Beauty Supplements Market Trend, Share, Growth, Size, Analysis and Forecast 2032

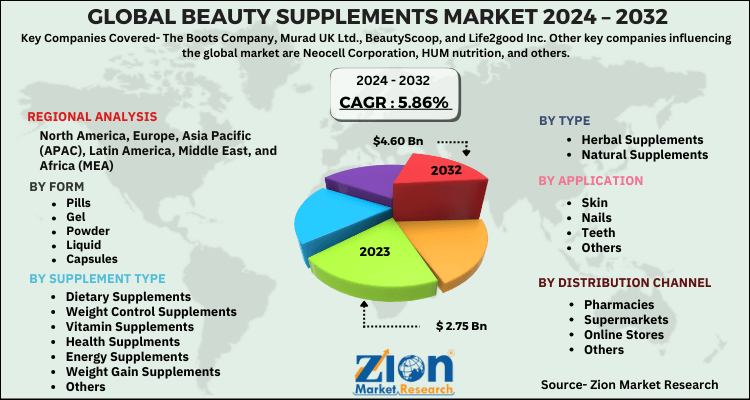

Beauty Supplements Market By Form (Pills, Gel, Powder, Liquid and Capsules), Type (Herbal Supplements and Natural Supplements), By Application (Skin, Nails,teeth and Others), By Supplement Types (Dietary, weight Control, Vitamin, Health, Energy, Weight Gain and Others) By Distribution Channel (Pharmacies, Supermarket, Online Stores, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

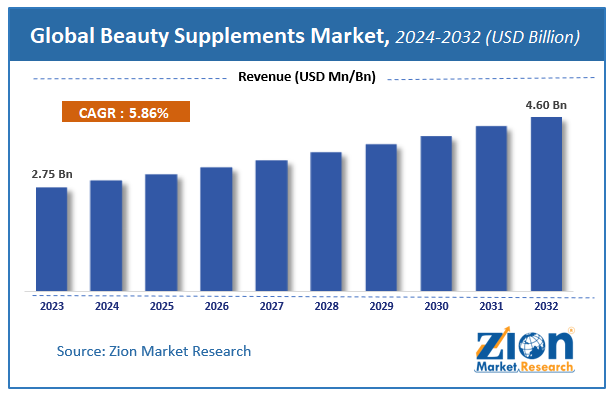

| USD 2.75 Billion | USD 4.60 Billion | 5.86% | 2023 |

Beauty Supplements Market Insights

According to Zion Market Research, the global Beauty Supplements Market was worth USD 2.75 Billion in 2023. The market is forecast to reach USD 4.60 Billion by 2032, growing at a compound annual growth rate (CAGR) of 5.86% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Beauty Supplements Market industry over the next decade.

Beauty Supplements Market: Overview

Supplements are medicines that are used to help the human body strengthen, stimulate, and sustain some sort of deficiency. Supplements are commonly sold to customers in the form of tablets, capsules, soft gels, powders, and liquids. Herbal supplements and natural supplements are two types of supplements that can be classified. Moreover, Due to factors such as growing concerns about skin and appearance, as well as strong purchasing capacity, the beauty supplements industry has seen substantial growth.

Key manufacturers in the region are focusing on various strategies such as new product launches and expansion along with mergers and acquisitions. For instance, in April 2020, Unilever expanded its geographical presence to Canada by the launch of its new beauty supplement “Olly”. Likewise, in March 2020, Melbourne-based Australian health, wellness, and natural skincare company launched its natural skincare brand “Swisse” in Indian Market. With the help of this expansion, the company aims to increase its customer base in the Indian market.

COVID-19 Impact Analysis

The beauty and skin care products industry showed positive growth during the COVID period owing to rising health & hygiene awareness among consumers. The skin-care, hair-care, and bath-and-body products sales increased during the pandemic period. Due to the closure of spa and beauty parlors during the lockdown women across the globe are forced to follow all the beauty routines at home thereby, contributing to the growth of the market. In addition, to increase their immunity consumers globally are consuming vitamin-rich supplements, which further is expected to increase the demand for the market during the pandemic period.

Growth Factors

The global beauty supplements industry has grown rapidly in recent years as people's worries about their skin and appearance have combined with their increased purchasing power. Furthermore, the use of beauty supplements for both females and males has had a positive effect on the global beauty supplements industry.

Beauty Supplements Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Beauty Supplements Market |

| Market Size in 2023 | USD 2.75 Billion |

| Market Forecast in 2032 | USD 4.60 Billion |

| Growth Rate | CAGR of 5.86% |

| Number of Pages | 150 |

| Key Companies Covered | The Boots Company, Murad UK Ltd., BeautyScoop, and Life2good Inc. Other key companies influencing the global market are Neocell Corporation, HUM nutrition, and others |

| Segments Covered | By Form, By Type, By Application, By Supplement Type, By Distribution Channel and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

To know more about this report, Request For Customization.

Supplement Type Segment Analysis Preview

On the basis of Supplement type, the market is classified into Dietary Supplements, Weight Control Supplements, Vitamin Supplements, Health supplements, Energy Supplements, Weight Gain Supplements, and Others. Weight control supplements are expected to grow at a significant rate during the forecast period owing to the rising obesity rate globally. For instance, the Centers for Disease Control and Prevention suggested that the prevalence of obesity was 42.4% in the year 2024-2032. Thereby, contributing to the growth of the market.

Application Segment Analysis Preview

On the basis of application, the market is classified into skin, nails, teeth, and others. The skin segment is expected to dominate the overall beauty supplement market over the forecast period due to increasing skin diseases globally. For instance, the Global Burden of Disease project suggests that skin diseases are the 4th leading cause of nonfatal disease burden worldwide. The aforementioned reasons are some of the key factors contributing to the growth of the market.

Distribution Channel Segment Analysis Preview

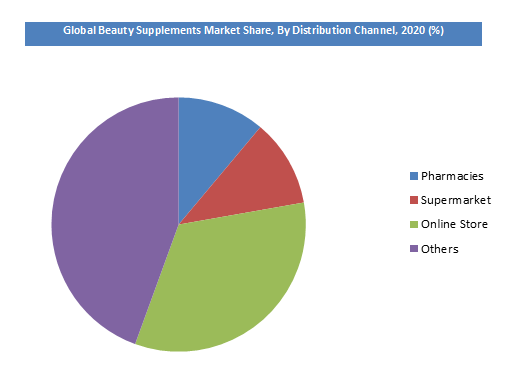

On the basis of distribution channels, the overall beauty supplements market is divided into supermarkets, pharmacies, online stores, and others. The online store segment is expected to hold a significant share over the forecast period as online channels provide ease to customers along with attractive discounts and offers. It is estimated that the Online sales of minerals, vitamins, and supplements surged by 20%, growing from $2 billion in 2016 to $2.4 billion in 2017. Hence, contributing to the growth of the market.

Regional Analysis Preview

In the near future, Europe is forecast to have the largest market share and to lead the global beauty supplement market. The global beauty supplements market is mostly concentrated in Western Europe, and it is projected to grow as people's worries about their looks and outward appearance grow, as well as consumers' high disposable income.

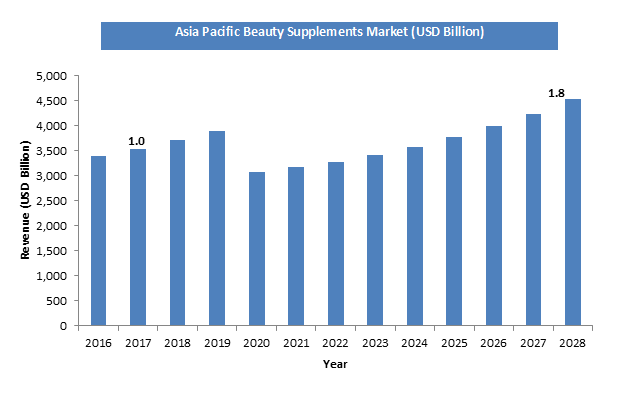

The growth of the region is also supported by factors such as increasing concerns of people towards their appearance, the influence of people with their peer group Furthermore, the presence of people in their peer community, neighbors, families, magazines, celebrity endorsement, and increasing disposable income are expected to drive the growth of the beauty supplements industry in North America and the Asia Pacific in the future. Japan is expected to be the largest sales producer in Asia Pacific, led by China.

Key Market Players & Competitive Landscape

Some of the major players dominating the global beauty supplements market are -

- The Boots Company

- Murad UK Ltd.

- BeautyScoop

- Life2good Inc.

- Neocell Corporation

- HUM nutrition

- others.

The global Beauty Supplements Market is segmented as follows:

By Form

- Pills

- Gel

- Powder

- Liquid

- Capsules

By Type

- Herbal Supplements

- Natural Supplements

By Application

- Skin

- Nails

- Teeth

- Others

By Supplement Type

- Dietary Supplements

- Weight Control Supplements

- Vitamin Supplements

- Health Supplments

- Energy Supplements

- Weight Gain Supplements

- Others

By Distribution Channel

- Pharmacies

- Supermarkets

- Online Stores

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

List of Contents

Market InsightsOverviewCOVID-19 Impact AnalysisGrowth FactorsReport ScopeTo know more about this report, Request For Customization.Supplement Type Segment Analysis PreviewApplication Segment Analysis PreviewDistribution Channel Segment Analysis PreviewRegional Analysis PreviewKey Market Players Competitive LandscapeRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed