3D Printing Photopolymer Market Size, Share, Trends Forecast 2034

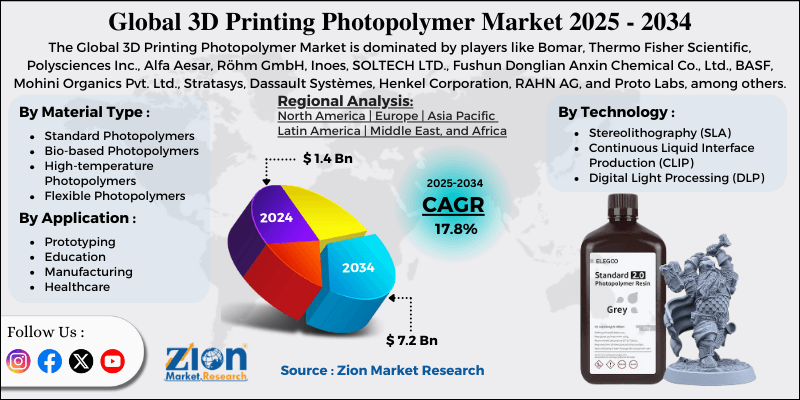

3D Printing Photopolymer Market By Material Type (Standard Photopolymers, Bio-based Photopolymers, High-temperature Photopolymers, and Flexible Photopolymers), By Application (Prototyping, Education, Manufacturing, and Healthcare), By Technology (Stereolithography (SLA), Continuous Liquid Interface Production (CLIP), and Digital Light Processing (DLP)), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.4 Billion | USD 7.2 Billion | 17.8% | 2024 |

3D Printing Photopolymer Industry Prospective:

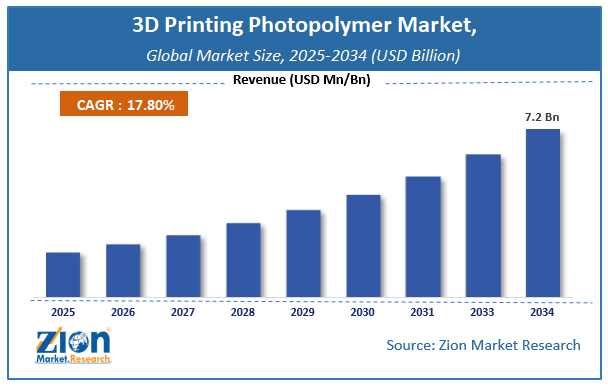

The global 3D printing photopolymer market size was worth around USD 1.4 billion in 2024 and is predicted to grow to around USD 7.2 billion by 2034, with a compound annual growth rate (CAGR) of roughly 17.8% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global 3D Printing Photopolymer market is estimated to grow annually at a CAGR of around 17.8% over the forecast period (2025-2034).

- In terms of revenue, the global 3D Printing Photopolymer market size was valued at around USD 1.4 billion in 2024 and is projected to reach USD 7.2 billion by 2034.

- Strong pull from dental applications is expected to drive the 3D Printing Photopolymer market over the forecast period.

- Based on the material type, the standard photopolymers segment is expected to capture the largest market share over the projected period.

- Based on the application, the prototyping segment is expected to capture the largest market share over the projected period.

- Based on the technology, the Stereolithography (SLA) segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

3D Printing Photopolymer Market: Overview

3D printing photopolymers, which are light-sensitive liquid resins, are used in additive manufacturing techniques like stereolithography (SLA), digital light processing (DLP), and material jetting. Photopolymerization is the process by which these materials are composed of monomers and oligomers that react to specific wavelengths of light, typically ultraviolet light. When printed, the liquid resin hardens one layer at a time based on a digital design. This produces a solid three-dimensional object with very good precision and fine surface detail. 3D printing with photopolymer materials is popular because they can produce objects with smooth surfaces, complex designs, and very tight size tolerances. They are typically used to manufacture prototypes, dental models, medical equipment, jewelry casting patterns, and designs for consumer products. Depending on how they are made, photopolymers can be designed with varied properties, such as flexibility, stiffness, transparency, heat resistance, and biocompatibility. Thermoplastics may be stronger and more robust in UV radiation than photopolymer prints, which could make them less useful for end-use applications than for prototypes.

3D Printing Photopolymer Market Dynamics

Growth Drivers

Does the rapid adoption of vat photopolymerization (SLA/DLP/MSLA) for high-precision parts propel the 3D printing photopolymer industry growth?

The 3D printing photopolymer industry is growing rapidly due to the rapid adoption of vat photopolymerization technologies (SLA, DLP, and MSLA). These technologies immediately increase material consumption and expand the range of applications where accuracy is important. These technologies use liquid photopolymer resins to achieve very fine layer resolution, perfect surface finishes, and tight dimensional tolerances, which are hard to achieve with methods that use filament or powder. As businesses need more complex shapes, micro-features, and surfaces that are almost finished, manufacturers and service providers select vat photopolymerization. This means that there is always a need for specialist photopolymer resins. The need for accuracy, repeatability, and customization for each patient is driving the adoption of this technology in medicine and dentistry. People often utilize SLA and DLP printers to make dental models, surgical guides, aligner molds, hearing aid shells, and temporary restorations. All of these things need a certified, biocompatible photopolymer. Because dental labs have so many cases, they always need resins, which gives material suppliers a steady stream of income and helps the market develop overall.

Restraints

High material cost compared to thermoplastics is impeding the growth of the market

The 3D printing photopolymer market isn't growing as quickly as it should because the materials are significantly more expensive than thermoplastics. Photopolymer resins are usually more expensive than well-known thermoplastic filaments like PLA, ABS, and PETG. This is because they have complex chemical compositions, high-quality standards, and specific production methods. This pricing differential increases the total production cost, especially for large parts or for printing many copies. This makes photopolymers less attractive in fields and uses where price is important. Because of this, many manufacturers still use thermoplastics for parts that need to work and for parts that will be used. Even while photopolymer-based 3D printing technologies have superior surface polish and precision, they aren't used as often.

Opportunities

Will the increasing innovative product launch by the combination of major market players offers a potential opportunity for the 3D printing photopolymer industry growth?

The growing innovative product launch by the combination of major market players are expected to offer a potential opportunity to the 3D Printing Photopolymer Market. For instance, in November 2025, ELEGOO, a rapidly rising global smart manufacturing brand, will take consumer 3D printing to the next level at Formnext 2025 with its all-in-one ecosystem solutions that cover the whole process, from choosing and slicing 3D models to choosing materials, printing, and controlling and monitoring from afar. The Nexprint platform, which debuted in August, connects designers worldwide and facilitates the sharing and downloading of 3D models. The ongoing $1 million creator fund provides creators with money for sharing original content and encouraging others to do the same. Elegoo's ElegooSlicer and SateLite speed up the slicing process for FDM and resin printing. The Matrix App lets you manage many printers from your phone in a very advanced way.

Challenges

Why do limited mechanical strength and long-term durability pose a major challenge to the 3D printing photopolymer market expansion?

The 3D printing photopolymer industry has been struggling to grow because the materials lack sufficient mechanical strength and long-term durability. Photopolymer resins certainly make things look nice and accurate, but many things printed with them are more fragile and less impact-resistant than those made of plastic or metal. When materials are exposed to UV radiation, heat, and other environmental factors, they can lose their mechanical properties, change color, and break down. Photopolymer-based parts can't be used for load-bearing, high-stress, or outdoor applications because of these constraints. Instead, they can only be used to make prototypes, visual models, and parts that only work for a limited time.

3D Printing Photopolymer Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | 3D Printing Photopolymer Market |

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2034 | USD 7.2 Billion |

| Growth Rate | CAGR of 17.8% |

| Number of Pages | 260 |

| Key Companies Covered | Bomar, Thermo Fisher Scientific, Polysciences Inc., Alfa Aesar, Röhm GmbH, Inoes, SOLTECH LTD., Fushun Donglian Anxin Chemical Co., Ltd., BASF, Mohini Organics Pvt. Ltd., Stratasys, Dassault Systèmes, Henkel Corporation, RAHN AG, and Proto Labs, among others. |

| Segments Covered | By Material Type, By Application, By Technology and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America,The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

3D Printing Photopolymer Market: Segmentation

Material Type Insights

The standard photopolymers segment dominates the market, capturing over 38% of the market share. The growth is due to its widespread use in general-purpose and prototyping applications. People often use these materials in SLA, DLP, and MSLA technologies to produce visual models, concept prototypes, functional parts, and design-validation elements. Because they are cheaper than specialist and high-performance photopolymers, they are the best choice for design studios, schools, and small to medium-sized organizations. This leads to steady demand and revenue.

Application Insights

The prototyping segment is expected to hold the largest revenue share over the projected period. This segment is driven by the growing demand for rapid product development and design validation across numerous industries. Photopolymer-based technologies, such as SLA and DLP, are frequently used in prototyping because they provide great dimensional accuracy, fine feature resolution, and better surface smoothness, all of which are necessary for evaluating form, fit, and aesthetics. This has resulted in high and recurring demand for photopolymer resins, which is directly contributing to market revenue growth.

Technology Insights

The Stereolithography (SLA) segment is expected to capture a substantial market share of more than 35%. The rise is due to its widespread use in making high-quality and high-precision parts. SLA makes things with a very smooth surface, precise features, and strict size limits by curing liquid photopolymer resins using lasers. This makes the technology well-suited for applications such as rapid prototyping, dental and medical models, jewelry patterns, and sophisticated industrial parts. As a result, there is always a need for photopolymer materials and systems that go with them.

3D Printing Photopolymer Market: Regional Analysis

North America is a major and well-established regional market for 3D printing photopolymers. This is because the region was an early adopter of new additive manufacturing technology and has many big industry competitors. There is strong demand for photopolymer-based technologies, such as stereolithography (SLA) and digital light processing (DLP), across industries, including healthcare, dental, aerospace, automotive, consumer goods, and industrial manufacturing. These technologies are widely used for prototyping and low-volume production. The North American photopolymer market for 3D printing is growing as photopolymers are increasingly used in medical and dental applications, including surgical guides, dental models, aligners, and personalized medical devices. The market is rising due to favorable regulations for medical-grade and biocompatible resins and the growing adoption of Industry 4.0 technologies.

Does the US's growing adoption of desktop SLA printers by design studios, startups, and educational institutions drive the 3D Printing Photopolymer market?

Photopolymer resins are almost the only type of resin used in desktop SLA printers. Their growing user base indicates sustained demand for materials. SLA is great for speedy prototyping, concept modeling, and product design validation, since it delivers smooth surfaces, high-resolution features, and accurate dimensions at a low cost per unit. This is why design studios and startups use these systems a lot. This cycle of constantly making prototypes means resin is always being used up, keeping market revenue growth steady. Schools and colleges play a significant role in the business's growth. In the US, universities, engineering colleges, and design schools are using desktop SLA printers in their classrooms and research labs to teach students to make products. This not only increases the immediate use of photopolymer but also promotes long-term demand by demonstrating to future engineers and designers how to apply photopolymer-based 3D printing technology. These factors all have a big effect on the long-term growth of the US 3D printing photopolymer market.

3D Printing Photopolymer Market: Competitive Analysis

The global 3D Printing Photopolymer market is dominated by players like-

- Bomar

- Thermo Fisher Scientific

- Polysciences Inc.

- Alfa Aesar

- Röhm GmbH

- Inoes

- SOLTECH LTD.

- Fushun Donglian Anxin Chemical Co.

- BASF

- Mohini Organics Pvt. Ltd.

- Stratasys

- Dassault Systèmes

- Henkel Corporation

- RAHN AG

- Proto Labs

- among others.

The global 3D Printing Photopolymer market is segmented as follows:

By Material Type

- Standard Photopolymers

- Bio-based Photopolymers

- High-temperature Photopolymers

- Flexible Photopolymers

By Application

- Prototyping

- Education

- Manufacturing

- Healthcare

By Technology

- Stereolithography (SLA)

- Continuous Liquid Interface Production (CLIP)

- Digital Light Processing (DLP)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed