Global Dietary Supplements Market Size, Share, Growth Analysis Report - Forecast 2034

Dietary Supplements Market By Product Type (Vitamins, Minerals, Proteins, Amino Acids, Enzymes, Probiotics, Others), By Form (Tablets, Capsules, Powder, Liquids, Gummies, Soft Gels), By Function (Energy & Weight Management, Bone & Joint Health, Immunity, Cardiac Health, Digestive Health, Others), By End-user (Adults, Children, Elderly, Pregnant Women), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies, Online, Specialty Stores), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

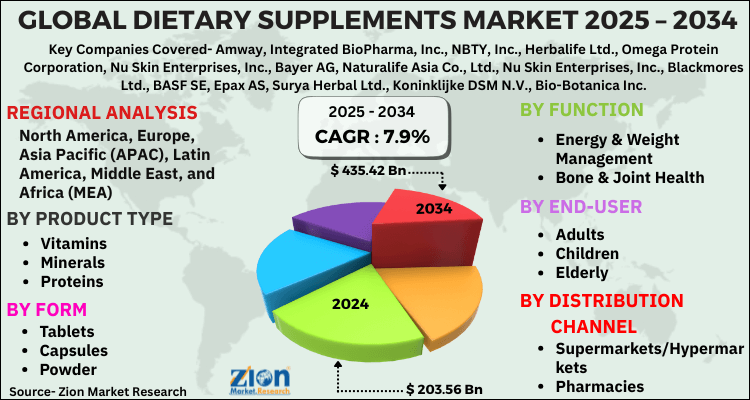

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 203.56 Billion | USD 435.42 Billion | 7.9% | 2024 |

Dietary Supplements Market: Industry Perspective

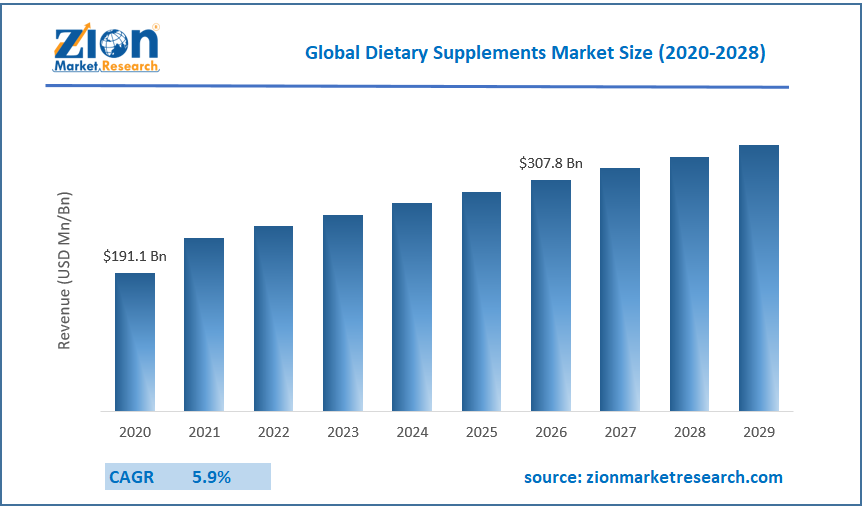

The global dietary supplements market size was worth around USD 203.56 Billion in 2024 and is predicted to grow to around USD 435.42 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.9% between 2025 and 2034.

The report analyzes the global dietary supplements market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the dietary supplements industry.

Dietary Supplements Market: Overview

Rising consumer awareness regarding personal health and well-being is predicted to be a key factor driving the marketplace for dietary supplements over the forecast period. The working population around the globe is struggling to satisfy the daily nutrient requirements due to hectic work schedules and changing lifestyles. This is often increasing their dependency on dietary supplements to satisfy their nutrient requirements due to their high convenience, which, in turn, is forecast to push the market over the forecast period. The US emerged as the number one market within the North American region in 2020 due to the upper expenditure capacity of the consumers.

Increasing spending on healthcare products, the increasing geriatric population, and growing interest in preventive healthcare and attaining wellness through diet are predictable to reinforce the market growth over the forecast period. A swelling number of health clubs, fitness centers, and gymnasiums, including the growing awareness about fitness among youngsters, is predicted to extend the demand for energy and weight management. Increasing acceptance of sports as a career is predicted to extend the demand for sports nutrition, which, in turn, benefits market growth. R&D is the key success factor for dietary supplements, which require significant investments. Moreover, stringent regulations regarding the health benefits claim and labeling of the products are expected to make challenges for the market over the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global dietary supplements market is estimated to grow annually at a CAGR of around 7.9% over the forecast period (2025-2034).

- Regarding revenue, the global dietary supplements market size was valued at around USD 203.56 Billion in 2024 and is projected to reach USD 435.42 Billion by 2034.

- The dietary supplements market is projected to grow at a significant rate due to rising health awareness, aging population, increasing focus on preventive healthcare, and growth in fitness and wellness trends.

- Based on Product Type, the Vitamins segment is expected to lead the global market.

- On the basis of Form, the Tablets segment is growing at a high rate and will continue to dominate the global market.

- Based on the Function, the Energy & Weight Management segment is projected to swipe the largest market share.

- By End-user, the Adults segment is expected to dominate the global market.

- In terms of Distribution Channel, the Supermarkets/Hypermarkets segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Dietary Supplements Market: Growth Factors

The market is increasingly driven by rising health awareness, shifting consumer preferences, a growing geriatric population, and the adoption of a healthy diet. The convergence of major industry trends is giving rise to new opportunities for key players within the industry. Dietary habits and changing lifestyles are one of the main factors escalating the demand for dietary supplements. The growing positive outlook toward sports nutrition would also positively impact the market.

Dietary Supplements Market: Segmentation Analysis

The global dietary supplements market is segmented based on Product Type, Form, Function, End-user, Distribution Channel, and region.

Based on Product Type, the global dietary supplements market is divided into Vitamins, Minerals, Proteins, Amino Acids, Enzymes, Probiotics, Others.

On the basis of Form, the global dietary supplements market is bifurcated into Tablets, Capsules, Powder, Liquids, Gummies, Soft Gels.

By Function, the global dietary supplements market is split into Energy & Weight Management, Bone & Joint Health, Immunity, Cardiac Health, Digestive Health, Others.

In terms of End-user, the global dietary supplements market is categorized into Adults, Children, Elderly, Pregnant Women.

By Distribution Channel, the global Dietary Supplements market is divided into Supermarkets/Hypermarkets, Pharmacies, Online, Specialty Stores.

Dietary Supplements Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dietary Supplements Market |

| Market Size in 2024 | USD 203.56 Billion |

| Market Forecast in 2034 | USD 435.42 Billion |

| Growth Rate | CAGR of 7.9% |

| Number of Pages | PagesNO |

| Key Companies Covered | Amway, Integrated BioPharma, Inc., NBTY, Inc., Herbalife Ltd., Omega Protein Corporation, Nu Skin Enterprises, Inc., Bayer AG, Naturalife Asia Co., Ltd., Nu Skin Enterprises, Inc., Blackmores Ltd., BASF SE, Epax AS, Surya Herbal Ltd., Koninklijke DSM N.V., Bio-Botanica Inc., The Himalaya Drug Company, Ricola AG, Pharmavite LLC, Blackmores Ltd., and Axellus AS., and others. |

| Segments Covered | By Product Type, By Form, By Function, By End-user, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dietary Supplements Market: Regional Analysis

Globally, Asia Pacific has been leading the worldwide dietary supplements market and is anticipated to continue in the dominant position within the years to return, states the dietary supplements market study. Large-scale product availability and growing awareness among purchasers about the advantages of its consumption is the main factor behind the dominance of the Asia Pacific dietary supplements market. For the record, APAC contributed over 31% of the dietary supplements market share in terms of volume in 2016.

Dietary Supplements Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the dietary supplements market on a global and regional basis.

The global dietary supplements market is dominated by players like:

- Amway

- Integrated BioPharma Inc.

- NBTY Inc.

- Herbalife Ltd.

- Omega Protein Corporation

- Nu Skin Enterprises Inc.

- Bayer AG

- Naturalife Asia Co. Ltd.

- Nu Skin Enterprises Inc.

- Blackmores Ltd.

- BASF SE

- Epax AS

- Surya Herbal Ltd.

- Koninklijke DSM N.V.

- Bio-Botanica Inc.

- The Himalaya Drug Company

- Ricola AG

- Pharmavite LLC

- Blackmores Ltd.

- and Axellus AS.

The global dietary supplements market is segmented as follows;

By Product Type

- Vitamins

- Minerals

- Proteins

- Amino Acids

- Enzymes

- Probiotics

- Others

By Form

- Tablets

- Capsules

- Powder

- Liquids

- Gummies

- Soft Gels

By Function

- Energy & Weight Management

- Bone & Joint Health

- Immunity

- Cardiac Health

- Digestive Health

- Others

By End-user

- Adults

- Children

- Elderly

- Pregnant Women

By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies

- Online

- Specialty Stores

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The Global dietary supplements market is expected to grow due to rising health awareness, aging population, increasing focus on preventive healthcare, and growth in fitness and wellness trends.

According to a study, the Global dietary supplements market size was worth around USD 203.56 Billion in 2024 and is expected to reach USD 435.42 Billion by 2034.

The Global dietary supplements market is expected to grow at a CAGR of 7.9% during the forecast period.

North America is expected to dominate the dietary supplements market over the forecast period.

Leading players in the Global dietary supplements market include Amway, Integrated BioPharma, Inc., NBTY, Inc., Herbalife Ltd., Omega Protein Corporation, Nu Skin Enterprises, Inc., Bayer AG, Naturalife Asia Co., Ltd., Nu Skin Enterprises, Inc., Blackmores Ltd., BASF SE, Epax AS, Surya Herbal Ltd., Koninklijke DSM N.V., Bio-Botanica Inc., The Himalaya Drug Company, Ricola AG, Pharmavite LLC, Blackmores Ltd., and Axellus AS., among others.

The report explores crucial aspects of the dietary supplements market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed