Automotive Tappets Market Size, Share, Trends, Growth & Forecast 2034

Automotive Tappets Market By Type (Hydraulic Tappets, Mechanical Tappets), By Material (Cast Iron Tappets, Alloy Steel Tappets), By Application (Passenger Vehicles, Commercial Vehicles, Motorcycles), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

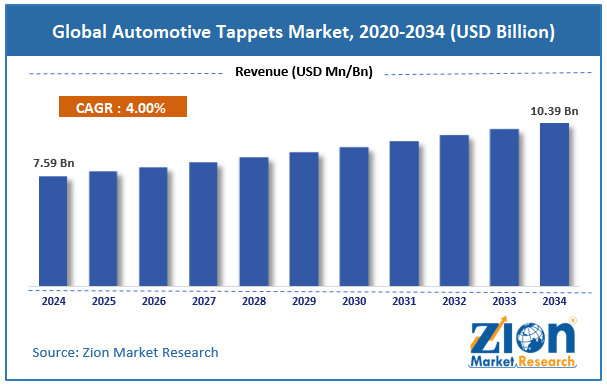

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.59 Billion | USD 10.39 Billion | 4.0% | 2024 |

Automotive Tappets Industry Perspective:

The global automotive tappets market size was approximately USD 7.59 billion in 2024 and is projected to reach around USD 10.39 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive tappets market is estimated to grow annually at a CAGR of around 4% over the forecast period (2025-2034)

- In terms of revenue, the global automotive tappets market size was valued at around USD 7.59 billion in 2024 and is projected to reach USD 10.39 billion by 2034.

- The automotive tappets market is projected to grow significantly due to increasing demand for fuel-efficient engines, advancements in the aftermarket service industry, and growing consumer preference for high-performance vehicles.

- Based on type, the hydraulic tappets segment is expected to lead the market, while the mechanical tappets segment is expected to grow considerably.

- Based on material, the alloy steel tappets segment is the dominant segment, while the cast iron tappets segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the passenger vehicles segment is expected to lead the market, followed by the commercial vehicles segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Automotive Tappets Market: Overview

Automotive tappets, also known as cam followers or valve lifters, are vital components in internal combustion engines that help regulate the opening and closing of engine valves. They transfer motion from the camshaft to the valves, ensuring adequate intake of the fuel-air mixture and release of exhaust gas, as well as accurate timing. The global automotive tappets market is projected to experience substantial growth, driven by increasing demand for fuel-efficient engines, advancements in engine design, and the expansion of aftermarket services. The shift towards fuel-efficient and lightweight engines has surged the adoption of precision-engineered tappets. Advanced tappet designs reduce friction losses and enhance fuel combustion efficacy. As governments tighten fuel economy norms, automakers are prioritizing tappet optimization to meet targets.

Moreover, advancements such as roller and hydraulic tappets have enhanced valve control, overall engine performance, and noise reduction. Modern tappets incorporate advanced coatings and materials to ensure durability under high-stress conditions. These improvements support the automotive sector's pursuit of quieter, smoother, and more durable engines.

Furthermore, the rising automotive aftermarket segment drives demand for tapper replacement and upgrades. Vehicles aging in markets like Europe and North America raise the need for high-quality replacement components; this trend promises constant industry revenue, even in markets with slowing new vehicle sales.

Although drivers exist, the global market is challenged by factors such as the high cost of advanced tappet systems and varying prices of raw materials. Advanced hydraulic and roller tappets incur high manufacturing costs due to the use of premium materials and complex designs. These cost pressures may restrict adoption in budget vehicle segments; manufacturers face challenges in balancing performance benefits with cost efficiency. Similarly, volatile prices of alloys, steel, and lubricants impact overall production costs. As tappets require high-precision machining, material fluctuations can significantly impact profit margins. Manufacturers often struggle to maintain consistent pricing strategies in volatile markets.

Even so, the global automotive tappets industry is well-positioned due to the development of lightweight tappet materials and integration with variable valve timing systems. The adoption of titanium, composite, and ceramic materials presents new growth opportunities. Lightweight tappets decrease inertia and improve engine response. Companies investing in material innovation can avail competitive benefits in fuel-efficient designs. Moreover, modern VVT systems depend on precision tappets to enhance performance. Integration with smart tappet mechanisms enhances emission control and responsiveness. As VVT penetration surges, the demand for compatible tappet designs will increase.

Automotive Tappets Market Dynamics

Growth Drivers

How are strict engine optimization regulations and emission norms boosting the automotive tappets market?

Worldwide regulations, such as BS-VI, China 6 standards, and Euro 6d, have increased the inclination towards clean combustion technologies. Tappets play a crucial role in maintaining accurate valve timing, which in turn affects combustion efficiency and emission output. According to the European Commission (2024), automotive CO2 emissions are expected to decrease by 55% by 2030, prompting manufacturers to adopt advanced valve control mechanisms. Tappets designed for low-friction performance help reduce mechanical losses, adding to compliance with these norms. Recent news from Cummins Inc. highlights novel engine platforms optimized with tappet advancements, aimed at achieving next-generation emission targets, thereby validating this growth propeller.

How do technological improvements in engine design fuel the automotive tappets market?

Ongoing technical advancements in engine framework have majorly impacted the adoption of new tappet designs. The development of roller tappets, variable lift systems, and DLC-coated tappets has enhanced durability, performance, and noise reduction in high-speed engines. For example, SKG Group and Schaeffler AG have recently launched improved tappet solutions featuring friction-reducing coatings, which enhance thermal efficacy. As automakers shift to downsized turbocharged engines, the integration of precision tappets becomes vital to maintain smooth valve operation. This constant R&D in tappet design promises compatibility with changing powertrains, boosting the progress of the automotive tappets market.

Restraints

Volatility in the prices of raw materials hampers the market progress

Automotive tappets primarily depend on alloy, steel, and other specialty materials, whose prices have been highly volatile. According to research, worldwide steel prices increased by 15% in the first half of 2024 due to supply chain disruptions and geopolitical tensions. These variations raise manufacturing costs and decrease profit margins for tappet producers. In recent news, many component producers in North America and Europe have temporarily slowed production due to significant increases in alloy costs, which are adversely impacting tappet supply. This raw material dependency restricts consistent scaling and impacts industry stability.

Opportunities

How does the adoption of lightweight materials present favorable prospects for the expansion of the automotive tappets market?

Automakers are moving towards lightweight engines to enhance fuel efficiency, motivating the use of alloy and aluminum tappets. According to the 2024 research, lightweight components can reduce engine weight by 5-10%, improving performance. Tappet manufacturers who advance in material science can gain a competitive advantage. Recent news from Schaeffler AG highlights tappet prototypes designed for hybrid engines. This material advancement offers a fresh market niche with substantial growth potential, positively impacting the automotive tappets industry.

Challenges

Technological complexity and R&D costs limit the market growth

Developing tappets for high-performance, GDI, and hybrid engines requires advanced research and development, as well as precision manufacturing. According to the 2024 reports, research and development costs for novel tappet designs can exceed USD 2-3 million per engine platform. High technical complexity raises testing cycles and failure risks. Recent delays reported by Bosch and Mahle in the introduction of tappet products highlight this intricacy. Companies should strike a balance between innovation and production feasibility to remain competitive.

Automotive Tappets Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Tappets Market |

| Market Size in 2024 | USD 7.59 Billion |

| Market Forecast in 2034 | USD 10.39 Billion |

| Growth Rate | CAGR of 4.0% |

| Number of Pages | 215 |

| Key Companies Covered | Schaeffler Group, Eaton Corporation, SKF Group, Johnson Lifters LLC, Rane Engine Valve Limited, NSK Ltd., Federal-Mogul LLC, Crower Cams & Equipment Co. Inc., SM Motorenteile GmbH, Wuxi Xizhou Machinery Co. Ltd., Lunati LLC, Jinan Haiyuan Engine Parts Co. Ltd., Engine Power Components Inc., Otics Corporation, Hylift-Johnson, and others. |

| Segments Covered | By Type, By Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Tappets Market: Segmentation

The global automotive tappets market is segmented based on type, material, application, and region.

Based on type, the global automotive tappets industry is divided into hydraulic tappets and mechanical tappets. The hydraulic tappets segment leads the industry owing to their automatic valve clearance adjustment, which assures reduced maintenance needs and smoother operation. They are broadly used in premium vehicles and new passenger cars for their ability to reduce vibration and noise. With strict emission regulations and a demand for low-maintenance and fuel-efficient engines, hydraulic tappets have become the standard choice for OEMs worldwide. Their integration in downsized and hybrid engines continues to reinforce their industry dominance.

Based on material, the global automotive tappets market is segmented into cast iron tappets and alloy steel tappets. The alloy steel tappets segment held the leadership position due to their durability, high strength, and wear resistance, thereby increasing their suitability for commercial vehicles and passenger cars. They can tolerate high temperatures and heavy loads, promising long-term engine performance and reliability. With the rising demand for fuel-efficient and high-performance engines, alloy steel tappets are preferred mainly by aftermarket suppliers and OEMs worldwide. Their adaptability to advanced engine designs and hybrid systems further strengthens their leadership in the industry.

Based on application, the global market is segmented into passenger vehicles, commercial vehicles, and motorcycles. The passenger vehicle segment captured the largest market share due to its high production volume and global demand. Tappets are crucial for ensuring effective engine operation, low maintenance, and improved fuel economy, all of which are key priorities for passenger car purchasers. With the inclination towards fuel-efficient and hybrid engines, the adoption of advanced tappet types, such as alloy steel and hydraulic variants, is leading in this segment. OEMs' focus on comfort, performance, and noise reduction in passenger vehicles continues to propel the segment's prominence.

Automotive Tappets Market: Regional Analysis

What enables the Asia Pacific to have a strong foothold in the global Automotive Tappets Market?

The Asia Pacific is likely to sustain its leadership in the automotive tappets market due to the rapid growth of automotive production, increasing demand for passenger vehicles, and the emergence of the commercial vehicle segment. The Asia Pacific, dominated by China, Japan, and India, accounts for a leading share of global vehicle production. In 2024, China produced more than 28 million vehicle units, accounting for approximately 30% of the total output, which fueled high demand for tappets. The region's growing automotive manufacturing base drives continuous demand for aftermarket components and OEM requirements.

Additionally, rising disposable income and urbanization have increased passenger vehicle sales in the APAC region. India's car sales reached over 5 million units in 2024, while China's passenger car sales surpassed 20 million units, underscoring the strong potential of the automotive industry. This trend promotes the adoption of advanced tappets, such as alloy steel and hydraulic variants. Speedy infrastructure development and logistic growth in economies like China, India, and Southeast Asia improve commercial vehicle production. APAC commercial vehicle production surpassed 6 million in 2024, needing durable tappets for heavy-duty engines. The demand for high-performance and long-lasting tappets remains strong in this domain.

Europe continues to hold the second-highest share in the automotive tappets industry, mainly due to its robust automotive manufacturing base, high demand for passenger vehicles, and advanced engine technologies. Europe is home to major automakers, including Mercedes-Benz, Volkswagen, BMW, and Renault, which collectively produce millions of vehicles annually. In 2024, European car passenger production reached 15 million units, fueling continuous demand for tappets. The region's strong automotive sector assures a steady requirement for advanced valve train components.

Furthermore, Europe boasts a sophisticated passenger vehicle industry, with over 250 million registered cars as of 2024. Customers prioritize reliability, fuel efficiency, and low maintenance, which motivates the adoption of alloy steel and hydraulic tappets. Strong passenger vehicle sales directly support the growth of the tappet industry in both aftermarket and OEM channels. European automakers are emphasizing a focus on engine downsizing, hybrid powertrains, and turbocharging to meet emission standards. Alloy steel and hydraulic tappets are broadly used to optimize valve timing, reduce engine noise, and improve fuel economy. This technological adoption boosts Europe's rank as the leading tappet market.

Automotive Tappets Market: Competitive Analysis

The leading players in the global automotive tappets market are:

- Schaeffler Group

- Eaton Corporation

- SKF Group

- Johnson Lifters LLC

- Rane Engine Valve Limited

- NSK Ltd.

- Federal-Mogul LLC

- Crower Cams & Equipment Co. Inc.

- SM Motorenteile GmbH

- Wuxi Xizhou Machinery Co. Ltd.

- Lunati LLC

- Jinan Haiyuan Engine Parts Co. Ltd.

- Engine Power Components Inc.

- Otics Corporation

- Hylift-Johnson

Automotive Tappets Market: Key Market Trends

Use of advanced materials:

Manufacturers are adopting alloy steel and low-weight composites to improve tappet wear resistance, strength, and engine performance. Alloy steel tappets hold leadership due to their superior durability under load and high-temperature conditions. Material innovation supports emission reduction and fuel efficiency goals in modern engine design.

Integration with Variable Valve Timing (VVT) Systems:

Automakers are actively pairing tappets with advanced engine control solutions and VVT for enhanced valve operation. This enhances fuel efficiency, emission control, and power output. As VVT adoption increases, tappets play a crucial role in improving engine performance.

The global automotive tappets market is segmented as follows:

By Type

- Hydraulic Tappets

- Mechanical Tappets

By Material

- Cast Iron Tappets

- Alloy Steel Tappets

By Application

- Passenger Vehicles

- Commercial Vehicles

- Motorcycles

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive tappets, also known as cam followers or valve lifters, are vital components in internal combustion engines that help regulate the opening and closing of engine valves. They transfer motion from the camshaft to the valves, ensuring adequate intake of the fuel-air mixture and release of exhaust gas, as well as accurate timing.

The global automotive tappets market is projected to grow due to mounting vehicle production worldwide, advancements in engine technology, and the rise of hybrid and electric vehicle segments.

According to study, the global automotive tappets market size was worth around USD 7.59 billion in 2024 and is predicted to grow to around USD 10.39 billion by 2034.

The CAGR value of the automotive tappets market is expected to be approximately 4% from 2025 to 2034.

Market trends and consumer preferences are inclining toward fuel-efficient, low-maintenance, and noise-reducing alloy steel and hydraulic tappets in newer vehicles.

Asia Pacific is expected to lead the global automotive tappets market during the forecast period.

The key players profiled in the global automotive tappets market include Schaeffler Group, Eaton Corporation, SKF Group, Johnson Lifters LLC, Rane Engine Valve Limited, NSK Ltd., Federal-Mogul LLC, Crower Cams & Equipment Co. Inc., SM Motorenteile GmbH, Wuxi Xizhou Machinery Co. Ltd., Lunati LLC, Jinan Haiyuan Engine Parts Co. Ltd., Engine Power Components Inc., Otics Corporation, and Hylift-Johnson.

The competitive landscape is dominated by global specialized tappet manufacturers and OEM suppliers, focusing on quality, innovation, and strategic partnerships.

Stakeholders should adopt innovative design and materials, strategic OEM partnerships, and expansion into emerging markets to stay competitive.

The report examines key aspects of the automotive tappets market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed