Downstream Market Size, Share, Trends, Growth and Forecast 2034

Downstream Market By Product (Centrifuges, Dryers, Chromatography Systems, Filters, Evaporators, and Others), By Technique (Purification by Chromatography, Solid-liquid Separation, Cell Disruption, Concentration, Formulation), By Application (Antibodies Production, Antibiotic Production, Hormone Production, Enzyme Production, Vaccine Production), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

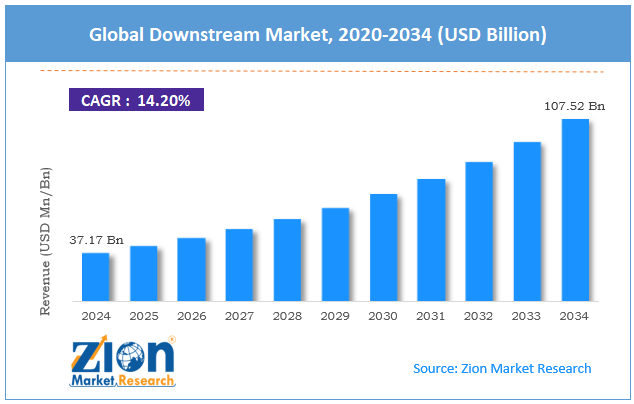

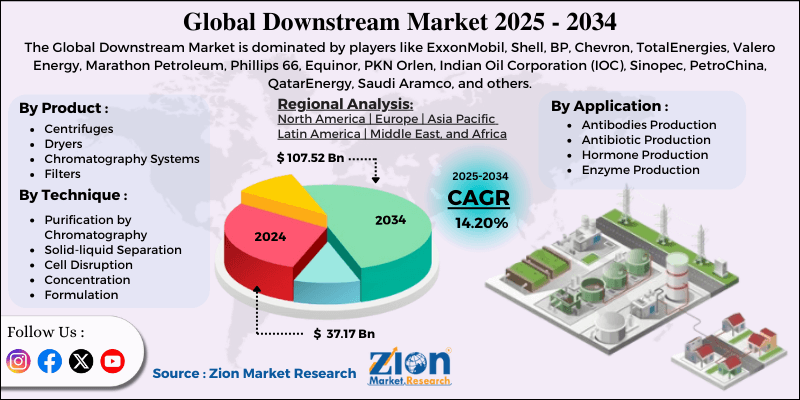

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 37.17 Billion | USD 107.52 Billion | 14.20% | 2024 |

Downstream Industry Perspective:

The global downstream market size was worth around USD 37.17 billion in 2024 and is predicted to grow to around USD 107.52 billion by 2034, with a compound annual growth rate (CAGR) of roughly 14.20% between 2025 and 2034.

Downstream Market: Overview

Downstream refers to the final stage of the oil & gas company, where natural gas and crude oil are refined, processed, and transformed into final fuel products like diesel, gasoline, jet fuel, petrochemicals, lubricants, and other consumer products. It comprises refining, distribution, and marketing activities that openly connect with industries and consumers. The global downstream market is poised for notable growth owing to the expanding petrochemical demand, growing industrialization and urbanization, and an increase in transportation and aviation. Petrochemicals are essential inputs for packaging, plastics, healthcare, and electronics. As consumer product industries progress, mainly in the Asia Pacific, petrochemical refining is becoming an indispensable growth driver for the downstream operators. Rapid urbanization in developing economies drives up energy consumption, particularly of diesel, gasoline, and jet fuel.

According to the UN reports, approximately 68% of the world's population will live in cities by 2050. This will majorly expand refined product demand. Furthermore, the aviation industry's rebound after the COVID-19 pandemic has doubled the demand for jet fuel. Likewise, the growth of logistics and e-commerce networks is surging demand for gasoline and diesel, impacting downstream progress.

Nevertheless, the global market faces limitations due to factors such as decarbonization pressure and environmental regulations, high operational and capital costs, and a shift towards EVs. Governments across the globe are tightening standards for emissions. Policies encouraging the adoption of EVs, green hydrogen, and biofuels may limit long-term demand for refined fossil fuels. Additionally, maintaining and building distribution networks and refineries requires significant investment. Small companies often struggle to compete with oil giants.

Additionally, growing adoption of electric vehicles directly decreases the demand for diesel and gasoline. With EVs anticipated to account for 62% of the worldwide car sales by 2035, this is a vital limitation. Still, the global downstream industry benefits from several favorable factors like renewable and biofuels refining, integration of digital technologies, and strategic associations and mergers & acquisitions. The move towards sustainable fuels offers opportunities in bio-jet fuel, renewable diesel, and ethanol blending.

Several refineries are repurposing facilities to accommodate green fuels. IoT, blockchain, and AI are allowing smart refineries, optimized distribution, and predictive maintenance, improving reliability and cost-efficiency in the downstream value chain. Acquisitions, joint ventures, and mergers are transforming the downstream outlook. Associations between NOCs and private players offer fresh growth avenues.

Key Insights:

- As per the analysis shared by our research analyst, the global downstream market is estimated to grow annually at a CAGR of around 14.20% over the forecast period (2025-2034)

- In terms of revenue, the global downstream market size was valued at around USD 37.17 billion in 2024 and is projected to reach USD 107.52 billion by 2034.

- The downstream market is projected to grow significantly owing to increasing transport fuel consumption, strategic government policies and subsidies, and growing demand for specialty chemicals.

- Based on product, the filters segment is expected to lead the market, while the chromatography systems segment is expected to grow considerably.

- Based on technique, the purification by chromatography segment is the dominating segment, while the solid-liquid separation segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the antibodies production segment is expected to lead the market compared to the vaccine production segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Downstream Market: Growth Drivers

Light ends pull and petrochemical integration boost market growth

Integration with petrochemicals is among the leading propellers for downstream profitability. As the demand for construction materials, plastics, and consumer goods remains strong, refiners are channeling more light ends into petrochemical feedstocks like LPG and naphtha. Worldwide ethylene capacity exceeded 200 million tonnes by 2024, with APAC registering the maximum share of new investments. The Middle East and China are forerunners in the push for crude-to-chemicals complexes, designed to convert 40-70% of crude oil directly into chemical items. These incorporated models provide strategic insulation from volatility in transport fuels, beyond just stabilizing refinery margins during fuel downturns.

How do digitalization, reliability, & decarbonization capex drive the global downstream market?

Refiners are actively investing in decarbonization and digital technologies projects to cut emissions and costs. Advanced process control (APC), digital twins, and AI-based predictive maintenance are enhancing unit reliability and driving utilization rates by 1.5%. Simultaneously, energy optimization projects like hydrogen management and waste heat recovery are reducing 1-3% of site energy use, producing substantial savings.

Several refiners are also piloting CCUS projects in Asia and Europe, tying into industrial collections. The integration of green capex and digitalization is helping downstream players maintain profitability while supporting their ESG commitments. These efforts are helping the growth of the downstream market.

Downstream Market: Restraints

How are stricter regulations and environmental compliance costs negatively impacting the industry's progress?

Stringent sustainability mandates and emission rules are increasing operational costs for refiners across the globe. The compliance with standards like Euro VI/BS-VI for road fuels and IMO 2020 (sulfur cap for marine fuels) has compelled heavy investment in desulfurization and hydrotreating units. Refiners in the EU and US are also pressurized by carbon pricing schemes, with the EU ETS carbon price expected to be around Euro 80-90/ton in 2023-24. These compliance costs reduce profitability, especially for smaller refiners who lack capital flexibility. In the latest news, many European refiners have declared multimillion-dollar capex initiatives for emissions reduction to prevent penalties, which in turn weakens and strains their balance sheets.

Downstream Market: Opportunities

How do product upgrading and emerging-market demand create promising avenues for industry growth?

Emerging parts of Africa, Asia, and India continue to post structural growth in gasoline, LPG, and diesel. The global liquids hovered near 102-103 mb/d in 2024, with the developing markets offsetting OECD fuel efficacy gains. LPG penetration for kerosene substitution and clean cooking is still a key policy priority, backing light-end countries. New retail footprints, premium fuels (low-sulfur diesel, additive gasoline), and loyalty programs lift downstream marketing promotions, impacting the progress of the downstream industry. Recent milestones include the retail network growth in Southeast and South Asia, as well as the phased start of Nigeria's 650 kb/d Dangote.

Downstream Market: Challenges

Financing, insurance, and stakeholder pressure restrict the market growth

Access to capital is narrowing for fossil-heavy assets as insurers and lenders surround climate risk. Insurance premiums and debt costs have increased for some operators, increasing paybacks on upgrades and maintenance. Equity markets favor expansion in low-carbon lines, pushing refiners to fund transitions while central margins are cyclical. Interruptions in securing permits for bioconversions and expansions add execution risk. 2023-2024 disclosures from independents and majors mentioned higher disclosure needs and stringent bank policies as material restraints.

Downstream Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Downstream Market |

| Market Size in 2024 | USD 37.17 Billion |

| Market Forecast in 2034 | USD 107.52 Billion |

| Growth Rate | CAGR of 14.20% |

| Number of Pages | 220 |

| Key Companies Covered | ExxonMobil, Shell, BP, Chevron, TotalEnergies, Valero Energy, Marathon Petroleum, Phillips 66, Equinor, PKN Orlen, Indian Oil Corporation (IOC), Sinopec, PetroChina, QatarEnergy, Saudi Aramco, and others. |

| Segments Covered | By Product, By Technique, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Downstream Market: Segmentation

The global downstream market is segmented based on product, technique, application, and region.

Based on product, the global downstream industry is divided into centrifuges, dryers, chromatography systems, filters, evaporators, and others. The filters segment dominates the international market since they are vital for purification, separation, and clarification in multiple industries. In petrochemical and refining plants, they eradicate sediments, impurities, and particulates to assure equipment protection and product consistency. Their comparatively low price, scalability, and efficacy increase their preference for precision and bulk operations. As demand for high-class fuels, bioproducts, and chemicals increases, filters are still the cornerstone of downstream processing.

Based on technique, the global downstream market is segmented into purification by chromatography, solid-liquid separation, cell disruption, concentration, and formulation. The purification by chromatography segment leads the global market since it is the crucial stage in promising product purity and compliance with strict standards. Chromatography is broadly used in biotechnology, specialty chemicals, and pharmaceuticals, where high-purity outputs are non-negotiable. Its reliability and precision make it the leading technique despite its high price, especially as specialty compounds and biologics witness growing demand.

Based on application, the global market is segmented into antibodies production, antibiotic production, hormone production, enzyme production, and vaccine production. The antibodies production segment holds the maximum market share, fueled by the growing demand for therapeutic proteins and monoclonal antibodies. These biologics are vital to treatments like cancer, infectious diseases, and autoimmune disorders, making them the fastest-progressing pharmaceutical categories. Worldwide biologics revenue exceeded USD 400 billion in 2023, with antibodies holding a significant share. The complexity of purification, mainly promising regulatory compliance and high production, keeps downstream processing central to the segment.

Downstream Market: Regional Analysis

What gives the Asia Pacific a competitive edge in the global Downstream Market?

Asia Pacific is projected to maintain its dominant position in the global downstream market owing to speedy industrialization and energy demand, strong petrochemical and refining capacity, and expanding middle-class and consumer markets. Asia Pacific accounts for a significant share of the market, driven by rapid industrialization in India, China, and Southeast Asia. The region demands more than 37% of the worldwide oil demand, making it the leading consumer market. Expanding logistics, manufacturing, and transportation sectors fuel strong downstream needs. India and China have developed as refining powerhouses, with China capturing more than 17 million barrels per day refining potential.

Large-scale integrated complexes boost the region's ability to satisfy both export and domestic requirements. This unparalleled refining ecosystem secures North America's dominance in downstream markets. Moreover, the rising middle-class population in APAC is fueling the demand for plastics, fuels, and consumer products obtained from petrochemicals. Asia is anticipated to host 2/3rd of the worldwide middle class by 2030. Growing incomes translate to high energy consumption, demand for refined petroleum-based products, and automotive usage.

North America maintains its position as the second-leading region in the global downstream industry due to large refining capacity, a strong plastics and petroleum industry, and improvements in refining. North America, led by the US, holds the most advanced refining ecosystems. The United States alone registers refining capacity of nearly 18 million barrels per day, ranking it as the largest single-nation refiner. This extensive capacity helps the region to satisfy significant export needs and domestic demand. Furthermore, the area is a key hub for petrochemicals, backed by abundant shale gas feedstock that offers cost benefits.

The United States Gulf Coast is a forerunner in polyethylene and ethylene production, with petroleum exports estimated at more than USD 35 billion in 2023. This strong industry boosts the regional dominance beyond fuels. The region also leads in adopting modernized refining solutions, process optimization, and digitization. US refiners are investing heavily in carbon capture technologies and renewable diesel, with more than 2.5 billion gallons of renewable diesel capacity projected by 2025. These advancements fuel the regional competitiveness in the progressing market.

Downstream Market: Competitive Analysis

The leading players in the global downstream market are:

- ExxonMobil

- Shell

- BP

- Chevron

- TotalEnergies

- Valero Energy

- Marathon Petroleum

- Phillips 66

- Equinor

- PKN Orlen

- Indian Oil Corporation (IOC)

- Sinopec

- PetroChina

- QatarEnergy

- and Saudi Aramco

Downstream Market: Key Market Trends

Smart refineries and digitalization:

Downstream operators are adopting IoT, AI, and automation to enhance refining efficacy and decrease operational costs. Digital twins and predictive maintenance are becoming industry standards, aiding in optimizing production.

Integration of petrochemicals with refining:

To offset declining fuel margins, several companies are integrating refining operations with petrochemicals. This integration leverages the value of crude oil to produce high-demand products, such as specialty chemicals and plastics. For instance, China's mega-refineries are primarily designed as refinery-petrochemical integrated hubs.

The global downstream market is segmented as follows:

By Product

- Centrifuges

- Dryers

- Chromatography Systems

- Filters

- Evaporators

- Others

By Technique

- Purification by Chromatography

- Solid-liquid Separation

- Cell Disruption

- Concentration

- Formulation

By Application

- Antibodies Production

- Antibiotic Production

- Hormone Production

- Enzyme Production

- Vaccine Production

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Downstream refers to the final stage of the oil & gas company, where natural gas and crude oil are refined, processed, and transformed into final fuel products like diesel, gasoline, jet fuel, petrochemicals, lubricants, and other consumer products. It comprises refining, distribution, and marketing activities that openly connect with industries and consumers.

The global downstream market is projected to grow due to improvements in refining technologies, ever-increasing global energy demand, and speedy urbanization and industrialization.

According to study, the global downstream market size was worth around USD 37.17 billion in 2024 and is predicted to grow to around USD 107.52 billion by 2034.

The CAGR value of the downstream market is expected to be around 14.20% during 2025-2034.

Asia Pacific is expected to lead the global downstream market during the forecast period.

China is a key contributor to the global downstream market, with refining capacity surpassing 17 million barrels per day in 2024. Its growing petrochemical complexes and integrated mega-refineries make it a key player in transforming global and regional product flows.

The refining segment is expected to dominate the downstream market by 2034, driven by sustained demand for jet fuel, diesel, and petrochemical feedstocks. Integration with petrochemicals and ongoing investments in complex refineries further strengthen its long-term dominance.

The value chain of the global downstream industry includes refining, distribution & logistics, retail marketing, and petrochemical production. These stages transform crude oil into chemicals and fuels, move products via supply networks, and deliver them to end users.

The key players profiled in the global downstream market include ExxonMobil, Shell, BP, Chevron, TotalEnergies, Valero Energy, Marathon Petroleum, Phillips 66, Equinor, PKN Orlen, Indian Oil Corporation (IOC), Sinopec, PetroChina, QatarEnergy, and Saudi Aramco.

The report examines key aspects of the downstream market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed