Aircraft Fuel Cell Market Size, Share, Trends, Growth 2034

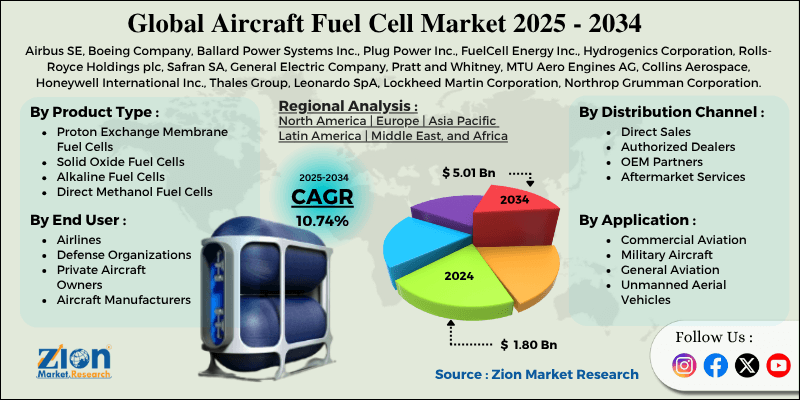

Aircraft Fuel Cell Market By Product Type (Proton Exchange Membrane Fuel Cells, Solid Oxide Fuel Cells, Alkaline Fuel Cells, and Direct Methanol Fuel Cells), By Application (Commercial Aviation, Military Aircraft, General Aviation, and Unmanned Aerial Vehicles), By Distribution Channel (Direct Sales, Authorized Dealers, OEM Partners, and Aftermarket Services), By End-User (Airlines, Defense Organizations, Private Aircraft Owners, and Aircraft Manufacturers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

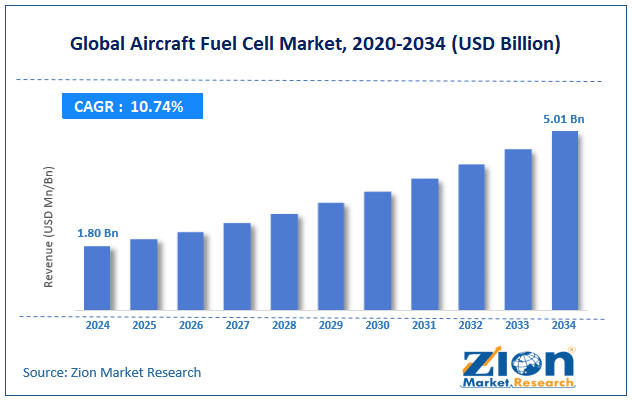

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.80 Billion | USD 5.01 Billion | 10.74% | 2024 |

Aircraft Fuel Cell Industry Perspective:

The global aircraft fuel cell market was valued at approximately USD 1.80 billion in 2024 and is expected to reach around USD 5.01 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 10.74% between 2025 and 2034.

Aircraft Fuel Cell Market: Overview

Aircraft fuel cells are advanced power systems that generate electricity by combining hydrogen and oxygen through electrochemical reactions, with only water vapor as a byproduct. These technologies provide better energy efficiency, lower emissions, and quieter performance than traditional jet engines.

Due to their lightweight and high energy output, fuel cells work well in many types of aircraft, ranging from small drones to large passenger planes. They support the aviation sector's shift toward cleaner and more sustainable flight operations. Ongoing research and development efforts are focused on improving fuel cell durability, power output, and integrating it with existing aircraft systems.

The increasing focus on carbon-neutral aviation and growing investments in hydrogen-powered aircraft technology are expected to drive substantial growth in the global aircraft fuel cell market over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global aircraft fuel cell market is estimated to grow annually at a CAGR of around 10.74% over the forecast period (2025-2034)

- In terms of revenue, the global aircraft fuel cell market size was valued at around USD 1.80 billion in 2024 and is projected to reach USD 5.01 billion by 2034.

- The aircraft fuel cell market is projected to grow significantly due to the increasing demand for sustainable aviation solutions and growing regulatory pressure for emission reduction in aviation.

- Based on product type, proton exchange membrane fuel cells lead the segment and are expected to continue dominating the global market.

- Based on the application, commercial aviation is expected to lead the market.

- Based on the distribution channel, direct sales are anticipated to command the largest market share.

- Based on end-users, airlines are expected to lead the market during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

Aircraft Fuel Cell Market: Growth Drivers

Environmental sustainability and emission reduction mandates

The aircraft fuel cell market is growing as aviation authorities worldwide enforce stricter emission rules and carbon reduction targets on the aerospace industry. Airlines are under pressure to cut their environmental impact, so fuel cells are a promising alternative to traditional jet fuel systems. Aircraft fuel cells produce zero carbon emissions during operation, releasing only clean water vapor and heat.

Governments are providing strong incentives and funding programs to support the development and use of clean aviation technologies, giving fuel cell manufacturers more opportunities. The aviation industry has committed to becoming net zero by 2050, so investments in hydrogen-powered aircraft systems are increasing rapidly.

Technological advancements and performance improvements

The aircraft fuel cell industry is experiencing major technological improvements that have boosted power output, lowered weight, and made fuel cell systems more reliable. Latest fuel cells offer higher energy density than traditional batteries, allowing for longer flights and more payload for aircraft operators.

Better materials and manufacturing methods have lowered costs and increased the lifespan of fuel cell parts. Integration with existing aircraft systems has also improved, making it easier to retrofit older planes.

Aircraft Fuel Cell Market: Restraints

High development costs and infrastructure requirements

Despite strong growth potential, the aircraft fuel cell market faces several major hurdles. Developing and manufacturing fuel cell systems needs a large investment. Aviation-grade fuel cells must meet strict engineering standards, requiring years of testing, certification, and validation that can cost millions.

Infrastructure is also a significant challenge, as airports lack the necessary hydrogen storage, transportation, and refueling setups, which require substantial capital investment to build. These high entry barriers reduce competition and slow the adoption of aircraft fuel cells across the industry.

Aircraft Fuel Cell Market: Opportunities

Military and defense sector adoption

The aircraft fuel cell market is growing as military organizations see the strategic advantages of fuel cell-powered aircraft for defense purposes. These aircraft are quieter than traditional engines, which gives a tactical edge in stealth and surveillance missions by lowering detection risks. Defense agencies are investing in unmanned aerial vehicle (UAV) programs that use fuel cells for longer flight times and better mission capabilities.

Fuel cell aircraft can operate independently of traditional fuel supply chains, making them ideal for remote military operations and emergency responses. Military budgets for advanced propulsion research offer steady funding for fuel cell makers focused on defense use. This growing military interest is expected to accelerate innovation and pave the way for wider adoption of fuel cell technology in both defense and commercial aviation sectors.

Aircraft Fuel Cell Market: Challenges

Technical complexity

The aircraft fuel cell market faces many technical challenges, especially with safely using hydrogen fuel in planes where weight and safety are paramount. Storing hydrogen needs special tanks and cooling systems that add weight and make the design more complicated.

Handling hydrogen at airports and on aircraft also needs new safety rules and training for pilots and staff. It is hard to connect fuel cell systems with existing aircraft parts. Fuel cells must work well in various weather conditions and altitudes, which requires strong materials and intelligent designs.

Aircraft Fuel Cell Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aircraft Fuel Cell Market |

| Market Size in 2024 | USD 1.80 Billion |

| Market Forecast in 2034 | USD 5.01 Billion |

| Growth Rate | CAGR of 10.74% |

| Number of Pages | 212 |

| Key Companies Covered | Airbus SE, Boeing Company, Ballard Power Systems Inc., Plug Power Inc., FuelCell Energy Inc., Hydrogenics Corporation, Rolls-Royce Holdings plc, Safran SA, General Electric Company, Pratt and Whitney, MTU Aero Engines AG, Collins Aerospace, Honeywell International Inc., Thales Group, Leonardo SpA, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, BAE Systems plc, Textron Inc., and others. |

| Segments Covered | By Product Type, By Application, By Distribution Channel, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aircraft Fuel Cell Market: Segmentation

The global aircraft fuel cell market is segmented into product type, application, distribution channel, end-user, and region.

Based on product type, the market is segregated into proton exchange membrane fuel cells, solid oxide fuel cells, alkaline fuel cells, and direct methanol fuel cells. Proton exchange membrane fuel cells lead the market due to their high power density, rapid startup capabilities, and proven reliability in aviation applications requiring consistent performance across varying operational conditions.

Based on application, the aircraft fuel cell industry is classified into commercial aviation, military aircraft, general aviation, and unmanned aerial vehicles. Commercial aviation holds the largest market share due to airline demand for sustainable propulsion solutions, regulatory pressure for emission reduction, and the potential for significant fuel cost savings over traditional jet engines.

Based on the distribution channel, the aircraft fuel cell market is divided into direct sales, authorized dealers, OEM partners, and aftermarket services. Direct sales are expected to lead the market during the forecast period due to the complex technical requirements, customization needs, and close collaboration required between fuel cell manufacturers and aircraft producers.

Based on the end-user, the market is segmented into airlines, defense organizations, private aircraft owners, and aircraft manufacturers. Airlines lead the market share due to sustainability initiatives, operational cost reduction goals, and the growing demand for environmentally responsible aviation solutions from passengers and regulatory authorities worldwide.

Aircraft Fuel Cell Market: Regional Analysis

North America to lead the market

North America is leading the global aircraft fuel cell market thanks to strong government support for clean aviation and a well-developed aerospace and research and development setup. The region accounts for 40% of the global market, with the U.S. leading investments in fuel cell aircraft projects.

Major aerospace firms in the area are working on hydrogen aircraft, increasing demand for advanced fuel cell systems. North America's aviation safety rules offer a clear path for testing and approving new fuel cell technologies.

Public and private partnerships are speeding up development and lowering technical risks. Government grants and tax breaks help fuel cell makers and aircraft developers. The presence of top fuel cell and aerospace companies in the region encourages strong innovation and industry growth.

Europe is set to show rapid expansion.

Europe is experiencing rapid growth in the aircraft fuel cell market, as the EU promotes stringent carbon reduction targets and invests in green aviation projects.

European aviation regulators are setting global standards for hydrogen-powered aircraft, helping guide investment and development. Major aircraft manufacturers in Europe are collaborating on fuel cell projects, leveraging their strong regional expertise in aerospace and clean energy.

Government programs like the Green Deal and Horizon Europe are investing billions into clean aviation, including fuel cells. European companies are teaming up with global aerospace firms to reach new markets and share technology faster.

The region's push for energy independence and cleaner transport supports fuel cell adoption. Hydrogen infrastructure projects at key airports are helping solve refueling challenges, which is crucial for fuel cell aircraft growth.

Recent Market Developments:

- In January 2025, Boeing partnered with a leading fuel cell manufacturer, Norsk e-Fuel, to develop next-generation propulsion systems for military unmanned aerial vehicles, targeting enhanced endurance and stealth capabilities.

Aircraft Fuel Cell Market: Competitive Analysis

The global aircraft fuel cell market is led by players like:

- Airbus SE

- Boeing Company

- Ballard Power Systems Inc.

- Plug Power Inc.

- FuelCell Energy Inc.

- Hydrogenics Corporation

- Rolls-Royce Holdings plc

- Safran SA

- General Electric Company

- Pratt and Whitney

- MTU Aero Engines AG

- Collins Aerospace

- Honeywell International Inc.

- Thales Group

- Leonardo SpA

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- BAE Systems plc

- Textron Inc.

The global Aircraft Fuel Cell market is segmented as follows:

By Product Type

- Proton Exchange Membrane Fuel Cells

- Solid Oxide Fuel Cells

- Alkaline Fuel Cells

- Direct Methanol Fuel Cells

By Application

- Commercial Aviation

- Military Aircraft

- General Aviation

- Unmanned Aerial Vehicles

By Distribution Channel

- Direct Sales

- Authorized Dealers

- OEM Partners

- Aftermarket Services

By End User

- Airlines

- Defense Organizations

- Private Aircraft Owners

- Aircraft Manufacturers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aircraft fuel cells are advanced power systems that generate electricity by combining hydrogen and oxygen through electrochemical reactions, with only water vapor as a byproduct.

The aircraft fuel cell market is expected to be driven by environmental sustainability mandates, technological advancements in fuel cell systems, increasing government investments in clean aviation, military adoption for strategic advantages, and growing airline commitments to carbon-neutral operations.

According to our study, the global aircraft fuel cell market was worth around USD 1.80 billion in 2024 and is predicted to grow to around USD 5.01 billion by 2034.

The CAGR value of the aircraft fuel cell market is expected to be around 10.74% during 2025-2034.

The global aircraft fuel cell market will register the highest revenue contribution from North America during the forecast period.

Key players in the aircraft fuel cell market include Airbus SE, Boeing Company, Ballard Power Systems Inc., Plug Power Inc., FuelCell Energy Inc., Hydrogenics Corporation, Rolls-Royce Holdings plc, Safran SA, General Electric Company, Pratt and Whitney, MTU Aero Engines AG, Collins Aerospace, Honeywell International Inc., Thales Group, Leonardo SpA, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, BAE Systems plc, and Textron Inc.

The report provides a comprehensive analysis of the aircraft fuel cell market, including an in-depth examination of market drivers, restraints, emerging trends, regional dynamics, and future growth prospects. It also examines the competitive dynamics, technological innovations, distribution strategies, and preferences within the aviation sector that shape the sustainable aerospace propulsion ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed