Broadcasting And Cable TV Market Size, Share, Value & Forecast 2034

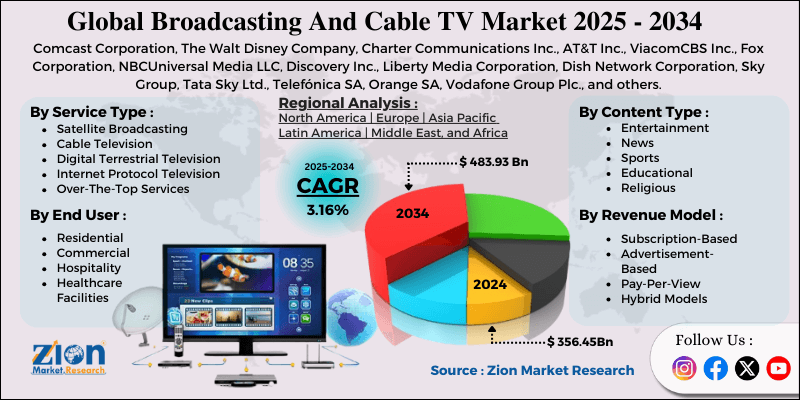

Broadcasting And Cable TV Market By Service Type (Satellite Broadcasting, Cable Television, Digital Terrestrial Television, Internet Protocol Television, Over-The-Top Services), By Content Type (Entertainment, News, Sports, Educational, Religious), By Revenue Model (Subscription-Based, Advertisement-Based, Pay-Per-View, Hybrid Models), By End-User (Residential, Commercial, Hospitality, Healthcare Facilities), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

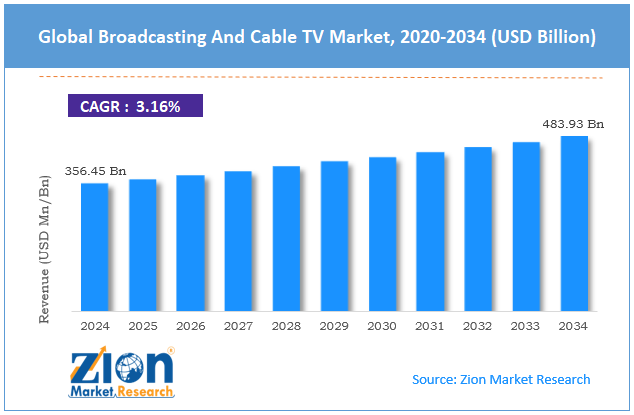

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 356.45 Billion | USD 483.93 Billion | 3.16% | 2024 |

Broadcasting And Cable TV Industry Perspective:

What will be the size of the broadcasting and cable TV market during the forecast period?

The global broadcasting and cable TV market size was worth approximately USD 356.45 billion in 2024 and is projected to grow to around USD 483.93 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.16% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global broadcasting and cable TV market is estimated to grow annually at a CAGR of around 3.16% over the forecast period (2025-2034).

- In terms of revenue, the global broadcasting and cable TV market size was valued at approximately USD 356.45 billion in 2024 and is projected to reach USD 483.93 billion by 2034.

- The broadcasting and cable TV market is projected to experience transformation due to shifting consumer preferences, rising internet penetration, growing demand for on-demand content, expanding sports broadcasting rights values, and technological convergence between traditional and digital platforms.

- Based on service type, the cable television segment is expected to maintain a significant presence in the broadcasting and cable TV market, while the over-the-top services segment is anticipated to experience substantial growth.

- Based on content type, the entertainment segment is expected to lead the broadcasting and cable TV market, while the sports segment is anticipated to witness strong revenue growth.

- Based on the revenue model, the subscription-based segment is the dominant segment, while the advertisement-based segment is projected to retain its importance over the forecast period.

- Based on end-user, the residential segment is expected to lead the market compared to the commercial segment.

- Based on region, North America is projected to maintain a significant position in the global broadcasting and cable TV market during the estimated period, with Asia Pacific showing rapid evolution.

Broadcasting And Cable TV Market: Overview

A broadcasting and cable TV system is a media distribution network delivering television channels, news, entertainment, and specialty content across multiple platforms. This communication infrastructure connects content creators, broadcasters, and service providers with large audiences while supporting advertising revenue and subscription services. Distribution technologies include satellite transmission, cable networks, digital terrestrial broadcasting, Internet Protocol television, and over-the-top streaming services. Satellite broadcasting uses geostationary satellites to deliver signals across vast regions, reaching rural areas and remote communities. Cable television relies on coaxial and fiber optic networks in cities and suburbs, providing stable, high-quality viewing experiences.

Digital terrestrial television broadcasts free-to-air digital signals via antennas, without subscription fees. Internet Protocol Television (IPTV) delivers live channels and on-demand content over broadband connections to connected devices. Entertainment programs, news coverage, live sports, educational shows, and religious channels serve diverse viewer interests. Residential users lead consumption, while businesses, hotels, healthcare facilities, and institutions use television services to enhance engagement and experiences. Broadcasting and cable TV systems remain essential for mass media distribution, audience reach, and the growth of digital entertainment worldwide.

The evolving media consumption patterns and ongoing digital transformation of television distribution are expected to significantly reshape the broadcasting and cable TV market throughout the forecast period.

Broadcasting And Cable TV Market: Technology Roadmap 2025–2034

The broadcasting and cable TV market is undergoing a fundamental transformation driven by the migration to internet protocol, the integration of artificial intelligence, the adoption of personalization technologies, and the convergence of traditional broadcasting and streaming platforms. The following is the technology roadmap divided into development phases expected to unfold through 2034.

2025–2027: Digital Convergence and Enhanced Experience Phase

- Unified streaming platforms integrate traditional broadcast channels with on-demand content libraries, providing seamless user experiences across devices and viewing contexts.

- Advanced compression technologies enable ultra-high-definition and high-dynamic-range broadcasting while optimizing bandwidth utilization and transmission costs.

- Interactive television features expand through real-time polling, synchronized second-screen experiences, and enhanced program information displays.

2028–2031: Intelligent Content and Personalization Phase

- Artificial intelligence-powered content recommendation systems provide personalized channel lineups, automated highlight generation, and predictive content suggestions based on viewing behavior.

- Cloud-based digital video recording eliminates the limitations of physical set-top boxes, enables unlimited storage, and supports multi-device access to recorded content.

- Addressable advertising technologies deliver targeted commercials to individual households, improving advertiser return on investment and viewer relevance.

2032–2034: Immersive Media and Next-Generation Distribution Phase

- Virtual and augmented reality broadcasting create immersive viewing experiences for sports events, concerts, and specialized programming.

- Fifth-generation wireless networks enable mobile broadcasting services, support outdoor viewing scenarios, and deliver high-quality streaming without fixed infrastructure.

- Blockchain-based content distribution models are emerging for rights management, micropayments, and direct creator-to-consumer content delivery.

Broadcasting And Cable TV Market: Dynamics

Growth Drivers

Sports content value escalation drives market growth

The broadcasting and cable TV market is seeing strong growth, driven by rising sports broadcasting rights, which support real-time viewing and premium advertising demand. Major sports leagues, including football, basketball, baseball, and soccer, sign multi-billion-dollar media contracts with networks seeking exclusive sports content. Global events like the Olympics and World Cup attract massive audiences and sponsors, thereby justifying higher subscription prices for pay television services. Regional sports networks covering local teams build loyal subscribers, limit cord-cutting pressure, and strengthen fee negotiations with cable distributors. College sports media partnerships expand as universities monetize athletics, conferences bundle rights, and regional rivalries attract consistent fan engagement.

Boxing and mixed martial arts generate pay-per-view revenue, attract younger audiences, and show willingness to pay for exclusive live events. Cricket broadcasting in South Asia delivers huge audiences, strong advertising revenue, and supports long-term growth for dedicated sports channels. Esports, fantasy sports, and betting partnerships increase engagement, extend viewing time, attract new demographics, and support steady revenue for the broadcasting industry.

Does the expansion of television infrastructure in emerging regions create opportunities for the broadcasting and cable TV market?

Emerging-market television infrastructure expansion is driving strong growth in the broadcasting and cable TV industry as governments and private operators invest in digital connectivity. Rapid urbanization increases demand for reliable home entertainment services across expanding residential communities. Rising middle-class populations support higher spending on subscription television and bundled content packages. Network upgrades from analog to digital cable improve signal quality, channel capacity, and service reliability. Expansion of last-mile connectivity enables cable television access in previously underserved semi-urban and rural regions.

Public and private infrastructure funding accelerates the rollout and modernization of cable networks. The growth of local-language channels and regional content strengthens viewer engagement and subscription retention. Advertising demand from regional brands increases broadcaster revenue and supports channel expansion. Hybrid cable broadband offerings combine television and internet services, improving value propositions. Regulatory support for media digitization encourages investment in compliant cable infrastructure. These combined drivers support the sustained growth of the broadcasting cable TV market in emerging economies.

Restraints

How do cord-cutting acceleration and streaming competition threaten traditional models?

A major challenge for the broadcasting and cable TV market is the ongoing loss of subscribers as viewers cancel pay television in favor of lower-cost streaming services. Younger audiences show weak attachment to traditional television, preferring on-demand viewing, mobile screens, and subscription video platforms without advertisements. Streaming platforms invest heavily in original content, attract leading creative talent, release premium series, and compete directly for entertainment spending. Subscription fatigue grows as households manage many streaming services, review monthly expenses, and reduce active subscriptions across competitive digital markets.

Advertising budgets shift toward digital platforms that offer precise targeting, measurable performance data, and automated buying tools, thereby weakening the value of traditional television advertising. Viewers resist channel bundles and demand flexible packages, individual channel selection, and affordable small bundles replacing large cable subscriptions. Rising sports broadcasting rights costs strain networks as subscriber numbers fall, per-subscriber expenses rise, and profitability pressures increase.

Opportunities

How is the hybrid service model innovation creating growth potential for the broadcasting and cable TV market?

The broadcasting and cable TV industry is finding new opportunities by blending traditional television with streaming, personalization tools, and interactive viewing experiences. Hybrid service models enable flexible channel access, cloud delivery, and customizable packages without the high costs of a heavy physical network investment. Virtual multichannel platforms combine live channels and on-demand content, helping broadcasters reach digital audiences across multiple connected devices. Bundled streaming partnerships and free advertisement-supported television channels reduce subscriber churn while creating new advertising and subscription revenue streams.

Live streaming extensions, social media links, and second-screen applications increase viewer interaction, content discovery, and engagement among younger audiences. Interactive overlays, voice control interfaces, and natural language search simplify navigation, improve accessibility, and enhance overall television user experience. Aggregation platforms bring multiple streaming services into unified dashboards, reducing application switching, improving convenience, and strengthening customer satisfaction. White-label streaming technology enables broadcasters to launch branded services, protect customer relationships, diversify revenue streams, and adapt digital distribution strategies.

Challenges

Content cost inflation and rights fragmentation create obstacles

The broadcasting and cable TV market faces significant pressure from rising content costs, intensifying competition for premium rights, and a fragmented market, all of which are reducing subscriber revenue. Original content budgets reach record levels as streaming platforms invest heavily, increase talent fees, and raise quality expectations across global television markets. Sports broadcasting rights costs continue climbing as leagues exploit competition among broadcasters, cable networks, and streaming platforms to secure higher fees. Scripted drama production becomes expensive due to star salaries, advanced visual effects, location filming demands, and longer schedules for premium series. Content owners gain leverage, charge higher licensing prices, protect intellectual property, and launch direct streaming services across international entertainment markets.

Marketing and promotion spending rises because crowded content libraries require stronger visibility, broader campaigns, and continuous audience attention. These combined cost pressures reduce profitability, limit programming flexibility, and create long-term financial challenges for the broadcasting and cable TV industry.

Broadcasting And Cable TV Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Broadcasting And Cable TV Market |

| Market Size in 2024 | USD 356.45 Billion |

| Market Forecast in 2034 | USD 483.93 Billion |

| Growth Rate | CAGR of 3.16% |

| Number of Pages | 214 |

| Key Companies Covered | Comcast Corporation, The Walt Disney Company, Charter Communications Inc., AT&T Inc., ViacomCBS Inc., Fox Corporation, NBCUniversal Media LLC, Discovery Inc., Liberty Media Corporation, Dish Network Corporation, Sky Group, Tata Sky Ltd., Telefónica SA, Orange SA, Vodafone Group Plc., and others. |

| Segments Covered | By Service Type, By Content Type, By Revenue Model, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Broadcasting And Cable TV Market: Segmentation

The global broadcasting and cable TV market is segmented based on service type, content type, revenue model, end-user, and region.

Based on service type, the global broadcasting and cable TV industry is classified into satellite broadcasting, cable television, digital terrestrial television, internet protocol television, and over-the-top services. Cable television maintains a strong market presence due to established infrastructure in developed markets, bundled service offerings combining internet and phone services, and reliable signal quality.

Based on content type, the industry is divided into entertainment, news, sports, educational, and religious programming. Entertainment content leads the market due to broad audience appeal across demographics, substantial production investment creating high-quality programming, and strong advertising support from consumer brand marketers.

Based on the revenue model, the global broadcasting and cable TV market is segregated into subscription-based, advertisement-based, pay-per-view, and hybrid models. Subscription-based models dominate market revenue due to predictable recurring income streams, a focus on customer retention that creates stable cash flows, the premium content exclusivity that justifies monthly fees, and bundle opportunities with other telecommunications services.

Based on end-user, the global broadcasting and cable TV market is divided into residential, commercial, hospitality, and healthcare facilities. Residential users represent the largest segment due to universal household television presence, entertainment consumption as a primary leisure activity, news and information access needs, and multi-generational viewing that supports diverse content demands.

Broadcasting And Cable TV Market: Regional Analysis

Multiple factors position North America as the leading market

North America is expected to grow at a CAGR of approximately 2.9%, maintaining its position as the leading region in the global broadcasting and cable TV market. North America maintains a strong presence in the global broadcasting and cable TV market despite cord-cutting pressure, supported by mature infrastructure, premium content production, and hybrid distribution models. The United States is the world's largest television advertising market, supporting broadcast networks, cable channels, and local station groups, generating high, stable revenue. Cable television infrastructure reaches almost all metropolitan and suburban households, although total subscriber numbers continue to decline from their previous peak penetration levels.

Satellite television services remain important in rural regions without cable access, while facing subscription pressure similar to that of traditional cable operators. Sports broadcasting delivers exceptional value through expensive rights agreements covering professional leagues, college athletics, and global competitions, attracting loyal and repeat viewership. News programming sustains strong audience demand during elections, national events, emergencies, and breaking news periods, despite ongoing audience fragmentation. Regional sports networks experience subscriber losses yet remain critical for dedicated local team followers unwilling to forgo live coverage. Television station groups pursue consolidation strategies to improve operating efficiency, secure stronger network agreements, and protect local advertising market share. Over-the-air broadcasting continues serving households without pay television subscriptions, supported by digital signal quality and permanent free content availability.

Retransmission consent fees paid by cable and satellite operators are providing growing revenue streams for broadcasters despite an ongoing decline in subscriber bases. Canada exhibits similar market dynamics, with established broadcast networks, widespread cable usage, and regulatory support for domestic content production. Mexico sustains its traditional television strength through dominant broadcast networks, popular telenovela production, and gradual cable and satellite expansion. These combined regional characteristics preserve the relevance of the North American broadcasting and cable TV markets during the ongoing digital transformation and industry changes.

What factors contribute to the rapid evolution of the broadcasting and cable TV market in the Asia-Pacific region?

Asia Pacific is expected to grow at a CAGR of approximately 6.1%, emerging as the fastest-growing region in the global market. Asia Pacific is seeing rapid growth in broadcasting and cable TV markets driven by large subscriber additions, digital technology adoption, mobile viewing habits, and strong regional content production. China is the largest television market by households, though state control limits the expansion of commercial broadcasting and restricts access to international streaming platforms. India is seeing strong growth across cable television, direct-to-home satellite, and streaming services, supported by rising incomes and expanding regional-language programming. Cricket broadcasting drives massive viewership in India, supports high media rights values, and fuels advertising growth across dedicated sports television channels.

Japan operates a mature broadcasting market with strong public broadcasters, high production quality, and global demand for anime television content. South Korea combines advanced broadband infrastructure with creative storytelling, driving the global popularity of Korean dramas and the rapid development of streaming platforms. Indonesia records steady growth in the television market, driven by urbanization, rising middle-class populations, and increased investment in local-language content. Southeast Asian markets, including Thailand, Vietnam, and the Philippines, are following similar growth paths, driven by economic development and evolving media consumption patterns. Australia reflects developed-market traits, with strong public broadcasting services, established pay television platforms, and rising household adoption of streaming services.

Regional film industries, including Bollywood, Kollywood, and local cinema, provide continuous content pipelines to support television schedules and digital streaming platforms. Mobile-first viewing dominates in many Asia-Pacific countries due to limited fixed broadband reach and widespread smartphone usage. Broadcasters adjust content formats, episode length, and delivery strategies to suit mobile screens and flexible viewing preferences. Diverse languages, cultures, and regulations create complex operating environments across the Asia Pacific broadcasting and cable TV markets. These combined factors position Asia Pacific as a high-growth region supporting long-term expansion across broadcasting, cable television, and digital media services.

Recent Market Developments

- In May 2025, Roku, Inc. completed its acquisition of Frndly TV for approximately $185 million, enabling Roku to expand its live television streaming offerings and integrate Frndly TV as a default application on Roku devices.

- On July 22, 2025, Sky TV in New Zealand finalized the acquisition of Discovery NZ from Warner Bros. Discovery, merging traditional television channels and streaming platforms under the Sky Free brand to boost audience reach.

Broadcasting And Cable TV Market: Competitive Analysis

The leading players in the global broadcasting and cable TV market are:

- Comcast Corporation

- The Walt Disney Company

- Charter Communications Inc.

- AT&T Inc.

- ViacomCBS Inc.

- Fox Corporation

- NBCUniversal Media LLC

- Discovery Inc.

- Liberty Media Corporation

- Dish Network Corporation

- Sky Group

- Tata Sky Ltd.

- Telefónica SA

- Orange SA

- Vodafone Group Plc.

The global broadcasting and cable TV market is segmented as follows:

By Service Type

- Satellite Broadcasting

- Cable Television

- Digital Terrestrial Television

- Internet Protocol Television

- Over-The-Top Services

By Content Type

- Entertainment

- News

- Sports

- Educational

- Religious

By Revenue Model

- Subscription-Based

- Advertisement-Based

- Pay-Per-View

- Hybrid Models

By End User

- Residential

- Commercial

- Hospitality

- Healthcare Facilities

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed