Biologics CDMO Market Size, Share, Trends, Growth 2034

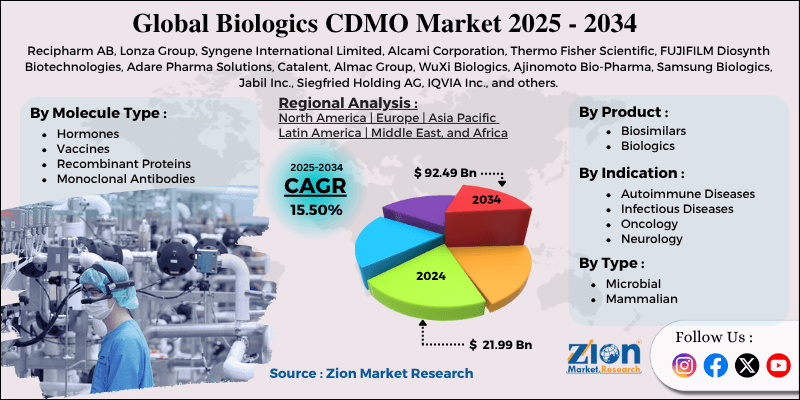

Biologics CDMO Market By Type (Microbial and Mammalian), By Molecule Type (Hormones, Vaccines, Recombinant Proteins, Monoclonal Antibodies, and Others), By Product (Biosimilars and Biologics), By Indication (Auto-Immune Diseases, Infectious Diseases, Oncology, Neurology, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 – 2034-

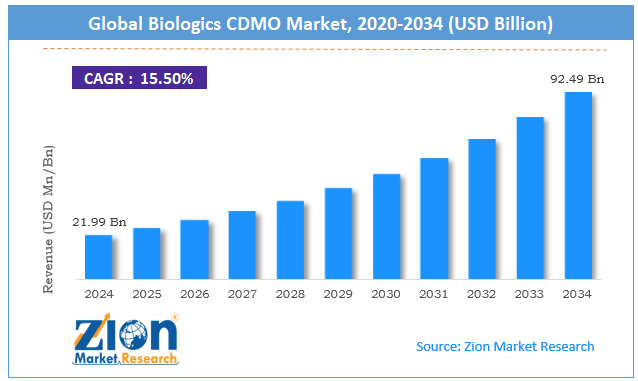

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.99 Billion | USD 92.49 Billion | 15.50% | 2024 |

Biologics CDMO Industry Perspective:

The global biologics CDMO market size was worth around USD 21.99 billion in 2024 and is predicted to grow to around USD 92.49 billion by 2034, with a compound annual growth rate (CAGR) of roughly 15.50% between 2025 and 2034.

Biologics CDMO Market: Overview

A biologics contract development and manufacturing organization (CDMO) is a company that specializes in services related to research & development (R&D) of biologics. Medical products derived from living cells and used for treating several healthcare issues are known as biologics. The demand for CDMO services among pharmaceutical and biotechnology companies has increased in the last few years.

According to market research, contract development and manufacturing organizations ensure multifold benefits for their clients. They are known to reduce research costs, aid improved drug development, and also ensure compliance with regional regulations.

Most biologic CDMOs are equipped with state-of-the-art technologies that aid enhanced drug R&D. During the forecast period, the demand for biologics CDMOs is expected to grow at a steady pace, mainly driven by increasing demand for effective vaccines for infectious diseases. Additionally, growing strategic partnerships and the rising adoption of advanced technological solutions by CDMOs will further help the industry thrive. High cost of services and risk of intellectual property theft to challenging market expansion rate.

Key Insights:

- As per the analysis shared by our research analyst, the global biologics CDMO market is estimated to grow annually at a CAGR of around 15.50% over the forecast period (2025-2034)

- In terms of revenue, the global biologics CDMO market size was valued at around USD 21.99 billion in 2024 and is projected to reach USD 92.49 billion by 2034.

- The biologics CDMO market is projected to grow at a significant rate due to the rising number of CDMO service providers and strategic partnerships.

- Based on the type, the microbial segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the product, the biologics segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Biologics CDMO Market: Growth Drivers

Rising number of CDMO service providers and strategic partnerships to fuel market expansion rate

The global biologics CDMO market is expected to be driven by the increasing number of companies offering CDMO services with novel approaches toward drug research & development.

In June 2024, Bionova Scientific, a full-service biologics CDMO and US subsidiary of Asahi Kasei, announced the launch of a new business segment dealing with plasmid Deoxyribonucleic Acid (DNA). The company will also open a new facility in the US to improve its business performance. Official data suggest that the parent company is currently driven by the 10 Growth Gears (GG10) strategy. Plasmid molecules have shown significant applications in modern medical-based research, such as cell and gene therapies, and in the development of several antibody drugs.

In January 2024, Exo Biologics, a Belgium-based biotechnology company, launched ExoXpert. It is a contract development and manufacturing organization that will provide services specializing in exosomes for treating rare diseases that have not found potential cures in the healthcare industry.

In addition, growing international partnerships, knowledge-sharing projects, and an urgent need to develop more effective drugs and treatments for patients with serious conditions will promote applications of biologics CDMO in the coming years.

Increasing focus on mass-scale production of critical vaccines for infectious diseases will continue to contribute to market revenue

Biologics have proven highly efficient in treating some of the most contagious and fatal infectious diseases worldwide. A recent example is the development of COVID-19 vaccines by medical companies such as Pfizer and others. In addition to this, biologics CDMO companies also provide assistance in the development of vaccines for the Ebola Virus, Anthrax, Tuberculosis, Human Immunodeficiency Virus (HIV), and others.

In October 2024, Naobios, a leading CDMO in bioprocess development and Good Manufacturing Practice (GMP) production of clinical batches of virus-based products, in partnership with Sumagen Canada, announced the production of the HIV-1 vaccine candidate at bench scale. Such advancements are expected to contribute to the revenue in the global biologics CDMO market during the forecast period.

Biologics CDMO Market: Restraints

High cost of services acts as a major growth barrier for the industry players

The global biologics CDMO industry is projected to be restricted by the high cost of services in the market. Contract development and manufacturing organizations are highly specialized service providers working with some of the world’s finest technologies to develop new treatments.

In addition, CDMOs also work with the most skilled employees, which further increases the overall cost of services. Furthermore, the extreme sensitivity of the raw materials used in biological production created a demand for the use of state-of-the-art and approved equipment, affecting the final charges of the overall project.

Biologics CDMO Market: Opportunities

Growing advancements in cancer research, backed by CDMOs, to generate growth opportunities

The global biologics CDMO market is expected to generate growth opportunities due to the rising advancements in cancer research worldwide. Cell and gene therapy (CGT) has emerged as a breakthrough treatment for cancer care in recent times. Regional regulatory bodies such as the US Food & Drug Administration (FDA) and others have several new CGTs that are expected to reduce the growing number of cancer-related deaths across the globe.

For instance, in August 2024, the FDA announced the approval of Tecelra (afamitresgene autoleucel). It is a gene therapy for treating adults with unresectable or metastatic synovial sarcoma. The patients must have received prior chemotherapy and be HLA antigen(s) A*02:01P, -A*02:02P, -A*02:03P, or -A*02:06P positive to undergo the treatment using the novel therapy.

In March 2025, Ori Biotech Ltd. announced the launch of a Preferred Partner Network (PPN) promoting collaboration between leading CDMOs and academic medical centers (AMCs) for making revolutionary advancements in cell and gene therapy manufacturing. Growing government support across countries to facilitate faster cancer research, the development of early cancer detection tools, and treatment procedures will fuel strategic collaborations between CDMOs and pharmaceutical companies in the coming years.

Biologics CDMO Market: Challenges

Risk of intellectual property (IP) theft is a major challenge for industry players

The global biologics CDMO industry is projected to be challenged by the risks associated with IP theft. Digitally stored sensitive information related to R&D may get compromised in case of a cyber-attack. Additionally, the risk of gaining detailed information about a client’s techniques and technologies can also impact the overall market revenue during the forecast period.

Biologics CDMO Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Biologics CDMO Market |

| Market Size in 2024 | USD 21.99 Billion |

| Market Forecast in 2034 | USD 92.49 Billion |

| Growth Rate | CAGR of 15.50% |

| Number of Pages | 214 |

| Key Companies Covered | Recipharm AB, Lonza Group, Syngene International Limited, Alcami Corporation, Thermo Fisher Scientific, FUJIFILM Diosynth Biotechnologies, Adare Pharma Solutions, Catalent, Almac Group, WuXi Biologics, Ajinomoto Bio-Pharma, Samsung Biologics, Jabil Inc., Siegfried Holding AG, IQVIA Inc., and others. |

| Segments Covered | By Type, By Molecule Type, By Product, By Indication, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Biologics CDMO Market: Segmentation

The global biologics CDMO market is segmented based on type, molecule type, product, indication, and region.

Based on the type, the global market segments are microbial and mammalian. In 2024, the highest growth rate was listed in the microbial segment. It deals with the production and development of biological drugs using yeast or bacteria, also known as microbial expression systems. CDMOs are essential throughout the process involving novel drug research and innovation, starting from strain development until final production and knowledge transfer. CDMOs handle clinical development and production for 3 to 8 years, depending on the overall complexities of the procedures.

Based on molecule type, the global biologics CDMO industry is divided into hormones, vaccines, recombinant proteins, monoclonal antibodies, and others.

Based on the product, the global market segments are biosimilars and biologics. In 2024, around 61.5% of the segment was led by biologics. Increased demand for biologics-based treatment for several conditions, such as diabetes, cancer, and autoimmune diseases, is fueling the segmental revenue. Furthermore, increasing focus on personalized care and targeted therapy may also work in the segment’s favor during the forecast period.

Based on indication, the global market divisions are auto-immune diseases, infectious diseases, oncology, neurology, and others.

Biologics CDMO Market: Regional Analysis

North America to dominate the industry during the forecast period

The global biologics CDMO market will be led by North America during the forecast period. In 2024, the region accounted for nearly 34.5% of the global revenue, with the US and Canada acting as major revenue generators.

In January 2025, Tanvex BioPharma, Inc., a leading CDMO company for biologics and biosimilars, announced the acquisition of Bora Biologics Co., Ltd. This move has allowed Tanvex to merge its commercialization plants at the company’s FDA-licensed commercial-scale facility and expertise in biosimilar development with the global early-stage biologics CDMO capabilities of Bora in Taiwan.

Asia-Pacific is another prominent market with growing demand for biologics CDMOs across major regions. In October 2024, the South Korea-based company Samsung Biologics launched S-HiCon. It is a high-concentration formulation platform facilitating the development and production of high-dose biopharmaceuticals. A growing number of patients across Asian countries and increased demand for vaccines targeting critical infectious diseases will promote regional market expansion.

In October 2024, Samsung Biologics signed the world’s largest contract with an Asia-based pharmaceutical company, signed by a single client worth USD 1.24 billion. The contract is expected to last until December 2037, with drug production taking place at Samsung’s facility in Songdo, South Korea.

Biologics CDMO Market: Competitive Analysis

The global biologics CDMO market is led by players like:

- Recipharm AB

- Lonza Group

- Syngene International Limited

- Alcami Corporation

- Thermo Fisher Scientific

- FUJIFILM Diosynth Biotechnologies

- Adare Pharma Solutions

- Catalent

- Almac Group

- WuXi Biologics

- Ajinomoto Bio-Pharma

- Samsung Biologics

- Jabil Inc.

- Siegfried Holding AG

- IQVIA Inc.

The global biologics CDMO market is segmented as follows:

By Type

- Microbial

- Mammalian

By Molecule Type

- Hormones

- Vaccines

- Recombinant Proteins

- Monoclonal Antibodies

- Others

By Product

- Biosimilars

- Biologics

By Indication

- Autoimmune Diseases

- Infectious Diseases

- Oncology

- Neurology

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A biologics contract development and manufacturing organization (CDMO) is a company that specializes in services related to research & development (R&D) of biologics.

The global biologics CDMO market is expected to be driven by the increasing number of companies offering CDMO services with novel approaches toward drug research & development.

According to study, the global biologics CDMO market size was worth around USD 21.99 billion in 2024 and is predicted to grow to around USD 92.49 billion by 2034.

The CAGR value of the biologics CDMO market is expected to be around 15.50% during 2025-2034.

The global biologics CDMO market will be led by North America during the forecast period.

The global biologics CDMO market is led by players like Recipharm AB, Lonza Group, Syngene International Limited, Alcami Corporation, Thermo Fisher Scientific, FUJIFILM Diosynth Biotechnologies, Adare Pharma Solutions, Catalent, Almac Group, WuXi Biologics, Ajinomoto Bio-Pharma, Samsung Biologics, Jabil Inc., Siegfried Holding AG, and IQVIA Inc.

The report explores crucial aspects of the biologics CDMO market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed