Contract Logistics Market Size, Share, Trends, Growth & Forecast 2034

Contract Logistics Market By Service (Transportation, Aftermarket Logistics, Warehousing, Distribution, and Others), By Type (Outsourcing and Insourcing), By Transportation Mode (Airways, Roadways, Waterways, and Railways), By Industry Vertical (Retail & E-Commerce, Pharma & Healthcare, Automotive, High-Tech & Electronics, Aerospace & Defense, Industrial & Manufacturing, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

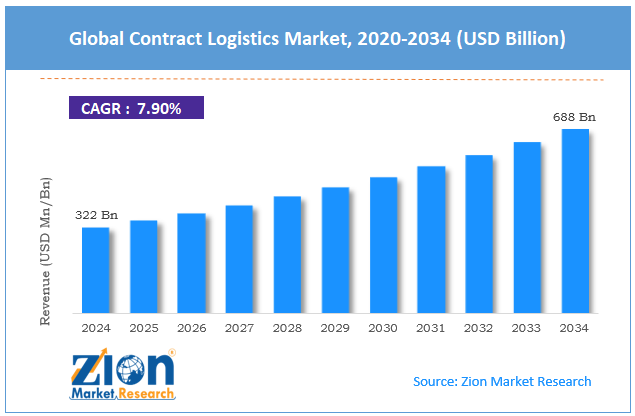

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 322 Billion | USD 688 Billion | 7.9% | 2024 |

Contract Logistics Industry Perspective:

What will be the size of the global contract logistics market during the forecast period?

The global contract logistics market size was worth around USD 322 billion in 2024 and is predicted to grow to around USD 688 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.9% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global contract logistics market is estimated to grow annually at a CAGR of around 7.9% over the forecast period (2025-2034).

- In terms of revenue, the global contract logistics market size was valued at around USD 322 billion in 2024 and is projected to reach USD 688 billion by 2034.

- Increasing e-commerce is expected to drive the contract logistics market.

- Based on the service, the transportation segment captured the largest market share, over 34%, in 2024.

- Based on the type, outsourcing holds a dominant position in the market.

- Based on the transportation mode, the roadways segment is expected to capture a prominent revenue share over the analysis period.

- Based on the industry vertical, the retail & e-commerce segment is expected to capture a prominent revenue share over the analysis period.

- Based on region, in 2024, the Asia Pacific region had the largest market share, exceeding 34.5%.

Contract Logistics Market: Overview

Companies use third-party vendors to manage their supply chains with long-term contracts. This is what is known as contract logistics. This business offers a wide range of services, including warehousing, inventory management, order fulfillment, item distribution, transportation coordination, and value-added packing and labeling. They also offer reverse logistics. Clients can leverage existing tools, such as warehouse management systems (WMS), transportation management systems (TMS), automation, and real-time tracking, to develop comprehensive solutions aligned with their business objectives. Contract logistics providers help firms in many fields, including retail and e-commerce, manufacturing, healthcare, and automotive, lower costs, streamline processes, and focus on their core businesses. They do this by using the provider's existing infrastructure, knowledge, and network resources.

Contract Logistics Market: Dynamics

Growth Drivers

Does the growth of e-commerce drive the growth of the contract logistics market?

The contract logistics market is growing fastest as e-commerce expands rapidly. Online shopping is increasingly prevalent worldwide, and the company needs to enhance its warehousing, order fulfillment, inventory management, and last-mile delivery systems to meet customers' expectations for fast, accurate deliveries. An increasing number of people are buying things online, which means businesses need to use third-party logistics companies that specialize in flexible solutions to help them manage their complex supply chains without spending a lot of money on their own.

Several assessments across industries show that e-commerce growth is a major driver of demand for contract logistics and market expansion. E-commerce is growing rapidly across the Asia Pacific region, including India. This indicates a greater need for warehousing and distribution services that logistics companies can contract to support online stores in their home countries and worldwide.

Restraints

High capital requirements are impeding the industry's development

The contract logistics sector faces many challenges in terms of growth, as it requires significant capital. Contract logistics companies need to make a lot of money, so they build large operational networks that include warehouses and distribution centers, cold-chain processing sites, automated storage systems, robotic systems, material handling solutions, advanced Warehouse Management Systems, and Transportation Management Systems. Small and medium-sized logistics companies that rely on long payback periods for their operations struggle with cash flow constraints because they must make substantial upfront expenditures. It costs more to enter healthcare logistics or temperature-controlled storage, as one must meet requirements, set up monitoring systems, and obtain certification. Customers want real-time tracking, automated systems, and advanced data analytics solutions, so businesses need to keep their technology up to date.

Companies with significant capital face many operational problems. This is because it makes it harder for new competitors to enter the market, slows business growth into new areas, prevents companies from adopting new technologies, and makes them more financially vulnerable when customer demand changes. The contract logistics market is still growing, but high-cost activities pose a major challenge for new countries and smaller suppliers.

Opportunities

Will the rising focus on sustainability offer a development opportunity for the contract logistics market?

As more individuals become interested in eco-friendly methods, the contract logistics company will grow faster. Environmental responsibility has been a top priority for governments, businesses, and consumers. As a result, companies today seek logistics partners that can support supply chain operations while minimizing emissions and maximizing energy use. Contract logistics companies are now choosing to develop green warehouses that use renewable energy, operate fleets of electric and alternative-fuel vehicles, implement optimal route-planning systems, offer eco-friendly packaging solutions, and implement reverse logistics systems for recycling and reuse.

Large firms now want their logistics partners to show that they can report on their carbon emissions and ESG performance. This gives suppliers with strong sustainability credentials a competitive edge. Companies must initially invest in sustainable practices, which make businesses more efficient, improve ESG performance, help secure high-value contracts, and generate brand recognition, thereby benefiting the broader market.

For instance, in July 2025, CEVA Logistics, the world's largest third-party logistics company, and Avolta, the largest global player in the travel retail and food and beverage markets, teamed up to start a new pilot project for sustainable transportation. It will use three Duo Trailer vehicles powered by renewable hydrotreated vegetable oil (HVO). The system currently in use on Spain's main traffic route between Barcelona and Madrid would reduce CO₂ emissions by 520 tons and nitrogen oxide emissions by 180 kilograms per year. This is equivalent to taking 440 trucks off the road.

Challenges

Why do labor shortages & rising labor costs pose a major challenge to the contract logistics industry's growth?

The contract logistics industry is struggling to grow because it requires a lot of physical labor, even as automated technology becomes more common. This is because there aren't enough workers, and wages are rising. People still need to do picking, packing, sorting, loading, driving, handling inventory, and overseeing the warehouse. During busy periods, such as e-commerce and holiday shopping, when fewer workers are available, companies struggle to maintain service standards and meet delivery schedules. Businesses have to pay more to run their operations because labor costs are higher, including higher wages, overtime pay, and employee benefits. Because their long-term, price-competitive contracts make it hard for them to pass on rising labor costs to customers, contract logistics service providers struggle to do so.

The process lowers profit margins, which makes it harder for businesses to grow, invest in new technology, and expand their networks. When there are insufficient workers, staff turnover increases, raising training costs and reducing operational efficiency, thereby impairing accuracy and service delivery. Some places have greater difficulty complying with regulations and paying for goods because they already have unions, wage laws, and stricter labor laws. The contract logistics sector faces serious staffing issues, making it hard for the business to grow as much as it could.

Contract Logistics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Contract Logistics Market |

| Market Size in 2024 | USD 322 Billion |

| Market Forecast in 2034 | USD 688 Billion |

| Growth Rate | CAGR of 7.9% |

| Number of Pages | 217 |

| Key Companies Covered | CEVA, DB Schenker, DHL Supply Chain, Agility, SNCF Logistics/GEODIS, Kuehne + Nagel, DSV, UPS Supply Chain, Ryder System Inc., Yusen Logistics, Hitachi Transport System, Neovia Logistics Services, XPO Logistics Inc., GEODIS, Penske, and others. |

| Segments Covered | By Service, By Type, By Transportation Mode,By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Contract Logistics Market: Segmentation

Service Insights

Why did the transportation segment dominate the contract logistics market during the analysis period?

The transportation segment accounted for the largest market share, exceeding 34%, in 2024. The sector is growing because demand for fast last-mile delivery services is increasing, same-day delivery systems are becoming more common, and e-commerce networks are expanding in both urban and rural areas.

Type Insights

Why does the outsourcing segment hold the largest share in the contract logistics market?

Outsourcing holds a dominant position in the market. Outsourcing supply chain services has developed, creating new business prospects in retail and e-commerce, manufacturing, automotive, and healthcare. More and more organizations are using third-party logistics companies that specialize in warehousing, inventory management, order fulfillment, transportation coordination, and value-added services. This helps them save money and stay focused on what they do best. Companies can leverage their suppliers' existing resources and new technologies, such as warehouse and transportation management systems and large distribution networks, without incurring substantial upfront costs.

Transportation Mode Insights

Why does the roadways segment dominate the contract logistics industry?

The roadways segment is expected to capture a prominent revenue share over the analysis period. The company is growing for two main reasons, including that more people want flexible last-mile delivery services, and more affordable short- to medium-distance transportation options are available.

Also, new road networks are being built. India's national highway network grew from 65,569 km in 2004 to 1,46,145 km in 2024. In the last ten years, the number of four-lane or wider stretches has increased by a factor of 2.6. The US government has set aside $1.32 billion for the 2025 RAISE award program to help 109 infrastructure projects that are highly committed to improving roads and connecting them. The ongoing improvements reinforce key operational foundations that enable contract logistics in major global markets.

Industry Vertical Insights

What factors cause the retail & e-commerce segment to be in a dominating position in the contract logistics industry?

The retail & e-commerce segment is expected to capture a prominent revenue share over the analysis period. The rise in online shopping and omnichannel retailing, as well as customers' demand for expedited delivery and real-time order tracking during transit, are all factors driving market growth.

In just three years, 125 million new people in India have started shopping online. By 2025, an additional 80 million are expected to do the same. As the number of customers in the contract logistics industry increases, companies need to develop rapid, advanced technology solutions for their operations.

Regional Insights

Why does the Asia Pacific hold the largest share in the contract logistics market?

In 2024, the Asia Pacific region had the largest market share, exceeding 34.5%. E-commerce, mobile commerce, and cross-border trade have all grown rapidly, helping firms expand. International financing is helping India improve its logistical infrastructure. India will receive $350 million from the Asian Development Bank (ADB) in 2024 to support its multimodal logistics reforms. These changes would establish institutional frameworks and involve the business sector. The next phases will help the supply chain operate more effectively, thereby increasing demand for integrated regional contract logistics services.

Contract Logistics Market: Competitive Analysis

The global contract logistics market is dominated by players like:

- CEVA

- DB Schenker

- DHL Supply Chain

- Agility

- SNCF Logistics/GEODIS

- Kuehne + Nagel

- DSV

- UPS Supply Chain

- Ryder System Inc.

- Yusen Logistics

- Hitachi Transport System

- Neovia Logistics Services

- XPO Logistics Inc.

- GEODIS

- Penske

The global contract logistics market is segmented as follows:

By Service

- Transportation

- Aftermarket Logistics

- Warehousing

- Distribution

- Others

By Type

- Outsourcing

- Insourcing

By Transportation Mode

- Airways

- Roadways

- Waterways

- Railways

By Industry Vertical

- Retail & E-Commerce

- Pharma & Healthcare

- Automotive

- High-Tech & Electronics

- Aerospace & Defense

- Industrial & Manufacturing

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed