period.

Asia-Pacific is expected to dominate the electronic display market over the forecast period.

Leading players in the global electronic display market include ActiveLight Inc., AU Optronics, Casio Computers Co. Ltd., LG Electronics, Toshiba Corporation, Sony Corporation, Zenith Electronics Corporation.,, among others.

The report explores crucial aspects of the electronic display market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed