Metal Powders For Additive Manufacturing Market Size, Share, & Forecast 2034

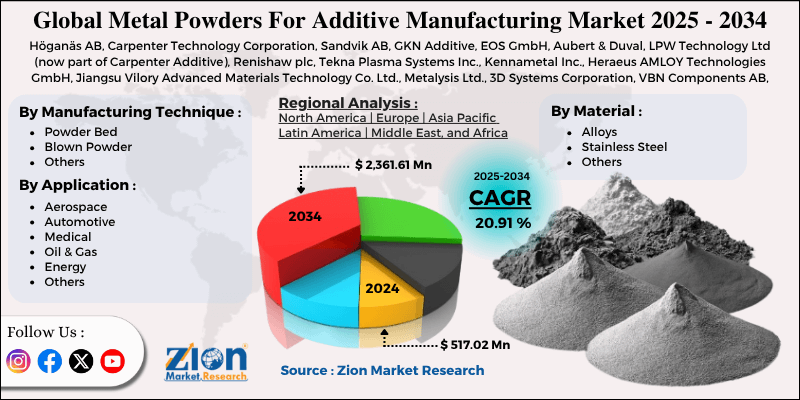

Metal Powders For Additive Manufacturing Market By Manufacturing Technique (Powder Bed, Blown Powder, and Others), By Material (Alloys, Stainless Steel, and Others), By Application (Aerospace, Automotive, Medical, Oil & Gas, Energy, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

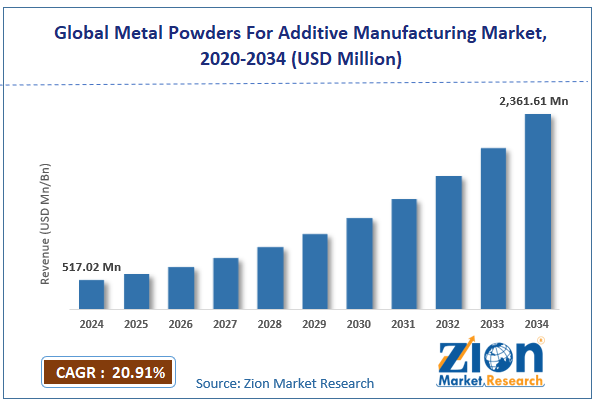

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 517.02 Million | USD 2361.61 Million | 20.91% | 2024 |

Metal Powders For Additive Manufacturing Industry Perspective:

The global metal powders for additive manufacturing market size was approximately USD 517.02 million in 2024 and is projected to reach around USD 2361.61 million by 2034, with a compound annual growth rate (CAGR) of roughly 20.91% between 2025 and 2034.

Metal Powders For Additive Manufacturing Market: Overview

Metal powders for additive manufacturing are fine-milled metals used as raw materials in 3D printing technologies, such as Electron Beam Melting and Selective Laser Melting. These powders commonly include stainless steel, aluminum, nickel, and titanium alloys, offering design flexibility, high precision, and material efficiency in the production of complex components. The global metal powders for additive manufacturing market is expected to expand rapidly, driven by the growing adoption of 3D printing in the defense and aerospace sectors, the automotive industry's use of lightweight design, and the medical industry's demand for patient-specific implants. Aerospace companies are actively using metal powders to generate lightweight and complex parts. This trend is expected to continue growing due to weight reduction, cost savings, and performance enhancements.

Moreover, leading automakers like Ford and BMW are leveraging metal AM to produce custom components, reduce emissions, and enhance fuel efficiency. This inclination towards electric vehicles has amplified the demand for thermally conductive and lightweight components. Also, hospitals and surgeons are increasingly using cobalt-chrome and titanium powders for 3D-printed dental and orthopedic implants. Additive manufacturing allows faster production and customization, enhancing patient outcomes.

Despite the growth, the global market is impeded by factors such as limited standardization in AM procedures and complex certifications and requirements. The lack of industry-wide printing and material standards leads to performance uncertainty and quality vulnerability. This impacts broader adoption in vital sectors, such as medicine and aerospace. Additionally, parts manufactured using metal AM must comply with stringent certifications, such as those from the FDA and FAA, which can be costly and time-consuming. These obstacles slow down time-to-industry for end-use goods.

Nonetheless, the global metal powders for additive manufacturing industry stands to gain from several key opportunities, such as sustainable manufacturing and on-demand production. Metal AM supports sustainability goals by reducing energy consumption and material waste. Powder recycling solutions and carbon-neutral production lines are gaining traction and investor interest. Furthermore, industries such as maritime, defense, and mining are utilizing metal AM for on-site fabrication of spare parts. This decreases logistics dependency and downtime in hostile and remote environments.

Key Insights:

- As per the analysis shared by our research analyst, the global metal powders for additive manufacturing market is estimated to grow annually at a CAGR of around 20.91% over the forecast period (2025-2034)

- In terms of revenue, the global metal powders for additive manufacturing market size was valued at around USD 517.02 million in 2024 and is projected to reach USD 2361.61 million by 2034.

- The metal powders for additive manufacturing market is projected to grow significantly due to the increasing demand for customized medical prosthetics and implants, rising investments in the aerospace and defense sectors, and enhanced material characteristics resulting from advancements in metal powder technology.

- Based on manufacturing technique, the powder bed segment is expected to lead the market, while the blown powder segment is expected to grow considerably.

- Based on material, the alloys segment is the dominant segment, while the stainless steel segment is projected to witness substantial revenue growth over the forecast period.

- Based on application, the aerospace segment is expected to lead the market, followed by the medical segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Metal Powders For Additive Manufacturing Market: Growth Drivers

Proliferation of direct energy deposition technologies and metal binder jetting drives market growth

Advancements in additive manufacturing methods, such as Direct Energy Deposition and Metal Binder Jetting, are primarily driving the use of metal powders in various industries. These solutions enable larger part sizes and faster build rates compared to conventional laser-based additive manufacturing techniques. This substantially propels the worldwide metal powders for additive manufacturing market.

Similarly, in 2024, the DED industry has progressed by more than 17%, fueled by applications in refurbishing and repairing turbine parts, significant industrial components, and molds. This notably fuels the demand for cobalt-chrome, nickel, and titanium powder blends enhanced for DED feedstock.

What key improvements in powder production and recycling are positively driving the growth of the metal powders for additive manufacturing market?

The metal powders industry is benefiting from advancements in atomization solutions and powder recycling solutions. These advancements are yielding higher purity, improved consistency, and enhanced flowability in powder morphology, which is vital for additive manufacturing.

Additionally, sustainability efforts in powder recycling and reuse are gaining momentum. A 2024 study reported a nearly 40% decrease in lifecycle costs when reusing metal powders in 5-6 build cycles, mainly for aluminum and stainless steel. This contributes to the industry's appeal, especially for cost-sensitive domains such as consumer electronics and automotive.

Metal Powders For Additive Manufacturing Market: Restraints

How does quality degradation over time and limited powder recyclability hinder the progress of the metal powders for the additive manufacturing market?

Metal powder reuse is common to lower costs; however, repeated reuse results in powder degradation, characterized by changes in oxidation, contamination, particle morphology, and decreased flowability. These changes impact mechanical performance, part quality, and overall build dependability.

This is highly challenging for reactive metals like aluminum and titanium, which oxidize speedily and are complex to recycle. Several companies lack robust in-house powder monitoring systems, resulting in inconsistent quality control across different builds.

Metal Powders For Additive Manufacturing Market: Opportunities

How does the development of high-performance materials and new alloy powders contribute to the metal powders for additive manufacturing market growth?

The momentum towards high-performing applications is fueling the demand for hybrid metal powders and new alloy formulations tailored for specific industries, thereby impacting the metal powders for additive manufacturing industry. These comprise materials with improved thermal stability, wear resistance, or tailored microstructures. There is a growing interest in refractory metals for use in aerospace, nuclear, and defense sectors owing to their ability to tolerate extreme conditions. The worldwide Advanced Metal Additive Project, introduced in mid-2024, plans to commercialize novel grades of niobium and tantalum powders by 2026.

Metal Powders For Additive Manufacturing Market: Challenges

Complex waste management and environmental impact limit the growth of the market

Metal powders, particularly when finely ground, pose significant risks to both occupational and environmental health. These comprise dust explosivity, inhalation hazards, and contamination risks associated with water or soil that is not correctly disposed of or handled.

Moreover, powder production, such as plasma atomization, is greatly energy-intensive, contributing to CO2 emissions. Sustainability is a growing concern, prompting market players to seek more environmentally friendly powder production techniques, such as powder recycling solutions and hydrogen atomization.

Metal Powders For Additive Manufacturing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Metal Powders For Additive Manufacturing Market |

| Market Size in 2024 | USD 517.02 Million |

| Market Forecast in 2034 | USD 2,361.61 Million |

| Growth Rate | CAGR of 20.91% |

| Number of Pages | 212 |

| Key Companies Covered | Höganäs AB, Carpenter Technology Corporation, Sandvik AB, GKN Additive, EOS GmbH, Aubert & Duval, LPW Technology Ltd (now part of Carpenter Additive), Renishaw plc, Tekna Plasma Systems Inc., Kennametal Inc., Heraeus AMLOY Technologies GmbH, Jiangsu Vilory Advanced Materials Technology Co. Ltd., Metalysis Ltd., 3D Systems Corporation, VBN Components AB, and others. |

| Segments Covered | By Manufacturing Technique, By Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Metal Powders For Additive Manufacturing Market: Segmentation

The global metal powders for additive manufacturing market is segmented based on manufacturing technique, material, application, and region.

Based on manufacturing technique, the global metal powders for additive manufacturing industry is divided into powder bed, blown powder, and others. The powder bed segment dominates the global market due to its excellent surface finish, high precision, and broader applications in the medical, aerospace, and automotive industries. Techniques such as Electron Beam Melting and Selective Laser Melting are widely used in PBF. The rising demand for high-strength and complex parts with tight tolerances fuels the demand for PBF.

Based on material, the global metal powders for additive manufacturing market is segmented into alloys, stainless steel, and others. The alloys segment captures a notable market share. These materials are widely used in automotive, aerospace, and medical applications due to their superior strength-to-weight ratios, high-temperature performance, and corrosion resistance. For instance, Inconel 718 and Ti6A14V are broadly used materials in space-grade and aerospace components, fueling substantial demand for alloy-based powders.

Based on application, the global market is segmented into aerospace, automotive, medical, oil & gas, energy, and others. The aerospace sector captured a leading share of the market, driven by growing demand for complex, lightweight, and high-performance components. Metal powders, such as nickel alloys and titanium, are utilized for the manufacture of structural parts, turbine blades, and engine components. Companies like Airbus and GE Aviation have adopted additive manufacturing to reduce part count, simplify production, and improve fuel efficiency. The industry's stringent cost-saving benefits and quality standards propel sustained adoption.

Metal Powders For Additive Manufacturing Market: Regional Analysis

What are the significant reasons dominating North America in the metal powders for additive manufacturing market?

North America is expected to maintain its leading position in the global metal powders for additive manufacturing market, driven by the robust aerospace and defense industry, significant government funding, and advanced technological infrastructure. North America, primarily the United States, boasts a leading aerospace and defense industry, which is the largest consumer of metal powders for additive manufacturing. Companies like Boeing, GE Aviation, and Lockheed Martin have actively integrated 3D printing for components like turbine blades and nozzles. The United States government supports additive manufacturing through initiatives such as the DoD's AM Forward and America Makes.

More than USD 1.2 billion was distributed to defense-associated 3D printing technologies in 2023, comprising advanced metal powders. This constant public-private investment drives local production capacity and fuels advancements in high-performance metal materials. North America holds a robust R&D infrastructure, with research centers like Oak Ridge National Laboratory, MIT, and NASA Marshall Space Flight Center fueling metal AM modernizations. These institutions collaborate with market leaders to develop next-generation refining manufacturing techniques and metal powders. The region's commitment to research and development promises consistent technological improvement and product superiority.

Europe ranks as the second-largest region in the global metal powders for additive manufacturing industry, thanks to its strong automotive and aerospace base, the expansion of dental and medical applications, and its leadership in certifications. Europe ranks second in the automotive and aerospace manufacturing sectors, with leading companies such as Volkswagen, Airbus, BMW, and Rolls-Royce at the forefront of adopting metal additive manufacturing.

For instance, Airbus utilizes aluminum and titanium powders extensively in aircraft components to enhance fuel efficiency and reduce weight. European nations have improved their healthcare systems and experienced strong demand for 3D-printed dental and orthopedic implants. Cobalt-chrome and titanium powders are broadly used in spinal, hip, and cranial implants.

Furthermore, the region plays a vital role in AM standardization, with organizations such as ISO/TC 261 and VDI working on international quality and AM material standards. This enables wider adoption in regulated industries such as energy, aerospace, and healthcare. Standardization promises trust in mechanical properties and powder consistency, thereby boosting a region's competitive position.

Metal Powders For Additive Manufacturing Market: Competitive Analysis

The leading players in the global metal powders for additive manufacturing market are:

- Höganäs AB

- Carpenter Technology Corporation

- Sandvik AB

- GKN Additive

- EOS GmbH

- Aubert & Duval

- LPW Technology Ltd (now part of Carpenter Additive)

- Renishaw plc

- Tekna Plasma Systems Inc.

- Kennametal Inc.

- Heraeus AMLOY Technologies GmbH

- Jiangsu Vilory Advanced Materials Technology Co. Ltd.

- Metalysis Ltd.

- 3D Systems Corporation

- VBN Components AB

Metal Powders For Additive Manufacturing Market: Key Market Trends

Increased adoption of lightweight and aluminum alloys:

The surging demand for aluminum-based and lightweight alloy powders, such as AlSi10Mg, in industries like aerospace, consumer electronics, and electric vehicles, is propelling the global market's growth. These powders offer optimal thermal conductivity and high strength-to-weight ratios. Their lowest cost compared to titanium also increases their appeal for mass prototyping and production.

Growth of binder jetting with metal powders:

Binder jetting, a more scalable and faster AM technology, is fueling prominence for producing metal components with high throughput and low cost. Companies like HP and Desktop Metal are enhancing their binder jetting capabilities with powders made from materials such as Inconel, stainless steel, and copper. This trend is offering prospects for broader material compatibility and industrial-scale production.

The global metal powders for additive manufacturing market is segmented as follows:

By Manufacturing Technique

- Powder Bed

- Blown Powder

- Others

By Material

- Alloys

- Stainless Steel

- Others

By Application

- Aerospace

- Automotive

- Medical

- Oil & Gas

- Energy

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Metal powders for additive manufacturing are fine-milled metals used as raw materials in 3D printing technologies, such as Electron Beam Melting and Selective Laser Melting. These powders commonly include stainless steel, aluminum, nickel, and titanium alloys, offering design flexibility, high precision, and material efficiency

The global metal powders for additive manufacturing market is projected to grow due to the expansion of the semiconductor and electronics industry, improvements in metal powder production technologies, and the proliferation of smart manufacturing and Industry 4.0.

According to study, the global metal powders for additive manufacturing market size was worth around USD 517.02 million in 2024 and is predicted to grow to around USD 2361.61 million by 2034.

What will be the CAGR value of the metal powders for additive manufacturing market during 2025-2034?

The CAGR value of the metal powders for additive manufacturing market is expected to be approximately 20.91% from 2025 to 2034.

North America is expected to lead the global metal powders for additive manufacturing market during the forecast period.

The key players profiled in the global metal powders for additive manufacturing market include Höganäs AB, Carpenter Technology Corporation, Sandvik AB, GKN Additive, EOS GmbH, Aubert & Duval, LPW Technology Ltd (now part of Carpenter Additive), Renishaw plc, Tekna Plasma Systems Inc., Kennametal Inc., Heraeus AMLOY Technologies GmbH, Jiangsu Vilory Advanced Materials Technology Co., Ltd., Metalysis Ltd., 3D Systems Corporation, and VBN Components AB.

Titanium-based powders are expected to dominate the metal powders for additive manufacturing market by 2034 due to their superior strength-to-weight ratio and corrosion resistance. Their broader use in medical implants, aerospace, and defense applications fuels this growth.

Emerging trends in the metal powders for additive manufacturing market include the development of novel alloys, the growth of sustainable and recyclable powders, and in-situ process monitoring solutions. Advancements like AI-driven powder design, binder jetting for metals, and closed-loop powder reuse systems are also transforming the market outlook.

List of Contents

Metal Powders For Additive ManufacturingIndustry Perspective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesChallengesReport ScopeSegmentationRegional AnalysisCompetitive AnalysisKey Market TrendsThe global metal powders for additive manufacturing market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed