Biosurfactants Market Size, Share, Trends, & Forecast Report 2032

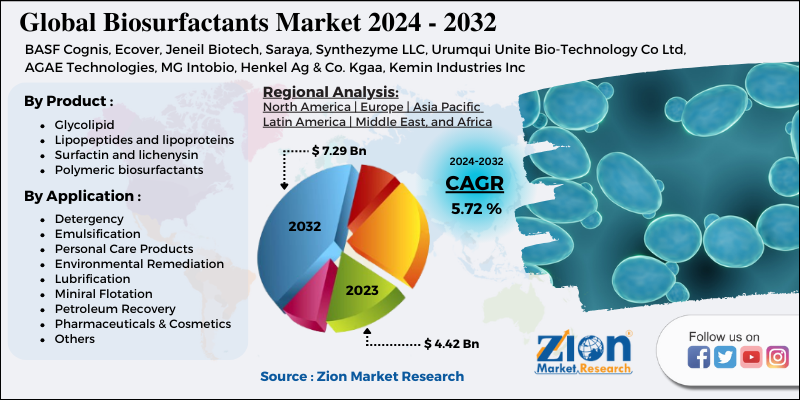

Biosurfactants Market: By Product Type (Glycolipid, Lipopeptides And Lipoproteins, Surfactin And Lichenysin, And Polymeric Biosurfactants), By Application (Detergency, Emulsification, Personal Care Products, Environmental Remediation, Lubrification, Mineral Flotation, Petroleum Recovery, Pharmaceuticals & Cosmetics And Other Applications), and Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032

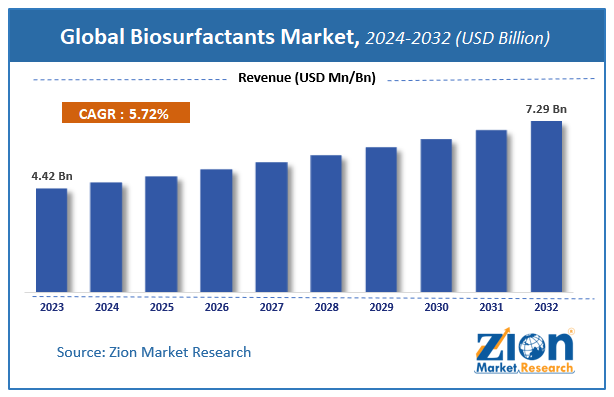

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.42 Billion | USD 7.29 Billion | 5.72% | 2023 |

Biosurfactants Market Size

Zion Market Research has published a report on the global Biosurfactants Market, estimating its value at USD 4.42 Billion in 2023, with projections indicating that it will reach USD 7.29 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5.72% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Biosurfactants Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Biosurfactants Market: Overview

Biosurfactants are also known as microbial surfactants Biosurfactants are amphiphilic compounds. Surface active biomolecules formed by microorganisms with special environmental-friendly properties are referred to as these. Detergents, wetting agents, foaming agents, and emulsifiers are also examples of biosurfactants. Biosurfactants have the ability to replace almost any synthetic surfactant while still adding new physicochemical properties. Biosurfactants are appealing to customers because of their unusual properties such as low toxicity, precision, high biodegradability, antibacterial, antifungal, and antiviral properties. Biosurfactants increase the surface area of hydrophobic water-insoluble substrates, which organisms use for growth, and function effectively in biodegradation, bioremediation, and biocontrol processes.

The bio surfactant industry has a significant growth opportunity, owing to rising environmental considerations, advances in biotechnology, and the advent of more strict regulations, which have made biosurfactants a viable alternative to chemical surfactants on the market.

COVID-19 Impact Analysis

Due to government-imposed lockdowns to prevent the spreading of COVID, the global biosurfactants industry has seen a small decrease in revenues in the short term. Because of the increasing infections and curbs, sales of biosurfactants are likely to suffer across the world. Because of the pandemic, agrochemicals, oilfield chemicals, garment processing facilities, and its shipping have been shut down around the world, potentially reducing biosurfactant use. However, in the midst of the pandemic, there has been a surge in product demand for applications such as domestic detergents, personal care, and industrial cleaners. The growing trend for sanitation in residential and commercial spaces to control the virus epidemic is driving this product market.

The restrictions imposed by various nations to contain COVID had stopped the production resulting in a disruption across the whole supply chain. However, the global markets are slowly opening to their full potential and theirs a surge in demand of auto parts of the vehicles. The market would remain bullish in upcoming year. The significant decrease in the global Biosurfactants market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Biosurfactants Market: Growth Factors

Biosurfactant industry growth is driven and supported by increased customer recognition and demand for bio-based materials, as well as the eco-friendly nature of Biosurfactant. Biosurfactants are expected to see increased demand in a variety of uses, including soaps and detergents, personal care, and industrial cleaning. The need for regulatory reforms as a result of the advesrse effects of synthetic surfactants and preservatives in forcing core operating companies to incorporate revolutionary biosurfactants and natural preservatives obtained from natural sources into personal care products. During the forecast period, factors such as high production, refining, and purification costs may restrict the growth of the global biosurfactants market.

Biosurfactants Market: Segmentation

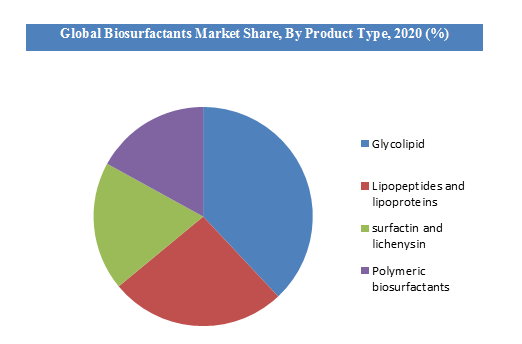

The biosurfactants market can be segmented into categories by product types such as glycolipid (rhamnolipids, trehalolipids, and sophorolipids), lipopeptides and lipoproteins, surfactin and lichenysin, and polymeric biosurfactants. Glycolipid accounted for the largest share of the global biosurfactants market in 2016. This can be attributed to the wide range of applications of glycolipid such as (rhamnolipids, trehalolipids, and sophorolipids). sophorolipids and rhamnolipids sub-segments of glycolipid segment are expected to register remarkable growth within the forecast period owing to their wide range of applications in the household and commercial fields.

Detergency, emulsification, personal care products, environmental remediation, lubrification, mineral flotation, petroleum recovery, pharmaceuticals & cosmetics are the major application segments of the global biosurfactants market. Among applications, detergency and personal care products for the largest market share in 2016, owing to factors such as high efficiency & demand over the chemically synthesized surfactants. Pharmaceuticals & cosmetics segment is expected to witness significant growth during the forecast period due to increasing consumer preference towards bio-based products and rising research and development activities in pharmaceutical & cosmetics industries.

Biosurfactants Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Biosurfactants Market |

| Market Size in 2023 | USD 4.42 Billion |

| Market Forecast in 2032 | USD 7.29 Billion |

| Growth Rate | CAGR of 5.72% |

| Number of Pages | 130 |

| Key Companies Covered | BASF Cognis, Ecover, Jeneil Biotech, Saraya, Synthezyme LLC, Urumqui Unite Bio-Technology Co Ltd, AGAE Technologies, MG Intobio, Henkel Ag & Co. Kgaa, Kemin Industries Inc |

| Segments Covered | By Product Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 - 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Biosurfactants Market: Regional Analysis

Europe accounted for the major share in global biosurfactants market in 2016 and is expected to grow significantly due to supporting the government regulations in the region that promote the adoption of biosurfactants. Moreover, the high awareness regarding what biosurfactants and technological developments in the region are expected to further drive the growth of the North America biosurfactants market within the forecast period. Asia Pacific is expected to witness significant growth owing to the huge population and high pollution rate in the region demand for a sustainable source for pollution control. In addition, the increasing awareness about the eco-friendly products in the region is expected to fuel the market during the forecast period. Factors such as high manufacturing, processing and purifying cost can restrain the growth of global biosurfactants market in the near future.

Biosurfactants Market: Competitive Players

Some of the major players of global Biosurfactants market includes:

- BASF Cognis

- Ecover

- Jeneil Biotech

- Saraya

- Synthezyme LLC

- Urumqui Unite Bio-Technology Co. Ltd.

- AGAE Technologies

- MG Intobio

- Henkel Ag & Co. Kgaa

- Kemin Industries Inc

The global biosurfactants market is segmented as follows:

By Product Type

- Glycolipid

- Rhamnolipids

- Trehalolipids

- Sophorolipids

- Lipopeptides and lipoproteins

- Surfactin and lichenysin

- Polymeric biosurfactants

By Applications

- Detergency

- Emulsification

- Personal Care Products

- Environmental Remediation

- Lubrification

- Miniral Flotation

- Petroleum Recovery

- Pharmaceuticals & Cosmetics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Biosurfactants are surface-active compounds produced by microorganisms like bacteria, fungi, and yeast. They reduce surface and interfacial tension, making them eco-friendly alternatives to synthetic surfactants in industries like cleaning, cosmetics, agriculture, and oil recovery.

According to study, the Biosurfactants Market size was worth around USD 4.42 billion in 2023 and is predicted to grow to around USD 7.29 billion by 2032.

The CAGR value of Biosurfactants Market is expected to be around 5.72% during 2024-2032.

Europe has been leading the Biosurfactants Market and is anticipated to continue on the dominant position in the years to come.

The Biosurfactants Market is led by players like BASF Cognis, Ecover, Jeneil Biotech, Saraya, Synthezyme LLC, Urumqui Unite Bio-Technology Co Ltd, AGAE Technologies, MG Intobio, Henkel Ag & Co. Kgaa, Kemin Industries Inc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed