Global LED Lighting Market Size, Share, Growth Analysis Report - Forecast 2034

LED Lighting Market By Product (Lamps (A-type, T-type, Others), Luminaires (Ceiling Fixtures, Recessed Troffers, Track Lighting, Others)), By Installation Type (New Installation, Retrofit), By Application (Indoor Lighting, Outdoor Lighting, Automotive Lighting, Backlighting, Others), By End-user (Residential, Commercial, Industrial, Government), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

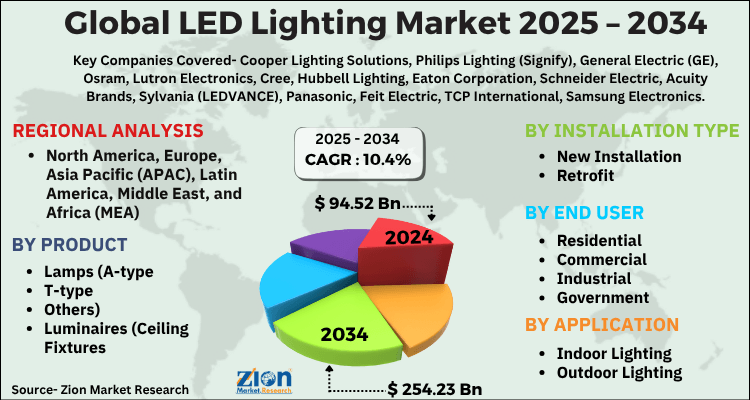

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 94.52 Billion | USD 254.23 Billion | 10.4% | 2024 |

LED Lighting Market Size

The global LED lighting market size was worth around USD 94.52 Billion in 2024 and is predicted to grow to around USD 254.23 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 10.4% between 2025 and 2034. The report analyzes the global LED lighting market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the LED lighting industry.

LED Lighting Market: Overview

LED lighting is an illuminating device that emits visible light with the help of light-emitting diodes (LED) which belong to the semiconductor industry. LED lights are exactly opposite to the photovoltaic cells that are used for converting visible light into electrical energy. An LED light is manufactured using two types of semiconductor material. These types are n-type and p-type. Both materials are called astringent materials and are dipped in a doping agent that helps to slightly modify the electrical properties of the variants from the original intrinsic form caalled the i-type.

LED lights have managed to revolutionize the lighting landscape since their inception. They are considered highly energy efficient as compared to other light devices. In addition to this, the industry for LED lighting is undergoing tremendous change and innovation since manufacturers are focusing on not only improving the overall durability of the lights but also improving the overall quality of performance. One of the key benefits of using LED lights is the reduced need for using diffusers and reflectors since LEDs emit light in a specific direction only. Thus making them highly efficient for specific applications such as task lighting and recessed downlights.

Key Insights

- As per the analysis shared by our research analyst, the global LED lighting market is estimated to grow annually at a CAGR of around 10.4% over the forecast period (2025-2034).

- Regarding revenue, the global LED lighting market size was valued at around USD 94.52 Billion in 2024 and is projected to reach USD 254.23 Billion by 2034.

- The LED lighting market is projected to grow at a significant rate due to energy efficiency mandates, decreasing LED costs, urban infrastructure development, and rising adoption in residential, commercial, and industrial applications.

- Based on Product, the Lamps (A-type segment is expected to lead the global market.

- On the basis of Installation Type, the New Installation segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Indoor Lighting segment is projected to swipe the largest market share.

- By End-user, the Residential segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

LED Lighting Market: Growth Drivers

Growing demand for energy-efficient lighting solutions and reduced environmental impact to drive market growth

The global LED lighting market is expected to benefit from the growing demand for energy-efficient lighting solutions. Research and extensive practical application of LED lights have proven that these lights consume less energy and produce the same intensity light as other illuminating mediums or lights. This is mainly due to the technology that powers LED systems as it uses electricity to solely emit light instead of using electricity to heat the system and then produce light which is generally observed in other lighting technologies. As reported by the Department of Energy LEDs are known to use 90% less energy as compared to traditional incandescent bulbs. Moreover, they also last 25 times longer than their counterparts. Since LEDs have a longer lifespan, it translates to a lower rate of carbon emissions. Given the higher durability of LEDs, fewer resources are used for manufacturing new light systems. The same cost and resource-saving trend then trickle down to other aspects of LED production and transportation.

As the world population along with consumer and industrial demand for lighting solutions continue to grow, energy consumption is expected to rise at an exponential rate. However, most of the current energy generation activities depend largely on non-renewable sources which is also a leading cause of environmental degradation and pollution. Regional governments, international energy agencies, and a growing part of the general population are actively seeking measures to become more energy-efficient which is expected to drive the consumption of LED lighting.

LED Lighting Market: Restraints

Higher initial cost of LED lighting and fixtures to restrict the market growth

The global LED lighting market growth may be limited due to the initial high cost of LED lights and fixtures as compared to conventionally used alternatives. For instance, a compact fluorescent lamp (CFL) may cost around USD 2 while the charge for an LED variant is USD 5. Although LED lights are not as expensive to maintain and use as CFL, many people may refrain from investing heavily in LED lights, especially among people with limited budgets or awareness. In addition to this, there is a significant group of consumers who do not prefer the quality of LED lights since they perceive it to be low-grade. More awareness is needed to tap into this market segment.

LED Lighting Market: Opportunities

Increasing purchasing power in emerging economies to create growth opportunities

The LED lighting industry players can expect higher demand for LED lights as the purchasing power of a larger part of the population in emerging economies is growing at a significant rate. This is mainly due to the growing foreign investments in these nations along with increased efforts by regional governments to promote domestic production of goods and services and export rates. For instance, in fiscal year 2022, India’s agriculture and allied export value was at USD 50.2 billion as compared to USD 41.1 billion in 2021. As the spending power of the general population rises, the demand for efficient consumer goods such as LED lighting will reach higher levels.

Growing number of product launches to deliver higher revenue possibilities

LED manufacturers have been extremely aggressive in terms of launching and developing new products to cater to the changing needs, demands, and expectations of consumers. The end-user verticals such as automotive and consumer electronic industries have also invested heavily in leveraging the strengths of LED lights. For instance, in August 2023, Hero Motocorp announced the launch of a new bike called the Karizma XMR. The highlight of the new launch is that it consists of all-LED headlights making it a unique design and the first-of-its-king by Hero. On the other hand, in July 2023, Techno, a brand operating in the smartphone segment, launched the Infinix GT 10 Pro equipped with LED lights at the back of the device.

LED Lighting Market: Challenges

Intense competition within the industry and from competing solutions to challenge growth trajectory

The LED lighting industry growth may be challenged by the intense competition existing within the market as there are several players with extensive lines of product portfolios offering LED light solutions at competing prices. Additionally, the difficulties may further intensify due to the presence of several other lighting solutions including CFLs, fluorescent tubes, laser lighting, incandescent bulbs, and fiber optic lighting.

LED Lighting Market: Segmentation Analysis

The global LED lighting market is segmented based on Product, Installation Type, Application, End-user, and region.

Based on Product, the global LED lighting market is divided into Lamps (A-type, T-type, Others), Luminaires (Ceiling Fixtures, Recessed Troffers, Track Lighting, Others).

On the basis of Installation Type, the global LED lighting market is bifurcated into New Installation, Retrofit.

By Application, the global LED lighting market is split into Indoor Lighting, Outdoor Lighting, Automotive Lighting, Backlighting, Others.

In terms of End-user, the global LED lighting market is categorized into Residential, Commercial, Industrial, Government.

LED Lighting Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | LED Lighting Market |

| Market Size in 2024 | USD 94.52 Billion |

| Market Forecast in 2034 | USD 254.23 Billion |

| Growth Rate | CAGR of 10.4% |

| Number of Pages | 232 |

| Key Companies Covered | Cooper Lighting Solutions, Philips Lighting (Signify), General Electric (GE), Osram, Lutron Electronics, Cree, Hubbell Lighting, Eaton Corporation, Schneider Electric, Acuity Brands, Sylvania (LEDVANCE), Panasonic, Feit Electric, TCP International, Samsung Electronics, and others., and others. |

| Segments Covered | By Product, By Installation Type, By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

LED Lighting Market: Regional Analysis

Asia-Pacific to register the highest growth during the forecast period

The global LED lighting market is projected to witness the highest growth in Asia-Pacific during the forecast period. In 2022, the region generated 43.65% of the global revenue. High domestic demand and consumption of LED lights is a crucial regional share propeller. The demand is high in all end-user verticals including residential, commercial, and industrial applications. The surging rate of infrastructure development projects in addition to the rising migration of people to urban areas with modern homes have resulted in greater consumption.

In August 2023, Signify, a leading manufacturer of lights, opened its biggest LED lighting manufacturing site in China. The site has over 192 production lines and is spread across 200,000 square meters. In November 2022, Signify launched 2 new portable smart lamps called Philips Smart LED Hero and Philips Smart LED Squire adapting to the changing needs of the emerging economy. North America is expected to generate significant revenue driven by growing awareness among consumers about the benefits of using LED lights. A recent report by the Residential Energy Consumption Survey (RECS) concluded that almost 47% of US households use LED lights for indoor space. Growing focus on improving energy efficiency could also aid regional growth.

LED Lighting Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the LED lighting market on a global and regional basis.

The global LED lighting market is dominated by players like:

- Cooper Lighting Solutions

- Philips Lighting (Signify)

- General Electric (GE)

- Osram

- Lutron Electronics

- Cree

- Hubbell Lighting

- Eaton Corporation

- Schneider Electric

- Acuity Brands

- Sylvania (LEDVANCE)

- Panasonic

- Feit Electric

- TCP International

- Samsung Electronics

- and others.

The global LED lighting market is segmented as follows;

By Product

- Lamps (A-type

- T-type

- Others)

- Luminaires (Ceiling Fixtures

- Recessed Troffers

- Track Lighting

- Others)

By Installation Type

- New Installation

- Retrofit

By Application

- Indoor Lighting

- Outdoor Lighting

- Automotive Lighting

- Backlighting

- Others

By End-user

- Residential

- Commercial

- Industrial

- Government

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed