Cell and Gene Therapy Manufacturing Market Size, Share, Trends, Growth and Forecast 2032

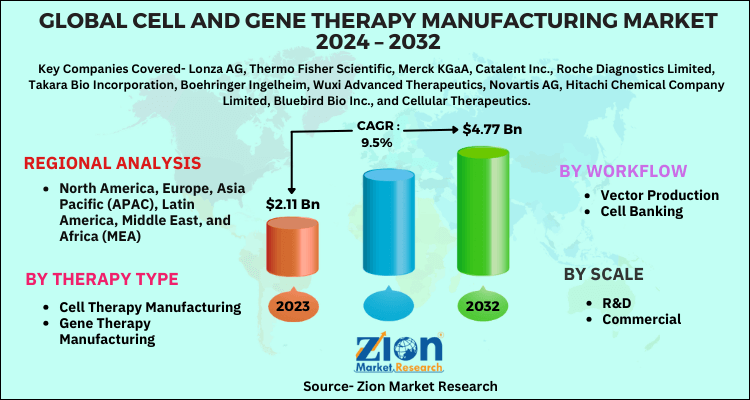

Cell and Gene Therapy Manufacturing Market - By Therapy Type (Cell Therapy Manufacturing and Gene Therapy Manufacturing), By Scale (R&D and Commercial), By Workflow (Vector Production and Cell Banking), And By Region- Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

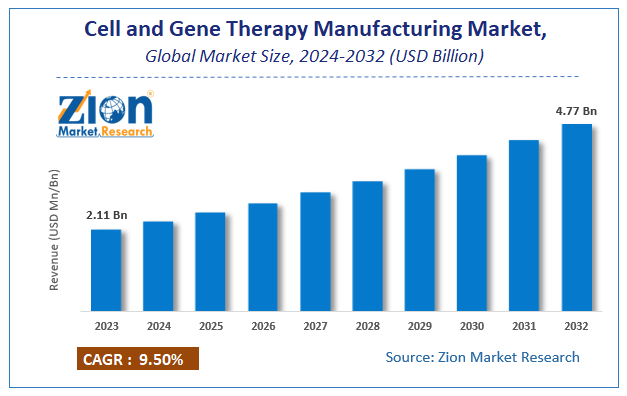

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.11 Billion | USD 4.77 Billion | 9.5% | 2023 |

Cell and Gene Therapy Manufacturing Market Insights

According to a report from Zion Market Research, the global Cell and Gene Therapy Manufacturing Market was valued at USD 2.11 Billion in 2023 and is projected to hit USD 4.77 Billion by 2032, with a compound annual growth rate (CAGR) of 9.5% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Cell and Gene Therapy Manufacturing Market industry over the next decade.

The report assesses and analyzes the global and regional cell and gene therapy manufacturing markets. The study offers a comprehensive assessment of market competition, constraints, revenue estimates, opportunities, evolving trends, and industry-validated data. The report provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD billion).

Cell and Gene Therapy Manufacturing Market: Synopsis

Cell and gene therapies are niche ones, and hence giant pharmaceutical firms are adding new products to their existing product lines, thereby enhancing their manufacturing capacities. Apart from this, mammoth pharma companies such as Thermo Fisher, Novartis, Catalent, and Roche are investing millions of dollars to improve the manufacturing capacity of products used in cell and gene treatments, thereby expanding the scope of the cell and gene therapy manufacturing business.

Cells are modified outside of the patient's body and then injected back into the patient's body, allowing them to function as live medicine.In gene therapy, genes are either deactivated, substituted, or introduced into human cells that are either inside the human body or taken outside the human body. Gene therapy is utilized for treating various kinds of chronic disorders in living beings. Apparently, gene and cell therapies are intended to halt disease progression as well as reverse disease progression.

Furthermore, giant firms are investing massively in cell and gene treatment research activities and expanding their bases through acquisitions. Citing an instance, in 2019, Novartis purchased CELLforCure, one of the largest French-based contract development and manufacturing organizations manufacturing cell and gene treatments, from LFB. In addition, the acquisition included a cell and gene manufacturing unit on the outskirts of Paris.

The strategic move was aimed at developing effective CAR-T cell treatments as well as expanding the research activities and base of Novartis in the cell and gene therapy domain in France. According to reports, companies such as Novartis have taken numerous steps to strengthen and expand their cell and gene manufacturing activities, including licensing, collaboration, and purchase agreements with Cellular Biomedicine Group for the production and supply of Kymriah—the first CAR-T cell treatment approved by the US Food and Drug Administration—to China.Apart from this, Novartis formed an alliance with the Fraunhofer Institute in Germany to facilitate cell and gene manufacturing for clinical tests and post-approval cell and gene manufacturing. It had also entered into a contract cell and gene manufacturing agreement with Japan. All these aforementioned aspects will assist the cell and gene therapy manufacturing market in exploring new paths of growth in the upcoming years.

Cell and Gene Therapy Manufacturing Market: Growth Dynamics

The evolution of new therapies has brought a paradigm shift in the biopharma sector and will revolutionize life-threatening and rare disease treatment, thereby steering the growth of the cell and gene therapy manufacturing market. In addition to this, the rapid spread of the COVID-19 virus across the globe has favorably influenced the expansion of the cell and gene therapy manufacturing market. Regulations supporting the use of cell and gene treatments for various diseases will augment the scope of cell and gene therapy manufacturing market growth in the forthcoming years. Decentralized manufacturing of cell and gene therapies is likely to bring a drastic transformation in cell and gene therapy manufacturing approaches, thereby driving market trends.

In recent years, mergers and acquisitions have also shaped the growth of the cell and gene therapy manufacturing industries. Citing an instance, in May 2019, Catalent Inc., a leading provider of drugs, consumer health products, and biologics, acquired Paragon BioServices Incorporation, a major viral vector developer and provider of manufacturing solutions for gene treatments, for nearly USD 1.2 billion. Reportedly, in May 2019, Thermo Fisher Scientific Inc. acquired Brammer Bio—a major viral vector producer for cell and gene treatments—for nearly USD 1.7 billion in cash. In April 2019, Hitachi Chemical, a Japanese firm manufacturing chemicals, acquired apceth Biopharma GmbH, a Germany-based CDMO for gene and cell treatments, for nearly USD 86.5 million, with a view to expanding its business in the new cell and gene therapy contract development and manufacturing solutions domain.

Additionally, the strategic move is aimed at the development of the regenerative drug business in the U.S., Japan, and Europe, thereby not only expanding its regional base but also accruing huge profits by entering the niche business of cell and gene manufacturing and launching differentiated and innovative products. Earlier in 2017, Hitachi had purchased PCT, LLC, a U.S.-headquartered contract producer of regenerative drugs, and then had commenced its manufacturing and contract development operations for producing regenerative drugs in April 2018 at its new unit in Yokohama, Japan.

Apart from this, new entrants are also likely to shape the growth of the cell and gene therapy manufacturing market in the near future. For instance, a small firm such as Bluebird Bio, a Massachusetts-based gene and cell therapy firm, set up its cell and gene therapy manufacturing establishment in Durham in March 2019 with the objective of producing lentiviral vectors to investigate gene and cell treatments. Furthermore, Abeona Therapeutics, a Texas-based biopharma firm, established a GMP manufacturing unit in Cleveland, Ohio, in 2018, with the goal of conducting gene and cell therapy research.During the same year, Mustang Bio, a New York-based biopharmaceutical organization, inaugurated a CAR-T cell treatment manufacturing base at Worcester, Massachusetts, in the U.S.

Furthermore, gene and cell-based treatments possess huge potential for offering new modes of treatment for several severe ailments, and this will pave the way for the enormous growth of the cell and gene therapy manufacturing market in the coming decade. With new insights in disease biology and the evolution of new cellular mechanisms, this has resulted in the rapid development and production of regenerative and immunotherapeutic medicines, thereby aiding the growth of the cell and gene therapy manufacturing industry over the assessment period.

Cell and Gene Therapy Manufacturing Market: Regional Landscape

North America To Contribute Majorly Towards Market Size By 2032

The growth of the cell and gene therapy manufacturing market in North America over the assessment period is owing to a surge in the proportion of clinical studies in countries such as the U.S. In addition to this, an increase in funding of research activities pertaining to cell and gene treatments will further boost the scope of the market in the sub-continent over the following years. Apart from this, the large-scale presence of firms in the cell and gene therapy business on the subcontinent will drive the business landscape in the region over the forecast timeline. New product development, mergers and acquisitions, partnerships, agreements, strategic alliances and collaborations between firms, and licensing of drugs and medicine patents or trade copyrights have favorably influenced regional market growth.

Cell and Gene Therapy Manufacturing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cell and Gene Therapy Manufacturing Market |

| Market Size in 2023 | USD 2.11 Billion |

| Market Forecast in 2032 | USD 4.77 Billion |

| Growth Rate | CAGR of 9.5% |

| Number of Pages | 150 |

| Key Companies Covered | Lonza AG, Thermo Fisher Scientific, Merck KGaA, Catalent Inc., Roche Diagnostics Limited, Takara Bio Incorporation, Boehringer Ingelheim, Wuxi Advanced Therapeutics, Novartis AG, Hitachi Chemical Company Limited, Bluebird Bio Inc., and Cellular Therapeutics. |

| Segments Covered | By Workflow, By Therapy Type, By Scale, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cell and Gene Therapy Manufacturing Market: Competitive Landscape

- Lonza AG

- Thermo Fisher Scientific

- Merck KGaA

- Catalent Inc.

- Roche Diagnostics Limited

- Takara Bio Incorporation

- Boehringer Ingelheim

- Wuxi Advanced Therapeutics

- Novartis AG

- Hitachi Chemical Company Limited

- Bluebird Bio Inc.

- Cellular Therapeutics.

The global Cell and Gene Therapy Manufacturing Market is segmented as follows:

By Workflow

- Vector Production

- Cell Banking

By Therapy Type

- Cell Therapy Manufacturing

- Gene Therapy Manufacturing

By Scale

- R&D

- Commercial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Evolution of new therapies has brought a paradigm shift in biopharma sector and will revolutionize life-threatening & rare disease treatment, thereby steering growth of cell and gene therapy manufacturing market. In addition to this, rapid spread of COVID-19 virus across the globe has favorably influenced expansion of cell and gene therapy manufacturing market size. Regulations supporting use of cell & gene treatments for various diseases will augment scope of cell and gene therapy manufacturing market growth in forthcoming years.

According to Zion market research report, the global Cell and Gene Therapy Manufacturing Market was valued at USD 2.11 Billion in 2023 and is projected to hit USD 4.77 Billion by 2032, with a compound annual growth rate (CAGR) of 9.5% during the forecast period 2024-2032.

North America will contribute lucratively towards the global market size over the estimated timeline. The regional market surge is due to surge in proportion of clinical experiments in countries such as the U.S. Additionally, increase in funding of research activities pertaining to cell & gene treatments will further boost scope of market in the sub-continent during forecasting years.

The key market participants leveraging business growth and contributing majorly towards market profitability & industry size include Lonza AG, Thermo Fisher Scientific, Merck KGaA, Catalent Inc., Roche Diagnostics Limited, Takara Bio Incorporation, Boehringer Ingelheim, Wuxi Advanced Therapeutics, Novartis AG, Hitachi Chemical Company Limited, Bluebird Bio Inc., and Cellular Therapeutics.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed