Sports Online Live Video Streaming Market Size, Share and Forecast 2034

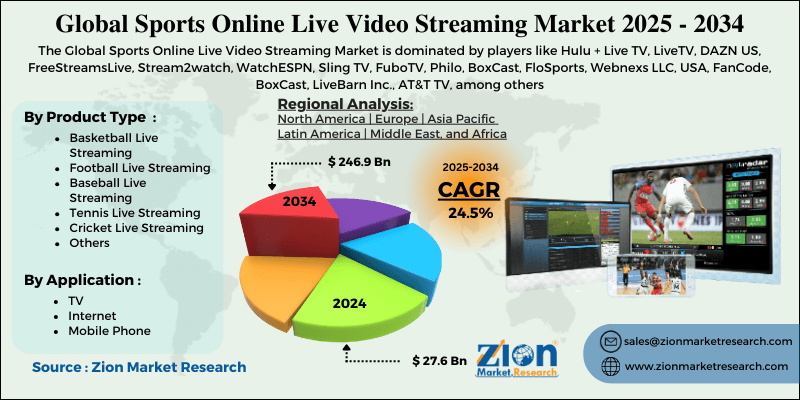

Sports Online Live Video Streaming Market By Product Type (Basketball Live Streaming, Football Live Streaming, Baseball Live Streaming, Tennis Live Streaming, Cricket Live Streaming, and Others), By Application (TV, Internet, and Mobile Phone), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

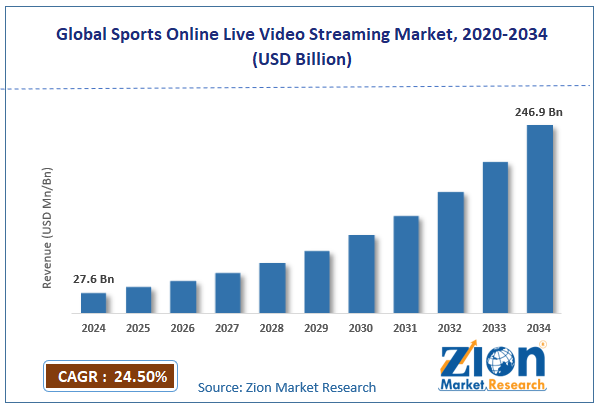

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 27.6 Billion | USD 246.9 Billion | 24.5% | 2024 |

Sports Online Live Video Streaming Industry Perspective:

The global sports online live video streaming market size was worth around USD 27.6 billion in 2024 and is predicted to grow to around USD 246.9 billion by 2034, with a compound annual growth rate (CAGR) of roughly 24.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global sports online live video streaming market is estimated to grow annually at a CAGR of around 24.5% over the forecast period (2025-2034).

- In terms of revenue, the global sports online live video streaming market size was valued at around USD 27.6 billion in 2024 and is projected to reach USD 246.9 billion by 2034.

- Increasing penetration of smart phones and internet infrastructure is expected to drive the sports online live video streaming market over the forecast period.

- Based on the product type, the football live streaming segment is expected to capture the largest market share over the projected period.

- Based on the application, the mobile phone segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Sports Online Live Video Streaming Market: Overview

Sports online live video streaming is the digital transmission of sporting events over the internet in real time. It allows users to watch live games, matches, and tournaments on their smartphones, tablets, computers, and smart TVs without cable or satellite TV. This technology records live video from venues, compresses it for quick transmission, and sends it over content delivery networks (CDNs) using protocols such as RTMP or WebRTC. This enables low-latency streaming and adaptive bitrate switching, which adjust the broadcast quality based on the viewer's internet speed. It allows users to engage immediately with features such as real-time metrics, multiple camera perspectives, interactive debates, and polls, which differ from video-on-demand. This makes watching something more than just a passive activity.

Sports Online Live Video Streaming Market: Dynamics

Growth Drivers

Does the growing internet and smartphone penetration drive the sports online live video streaming industry growth?

The sports streaming revolution has been made possible by the rise of high-speed internet and the proliferation of smartphones and other mobile devices worldwide. This is especially essential in developing and growing countries, as mobile-first connectivity often means that traditional cable TV infrastructure is no longer needed. As 4G and 5G networks become more ubiquitous, they offer the fast, reliable connectivity required to stream live events in high definition without buffering or lag. This means millions of new prospective viewers can now watch live sports content on the go, whether they are on their way to work, at a café, or elsewhere. This means the sports streaming business will attract more customers and gain greater flexibility and accessibility, with live games available on almost any device, worldwide.

For instance, according to GSMA, Mobile technologies and services now account for around 5.8% of global GDP, equivalent to $6.5 trillion in economic value added. By 2030, the value will have risen to about $11 trillion, or 8.4% of GDP. Thus, the stats above are expected to drive the sports online live video streaming market.

Restraints

Infrastructure limitations are restraining the market growth

Even though a lot of progress has been made, there are still many infrastructure challenges, especially in certain areas and situations. Cities in industrialized countries frequently have good internet and 5G networks. However, in many developing nations and rural regions, internet access remains slow and difficult to obtain. This digital divide directly affects how many individuals can watch live sports online. When the internet connection is slow, it can create buffering, low-resolution streams, and a bad viewing experience. Even in areas with robust connectivity, the network's capacity can be strained during major events, when demand is highest, leading to delays or even outages. Edge computing and content delivery networks (CDNs) can help with these issues. Still, the massive volume of data that comes with high-definition live video streaming, especially to a global audience simultaneously, makes it challenging to keep up with technological issues. This means that the network infrastructure must be continually updated and enhanced to ensure that all users experience a consistently high-quality experience. Thus, infrastructure limitations, especially in developing nations, impede the growth of the online live video streaming market for sports.

Opportunities

Does the rising agreement offer a potential opportunity for the sports online live video streaming industry growth?

The growing agreement is expected to create an opportunity for the online live video streaming market in sports. For instance, in February 2025, FanCode, India's leading digital sports portal, expanded its motorsports portfolio by gaining exclusive digital streaming rights to MotoGP. This three-year agreement strengthens FanCode's position as the go-to platform for motorsport enthusiasts, building on its previous success with Formula One streaming. With this historic agreement, FanCode will live broadcast every MotoGP Tissot Sprint and Grand Prix race, providing fans with unprecedented access to the most thrilling sport on the planet. MotoGP is well-known for its spectacular races featuring the fastest riders on cutting-edge bikes, and it has a large fanbase in India.

Challenges

How the piracy and unauthorized streaming pose a major challenge to sports online live video streaming market expansion?

The widespread problem of piracy and illegal streaming makes it challenging for the online live sports video streaming industry to generate revenue and operate. There is strong demand for premium live sports content, and exclusive license deals and rising subscription rates make it very tempting for illegal operators to offer free, unauthorized broadcasts. These pirated broadcasts, which are often shared on social media, torrent sites, and specialized unlicensed platforms, directly deprive fundamental rights holders and streaming services of revenue. It costs a lot of money to fight piracy, and it requires a lot of money to buy powerful anti-piracy equipment, enforce the law, and keep an eye on things all the time. Even though many have tried, it's pretty hard to eliminate all illegal sources because live broadcasts don't last long, and the internet is available worldwide. This constant threat of piracy devalues legal subscribers, reduces profits, and deters investment in future premium content. This is a long-term problem for the growth of the online live video streaming sector.

Sports Online Live Video Streaming Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sports Online Live Video Streaming Market Research Report |

| Market Size in 2024 | USD 27.6 Billion |

| Market Forecast in 2034 | USD 246.9 Billion |

| Growth Rate | CAGR of 24.5% |

| Number of Pages | 215 |

| Key Companies Covered | Hulu + Live TV, LiveTV, DAZN US, FreeStreamsLive, Stream2watch, WatchESPN, Sling TV, FuboTV, Philo, BoxCast, FloSports, Webnexs LLC, USA, FanCode, BoxCast, LiveBarn Inc., AT&T TV, among others |

| Segments Covered | By Product Type, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sports Online Live Video Streaming Market: Segmentation

The global sports online live video streaming industry is segmented based on product type, application, and region.

Based on product type, the global sports online live video streaming market is bifurcated into basketball live streaming, football live streaming, baseball live streaming, tennis live streaming, cricket live streaming, and others. The football live streaming segment is expected to dominate the market. The growth in the segment is owing to its global fanbase and high-value deals from leagues like Premier League, La Liga, and UEFA Champions League, fueling billions in licensing fees and user acquisition.

Based on application, the global sports online live video streaming industry is bifurcated into TV, internet, and mobile phone. The mobile phone segment holds a significant market share. The increasing adoption of smartphones is one of the major drivers for the market growth.

Sports Online Live Video Streaming Market: Regional Analysis

Will North America dominate the sports online live video streaming market over the projected period?

North America dominates the sports online live video streaming sector. More people are using digital devices, and significant changes in how people watch TV are driving the regional market. The region has one of the highest rates of internet and smartphone use globally, facilitating access to live sports on mobile devices, smart TVs, and OTT platforms. In the US and Canada, more and more people are cutting the cord. Millions of homes are giving up traditional cable or satellite TV in favor of streaming services like ESPN+, Amazon Prime Video, Apple TV+, Peacock, and DAZN. These services have exclusive or semi-exclusive rights to popular leagues like the NFL, NBA, MLB, NHL, MLS, and various college sports. The shift of premium sports rights from traditional broadcasters to digital platforms is a significant factor in North America's income growth. OTT providers generate revenue through subscription fees, pay-per-view models, targeted advertising, and packaged sports packages.

Sports Online Live Video Streaming Market: Competitive Analysis

The global sports online live video streaming market is dominated by players like

- Hulu + Live TV

- LiveTV

- DAZN US

- FreeStreamsLive

- Stream2watch

- WatchESPN

- Sling TV

- FuboTV

- Philo

- BoxCast

- FloSports

- Webnexs LLC USA

- FanCode

- BoxCast

- LiveBarn Inc

- AT&T TV

The global sports online live video streaming market is segmented as follows:

By Product Type

- Basketball Live Streaming

- Football Live Streaming

- Baseball Live Streaming

- Tennis Live Streaming

- Cricket Live Streaming

- Others

By Application

- TV

- Internet

- Mobile Phone

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed