Electron-Beam Furnace Market Size, Share, Trends, Growth 2034

Electron-Beam Furnace Market By Type (Electron-Beam Melting [EBM] Furnaces, Electron-Beam Welding Furnaces, Electron Beam Furnaces), By Application (Automotive, Medical Devices, Energy and Power, Research and Development, Electronics and Semiconductors, Metal Additive Manufacturing [3D Printing]), By End-User (Manufacturers of Original Equipment [OEMs], Contract Manufacturing Services), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

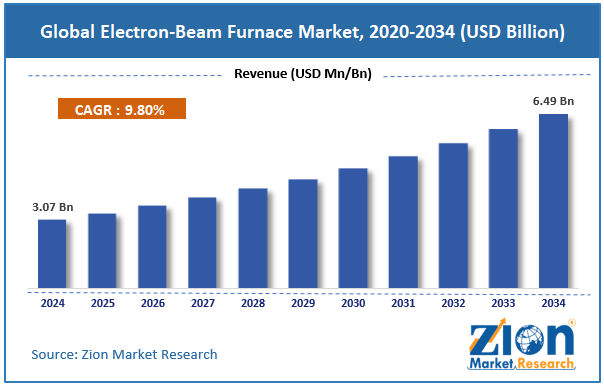

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.07 Billion | USD 6.49 Billion | 9.80% | 2024 |

Electron-Beam Furnace Industry Perspective:

What will be the size of the global electron-beam furnace market during the forecast period?

The global electron-beam furnace market size was around USD 3.07 billion in 2024 and is projected to reach USD 6.49 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.80% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global electron-beam furnace market is estimated to grow annually at a CAGR of around 9.80% over the forecast period (2025-2034)

- In terms of revenue, the global electron-beam furnace market size was valued at around USD 3.07 billion in 2024 and is projected to reach USD 6.49 billion by 2034.

- The electron-beam furnace market is projected to grow significantly owing to growth in the aerospace and defense industries, rising use in medical device manufacturing, and demand for precision casting and welding.

- Based on type, the Electron-Beam Melting (EBM) furnaces segment is expected to lead the market, while the electron beam furnaces segment is expected to grow considerably.

- Based on application, the metal additive manufacturing (3D printing) segment is the largest, while the automotive segment is projected to record sizeable revenue over the forecast period.

- Based on end-user, the Manufacturers of Original Equipment (OEMs) segment is expected to lead the market, followed by the contract manufacturing services segment.

- By region, the Asia Pacific is projected to dominate the global market during the forecast period, followed by North America.

Electron-Beam Furnace Market: Overview

An electron-beam furnace is a high-temperature refining and melting device that uses a focused beam of high-energy electrons to heat and melt materials, primarily metals. The process is performed in a vacuum, which prevents contamination and enables precise control of melting and temperature conditions. The global electron-beam furnace market is likely to expand rapidly, driven by rising demand for high-performance materials, growth in defense and aerospace manufacturing, and advances in additive manufacturing (3D printing). Industries such as defense, aerospace, and medical require materials with exceptional strength, performance, and purity, which electron-beam furnaces enable through vacuum refining and controlled processing.

Moreover, the advancing aerospace industry demands high-strength, lightweight alloys such as nickel-based superalloys and titanium, driving the adoption of electron-beam furnaces for recycling and production. Furthermore, electron-beam furnaces support the production of high-class metal powders and feedstock, which are crucial for the powder-bed fusion additive manufacturing process.

Despite growth, the global market is constrained by factors such as high capital requirements, complex operations, skilled labor, and high operational costs. Electron-beam furnaces require a high upfront cost, making them less accessible to medium- and small-sized producers. Specialized expertise and training are important for maintaining and operating EBF systems, but their limited availability limits adoption in areas with limited labor skills. Similarly, maintaining a high-vacuum environment, regular maintenance, and energy consumption contribute to ongoing operational expenses.

Nonetheless, the global electron-beam furnace industry stands to gain from several key opportunities, including integration with smart manufacturing, expansion in medical device manufacturing, and strategic alliances and service models. Incorporating IoT, predictive maintenance, and real-time monitoring can improve performance and appeal to Industry 4.0 adopters. Surging demand for high-purity, biocompatible medical implants opens new avenues for EBF use in specialized material production. Additionally, offering furnace services or entering into agreements with material producers may reduce barriers to entry for small firms.

Electron-Beam Furnace Market: Dynamics

Growth Drivers

How is the growth of Additive Manufacturing (AM) applications augmenting the electron-beam furnace market?

Electron-beam additive manufacturing (EBAM) is offering fresh opportunities for electron-beam furnace utilization. It allows the production of complex metal components with minimal waste and high structural integrity. Automotive, aerospace, and defense industries are adopting EBAM for limited production runs and prototyping. Integration with Industry 4.0 and manufacturing strategies increases the appeal of furnaces. Manufacturers are enticed with cost savings from reduced material waste. The trend toward using EBAM in precision components continues to gain momentum in the electron-beam furnace market.

How is the electron-beam furnace market driven by sustainability and energy efficiency pressures?

Industries are prioritizing equipment with low energy consumption and reduced carbon emissions, favoring electron-beam furnaces. Vacuum melting reduces waste and enhances material use, backing sustainability goals. Companies steadily evaluate equipment depending on lifecycle energy performance. The technology helps operations reduce long-term operational costs. Growing environmental awareness is a major driver of the adoption of electron-beam furnaces.

Restraints

Competition from alternative technologies unfavorably impacts the market progress

Induction melting, plasma melting, and arc furnaces are broadly used and often cheaper alternatives. Several industries continue to depend on these established processes for conventional alloy production. Electron-beam furnaces should comply by demonstrating elevated precision and efficiency. Some manufacturers deter switching because of familiarity and the low operating costs of alternative techniques. This competitive landscape slows the industry growth. Resistance to new technology remains a major restraint.

Opportunities

How is customized alloy production opening lucrative opportunities for the development of the electron-beam furnace market?

The growing demand for specialized alloys with precise properties presents opportunities for electron-beam furnaces. Industries such as aerospace parts, electronics, and medical implants require customized compositions. Customized production allows manufacturers to charge premium costs. Demand for high-performing metals in niche industries is growing. Flexibility in alloy production is a strong driver of the electron-beam furnace industry. This creates opportunities for value-added services and differentiation.

Challenges

Supply chain and raw material constraints limit the market growth

Access to high-class refractory alloys and metals is crucial for furnace operation. Supply chain disturbances may delay production or increase costs. Geopolitical factors and raw material scarcity exacerbate this challenge. Reliance on imported materials restricts flexibility for some manufacturers. Managing supply chain risks is important for consistent industry growth. This is still a strategic concern for operators.

Electron-Beam Furnace Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electron-Beam Furnace Market |

| Market Size in 2024 | USD 3.07 Billion |

| Market Forecast in 2034 | USD 6.49 Billion |

| Growth Rate | CAGR of 9.80% |

| Number of Pages | 213 |

| Key Companies Covered | Heraeus Holding GmbH, ATI Allegheny Technologies Inc., Sumitomo Heavy Industries Ltd., SPG Metals & Minerals Inc., Ametek Inc., VACUUMSCHMELZE GmbH & Co. KG, ALD Vacuum Technologies GmbH, Kurt J Lesker Company, Ningbo Yunxing Rare Metal Materials Co. Ltd., SECO/WARWICK S.A., I2r POWER, Vacuum Furnace Engineering, KV-Titan, Antares, Solution Research Company, and others. |

| Segments Covered | By Type, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electron-Beam Furnace Market: Segmentation

The global electron-beam furnace market is segmented based on type, application, end-user, and region.

Based on type, the global electron-beam furnace industry is divided into Electron-Beam Melting (EBM) furnaces, electron-beam welding furnaces, and electron beam furnaces. The electron-beam melting (EBM) furnaces segment leads with 50% market share, as EBM systems are widely used for additive manufacturing and high-precision melting of specialty alloys and metals. This is mainly used for medical, aerospace, and advanced industrial applications. These systems lead because of their ability to produce complex and high-performing parts and feedstock with optimal material properties.

On the other hand, the electron beam furnaces segment holds a second rank with 30% market share. This prominence is supported by broader industrial heat-treatment and material-processing needs, where electron beams are used to control temperatures and material properties.

Based on application, the global electron-beam furnace market is segmented into automotive, medical devices, energy and power, research and development, electronics and semiconductors, and metal additive manufacturing (3D Printing). The metal additive manufacturing (3D printing) segment captures 45% of the total market share due to its use in producing complex components and high-performance alloys with precision. Electron-beam melting promises high-purity and superior material properties for aerospace parts. The demand is backed by the rise of advanced manufacturing and aerospace applications.

Conversely, the automotive segment maintains second position with 25% of the market. Automakers use electron-beam furnaces for lightweight and high-strength components and heat-treated materials. The segment benefits from trends such as fuel efficiency and the growing demand for electric vehicles. EBF technology enables precise control over material quality and alloy composition.

Based on end-user, the global market is segmented into original equipment manufacturers (OEMs) and contract manufacturers. The original equipment manufacturers (OEMs) segment dominates with 60% of the market. This growth is because of the integration of electron-beam furnaces directly into in-house production processes. They use EBF technology for high-precision melting, additive manufacturing, and welding of alloys and metals. OEM investments are driven by the need for high material quality, process control, and efficiency.

However, the contract manufacturing services segment accounts for 30% of the total market and provides EBF processing services to numerous clients across the industrial, medical, and aerospace sectors. They allow companies to access advanced furnace capabilities without investing in their own equipment. This segment is advancing due to outsourcing trends, though it remains smaller than OEM adoption in the overall market.

Electron-Beam Furnace Market: Regional Analysis

What enables Asia Pacific's strong foothold in the global Electron-Beam Furnace Market?

Asia Pacific is anticipated to retain its leading role with a 9.8% CAGR in the global electron-beam furnace market, driven by the region's largest market share, fastest growth, rapid industrialization and manufacturing expansion, and supportive government initiatives and technology investments. Asia Pacific holds a leading share (35%) in the market, fueled by industrial growth in metals, automotive, and aerospace. Leading economies like Japan, China, and India support high adoption of EBF technology. The region’s strong manufacturing base promises continued industry dominance. Growing industries in aerospace, metallurgy, and automotive create robust demand for EBF. Expanding engineering capabilities and modern supply chains promise efficient adoption of EBF systems. This manufacturing infrastructure boosts the regional rank.

Furthermore, programs like Made in 2025, launched by China, encourage the adoption of advanced manufacturing. Investments in high-performance furnace systems and research and development support technology development. Incentives in automotive, aerospace, and medical sectors drive EBF use in the region.

North America ranks as the second-leading region in the global electron-beam furnace industry, with an 8% CAGR, driven by remarkable market share and steady growth, advanced defense and aerospace industries, and a focus on technology innovation and R&D. North America registers a leading share of the worldwide market, holding nearly 30% of the overall revenue. The region benefits from a sophisticated industrial base, especially in defense, aerospace, and high-tech manufacturing support consistent industry growth despite high equipment costs. The strong presence of defense and aerospace manufacturers fuels demand for high-performance, high-purity metals processed in electron-beam furnaces. Components such as structural alloys, turbine blades, and critical engine components require precision melting and proper welding. Regional focus on advanced material quality and performance promises sustained EBF adoption in these industries.

Additionally, North American companies are heavily investing in R&D, discovering innovations in high-performance alloys, additive manufacturing, and automated furnace controls. Collaborations between industrial manufacturers and research institutions accelerate the development of materials and the advancement of processes. Private funding and government programs for automotive, aerospace, and medical technologies further stimulate the adoption of electron-beam furnaces.

Electron-Beam Furnace Market: Competitive Analysis

The leading players in the global electron-beam furnace market are:

- Heraeus Holding GmbH

- ATI Allegheny Technologies Inc.

- Sumitomo Heavy Industries Ltd.

- SPG Metals & Minerals Inc.

- Ametek Inc.

- VACUUMSCHMELZE GmbH & Co. KG

- ALD Vacuum Technologies GmbH

- Kurt J Lesker Company

- Ningbo Yunxing Rare Metal Materials Co. Ltd.

- SECO/WARWICK S.A.

- I2r POWER

- Vacuum Furnace Engineering

- KV-Titan

- Antares

- Solution Research Company

What are the key trends in the global Electron-Beam Furnace Market?

Expansion into new industrial sectors:

Electron-beam furnace use is expanding beyond conventional metallurgy into industries such as space components, biomedical devices, and high-performance specialty alloys. These industries need ultra-pure materials and complex geometries that electron-beam furnace technology uniquely provides, backing diversified industry growth. As developing applications advance, they expand market demand and create fresh adoption pathways.

Emphasis on sustainability and green manufacturing:

Environmental concerns and regulatory focus on sustainability are driving the adoption of electron-beam furnaces, which operate in a vacuum, avoid combustion, and produce less waste than traditional melting methods. Their ability to recycle scrap materials and lower emissions supports governmental and corporate sustainability goals. These eco-friendly manufacturing practices are becoming a competitive advantage in metal processing.

The global electron-beam furnace market is segmented as follows:

By Type

- Electron-Beam Melting (EBM) Furnaces

- Electron-Beam Welding Furnaces

- Electron Beam Furnaces

By Application

- Automotive

- Medical Devices

- Energy and Power

- Research and Development

- Electronics and Semiconductors

- Metal Additive Manufacturing (3D Printing)

By End-User

- Manufacturers of Original Equipment (OEMs)

- Contract Manufacturing Services

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed