Global Aviation Test Equipment Market Size, Share, Growth Analysis Report - Forecast 2034

Aviation Test Equipment Market By Product (Electrical Aviation Test Equipment and Hydraulic Aviation Test Equipment), By End-User (Commercial and Defense), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

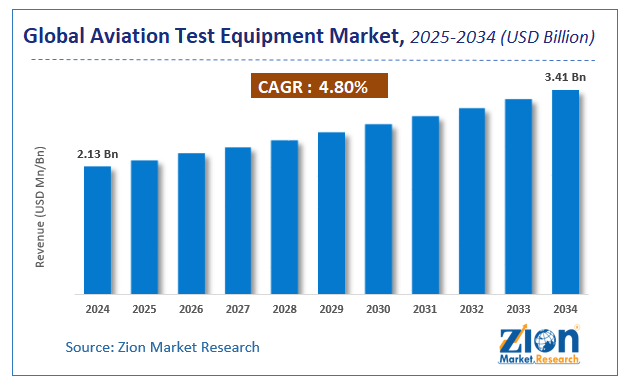

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.13 Billion | USD 3.41 Billion | 4.8% | 2024 |

Aviation Test Equipment Market Size

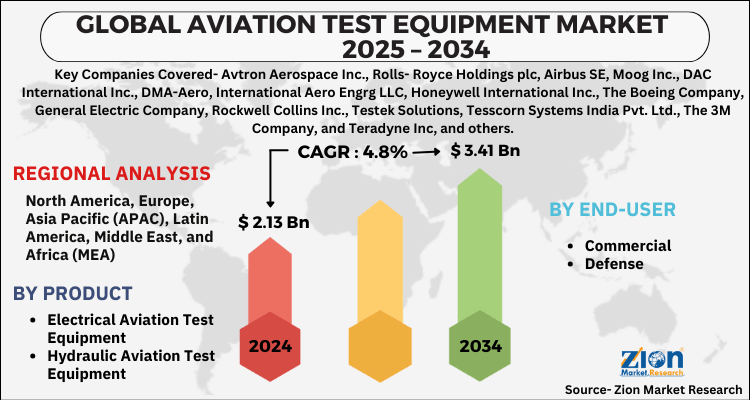

The global aviation test equipment market size was worth around USD 2.13 Billion in 2024 and is predicted to grow to around USD 3.41 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.8% between 2025 and 2034.

The report analyzes the global aviation test equipment market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the aviation test equipment industry.

Aviation test equipment are used in the aviation industry to maintain and upgrade the pneumatic, electrical power systems and hydraulic systems. They are used for testing aircraft, artificial satellites, and spacecraft. Aviation is the practical aspect or art of aeronautics, design, development, production, operation and use of aircraft, particularly heavier than air aircraft. Aviation test equipment manufacturer has been developing innovative test technology to support the needs of commercial and military aircraft manufacturers, component OEMs, and MRO facilities worldwide.

Growth in worldwide aerospace and defense industry and rising R&D activities of aviation test equipment are expected to be the major drivers for the global aviation test equipment market. Rising demand from commercial aerospace and increasing use of software adaptable solution is expected to support the aviation test equipment market growth in the near future. In addition, increasing trends towards software-adaptable solutions, multi-use test systems for multiple weapons platform and overall technological advancement is also expected boost the demand for the aviation test equipment. However, long-term investment funding may curb the demand for aviation test equipment within the forecast period. Nonetheless, the greening of aerospace and defense products are expected open new avenues for the market growth over the next few years.

Key Insights

- As per the analysis shared by our research analyst, the global aviation test equipment market is estimated to grow annually at a CAGR of around 4.8% over the forecast period (2025-2034).

- Regarding revenue, the global aviation test equipment market size was valued at around USD 2.13 Billion in 2024 and is projected to reach USD 3.41 Billion by 2034.

- The aviation test equipment market is projected to grow at a significant rate due to rising demand for advanced avionics systems, increasing aircraft production, stringent safety regulations, and growing investments in military and commercial aviation testing technologies.

- Based on Product, the Electrical Aviation Test Equipment segment is expected to lead the global market.

- On the basis of End-User, the Commercial segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Aviation Test Equipment Market: Outlook

Aviation test equipment is utilized for calibration, evaluation, and inspection as well as testing of aircraft components. Reportedly, it refers to myriad kinds of devices utilized in the maintenance of hydraulic tools & electrical power in an aircraft. Moreover, the aim of these instruments is to inspect & resolve electrical as well as mechanical issues along with carrying out performance checks. The equipment also detects whether brakes or other components of aircraft need repairs or not. It aims at determining component failures in aircraft, enhancing the reliability & safety of aircraft parts, minimizing life-cycle cost, and improving testability. For the record, vacuum & pressure instrument chambers, single-axis rate tables, manual turn & tilt tables, and tachometer testers are a few of the common aviation test devices.

In addition to this, a few of the key functions of the product are effective reporting management and monitoring & memorizing test results. Apart from this, aviation test equipment performs routine maintenance of aircraft along with diagnosing its electrical & mechanical problems. It also inspects the work of the process of aircraft operations for maintaining the standard of its performance. Testing equipment for the aviation industry includes radar test sets, communication test sets, traffic collision avoidance systems, GPS satellite simulators, air data test sets, battery testers, tactical air navigation system testers, engine test sets, altimeter test sets, transponder test sets, and pilot static adapters.

Aviation Test Equipment Market: Growth Dynamics

An increase in the defense budget and high fund allocation by the government on research & development activities pertaining to aviation test equipment will embellish market trends. In addition to this, large-scale use of products in defense aircraft will open new growth dimensions for the aviation test equipment industry. Furthermore, the rise in disposable income and spending power of individuals has resulted in the thriving of the tourism sector, thereby paving way for the expansion of the aviation test equipment industry. Additionally, low aircraft fares have increased the preference for airplanes as a mode of travel, thereby providing impetus to the expansion of the aviation test equipment market.

Moreover, the rise in aerospace activity has culminated in expediting demand for aviation test equipment globally. A prominent increase in the use of unmanned aircraft and UAVs in the defense sector has translated into humungous demand for the production & sale of the aviation test equipment industry.

Aviation Test Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aviation Test Equipment Market |

| Market Size in 2024 | USD 2.13 Billion |

| Market Forecast in 2034 | USD 3.41 Billion |

| Growth Rate | CAGR of 4.8% |

| Number of Pages | 188 |

| Key Companies Covered | Avtron Aerospace Inc., Rolls- Royce Holdings plc, Airbus SE, Moog Inc., DAC International Inc., DMA-Aero, International Aero Engrg LLC, Honeywell International Inc., The Boeing Company, General Electric Company, Rockwell Collins Inc., Testek Solutions, Tesscorn Systems India Pvt. Ltd., The 3M Company, and Teradyne Inc, and others. |

| Segments Covered | By Product, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aviation Test Equipment Market: Regional Analysis

Europe To Make Notable Contributions Towards Regional Market Size By 2034

The rapid expansion of the aviation test equipment industry in Europe over the forecasting period can be credited to its advanced technological capability in aerospace activities. In addition to this, major innovations & expertise of western countries in the aviation sector will prompt a regional market surge. Additionally, the presence of giant manufacturers in the continent will also contribute sizably to the growth of the aviation test equipment market in Europe.

Aviation Test Equipment Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the aviation test equipment market on a global and regional basis.

The global aviation test equipment market is dominated by players like:

- Avtron Aerospace Inc.

- Rolls- Royce Holdings plc

- Airbus SE

- Moog Inc.

- DAC International Inc.

- DMA-Aero

- International Aero Engrg LLC

- Honeywell International Inc.

- The Boeing Company

- General Electric Company

- Rockwell Collins Inc.

- Testek Solutions

- Tesscorn Systems India Pvt. Ltd.

- The 3M Company

- and Teradyne Inc

The global aviation test equipment market is segmented as follows;

By Product

- Electrical Aviation Test Equipment

- Hydraulic Aviation Test Equipment

By End-User

- Commercial

- Defense

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global aviation test equipment market is expected to grow due to increasing air traffic, stringent safety regulations, and the growing complexity of modern aircraft systems requiring advanced testing and maintenance solutions.

According to a study, the global aviation test equipment market size was worth around USD 2.13 Billion in 2024 and is expected to reach USD 3.41 Billion by 2034.

The global aviation test equipment market is expected to grow at a CAGR of 4.8% during the forecast period.

North America is expected to dominate the aviation test equipment market over the forecast period.

Leading players in the global aviation test equipment market include Avtron Aerospace Inc., Rolls- Royce Holdings plc, Airbus SE, Moog Inc., DAC International Inc., DMA-Aero, International Aero Engrg LLC, Honeywell International Inc., The Boeing Company, General Electric Company, Rockwell Collins Inc., Testek Solutions, Tesscorn Systems India Pvt. Ltd., The 3M Company, and Teradyne Inc, among others.

The report explores crucial aspects of the aviation test equipment market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed