Application Performance Monitoring (APM) Market Size, Share, Trends Forecast 2034

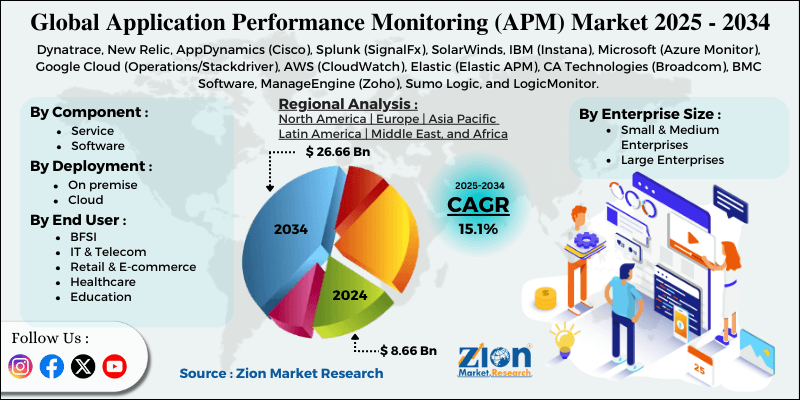

Application Performance Monitoring (APM) Market By Component (Service, Software), By Deployment (On premise, Cloud), By Enterprise Size (Small & Medium Enterprises, Large Enterprises), By End-User (Banking, Financial Services and Insurance [BFSI], IT & Telecom, Retail & E-commerce, Healthcare, Education, Media & Entertainment, Manufacturing), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

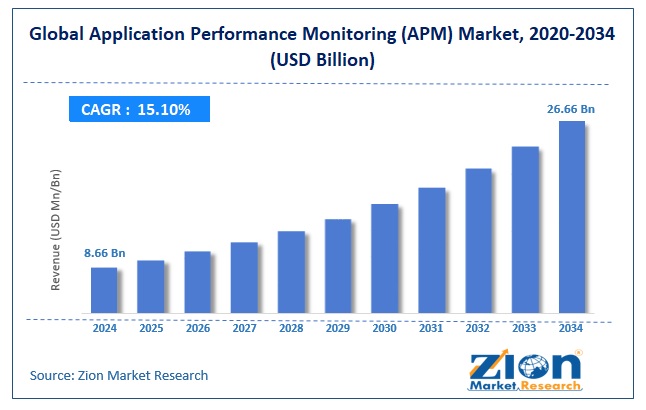

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.66 Billion | USD 26.66 Billion | 15.1% | 2024 |

Application Performance Monitoring (APM) Industry Prospective:

The global application performance monitoring (APM) market size was worth around USD 8.66 billion in 2024 and is predicted to grow to around USD 26.66 billion by 2034, with a compound annual growth rate (CAGR) of roughly 15.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global application performance monitoring (APM) market is estimated to grow annually at a CAGR of around 15.10% over the forecast period (2025-2034)

- In terms of revenue, the global application performance monitoring (APM) market size was valued at around USD 8.66 billion in 2024 and is projected to reach USD 26.66 billion by 2034.

- The application performance monitoring (APM) market is projected to grow significantly owing to the rising complexity of IT environments, expansion of DevOps and CI/CD practices, and the need for enhanced end-user experience monitoring.

- By component, the software segment is expected to lead the market, while the services segment is expected to grow considerably.

- Based on deployment, the cloud segment is the dominating segment, while the on-premises segment is projected to witness sizeable revenue over the forecast period.

- Based on enterprise size, the large-enterprise segment leads the market, while the small & medium enterprises segment is projected to grow rapidly.

- Based on end-user, the IT & telecom segment is expected to lead the market, followed by the Banking, Financial Services and Insurance (BFSI) segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Application Performance Monitoring (APM) Market: Overview

Application Performance Monitoring is the practice of analyzing and tracking how software applications perform in real-time to ensure they run efficiently and smoothly. It offers visibility into metrics such as error rates, response times, user experience, and resource usage, helping teams quickly detect performance issues and identify their causes. The global Application Performance Monitoring (APM) market is poised for notable growth owing to digital transformation initiatives, adoption of hybrid and Cloud IT, and growth of web and mobile applications. Businesses modernize customer-facing systems and operations, thereby increasing dependency on digital applications.

With the growing volume of online work, visibility into performance is becoming increasingly important. APM assures these digital services remain reliable, fast, and competitive. Moreover, hybrid and cloud infrastructure create dynamic and distributed environments. Monitoring performance in these layers becomes more crucial and complex. APM tools offer unified visibility to manage this complexity efficiently. Furthermore, user expectations for smooth, fast app experiences are high. Web and mobile performance issues directly affect revenue and satisfaction. APM helps maintain responsiveness in all user touchpoints.

Nevertheless, the global market faces limitations, including high deployment & maintenance costs and a shortage of skills and expertise. Exhaustive APM tools can be financially challenging to scale and implement. Licensing, setup, and current management create financial obstacles. Smaller companies usually struggle to justify the investment. Likewise, APM solutions need skilled analysts to interpret complex metrics. Only some businesses have personnel capable of advanced monitoring tasks. This restricts the full value APM can deliver. Older applications may not support modern monitoring tools.

Integrating them usually demands workarounds and custom engineering. This increases complexity and implementation time. Still, the global Application Performance Monitoring (APM) industry benefits from several favorable factors, such as ML & AI integration, the expansion of AIOps platforms, and the rise of digital experience monitoring (DEM). AI allows predictive performance insights and proactive anomaly detection. Automated root-cause analysis decreases manual troubleshooting time. This majorly improves APM efficiency and value. APM data can feed into AIOps systems for automated issue resolution. This creates end-to-end smart operations workflows. Vendors benefit from integrating APM with wider IT automation. Combining APM with real-user analytics provides complete visibility into use journeys. DEM expands APM beyond metrics to business impact. This creates new service and product opportunities.

Application Performance Monitoring (APM) Market Dynamics

Growth Drivers

How is the application performance monitoring (APM) market driven by Microservices, DevOps, and Agile Delivery?

The shift from monolithic systems to APIs and microservices has multiplied the number of performance touchpoints, increasing complexity. Agile practices and DevOps need continuous feedback loops that incorporate APM into deployment and development workflows. Real-time tracing and automated issue detection allow quick releases with fewer performance regressions. This alignment of APM with CI/CD processes amplifies operational efficiency and adoption.

How is the application performance monitoring (APM) industry fueled by unified observability across tech stacks?

Siloed monitoring of metrics, logs, and user experience no longer meets business needs, fueling demand for unified observability platforms and driving the growth of the application performance monitoring (APM) market. APM solutions that incorporate application, business, and infrastructure telemetry provide a holistic view of digital operations. Cross-functional insights enable faster root-cause analysis and improved team collaboration. This convergence decreases tool sprawl and improves visibility in complex environments.

Restraints

Skilled workforce shortage negatively impacts the market progress

Implementing and managing APM tools requires expertise in DevOps, cloud computing, and performance analytics. The lack of skilled, trained professionals hampers deployment, reduces the value of monitoring insights, and increases reliance on external consultants. Small teams struggle to fully leverage improved features such as distributed tracing or AI-driven anomaly detection. This skills gap remains a key restraint, particularly in mid-sized businesses with fewer IT staff. Businesses should invest in managed services or training to overcome this obstacle.

Opportunities

How does growing focus on end-user experience offer advantageous conditions for the application performance monitoring (APM) market development?

Businesses are prioritizing application performance as a key metric of success, linking user experience directly to profits. APM solutions that offer real-user monitoring, experience analytics, and synthetic testing can capture this rising focus. There is an opportunity in the application performance monitoring (APM) industry for vendors to offer performance insights linked to business KPIs. Businesses are steadily adopting APM to reduce churn, enhance customer satisfaction, and improve digital services. This trend fuels the demand for advanced monitoring tools.

Challenges

Managing large volumes of telemetry data restricts the market growth

Modern applications generate vast amounts of traces, metrics, and logs, making data management a major challenge. Processing, storing, and analyzing this data in real time requires scalable platforms and robust infrastructure. Inefficient handling of telemetry can delay insights and lead to missed performance issues. Businesses require smart filtering and analytics to focus on meaningful signs. Efficiently managing big data is important for APM success.

Application Performance Monitoring (APM) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Application Performance Monitoring (APM) Market |

| Market Size in 2024 | USD 8.66 Billion |

| Market Forecast in 2034 | USD 26.66 Billion |

| Growth Rate | CAGR of 15.1% |

| Number of Pages | 250 |

| Key Companies Covered | Dynatrace, New Relic, AppDynamics (Cisco), Splunk (SignalFx), SolarWinds, IBM (Instana), Microsoft (Azure Monitor), Google Cloud (Operations/Stackdriver), AWS (CloudWatch), Elastic (Elastic APM), CA Technologies (Broadcom), BMC Software, ManageEngine (Zoho), Sumo Logic, and LogicMonitor. |

| Segments Covered | By Component, By Deployment, By Enterprise Size, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Application Performance Monitoring (APM) Market: Segmentation

The global application performance monitoring (APM) market is segmented based on component, application, enterprise size, end-user, and region.

Based on component, the global application performance monitoring (APM) industry is divided into service and software. The software segment holds a 65-70% share, as businesses primarily invest in APM tools to collect metrics, analyze performance, and monitor applications in complex IT environments. The adoption of cloud-based, hybrid, and on-premises solutions fuels segmental growth.

On the other hand, the services segment holds a 30-35% market share, as many businesses need expert support to deploy and optimize APM solutions effectively.

Based on deployment, the global market is segmented into on-premises and cloud. The cloud segment accounts for 55-60% due to the growing adoption of cloud infrastructure, hybrid IT environments, and SaaS applications. Cloud APM offers benefits such as lower upfront costs, easier updates, scalability, and remote accessibility, which increase its appeal to modern businesses.

However, on-premises APM ranks second in the market, with a 40-45% share, as several large businesses and regulated industries choose to host monitoring solutions on their own infrastructure for enhanced control, compliance, and security.

Based on enterprise size, the global application performance monitoring (APM) market is segmented into small & medium enterprises and large enterprises. The large enterprises segment holds a dominant share (60-65%) because they typically have complex IT infrastructures, multiple applications, and high budgets, making strong APM solutions vital for ensuring reliable performance and customer satisfaction in their operations.

Nonetheless, the small & medium enterprises segment captures a 35-40% share, driven by growing digital adoption and the availability of cost-efficient, cloud-based APM solutions, even though their overall APM spending is lower than that of large businesses.

Based on end-user, the global market is segmented into Banking, Financial Services and Insurance (BFSI), IT & telecom, retail & e-commerce, healthcare, education, media & entertainment, and manufacturing. The IT & telecom segment leads with 35-40%, as businesses in this industry depend heavily on high-availability and complex applications and digital services. They require continuous monitoring to ensure optimal network performance, end-user experience, and application uptime.

Conversely, the BFSI segment leads with a 25-30% share due to the acute need for high-performing, secure applications that support mobile transactions, regulatory compliance, trading platforms, and online banking. Poor performance in BFSI applications can directly impact customer trust and financial operations.

Application Performance Monitoring (APM) Market: Regional Analysis

What enables North America’s strong foothold in the global Application Performance Monitoring (APM) Market?

North America is projected to maintain its dominant position with an 11-12% CAGR in the global Application Performance Monitoring (APM) market, owing to developed IT infrastructure & high adoption rates, the presence of leading APM vendors and innovation hubs, and broader enterprise digital transformation. North America holds a leading position in the market because of its well-established IT infrastructure and broader adoption of hybrid and cloud environments. Businesses prioritize application performance and uptime, fueling robust demand for monitoring solutions. This maturity assures faster deployment and incorporation of advanced APM tools.

Moreover, the region hosts several prominent APM vendors and technology innovation centers, fostering rapid product development. Technology hubs like Silicon Valley amplify research, cutting-edge features, and early adoption. This concentration boosts North America’s dominance in innovation and market share. Furthermore, North American businesses are heavily capitalizing on digital transformation initiatives, comprising microservices and cloud migration. Greater emphasis on user experience and performance drives sustained investment in APM solutions. Businesses deploy these tools to ensure seamless operations and compliance with stringent SLAs.

Europe maintains its position as the second-largest region, with a 9-10% CAGR, in the global Application Performance Monitoring (APM) industry, driven by digital transformation across businesses, the presence of key IT & software companies, and regulatory compliance and data security requirements. European businesses are increasingly adopting microservices, cloud services, and digital platforms, thereby increasing demand for APM solutions. Businesses focus on enhancing user experience and reducing application downtime.

This digital transformation supports steady growth in APM adoption in industries. Moreover, Europe houses several large IT companies and software vendors that offer and consume APM solutions. The region benefits from modernized technological expertise and the local development of performance-monitoring tools. This infrastructure supports innovation and improves the region’s market penetration. Additionally, stringent regulations such as GDPR drive businesses to maintain secure, highly reliable applications. APM tools help monitor performance while assuring compliance with data privacy regulations. Firms invest in APM to avoid penalties and maintain consumer trust.

Application Performance Monitoring (APM) Market: Competitive Analysis

The leading players in the global application performance monitoring (APM) market are-

- Dynatrace

- New Relic

- AppDynamics (Cisco)

- Splunk (SignalFx)

- SolarWinds

- IBM (Instana)

- Microsoft (Azure Monitor)

- Google Cloud (Operations/Stackdriver)

- AWS (CloudWatch)

- Elastic (Elastic APM)

- CA Technologies (Broadcom)

- BMC Software

- ManageEngine (Zoho)

- Sumo Logic

- LogicMonitor.

Application Performance Monitoring (APM) Market: Key Market Trends

Cloud-Native & Microservices Monitoring:

With the growth of cloud adoption, APM solutions are adapting to monitor multi-cloud, hybrid, and containerized environments. Microservices frameworks need granular visibility in distributed systems. Tools now offer dynamic monitoring that adjusts to speedily changing infrastructures. This ensures seamless performance tracking even in scalable, complex deployments.

Real-user & full-stack observability:

APM is progressing toward comprehensive full-stack monitoring, covering everything from the backend to the frontend user interfaces. Real-user monitoring tracks actual user experiences in real time, highlighting performance bottlenecks. This helps organizations to optimize customer satisfaction and system health. End-to-end observability assures all components of the IT infrastructure are monitored efficiently.

The global application performance monitoring (APM) market is segmented as follows:

By Component

- Service

- Software

By Deployment

- On premise

- Cloud

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By End User

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Retail & E-commerce

- Healthcare

- Education

- Media & Entertainment

- Manufacturing

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

What will be the CAGR value of the application performance monitoring (APM) market during 2025-2034?

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed