Autonomous Mobile Robot Market Size, Share, Trends, Growth 2034

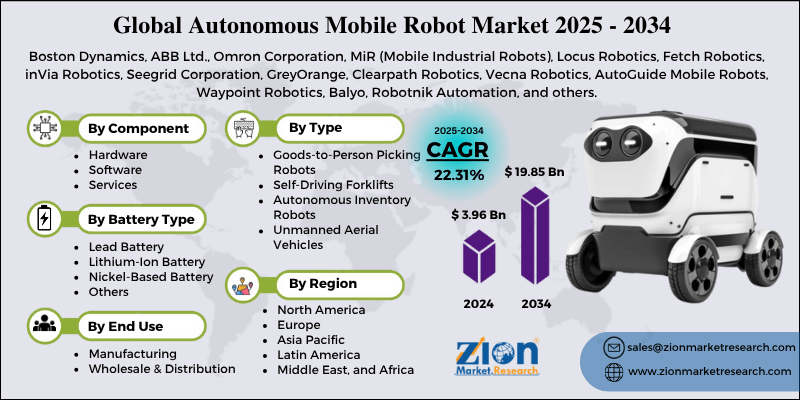

Autonomous Mobile Robot Market By Type (Goods-to-Person Picking Robots, Self-Driving Forklifts, Autonomous Inventory Robots, Unmanned Aerial Vehicles), By Component (Hardware, Software, Services), By Battery Type (Lead Battery, Lithium-Ion Battery, Nickel-Based Battery, and Others), By End-Use (Manufacturing, Wholesale & Distribution), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

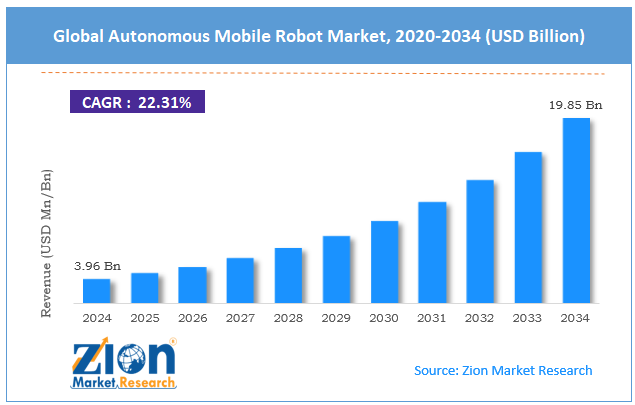

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.96 Billion | USD 19.85 Billion | 22.31% | 2024 |

Autonomous Mobile Robot Industry Perspective:

The global autonomous mobile robot market size was approximately USD 3.96 billion in 2024 and is projected to reach around USD 19.85 billion by 2034, with a compound annual growth rate (CAGR) of roughly 22.31% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global autonomous mobile robot market is estimated to grow annually at a CAGR of around 22.31% over the forecast period (2025-2034)

- In terms of revenue, the global autonomous mobile robot market size was valued at around USD 3.96 billion in 2024 and is projected to reach USD 19.85 billion by 2034.

- The autonomous mobile robot market is projected to grow significantly due to the rise of the logistics and e-commerce sectors, improvements in machine learning, AI, and robotics, and surging adoption in the retail and healthcare industries.

- Based on type, the goods-to-person picking robots segment is expected to lead the market, while the self-driving forklifts segment is expected to grow considerably.

- Based on the component, the hardware segment is the dominant segment, while the software segment is projected to witness sizable revenue growth over the forecast period.

- Based on battery type, the lithium-ion battery segment is expected to lead the market, surpassing the lead battery segment.

- Based on end-use, the manufacturing segment leads the market, while the wholesale & distribution segment is expected to grow considerably.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Autonomous Mobile Robot Market: Overview

Autonomous mobile robots are advanced robotic systems equipped with sensors, artificial intelligence, and cameras that enable navigation and operations to be performed independently without human assistance. They are designed to move materials, assist in logistics and manufacturing environments, and perform inspections with efficiency and precision. The global autonomous mobile robot market is projected to witness substantial growth, driven by rising labor costs and labor scarcity, as well as the integration of IoT and Industry 4.0, and advancements in sensor and AI technologies. Many regions, particularly in developed economies, are experiencing workforce shortages in the warehousing and manufacturing sectors. AMRs help fill this gap by performing strenuous and repetitive tasks, improving productivity. Growing employee turnover rates and rising wages further incentivize the adoption of automation.

Moreover, the integration of IoT and Industry 4.0 enables AMRs to communicate seamlessly with factory systems, digital twins, and machinery. This connectivity improves predictive maintenance, real-time optimization, and operational transparency. The growth of smart factories has become a significant catalyst for the development of autonomous mobile robots. Furthermore, improvements in computer vision, SLAM, and LiDAR allow AMRs to navigate dynamic environments with high precision. These solutions help mitigate risks and enhance autonomous decision-making, expanding AMR applications beyond controlled domains.

Although drivers exist, the global market is challenged by factors such as complex integration with legacy systems and safety and compliance issues. Integrating AMRs into manufacturing setups or existing warehouse management systems can be challenging. Several facilities utilize outdated layouts and software, requiring costly customization. Compatibility issues frequently result in inefficiencies and delays during the deployment process. Likewise, autonomous mobile robots should meet strict safety standards, such as ISO 3691-4, to operate alongside humans. Assuring a reliable fail-safe mechanism and obstacle detection is technically demanding. Any malfunction can cause workspace mishaps, impacting brand trust and regulatory compliance.

Even so, the global autonomous mobile robot industry is well-positioned due to the growth in the hospitality and retail sectors, as well as the integration with cloud robotics platforms. AMRs are actively deployed for in-store delivery, customer service, and shelf scanning in the hospitality and retail sectors. As service robotics gains traction, these industries offer lucrative prospects for non-industrial AMR applications. Additionally, cloud-based platforms improve AMR fleet management, remote monitoring, and data analytics. Vendors are offering AI-driven optimization tools that allow more innovative path planning, performance benchmarking, and predictive maintenance.

Autonomous Mobile Robot Market Dynamics

Growth Drivers

How is the autonomous mobile robot market fueled by the growing adoption in the hospitality and healthcare sectors?

Beyond logistics and manufacturing, AMRs are finding extensive applications in the hospitality and healthcare sectors. The worldwide healthcare robotics industry experienced a 21% rise in AMR adoption in 2024, as hospitals increasingly deploy robots for material transport, medication delivery, and disinfection.

In 2025, Singapore's Changi General Hospital introduced AMRs to automate meal distribution, reducing human contact and the risk of infection. Similarly, airports and hotels are adopting AMRs for cleaning, guest service, and luggage handling to enhance hygiene and efficacy. This sectoral diversification is expanding the reach of the AMR market, ensuring demand stability across economic cycles.

How are smart manufacturing initiatives and the expansion of Industry 4.0 fueling the autonomous mobile robot market?

The rising focus on digital transformation and Industry 4.0 is a strong catalyst for the growth of the autonomous mobile robot market. AMRs are crucial for creating reconfigurable, flexible production systems that respond quickly to changes in demand. Recent deployments in Foxconn's and BMW's smart factories are progressing, and AMRs will continue to be crucial to enhancing operational agility, minimizing downtime, and achieving end-to-end automation.

Restraints

Limited operational scope and payload capacity negatively impact the market progress

Several AMRs are designed for lightweight material handling, restricting their application in construction and heavy manufacturing. In 2025, Foxconn's pilot AMR program encountered operational constraints in transporting heavy electronic components, highlighting the need for high-capacity mobility. This limitation primarily hampers the adoption of AMRs in hospitals, warehouses, and e-commerce logistics, hindering their penetration into industries that require heavy-duty automation. Constant advancement is needed to bridge this capacity gap.

Opportunities

How are green and sustainable operations opening lucrative opportunities for the advancement of the autonomous mobile robot industry?

AMRs support eco-friendly operations by reducing energy consumption and enhancing material flow. According to recent reports, implementing AMRs may reduce warehouse energy use by 15% compared to conventional forklifts. In 2024, DHL Supply Chain launched electric-powered AMRs in its European facilities to meet sustainability objectives. The drive for carbon neutrality in the manufacturing and logistics industries offers an opportunity for vendors in the autonomous mobile robot industry, offering low-emission and energy-efficient AMRs. Sustainability-focused clients are increasingly willing to invest in advanced robotic solutions.

Challenges

Rapid technological obsolescence limits the market growth

The rapid pace of technological advancements can render current AMRs obsolete in a few years. For instance, LiDAR, battery systems, and AI processors are improving speedily, and older models may need expensive upgrades. In 2025, OTTO Motors declared a major product update, rendering earlier AMR models less competitive. Companies face pressure to invest in innovative models to remain relevant continually. This outdatedness demotivates long-term capital expenditure, particularly for small and medium-sized enterprises considering the adoption of AMR.

Autonomous Mobile Robot Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Autonomous Mobile Robot Market |

| Market Size in 2024 | USD 3.96 Billion |

| Market Forecast in 2034 | USD 19.85 Billion |

| Growth Rate | CAGR of 22.31% |

| Number of Pages | 216 |

| Key Companies Covered | Boston Dynamics, ABB Ltd., Omron Corporation, MiR (Mobile Industrial Robots), Locus Robotics, Fetch Robotics, inVia Robotics, Seegrid Corporation, GreyOrange, Clearpath Robotics, Vecna Robotics, AutoGuide Mobile Robots, Waypoint Robotics, Balyo, Robotnik Automation, and others. |

| Segments Covered | By Type, By Component, By Battery Type, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Autonomous Mobile Robot Market: Segmentation

The global autonomous mobile robot market is segmented by type, component, battery type, end-use, and region.

Based on type, the global autonomous mobile robot industry is divided into goods-to-person picking robots, self-driving forklifts, autonomous inventory robots, and unmanned aerial vehicles. The goods-to-person picking robots segment held a dominant share, as they significantly improve picking accuracy and speed in warehouses. They are primarily used in retail and e-commerce giants to manage high-volume order fulfillment effectively.

On the other hand, the 'self-driving forklifts' segment held the second position due to its ability to automate material transport and heavy lifting tasks. They improve operational efficiency and workplace safety in logistics and manufacturing facilities.

Based on component, the global market is segmented into hardware, software, and services. The hardware segment leads the market, as it comprises vital elements such as robotic platforms, LiDAR, and sensors, which are essential for the operation of AMRs. Segment dominance is attributed to the increasing deployment of AMRs in manufacturing facilities and warehouses.

Conversely, the software segment leads the market, as navigation, AI-driven optimization software, and fleet management are crucial for automation functionality. The segment's growth is backed by the rising adoption of Industry 4.0 and smart factory solutions.

Based on battery type, the global autonomous mobile robot market is segmented into lead battery, lithium-ion battery, nickel-based battery, and others. The lithium-ion battery segment holds a dominating share due to its high energy density, faster charging, and longer lifecycle, increasing its suitability for continuous AMR operations.

Nonetheless, the lead battery segment registers a second-leading share due to its proven reliability and low costs. However, it has a shorter lifespan and is heavier than the lithium-ion battery.

Based on end-use, the global market is segmented into manufacturing and wholesale & distribution. The manufacturing segment holds a leadership position since AMRs simplify production lines, assembly processes, and material transport, thereby improving efficiency and reducing labor costs. The adoption is fueled by Industry 4.0 initiatives and the push for smart factories.

However, the wholesale & distribution segment ranks second, as AMRs optimize warehouse operations, inventory management, and order picking, enhancing accuracy and speed in supply chain networks and logistics. The growth of e-commerce backs the segment dominance.

Autonomous Mobile Robot Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global Autonomous Mobile Robot Market?

The Asia Pacific is likely to maintain its leadership in the autonomous mobile robot market due to advancements in the logistics and e-commerce sectors, government initiatives supporting robotics, and the expansion of the automotive and manufacturing industries. The region boasts a growing e-commerce market, with APAC accounting for more than 60% of worldwide e-commerce sales in 2024. Logistics providers and retailers are increasingly deploying AMRs for order fulfillment, warehouse management, and picking, driving the demand for automation solutions. Governments in economies like Singapore, Japan, and China are promoting automation and robotics through policy support and funding initiatives. Programs like Japan's 'Robot Revolution Initiative' and China's 'Made in China 2025' boost AMR adoption in healthcare, logistics, and manufacturing sectors.

Furthermore, the APAC region is home to leading electronics and automotive manufacturing hubs, which necessitate high-volume material handling solutions. The use of AMRs for assembly, inventory management, and pallet transport is growing, with the automotive industry accounting for more than 25% of the regional industry revenue in 2024.

North America continues to hold the second-highest share in the autonomous mobile robot industry, driven by strong e-commerce and warehouse automation, the presence of leading AMR vendors, and advanced manufacturing and industrial sectors. North America boasts a sophisticated e-commerce sector, with the United States alone accounting for more than USD 1.3 trillion in online sales as of 2024. The rise in order volumes fuels the deployment of autonomous mobile robots in warehouses and fulfillment centers for inventory management, good-to-person picking, and last-mile logistics, driving industry adoption.

Additionally, the region hosts leading AMR companies, such as Fetch Robotics, Amazon Robotics, and Locus Robotics, which enhances local adoption of advanced mobile robotics technology. These companies offer support services and cutting-edge solutions, thereby reinforcing the region's growth and infrastructure in the AMR industry.

Additionally, North America boasts large-scale automotive and manufacturing hubs in the United States, Canada, and Mexico. Industries are actively investing in AMRs for assembly, material handling, and intralogistics, with automation penetration in warehouses anticipated to exceed 30% by 2025.

Autonomous Mobile Robot Market: Competitive Analysis

The leading players in the global autonomous mobile robot market are:

- Boston Dynamics

- ABB Ltd.

- Omron Corporation

- MiR (Mobile Industrial Robots)

- Locus Robotics

- Fetch Robotics

- inVia Robotics

- Seegrid Corporation

- GreyOrange

- Clearpath Robotics

- Vecna Robotics

- AutoGuide Mobile Robots

- Waypoint Robotics

- Balyo

- Robotnik Automation

Autonomous Mobile Robot Market: Key Market Trends

Expansion into non-industrial sectors:

AMRs are moving beyond manufacturing and warehouse hubs into hospitality, healthcare, and retail. Applications include contactless delivery, in-store inventory management, disinfection, and expanding the industry's potential.

Collaborative and human-robot interaction:

Next-generation AMRs are designed to work safely alongside humans, supporting hybrid workflows. Collaborative robots enhance productivity and operational flexibility while maintaining safety standards in shared workspaces.

The global autonomous mobile robot market is segmented as follows:

By Type

- Goods-to-Person Picking Robots

- Self-Driving Forklifts

- Autonomous Inventory Robots

- Unmanned Aerial Vehicles

By Component

- Hardware

- Software

- Services

By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-Based Battery

- Others

By End Use

- Manufacturing

- Wholesale & Distribution

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Autonomous mobile robots are advanced robotic systems equipped with sensors, artificial intelligence, and cameras that enable navigation and operations to be performed independently without human assistance. They are designed to move materials, assist in logistics and manufacturing environments, and perform inspections with efficiency and precision.

The global autonomous mobile robot market is projected to grow due to escalating demand for warehouse automation, rising labor costs, and workforce shortages, as well as the integration of cloud-based robotics and IoT platforms.

According to study, the global autonomous mobile robot market size was worth around USD 3.96 billion in 2024 and is predicted to grow to around USD 19.85 billion by 2034.

The CAGR value of the autonomous mobile robot market is expected to be approximately 22.31% from 2025 to 2034.

Significant challenges include complex system integration, high initial costs, a limited skilled workforce, safety and regulatory concerns, and cybersecurity risks.

Technological advancements in sensors, AI, navigation systems, and IoT are enhancing AMR efficiency, adaptability, and autonomy, driving broader adoption across industries.

Investment and partnership opportunities include Robotics-as-a-Service (RaaS) models, R&D collaborations, joint ventures, and AI software development for regional market expansion.

Which region is expected to make a notable contribution to the autonomous mobile robot market value?

Asia Pacific is expected to lead the global autonomous mobile robot market during the forecast period.

The key players profiled in the global autonomous mobile robot market include Boston Dynamics, ABB Ltd., Omron Corporation, MiR (Mobile Industrial Robots), Locus Robotics, Fetch Robotics, inVia Robotics, Seegrid Corporation, GreyOrange, Clearpath Robotics, Vecna Robotics, AutoGuide Mobile Robots, Waypoint Robotics, Balyo, and Robotnik Automation.

The report examines key aspects of the autonomous mobile robot market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed