Data Warehouse Market Size, Share, Growth, Opportunities 2034

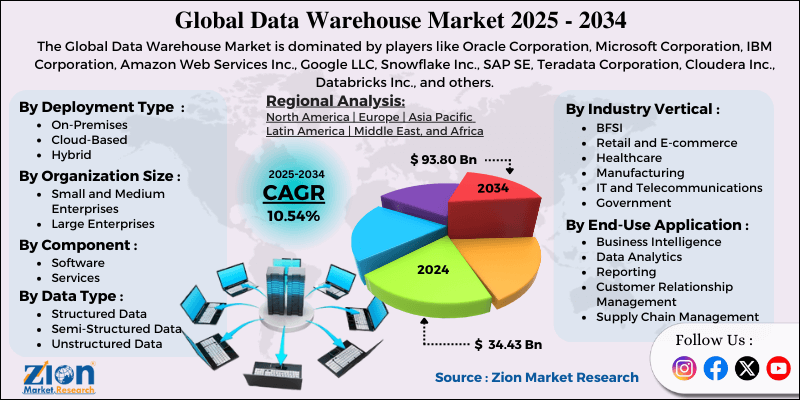

Data Warehouse Market By Deployment Type (On-Premises, Cloud-Based, Hybrid), By Organization Size (Small and Medium Enterprises, Large Enterprises), By Component (Software, Services), By Industry Vertical (BFSI, Retail and E-commerce, Healthcare, Manufacturing, IT and Telecommunications, Government, Education, Media and Entertainment, and Others), By Data Type (Structured Data, Semi-Structured Data, Unstructured Data), By End-Use Application (Business Intelligence, Data Analytics, Reporting, Customer Relationship Management, Supply Chain Management), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

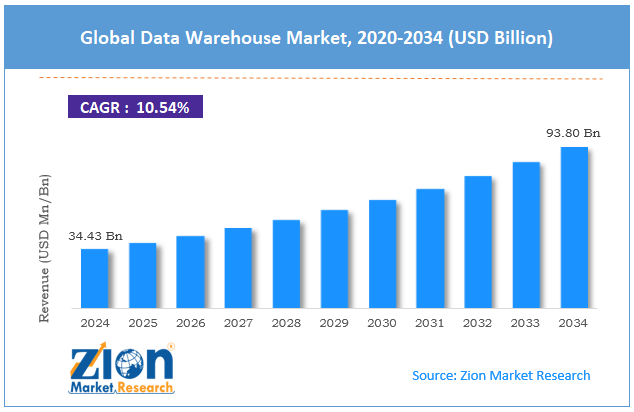

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 34.43 Billion | USD 93.90 Billion | 10.54% | 2024 |

Data Warehouse Industry Perspective:

The global data warehouse market size was worth approximately USD 34.43 billion in 2024 and is projected to grow to around USD 93.80 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.54% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global data warehouse market is estimated to grow annually at a CAGR of around 10.54% over the forecast period (2025-2034).

- In terms of revenue, the global data warehouse market size was valued at approximately USD 34.43 billion in 2024 and is projected to reach USD 93.80 billion by 2034.

- The data warehouse market is projected to grow significantly due to the rising data volumes, increasing need for business intelligence, digital transformation initiatives requiring advanced analytics, and growing adoption of cloud computing technologies.

- Based on deployment type, the cloud-based segment is expected to lead the data warehouse market, while the hybrid segment is anticipated to experience significant growth.

- Based on organization size, the large enterprises segment is expected to lead the data warehouse market, while the small and medium enterprises segment is anticipated to witness notable growth.

- Based on component, the software segment is the dominating segment, while the services segment is projected to witness sizeable revenue over the forecast period.

- Based on industry vertical, the BFSI segment is expected to lead the market compared to the healthcare segment.

- Based on region, North America is projected to dominate the global data warehouse market during the estimated period, followed by Europe.

Data Warehouse Market: Overview

A data warehouse is a centralized system created to store and manage large amounts of structured and unstructured data from many sources for analysis and reporting. It allows organizations to combine information from different departments, applications, and external sources into a single platform, enabling clear decision-making. Building a data warehouse includes extracting data, transforming it into usable formats, loading it into storage, and enabling fast queries and reports for business users. These systems are used by small companies and large global enterprises seeking better control of their information. Common designs include traditional enterprise data warehouses, cloud-based warehouses, data marts, operational data stores, and modern data lakehouse models. Newer versions support real-time processing, artificial intelligence features, machine learning use cases, and automated data quality checks for stronger business intelligence. Scalable storage, strong security, and compliance features help meet enterprise needs, while advanced analytics and visual dashboards improve user understanding and long-term adoption.

The increasing volume of business data and growing need for data-driven decision-making are expected to drive growth in the data warehouse market throughout the forecast period.

Data Warehouse Market Dynamics

Growth Drivers

How is digital transformation and data explosion driving the data warehouse market growth?

The data warehouse market is growing quickly because modern businesses generate large amounts of information requiring organized storage and strong analysis support across many operations. Companies collect data from customer activity, transactions, social media, sensors, and connected devices, producing constant streams that need effective management. Digital transformation efforts push organizations to replace older systems with unified platforms offering better visibility across departments and daily workflows.

E-commerce companies record customer behavior, order details, inventory movements, and shipping information, requiring consolidation for planning and forecasting. Internet of Things devices produce continuous data from factories, supply chains, smart buildings, and consumer products, requiring real-time processing for efficient operations. Mobile applications add engagement patterns, location details, and usage insights, helping companies improve service quality and customer experiences. Cloud computing adoption supports scalable storage for rising data volumes without large hardware investments. Regulatory requirements create pressure to maintain detailed records and audit trails across industries.

Advanced analytics and artificial intelligence integration

The global data warehouse market is growing steadily as organizations use advanced analytical tools designed to extract clear insights from complex datasets supporting many business goals. Machine learning studies past patterns to identify trends, unusual behavior, and useful relationships, helping companies predict future outcomes and improve decision-making. Predictive analytics supports sales forecasting, demand planning, churn prediction, and inventory control, reducing costs and improving efficiency across daily operations. Natural language processing allows users to ask questions in simple language, removing technical barriers and widening access to important information.

Automated data preparation tools reduce manual cleaning and organizing work, allowing analysts to focus on understanding results instead of processing tasks. Real-time analytics provides immediate visibility into operations, helping teams respond quickly to market changes and customer needs. Artificial intelligence tools highlight key metrics and unusual patterns, guiding users toward valuable insights. Data visualization converts complex numbers into clear charts and dashboards, supporting easy understanding.

Restraints

High implementation costs and complexity are affecting adoption patterns

The data warehouse industry faces several restraints that influence adoption across many organizations, including cost, complexity, and skill shortages. High upfront spending for hardware, software, consulting, and infrastructure discourages smaller businesses with limited financial resources. Complex implementation steps involving migration, integration, testing, and training extend project schedules and increase total expenses. Technical skill requirements create hiring challenges as companies struggle to find experts in data modeling, administration, and analytics. Legacy systems create integration issues when older applications do not connect smoothly with modern platforms, requiring extra development work.

Data quality issues reduce accuracy when source systems contain missing, inconsistent, or duplicate records needing extensive cleaning before analysis. Growing data volumes create performance challenges requiring ongoing tuning and upgrades to maintain fast query speeds. Maintenance tasks add operational overhead through updates, patches, security checks, and backups. Vendor lock-in concerns arise when companies fear the difficulties of migrating from proprietary systems.

Opportunities

How is cloud computing expansion creating new opportunities for the data warehouse market?

The data warehouse industry is gaining strong growth opportunities as cloud adoption reduces infrastructure costs and supports flexible deployment models for many organizations. Software as a service platforms remove hardware expenses and allow access to enterprise features through manageable subscription pricing. Elastic scalability helps companies adjust computing power based on real usage, preventing over-provisioning and reducing waste during slower periods. Faster deployment options allow businesses to launch data warehouse solutions within weeks, improving time to value compared with traditional installations.

Global access supports distributed teams using analytical tools from any location, creating smooth collaboration across regions. Automatic updates give organizations the latest features and security improvements without manual work. Pay-as-you-go plans align spending with actual demand, making advanced analytics possible for smaller companies. Hybrid cloud designs combine on-premises systems with cloud environments, allowing gradual migration while protecting sensitive data. Multi-cloud strategies help avoid vendor dependence by spreading workloads across providers. Managed services reduce operational burden, and strong integration ecosystems simplify connections to applications and data sources.

Challenges

How is data security and privacy compliance creating challenges for the data warehouse industry?

The data warehouse market faces many obstacles because protecting sensitive information and meeting strict regulations increases complexity across implementation and daily operations. Cybersecurity risks require strong safeguards to prevent breaches, unauthorized access, and malicious attacks targeting valuable business data stored in central systems. Encryption demands add processing load, complicate key management, and require careful planning to maintain secure access for approved users. Privacy rules enforce tight controls over the collection, storage, and retention of personal information, creating detailed compliance obligations under legal and technical pressure. Data residency laws restrict where data can be stored, forcing companies to maintain separate systems across multiple countries and raising operational costs.

Access control becomes challenging as teams define precise permissions supporting secure visibility across user groups. Audit requirements demand complete logs of data activity supporting investigations and security reviews. Vendor risk management increases when external services connect to warehouse platforms. Breach reporting rules create legal exposure and reputational harm during security incidents. Cross-border data transfers face legal limits requiring strong safeguards, while employee training programs ensure staff follow security procedures.

Data Warehouse Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Data Warehouse Market |

| Market Size in 2024 | USD 34.43 Billion |

| Market Forecast in 2034 | USD 93.80 Billion |

| Growth Rate | CAGR of 10.54% |

| Number of Pages | 213 |

| Key Companies Covered | Oracle Corporation, Microsoft Corporation, IBM Corporation, Amazon Web Services Inc., Google LLC, Snowflake Inc., SAP SE, Teradata Corporation, Cloudera Inc., Databricks Inc., and others. |

| Segments Covered | By Deployment Type, By Organization Size, By Component, By Industry Vertical, By Data Type, By End-Use Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Data Warehouse Market: Segmentation

The global data warehouse market is segmented based on deployment type, organization size, component, industry vertical, data type, end-use application, and region.

Based on deployment type, the global data warehouse industry is segregated into on-premises, cloud-based, and hybrid. Cloud-based solutions lead the market due to lower upfront costs, rapid deployment capabilities, automatic scaling features, and reduced maintenance requirements, appealing to organizations seeking flexible infrastructure options.

Based on organization size, the industry is divided into small and medium enterprises and large enterprises. Large enterprises lead the market due to their substantial data volumes, complex analytical requirements, larger budgets for technology investments, and established practices supporting advanced business intelligence initiatives.

Based on component, the global data warehouse market is segmented into software and services. Software is expected to lead the market during the forecast period due to core platform capabilities, licensing revenue models, and essential functionality supporting data storage and analytical processing requirements.

Based on industry vertical, the global market is classified into BFSI, retail and e-commerce, healthcare, manufacturing, IT and telecommunications, government, education, media and entertainment, and others. BFSI holds the largest market share due to massive transaction volumes, strict regulatory requirements, and sophisticated fraud detection needs.

Based on data type, the global market is categorized into structured data, semi-structured data, and unstructured data. Structured data holds the largest market share due to traditional business systems that generate structured information and are compatible with standard analytical tools.

Based on end-use application, the global market is classified into business intelligence, data analytics, reporting, customer relationship management, and supply chain management. Business intelligence holds the largest market share due to widespread adoption and the need for executive dashboards.

Data Warehouse Market: Regional Analysis

What factors are contributing to North America's dominance in the global data warehouse market?

North America leads the data warehouse market because of strong technology adoption, high digital maturity, and a long history of innovation supporting widespread use across many industries. The United States spends heavily on technology, and organizations rely on data-driven strategies that strengthen their competitive position in global markets. Early adoption laid the foundation for mature systems, and companies continue upgrading their platforms with new features developed over years of experience. Venture capital funding supports startups building modern data tools, encouraging rapid improvement and healthy competition. Large technology companies in the region guide product development, set industry standards, and influence global trends through major research investments.

Cloud computing leadership gives North American providers a strong global presence with large data centers and advanced services. Financial services companies in major cities depend on data warehouses for trading, risk management, and regulatory requirements. Retailers use data systems for customer analytics, inventory planning, and smooth coordination of online and store operations. Healthcare organizations generate large datasets from medical records, insurance claims, and patient monitoring, creating a strong demand for reliable management platforms.

A skilled workforce provides experts in database administration, data science, and business intelligence needed for complex projects. Universities offer programs preparing students for careers in data management and analytics, supporting continuous talent growth. Government programs promote data-driven decision-making and encourage public sector use of advanced analytics. Canada shows similar patterns with active technology hubs, national digitization efforts, and bilingual environments supporting strong market development.

Asia Pacific is experiencing significant growth.

Asia Pacific is experiencing strong growth in the data warehouse market because economic development, digital transformation, and rising technology use increase demand for advanced data management across many countries. China offers the largest opportunity due to its huge population, fast digitization, government support for technology, and massive e-commerce activity producing extremely high data volumes. India provides significant potential as its technology services industry, startup ecosystem, and digital payment growth create large needs for data analytics supporting business operations and innovation. Government and enterprise transformation programs modernize infrastructure by replacing older systems with integrated platforms, improving decisions and efficiency.

Manufacturing industries generate production data, supply chain records, and quality information requiring centralized analysis for better performance. Financial technology companies deliver digital payments, lending services, and online banking, all of which require robust data processing to support fast growth. Expanding e-commerce produces behavior data, transaction logs, and logistics details supporting personalization and smoother operations.

Smart city projects use sensors and connected devices, producing large datasets requiring real-time processing for planning and public services. Telecommunications providers handle millions of users and need reliable data systems for network management and service quality. Government digitization introduces electronic services, digital identity systems, and data-driven policy development requiring secure platforms. A growing middle class increases digital activity and creates business needs for analytics supporting market understanding. Strong technology talent across the region offers skilled professionals trained in data science and engineering. International investment brings global vendors building regional operations and partnerships.

Recent Market Developments

- In March 2025, Amazon Redshift Serverless introduced a dual-track release model (Current and Trailing Tracks), giving users a choice between the latest updates or a more stable, pre-certified version, helping businesses manage analytics workloads with flexible update options.

Data Warehouse Market: Competitive Analysis

The leading players in the global data warehouse market are:

- Oracle Corporation

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services Inc.

- Google LLC

- Snowflake Inc.

- SAP SE

- Teradata Corporation

- Cloudera Inc.

- Databricks Inc.

The global data warehouse market is segmented as follows:

By Deployment Type

- On-Premises

- Cloud-Based

- Hybrid

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Component

- Software

- Services

By Industry Vertical

- BFSI

- Retail and E-commerce

- Healthcare

- Manufacturing

- IT and Telecommunications

- Government

- Education

- Media and Entertainment

- Others

By Data Type

- Structured Data

- Semi-Structured Data

- Unstructured Data

By End-Use Application

- Business Intelligence

- Data Analytics

- Reporting

- Customer Relationship Management

- Supply Chain Management

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed