Captive Insurance Market Size, Growth, Global Trends, Forecast 2034

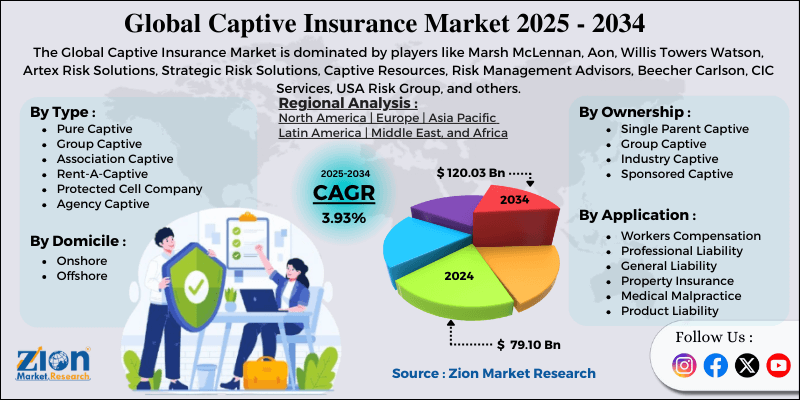

Captive Insurance Market By Type (Pure Captive, Group Captive, Association Captive, Rent-A-Captive, Protected Cell Company, Agency Captive), By Ownership (Single Parent Captive, Group Captive, Industry Captive, Sponsored Captive), By Application (Workers Compensation, Professional Liability, General Liability, Property Insurance, Medical Malpractice, Product Liability), By Domicile (Onshore, Offshore), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

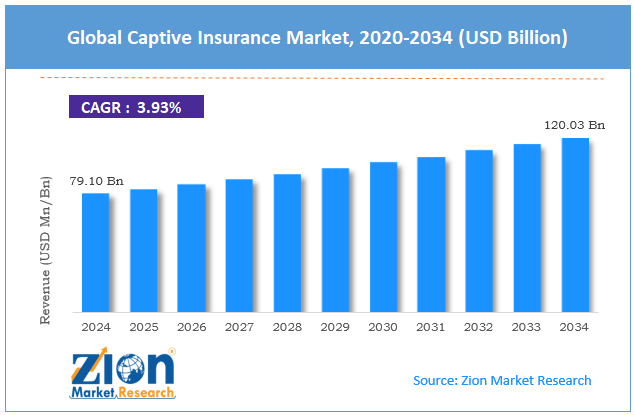

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 79.10 Billion | USD 120.03 Billion | 3.93% | 2024 |

Captive Insurance Industry Perspective:

What will be the size of the global captive insurance market during the forecast period?

The global captive insurance market size was worth approximately USD 79.10 billion in 2024 and is projected to grow to around USD 120.03 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.93% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global captive insurance market is estimated to grow annually at a CAGR of around 3.93% over the forecast period (2025-2034).

- In terms of revenue, the global captive insurance market size was valued at approximately USD 79.10 billion in 2024 and is projected to reach USD 120.03 billion by 2034.

- The captive insurance market is projected to grow significantly due to rising commercial insurance costs, increasing risk complexity, growing regulatory requirements, and expanding awareness of alternative risk transfer solutions.

- Based on type, the pure captive segment is expected to lead the captive insurance market, while the protected cell company segment is anticipated to grow significantly.

- Based on ownership, the single-parent captive segment is expected to lead the captive insurance market, while the group captive segment is anticipated to witness notable growth.

- Based on application, the workers' compensation segment is the dominating segment, while the professional liability segment is projected to witness sizeable revenue over the forecast period.

- Based on domicile, the offshore segment is expected to lead the market compared to the onshore segment.

- Based on region, North America is projected to dominate the global captive insurance market during the estimated period, followed by Europe.

Captive Insurance Market: Overview

Captive insurance is a simple risk management approach in which a company establishes its own insurance company to cover business risks rather than buying policies from traditional insurers. This setup gives businesses greater control over insurance costs, policy terms, claims handling, and premium management. Some captives insure only one company, while others allow multiple companies within the same industry to share risks. Trade associations may form captives to serve their members, and rent-a-captive models let firms participate without creating a full insurance company. Protected cell structures keep each participant's funds legally separate, providing added safety. Captive insurance can cover many risks, such as employee injuries, professional errors, property damage, product issues, and medical liability.

Companies typically establish captives in jurisdictions with supportive laws, tax efficiency, and flexible regulations. Popular onshore locations include Vermont and Delaware, while offshore options include Bermuda and the Cayman Islands. Captive insurance is attractive when commercial insurance becomes expensive or difficult to obtain. Businesses also benefit by keeping underwriting profits and earning investment income on reserves. During periods of rising insurance premiums, captive insurance offers cost control, customized coverage, and long-term financial stability.

The increasing complexity of corporate risks and rising commercial insurance costs is expected to drive growth in the captive insurance market throughout the forecast period.

Captive Insurance Market: Evolution Roadmap 2025–2034

The captive insurance market is entering a structured phase of development, driven by rising commercial insurance costs, regulatory maturity, digital risk management tools, and growing adoption among mid-sized companies. The following roadmap outlines expected development phases through 2034 in simple terms.

2025–2027: Cost Control and Structural Expansion Phase

- More businesses form group captives and protected cell companies to share costs, reduce entry barriers, and manage insurance risks more efficiently.

- Improved feasibility tools and actuarial modeling help companies better understand risks, set accurate premiums, and decide whether captive insurance fits their needs.

2028–2031: Digital Management and Middle-Market Adoption Phase

- Digital platforms simplify captive administration, reporting, claims tracking, and compliance, reducing operational burden and ongoing management costs.

- Increased education, broker involvement, and success stories drive wider captive insurance adoption among mid-sized companies across multiple industries.

- Closer collaboration with reinsurers improves loss protection, capital efficiency, and long-term stability for captive insurance programs.

2032–2034: Integrated Risk Strategy and Regulatory Alignment Phase

- Captive insurance becomes fully integrated with enterprise risk management, cyber risk planning, and supply chain risk strategies.

- Stronger regulatory alignment and transparency standards improve credibility, governance, and long-term sustainability of captive structures.

- Advanced analytics support better loss prevention, performance monitoring, and strategic decision-making across global captive insurance portfolios.

Captive Insurance Market: Dynamics

Growth Drivers

How is the insurance market hardening driving the growth of the captive insurance market?

The captive insurance market is growing strongly as regular insurance becomes more expensive and harder for businesses to access. Traditional insurance companies raise premiums sharply after major losses from natural disasters, pandemics, lawsuits, and large claim payouts. To protect profits, insurers reduce coverage options, increase deductibles, lower policy limits, and add more exclusions. Many businesses struggle to find affordable protection against risks such as cyberattacks, environmental damage, and employee-related claims. These challenges push companies to look for better ways to manage risk and control insurance spending. Captive insurance allows businesses to insure risks they understand, rather than paying high prices to commercial insurers.

Companies keep premium savings and benefit from underwriting profits inside their own captive structure. Businesses with strong safety programs and good loss records gain the most advantage from this approach. Captive insurance also avoids cross-subsidizing higher-risk companies in traditional insurance pools. During long periods of rising premiums, captive insurance offers stability, flexibility, and better financial planning for organizations across many industries.

Increasing regulatory complexity is driving captive insurance adoption.

The global captive insurance industry is growing steadily as businesses face increasingly stringent regulatory requirements that require stronger risk management systems and more detailed insurance documentation. Corporate governance standards expect company boards to clearly demonstrate effective oversight of risks and insurance programs. Companies operating internationally must follow different insurance and compliance requirements across multiple countries. Complex global supply chains increase liability risks involving suppliers, contractors, and logistics partners. Data protection laws, such as the GDPR, impose substantial fines, and traditional insurance often provides limited coverage for these exposures.

Employment regulations expand employers' liabilities for discrimination, harassment, and workplace conduct. Environmental laws hold companies accountable for pollution from both current operations and past activities. Professional licensing bodies require proof of adequate insurance before granting authorization to operate. Customer contracts and lender agreements demand specific coverage limits and policy types. Captive insurance offers flexibility and customized coverage to effectively manage these complex regulatory challenges.

Restraints

High formation and operational costs limit market growth.

A major challenge for the captive insurance market is the high cost of setting up and operating a captive insurance company. Creating a captive involves legal work, licensing, actuarial studies, and consulting support, which can cost hundreds of thousands of dollars. Most captive domiciles require large minimum capital investments, often ranging from $250,000 to over $1 million. Ongoing expenses include management fees, audits, regulatory filings, actuarial reviews, board governance costs, fronting arrangements, reinsurance protection, and compliance with complex accounting and tax reporting standards.

Smaller businesses often find these combined costs difficult to justify relative to traditional insurance premiums, particularly because funds reserved for future claims reduce cash available for day-to-day operations. During economic downturns, rising claims, limited capital availability, frequent regulatory changes, and unexpected compliance costs further increase financial pressure, slowing captive insurance adoption despite its potential long-term strategic benefits.

Opportunities

How is expansion into the middle market creating new opportunities for the captive insurance market?

The captive insurance market is seeing strong growth opportunities as mid-sized companies gain access to insurance options previously available only to very large businesses. New insurance technology lowers management and reporting costs, making captive insurance more affordable for smaller organizations. Group captives and cell captives allow multiple companies to share setup costs, reducing the financial burden for each participant. Some regulatory regions offer simpler rules and faster approval processes designed to attract smaller captive owners. Service providers now offer captive management packages specifically priced for mid-sized businesses.

Growing competition among captive domiciles encourages lower fees and more flexible capital requirements. Insurance brokers actively promote captive insurance to middle-market companies seeking cost control and stable coverage. Industry associations facilitate members' participation in shared captives, thereby expanding access to self-insurance benefits. Improved efficiency lowers the minimum premium levels needed to run captives sustainably.

More education and awareness help business leaders clearly understand the advantages of captives through training, conferences, and advisory support. Real-world success stories and ongoing traditional insurance challenges together build confidence, increase interest, and push mid-sized firms toward captive solutions. Tailored captive programs offer better protection for specialized risks, supporting steady growth in the captive insurance market.

Challenges

How are regulatory scrutiny and tax law changes creating challenges for the captive insurance industry?

The captive insurance market faces growing challenges as regulations and tax rules become stricter across many regions worldwide. Tax authorities closely review captive insurance setups to prevent misuse and improper tax advantages. In the United States, tax agencies limit premium deductions for certain captive arrangements. Small captives, used mainly for tax savings, are now under increased scrutiny and legal challenges. Disclosure rules require companies to report specific captive structures, thereby increasing audit risk. International captives face complex pricing documentation requirements to comply with transfer pricing rules. Many countries have introduced laws to reduce perceived tax benefits from captives.

Regulators in popular captive locations are raising oversight standards and increasing compliance checks. Solvency and capital requirements increase to ensure captives remain financially strong and able to pay claims during unexpected loss events. More reporting obligations, frequent regulatory examinations, and higher governance expectations together increase administrative workload, operating costs, and compliance complexity for captive owners. Media attention and political pressure sometimes portray captives as tax shelters, reducing offshore incentives and forcing companies to adopt stronger transparency to maintain credibility.

Captive Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Captive Insurance Market |

| Market Size in 2024 | USD 79.10 Billion |

| Market Forecast in 2034 | USD 120.03 Billion |

| Growth Rate | CAGR of 3.93% |

| Number of Pages | 213 |

| Key Companies Covered | Marsh McLennan, Aon, Willis Towers Watson, Artex Risk Solutions, Strategic Risk Solutions, Captive Resources, Risk Management Advisors, Beecher Carlson, CIC Services, USA Risk Group, and others. |

| Segments Covered | By Type, By Ownership, By Application, By Domicile, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Captive Insurance Market: Segmentation

The global captive insurance market is segmented based on type, ownership, application, domicile, and region.

Based on type, the global captive insurance industry is classified into pure captives, group captives, association captives, rent-a-captives, protected cell companies, and agency captives. Pure captive leads the market due to maximum control for parent companies, retention of all underwriting profits, and the ability to customize coverage precisely to organizational needs.

Based on ownership, the industry is divided into single-parent captives, group captives, industry captives, and sponsored captives. Single-parent captive leads the market due to complete control, direct financial benefits, and the ability to address unique organizational risk profiles without compromise.

Based on application, the global captive insurance market is categorized into workers' compensation, professional liability, general liability, property insurance, medical malpractice, and product liability. Workers' compensation holds the largest market share due to predictable loss patterns, substantial premium volume, and a strong history of captive performance in this coverage line.

Based on domicile, the global market is segregated into onshore and offshore. Offshore holds the largest market share due to favorable tax treatment, lighter regulatory requirements, operational flexibility, and established infrastructure in premier captive domiciles.

Captive Insurance Market: Regional Analysis

What factors are contributing to North America's dominance in the global captive insurance market?

North America is expected to grow at a 5.8% CAGR in the captive insurance market during the forecast period, driven by rising insurance costs and growing demand for customized risk management solutions. North America leads the captive insurance market because the region has well-developed regulations, strong business awareness, and long experience with alternative insurance models. The United States played a major role in shaping modern captive insurance, with Vermont passing the first clear, structured captive insurance laws.

Today, several U.S. states compete to attract captive insurers by offering business-friendly rules, clear guidance, and dedicated regulatory teams. Vermont remains the largest captive insurance domicile in the United States, hosting hundreds of captives and supporting them with deep professional expertise. States such as Delaware and Hawaii also attract captives by offering flexible structures and specialized regulatory advantages. Canada continues to expand captive insurance activity, with provinces such as British Columbia providing supportive legal frameworks. Many large corporations in North America understand risk management well and see captive insurance as a long-term financial and strategic tool. High commercial insurance premiums across the region push companies to seek more cost-stable alternatives.

Strong litigation exposure motivates businesses to keep greater control over claims handling and legal defense. Complex corporate groups benefit from captive programs that cover multiple subsidiaries under a single structure. A strong network of actuaries, lawyers, consultants, and captive managers supports smooth formation and daily operations. Insurance brokers actively educate clients about the feasibility of captive benefits. Regulatory familiarity with captive insurance reduces approval delays and operational uncertainty. Overall, supportive regulations, mature expertise, and rising insurance challenges continue to strengthen North America's leadership in the captive insurance market.

Europe is experiencing significant growth.

Europe is expected to grow at a 5.1% CAGR in the captive insurance market during the forecast period, driven by regulatory coordination, rising insurance costs, and wider adoption of structured risk management solutions. Europe is witnessing steady expansion in the captive insurance market as companies seek greater control over insurance programs spanning multiple countries and regulatory systems. European Union insurance directives establish common frameworks that facilitate cross-border captive operations and promote consistent risk coverage across member states. Guernsey remains a leading European captive domicile, supported by experienced regulators, strong governance standards, and deep professional expertise. Ireland continues to attract multinational corporations by offering an onshore European base, favorable regulations, and seamless access to EU markets. Luxembourg strengthens its captive insurance presence by focusing on large corporations operating across several European jurisdictions. Malta is emerging as an attractive captive location within the European Union, offering flexible rules and competitive operating costs.

The United Kingdom maintains a strong insurance services ecosystem that supports captive formation, management, and advisory activities. Large European manufacturing companies increasingly use captive insurance to manage property damage, product liability, and operational risks more efficiently. Pharmaceutical and chemical firms rely on captives to address complex regulatory, environmental, and liability exposures. At the same time, Solvency II capital requirements reduce traditional insurer capacity, while evolving tax frameworks and post-Brexit restructuring encourage businesses to adopt centralized captive programs that simplify compliance, improve cost stability, and support coordinated risk management across Europe.

Recent Market Developments

- In September 2025, Opulence Ltd launched a new captive cell structure in Labuan, backed by China Re and Northern Trust, expanding institutional-grade captive insurance solutions in Asia for risk control and capital efficiency.

- In October 2025, WTW (Willis Towers Watson) launched Captive Fit, a strategic service that helps captive owners optimize risk financing, reserve adequacy, and investment strategy through advanced analytics and stress-testing tools.

Captive Insurance Market: Competitive Analysis

The leading players in the global captive insurance market are:

- Marsh McLennan

- Aon

- Willis Towers Watson

- Artex Risk Solutions

- Strategic Risk Solutions

- Captive Resources

- Risk Management Advisors

- Beecher Carlson

- CIC Services

- USA Risk Group

The global captive insurance market is segmented as follows:

By Type

- Pure Captive

- Group Captive

- Association Captive

- Rent-A-Captive

- Protected Cell Company

- Agency Captive

By Ownership

- Single Parent Captive

- Group Captive

- Industry Captive

- Sponsored Captive

By Application

- Workers Compensation

- Professional Liability

- General Liability

- Property Insurance

- Medical Malpractice

- Product Liability

By Domicile

- Onshore

- Offshore

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed