Data Center Security Market Size, Share, And Growth Report 2032

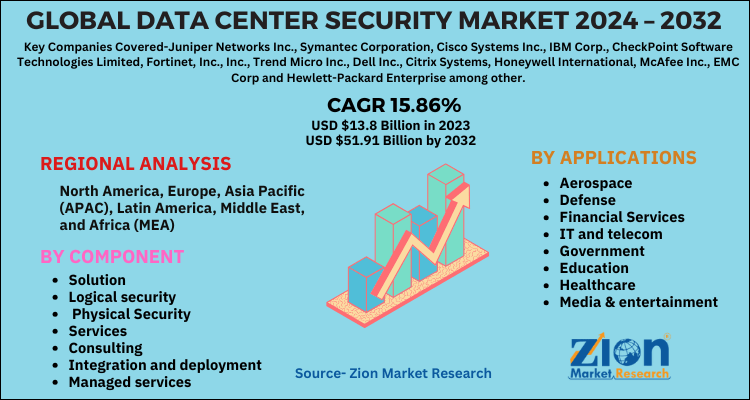

Data Center Security Market by Component (Solution, and Consulting) By Application (Aerospace , Defense, Financial Services, IT and telecom, Government, Education, Healthcare, Media & Entertainment and others), and By Region - Global and Regional Industry Overview, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 13.8 Billion | USD 51.91 Billion | 15.86% | 2023 |

Data Center Security Market Size

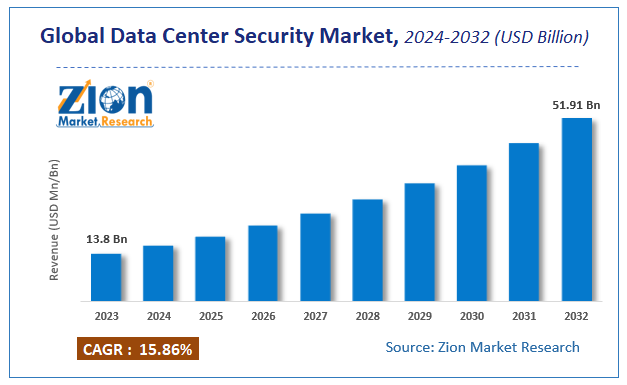

According to a report from Zion Market Research, the global Data Center Security Market was valued at USD 13.8 Billion in 2023 and is projected to hit USD 51.91 Billion by 2032, with a compound annual growth rate (CAGR) of 15.86% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Data Center Security Market industry over the next decade.

Data Center Security Market: Overview

It is a matter of fact that internet is not safe. Many occasions have revealed that there are folks in this massive interconnection of networks that steal information, interrupt service of a general amenity provider, and outbreak into systems to gain admittance or to fetch them down. Network safety has revolved out to be an essential component of every association to certify protect internet connectivity and defense in contradiction of data breach.

The players in the industry are focusing aggressively on innovation, as well as on including advanced remediation technologies. Over the coming years, they are also expected to take up partnerships and mergers and acquisitions as their key strategy for business development, states the Data Center Security market study.

COVID-19 Impact Analysis:

The restrictions imposed by various nations to contain COVID had stopped the demand and supply resulting in a disruption across the whole supply chain. However, the global markets are slowly opening to their full potential and their surge in demand. Although the recession, information technology (IT) infrastructure providers internet service providers (ISPs), and data centers are the segments of economy seeing increment as a consequence of the work from home. The upsurge in Data center market is driven by rising corporations consciousness of the assistances that cloud services can deliver, augmented burden from the panels to offer more safe and strong IT environs, coupled with arrangement of native data centers across the region.

Data Center Security Market: Growth Factors

High Spending In The Infrastructure To Meet The Increasing Requirements From Different Sections To Tower The Requirement Of Data Center Security Market

Adoption of advanced security solutions and rising number of new data centers are presenting noteworthy opportunities to the new and established security solutions providers, thereby boosting the data center security market. High spending in the infrastructure to meet the increasing requirements from different sections is towering the requirement of data center security market. The safety of the data and avoidance of intentional or accidental manipulation of hardware indicates that data centers are placed in sturdy & well-constructed buildings that house storage devices, servers, and cables. Rising security concern for personal & business data and rising requirement for data virtualization & cloud computing are the factors that are making the data center security market to develop profitably in the years to come.

Data Center Security Market: Segmentation

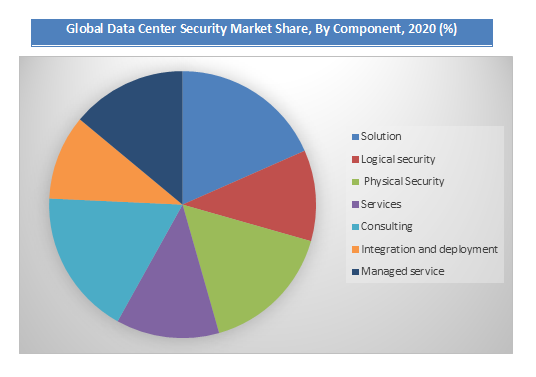

Data center security market is bifurcated based on application and component.

Components of the data security market are services and solution. The solution sector of data center security market is additionally classified into physical security and logical security. Storage units and Servers (which are sheltered in the data hubs) need physical safety from external dangers that can disturb business activities. Video surveillance via cameras, perimeter security, and access control systems among others are major security solutions being used by companies for physical safety. Services sector of data center security market are additionally divided into integration, consulting, managed services, and deployment.

By Application the market is segmented into Aerospace and Defense, Others, Financial Services, IT and telecom, Government, Education, Healthcare, Media & Entertainment and others. IT and telecom segment owing increasing demand for data security across the industry.

Data Center Security Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Data Center Security Market |

| Market Size in 2023 | USD 13.8 Billion |

| Market Forecast in 2032 | USD 51.91 Billion |

| Growth Rate | CAGR of 15.86% |

| Number of Pages | 160 |

| Key Companies Covered | Juniper Networks Inc., Symantec Corporation, Cisco Systems Inc., IBM Corp., CheckPoint Software Technologies Limited, Fortinet, Inc., Inc., Trend Micro Inc., Dell Inc., Citrix Systems, Honeywell International, McAfee Inc., EMC Corp and Hewlett-Packard Enterprise among other |

| Segments Covered | By Component, By Applications and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

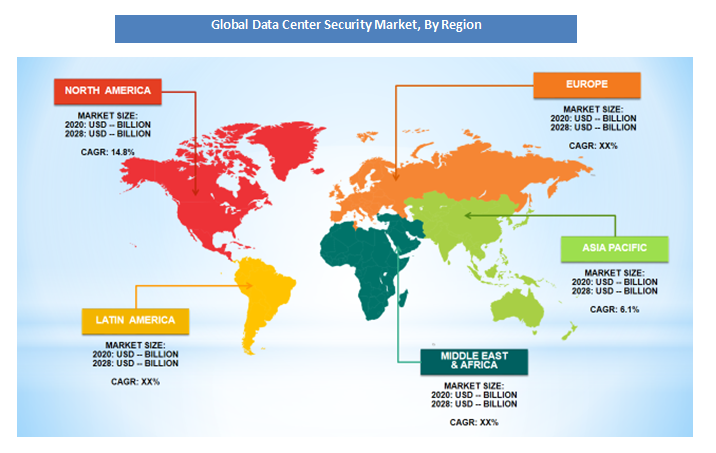

Data Center Security Market: Regional Analysis

By region, North America grabbed the biggest share and will be likely to show steady development in data center security market in coming years. By application, the data center security market is segmented into IT and telecom, financial services, education, government, media & entertainment, healthcare, and others.

Data Center Security Market: Competitive Players

The report covers detailed competitive outlook including the market share and company profiles of the key participants operating in the global Data Center Security Market are:

- Juniper Networks Inc.

- Symantec Corporation

- Cisco Systems Inc.

- IBM Corp.

- CheckPoint Software Technologies Limited

- Fortinet Inc.

- Trend Micro Inc.

- Dell Inc.

- Citrix Systems

- Honeywell International

- McAfee Inc.

- EMC Corp

- Hewlett-Packard Enterprise

The global Data Center Security Market is segmented as follows:

By Component

- Solution

- Logical security

- Physical Security

- Services

- Consulting

- Integration and deployment

- Managed services

By Applications

- Aerospace

- Defense

- Financial Services

- IT and telecom

- Government

- Education

- Healthcare

- Media & entertainment

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Data center security encompasses measures and technologies designed to protect a data center's infrastructure, systems, and stored data from physical and cyber threats. It includes physical safeguards like access controls and surveillance, as well as cybersecurity solutions like firewalls, encryption, and intrusion detection to ensure data integrity and availability.

According to study, the Data Center Security Market size was worth around USD 13.8 billion in 2023 and is predicted to grow to around USD 51.91 billion by 2032.

The CAGR value of Data Center Security Market is expected to be around 15.86% during 2024-2032.

North America has been leading the Data Center Security Market and is anticipated to continue on the dominant position in the years to come.

The Data Center Security Market is led by players like Juniper Networks Inc., Symantec Corporation, Cisco Systems Inc., IBM Corp., CheckPoint Software Technologies Limited, Fortinet, Inc., Inc., Trend Micro Inc., Dell Inc., Citrix Systems, Honeywell International, McAfee Inc., EMC Corp, Hewlett-Packard Enterprise, and among other.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed