Commercial Greenhouse Market Size, Share, Trends, Growth & Forecast 2034

Commercial Greenhouse Market By Crop Type (Vegetables & Fruits, Herbs & Specialty Edibles, Ornamentals and Flowers, and Others), By Type (Glass Greenhouse and Plastic Greenhouse), By Equipment Type (Cooling Systems, Heating Systems, and Other Equipment), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

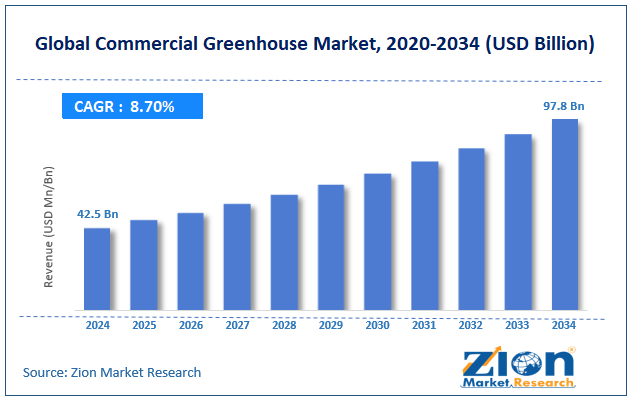

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 42.5 Billion | USD 97.8 Billion | 8.7% | 2024 |

Commercial Greenhouse Industry Perspective:

What will be the size of the global commercial greenhouse market during the forecast period?

The global commercial greenhouse market size was worth around USD 42.5 billion in 2024 and is predicted to grow to around USD 97.8 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.7% between 2025 and 2034.

Request Free Sample

Request Free Sample

Key Insights

- As per the analysis shared by our research analyst, the global commercial greenhouse market is estimated to grow annually at a CAGR of around 8.7% over the forecast period (2025-2034).

- In terms of revenue, the global commercial greenhouse market size was valued at around USD 42.5 billion in 2024 and is projected to reach USD 97.8 billion by 2034.

- Year-round demand for fresh, high-quality produce is expected to drive the commercial greenhouse market.

- Based on the crop type, vegetables & fruits captured a significant market share of over 45% in 2024.

- Based on the type, the plastic greenhouse holds the dominating position in the market of more than 55% in 2024.

- Based on the equipment type, the cooling systems segment is expected to capture a prominent revenue share over the analysis period.

- Based on region, in 2024, the Asia Pacific region had the largest market share, exceeding 65%.

Commercial Greenhouse Market: Overview

The commercial greenhouse market is a global business that designs, builds, operates, and supplies extensive greenhouses for agricultural purposes. The greenhouses establish a controlled environment that enables year-round cultivation of vegetables, fruits, flowers, ornamental plants, herbs, and other premium products through their management of temperature, humidity, light, irrigation, and carbon dioxide levels. Commercial greenhouses implement automated climate control systems, along with hydroponics, fertigation, LED grow lights, and monitoring sensors, to improve production capabilities, crop quality, and resource efficiency. This agricultural method differs from conventional farming, which uses open fields.

The market includes greenhouse structures made of glass, polycarbonate, and polyethylene, as well as equipment suppliers, irrigation and lighting manufacturers, software and automation providers, and large-scale commercial growers. The industry experienced growth as more people began consuming fresh fruits and vegetables, food security became a major concern, changing weather patterns emerged, urbanization increased, and controlled environment agriculture (CEA) methods became widely accepted.

Commercial Greenhouse Market: Dynamics

Growth Drivers

How does the rising importance of food security and year-round production drive the commercial greenhouse market growth?

Food security is increasingly important, as more than 300 million people worldwide still go hungry. Climate change, violent conflicts, and rising costs are making it harder to get food in the future. This situation has led to a greater need for technology that enables year-round food production. As a result, governments and businesses are looking for long-term solutions to food supply problems. To protect food supply chains, reduce the risks posed by climate change, and help cities and countries achieve their food security goals, the agricultural industry is adopting year-round production methods, such as greenhouses, indoor farming, and controlled-environment agriculture. A United Nations report says that by 2024, 673 million people will be malnourished. This is 8.2% of the world's population, down from 8.7% the year before.

Restraints

Why do the high initial capital costs act as a major restraining factor to the commercial greenhouse market growth?

The commercial greenhouse business is struggling to grow because it requires substantial capital to get started. A modern greenhouse requires significant upfront costs to purchase or rent land and to buy building materials such as glass, polycarbonate, polyethylene, and steel framing, as well as irrigation and fertigation systems, heating and cooling systems, ventilation and shading systems, LED grow lights, and automation systems. It costs more money to set up modern greenhouses with climate control systems, IoT monitoring, AI-driven crop management software, and hydroponic systems. Investors have to pay for both construction and technology, as well as for installing the system, hiring qualified workers, installing utilities, setting up backup systems, and complying with environmental and regulatory rules. The cost of acquiring land for farming varies with the land's complexity and location, resulting in higher-than-usual costs for open-field farming.

Small and medium-sized agricultural businesses can't enter markets because they can't afford the high costs of doing business. This slows down expansion in new market areas. Long payback periods and the dangers of fluctuations in energy costs and agricultural prices make it hard to secure funding. People want fresh fruits and vegetables year-round and high-quality food products, but there are no limits on the market for these items. Greenhouse operations, on the other hand, struggle because they need a lot of capital to start new operations and build more facilities around the world.

Opportunities

Does the emerging collaborative project among players present a development opportunity for the commercial greenhouse industry?

The commercial greenhouse industry may have an opportunity to flourish, as more companies are collaborating on projects. Strategic partnerships between greenhouse builders, LED lighting producers, automation suppliers, seed companies, banks, and large-scale farmers are what drive the greenhouse industry to develop new technologies and expand its market. Businesses are shifting from operating independently to joint ventures, public-private partnerships, and technology alliances. These types of collaborations let them share investment risk, combine their knowledge, and accelerate the development of new ideas.

For instance, in February 2026, Albotherm and CPI will work together to develop greenhouse technology for UK farmers that doesn't pollute the air excessively. They will spend $2.7 million on this. The main goal of the project is to improve Albotherm's product development and increase its manufacturing capacity. This includes improving production methods and formulations to enable the commercial sale of temperature-sensitive additives for greenhouse retrofit coatings. The process of making materials ensures they are made throughout, while also meeting the performance standards needed for glasshouse and polytunnel activities that require temperature control without using energy.

The retrofit approach helps producers achieve three goals: using less energy, reducing pollution, and protecting crops from excessive heat. Albotherm will work with CPI on the project to leverage our deep knowledge of eco-friendly materials and manufacturing methods to improve the production process of its technology for business use. They will work with R&L Holt, one of the UK's largest and oldest tomato growers, on commercial trials to ensure the solution works in real-world commercial growing conditions and delivers measurable benefits to growers.

Challenges

Energy sustainability & environmental constraints pose a significant challenge to the industry’s growth

The commercial greenhouse industry faces two major challenge including environmental regulations and the need for environmentally friendly energy sources. Modern greenhouses require a lot of energy to maintain optimal growing conditions year-round. They do this through heating, cooling, and ventilation systems, as well as artificial lighting and automated climate-control technologies. Colder areas have the highest total operating costs, as heating expenditures consume most of a company's resources. Warmer areas, by contrast, have higher electrical demand because they require cooling and ventilation systems. Agriculture is using more electricity because more people are using high-intensity LED grow lights and CO₂ enrichment devices.

Utility costs have a significant impact on the performance of greenhouse operations. This is because rising energy prices and changes in the fuel market can be very bad for the business. Firms must comply with both environmental and carbon-emission reduction standards. This makes compliance more expensive for them, but it also encourages them to install solar panels, geothermal heating systems, and biomass boiler technology. The solutions are good for the environment in the long run, but small and medium-sized businesses struggle to pay for them up front because they are so expensive. Rules governing the use of water and the handling of waste, as well as those governing the use of chemical fertilizers and pesticides, make it much harder to run a business. The combination of higher energy consumption and stricter environmental rules makes it harder for projects to get off the ground and for businesses to grow, slowing growth across the industry.

Commercial Greenhouse Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Greenhouse Market |

| Market Size in 2024 | USD 42.5 Billion |

| Market Forecast in 2034 | USD 97.8 Billion |

| Growth Rate | CAGR of 8.7% |

| Number of Pages | 219 |

| Key Companies Covered | Hort Americas, Berry Global, Heliospectra AB, Plastika Kritis, Everlight Electronics, Signify Holding, Rough Brothers Inc, Argus Control Systems, Richel Group, Agra-tech Inc, Certhon, LumiGrow, Logiqs BV, Ammerlaan Constructions, Top Greenhouses, DeCloet Manufacturing Ltd, Stuppy Greenhouse, The Glasshouse Company, Europrogress, Harford, Luiten Greenhouses, Nobutec BV, Sotrafa, Saveer Biotech Ltd., Ludy Greenhouse, and others. |

| Segments Covered | By Crop Type, By Type, By Equipment Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Commercial Greenhouse Market: Segmentation

Crop Type Insights

Why vegetables & fruits segment dominating the commercial greenhouse market during the study period?

Vegetables & fruits captured a significant market share of over 45% in 2024. The rise is due to more people worldwide seeking fresh, high-quality, pesticide-free fruits and vegetables year-round. The greenhouse cultivation system grows tomatoes, cucumbers, bell peppers, lettuce, strawberries, and other high-value fruits and vegetables year-round for supermarkets, foodservice providers, and export markets. Several key factors are driving revenue growth in this market segment, including increased demand for locally grown food, population growth in cities, and greater awareness of food safety and strategies to mitigate climate-related losses in farming.

Type Insights

Why does the plastic greenhouse segment hold the largest share in the commercial greenhouse industry?

The plastic greenhouse holds a dominant market share of more than 55% in 2024. There are several reasons for the expansion: it is cost-effective, adaptable to different weather conditions, and suitable for a variety of conditions. Plastic greenhouses are good for small- and medium-sized farmers and growing agricultural markets because they cost less to set up than glass greenhouses. The system's lightweight design makes it easy to set up quickly, and its low maintenance needs make it easier for people to embrace and build their networks.

Equipment Type Insights

Why does the cooling systems segment dominate the commercial greenhouse industry?

The cooling systems segment is expected to capture a prominent revenue share over the analysis period. As global temperatures rise and weather patterns become more extreme, the need for accurate systems for managing temperature and humidity has increased. The agricultural sector needs effective cooling systems, such as evaporative cooling pads, ventilation fans, misting and fogging systems, and automated temperature control technologies, to create the best conditions for growth. The growth of commercial farming in hot, arid areas has increased the need for energy-efficient cooling systems that leverage cutting-edge technologies.

Regional Insights

Why does the Asia Pacific hold the largest share in the commercial greenhouse market?

In 2024, the Asia-Pacific region held the largest market share, exceeding 65%. Regional growth has been driven by rapid urbanization, a growing population, and year-round demand for fresh veggies. Protected farming in China, India, Japan, South Korea, and Australia will improve food safety and increase food production. Government incentives for innovative farming methods and greenhouse construction, together with investments in controlled environment agriculture (CEA), are helping the regional market flourish.

The growth of the middle class and the demand for high-quality, pesticide-free, greenhouse-grown fruits and vegetables are increasing the demand for these products. Using hydroponics, drip irrigation, LED grow lights, and automated climate control systems has led to more commercial farming and improved crop yields. The Asia Pacific region has become a rapidly growing market that outpaces any other part of the international commercial greenhouse business.

Commercial Greenhouse Market: Competitive Analysis

The global commercial greenhouse market is dominated by players like:

- Hort Americas

- Berry Global

- Heliospectra AB

- Plastika Kritis

- Everlight Electronics

- Signify Holding

- Rough Brothers Inc

- Argus Control Systems

- Richel Group

- Agra-tech Inc

- Certhon

- LumiGrow

- Logiqs BV

- Ammerlaan Constructions

- Top Greenhouses

- DeCloet Manufacturing Ltd

- Stuppy Greenhouse

- The Glasshouse Company

- Europrogress

- Harford

- Luiten Greenhouses

- Nobutec BV

- Sotrafa

- Saveer Biotech Ltd.

- Ludy Greenhouse

The global commercial greenhouse market is segmented as follows:

By Crop Type

- Vegetables & Fruits

- Herbs & Specialty Edibles

- Ornamentals and Flowers

- Others

By Type

- Glass Greenhouse

- Plastic Greenhouse

By Equipment Type

- Cooling Systems

- Heating Systems

- Other Equipment

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed