Industrial Coatings Market Size, Share, Trends, Growth Report 2034

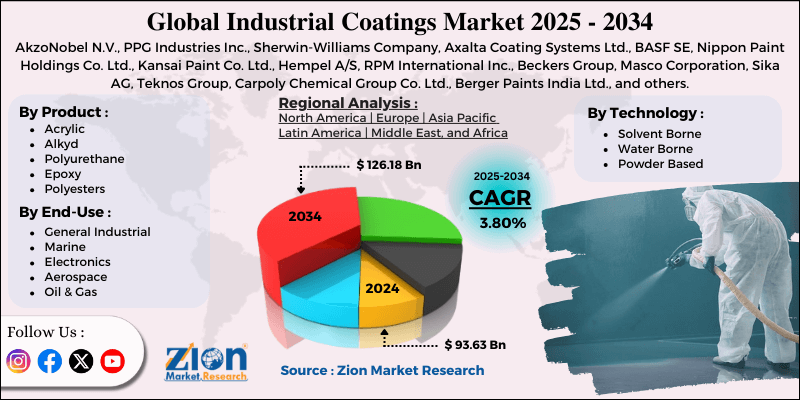

Industrial Coatings Market By Product (Acrylic, Alkyd, Polyurethane, Epoxy, Polyesters, and Others), By Technology (Solvent Borne, Water Borne, Powder Based, and Others), By End-Use (General Industrial Marine, Automotive & Vehicle Refinish, Electronics, Aerospace, Oil & Gas, Mining, Power Generation, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

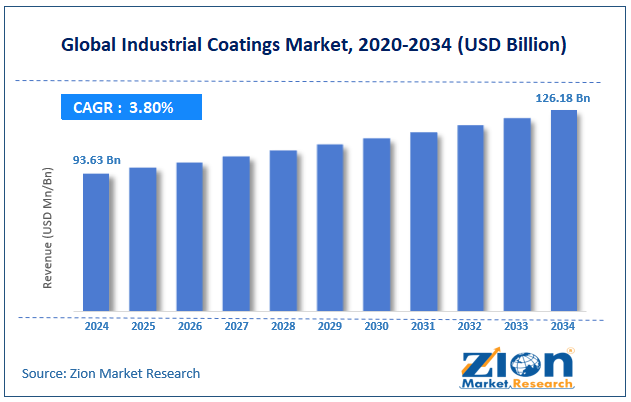

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 93.63 Billion | USD 126.18 Billion | 3.80% | 2024 |

Industrial Coatings Market: Industry Perspective

The global industrial coatings market size was worth around USD 93.63 billion in 2024 and is predicted to grow to around USD 126.18 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.80% between 2025 and 2034.

Industrial Coatings Market: Overview

Industrial coatings comprise specialized paints and coatings prepared to protect surfaces like plastics, concrete, and metals from corrosion, chemicals, wear, and environmental damage while improving performance and appearance. They are broadly used in diverse industries and use technologies like high-performing fluoropolymers, powder coatings, and waterborne systems. The global industrial coatings market is poised for notable growth owing to the growing demand in transportation and automotive, urbanization and infrastructure development, and technological improvements in coating formulations. The worldwide automotive industry's production recovery after the pandemic, along with the demand for corrosion-resistant coatings, is fueling growth in a majority of economies. High-performance coatings meet durability, lightweight material, and aesthetic needs in commercial fleets and electric vehicles.

Moreover, heavy investments in infrastructure in the Middle East and Africa, and the Asia Pacific are propelling the adoption of industrial coatings for pipelines, public figures, and bridge facilities. Coatings extend the service life of assets in harsh climates, decreasing maintenance costs. India's Smart Cities Mission and China's Belt and Road projects are key examples of ongoing demand.

Also, advancements like self-healing coatings, anti-microbial finishes, and nanocoatings are gaining industry appeal. These fresh technologies improve performance, durability, and environmental compliance. For example, nanostructured coatings may increase wear resistance by more than 30% to traditional coatings.

Nevertheless, the global market faces limitations due to factors such as unstable prices of raw materials and strict environmental compliance costs. Prices of epoxy resins, solvents, and titanium dioxide vary due to global supply chain disturbances and fluctuations in energy prices, which directly affect the margins of coating producers. Furthermore, while eco-friendly coatings are higher in demand, the manufacturing and research and development costs for low-VOC and solvent-free solutions are remarkably high and challenge small producers.

Still, the global industrial coatings industry benefits from several favorable factors, like sustainable and bio-based coatings and smart coatings embedded with IoT. Growing global interest in biodegradable and plant-based coatings is offering fresh opportunities and product lines for eco-conscious markets. Likewise, self-sensing coatings that detect corrosion and monitor structural health in real-time are progressing as high-value solutions for crucial infrastructure.

Key Insights:

- As per the analysis shared by our research analyst, the global industrial coatings market is estimated to grow annually at a CAGR of around 3.80% over the forecast period (2025-2034)

- In terms of revenue, the global industrial coatings market size was valued at around USD 93.63 billion in 2024 and is projected to reach USD 126.18 billion by 2034.

- The industrial coatings market is projected to grow significantly owing to the growing need for corrosion protection solutions, increased maintenance and refurbishment activities, and growth in the marine and oil & gas industries.

- Based on product, the acrylic segment is expected to lead the market, while the polyurethane segment is expected to grow considerably.

- Based on technology, the solvent borne segment is the dominating segment, while the water borne segment is projected to witness sizeable revenue over the forecast period.

- Based on end-use, the general industrial segment is expected to lead the market compared to the automotive & vehicle refinish segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Industrial Coatings Market: Growth Drivers

How are longevity economics and corrosion protection in energy & heavy industry boosting the industrial coatings market?

Corrosion prevention remains a foundational propeller in the global industrial coatings market, as marine, oil & gas, and power generation industries require long-life protective coatings to minimize costly downtime and extend asset life, thereby fueling the demand for specialized anti-corrosive epoxies, advanced surface treatments, and polyurethanes. Increasing maintenance and commodity costs make capex-vs.-open calculations prefer high-performing coatings in the higher upfront cost procurement groups, which essentially measure total ownership cost and lifecycle performance.

How are key advances in intelligent and functional coatings fueling the industrial coatings market?

Advancements such as self-healing coatings with microencapsulated corrosion inhibitors, nanotechnology, conductive/EMI shielding, anti-fouling systems, and anti-microbial/antiviral coatings fuel novel use applications and premiumization in medical devices, electronics, infrastructure, and transport. End users in aerospace and electronics demand higher-performing, thinner, and lighter performance coatings with tightly controlled thermal and dielectric properties, promoting ingredient formulators and suppliers to co-develop.

Industrial Coatings Market: Restraints

Customer adoption barriers and technology transition hamper the market progress

While powder, waterborne, and bio-based coatings are gaining popularity and increased adoption, several heavy-duty applications like oil rigs, marine structures, and mining equipment continue to depend on solvent borne systems because of their proven application flexibility, durability, and tolerance to harsh conditions. This unwillingness to change is usually associated with performance concerns, high upfront costs, and the need for equipment changes for environmentally-friendly solutions. In 2023, solvent borne coatings still registered for more than 55% of industrial coatings demand in corrosion-critical uses, denoting a slower-than-projected shift to green solutions despite regulatory pressures.

Industrial Coatings Market: Opportunities

How does Industry 4.0 integration and digitalization favor the expansion of the industrial coatings market?

The adoption of digital solutions, such as IoT-driven spray guns, data analytics, AI-based quality control, and robotics, is transforming coating application processes across various industries, thereby fueling the growth of the industrial coatings industry. These tools enhance coating uniformity, enable predictive maintenance, and reduce material waste by monitoring coating thickness and equipment status in real-time.

For instance, smart spray systems may automatically adjust spray parameters to maintain consistent film thickness notwithstanding environmental disparities, reducing rework and amplifying productivity. This digital transformation enables coating companies to offer value-added services bundled with their products, reinforcing customer relationships and distinguishing themselves in a competitive market.

Industrial Coatings Market: Challenges

Dependency on key suppliers and supply chain concentration limits the market progress

A restricted number of global suppliers hold leadership in the production of crucial raw materials like specialty resins, curing agents, titanium dioxide, and pigments. This creates supply chain exposures that may disturb production during export restrictions, plant shutdowns, or transport barriers.

For example, the TiO2 scarcity in 2022-2023 caused by logistic issues and capacity constraints affected industrial coatings worldwide, forcing costly reformulations and delaying shipments. The dependence on a small supplier base also restricts negotiation power and pricing flexibility, mainly for smaller coatings manufacturers.

Industrial Coatings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Coatings Market |

| Market Size in 2024 | USD 93.63 Billion |

| Market Forecast in 2034 | USD 126.18 Billion |

| Growth Rate | CAGR of 3.80% |

| Number of Pages | 213 |

| Key Companies Covered | AkzoNobel N.V., PPG Industries Inc., Sherwin-Williams Company, Axalta Coating Systems Ltd., BASF SE, Nippon Paint Holdings Co. Ltd., Kansai Paint Co. Ltd., Hempel A/S, RPM International Inc., Beckers Group, Masco Corporation, Sika AG, Teknos Group, Carpoly Chemical Group Co. Ltd., Berger Paints India Ltd., and others. |

| Segments Covered | By Product, By Technology, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Coatings Market: Segmentation

The global industrial coatings market is segmented based on product, technology, end-use, and region.

Based on product, the global industrial coatings industry is divided into acrylic, alkyd, polyurethane, epoxy, polyesters, and others. The acrylic segment holds a dominating share of the market because of its excellent UV resistance, versatility, and color resistance in diverse substrates, like plastics, concrete, and metal. They are extensively used in construction, automotive, marine, and industrial equipment sectors. Their comparatively low cost and ability to be formulated in solvent-borne and waterborne systems further improve their adoption. The rising pressure towards environmentally-friendly coatings has also elevated the demand for water-based formulations.

Based on technology, the global industrial coatings market is segmented as solvent borne, water borne, powder based, and others. The solvent borne segment leads the global market due to its optimal properties, including adhesion, consistent performance, and a smooth finish in various environmental conditions. They are less sensitive to humidity during application and heal faster, increasing their suitability for heavy-duty industrial, marine, and automotive uses. Their long track record and developed application infrastructure sustain strong demand worldwide.

Based on end-use, the global market is segmented as general industrial, marine, automotive & vehicle refinish, electronics, aerospace, oil & gas, mining, power generation, and others. The general industrial segment holds leadership in the worldwide market because of its broader use in manufacturing equipment, appliances, tools, fabricated metals, and various industrial goods. These coatings offer necessary chemical protection, aesthetic finish, and corrosion resistance, promising long asset life and reduced maintenance. The demand is attributed to speedy industrialization in developing economies, along with the current upgrades in developed manufacturing hubs.

Industrial Coatings Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Industrial Coatings Market?

Asia Pacific is projected to maintain its dominant position in the global industrial coatings market owing to the strong industrial and manufacturing base, booming automotive production, and expanding infrastructure and construction projects. APAC houses several of the largest manufacturing hubs, comprising India, China, South Korea, and Japan, which are leading consumers of industrial coatings. China alone registers for more than 28% of worldwide manufacturing output, fueling heavy demand in fabricated metals, appliances, and machinery. The region's large-scale industrial activities offer a continuous need for decorative and protective coatings.

The region also leads in global automotive manufacturing, with China producing more than 30 million vehicle units and India exceeding 5 million units in 2023. This directly surges the demand for vehicle finish products and OEM coatings. Speedy growth in electric vehicle production is also amplifying high-performance coating needs.

Moreover, mega infrastructure developments in leading economies like China and India are fueling the demand for coatings in steel structures, public facilities, and bridges. The APAC construction sector was estimated at more than $6.5 trillion in 2023, accounting for the largest across the globe. Coatings are vital for asset durability in different climate conditions.

North America maintains its position as the second-leading region in the global industrial coatings industry due to the strong presence of key end-use sectors, advanced defense and aerospace industries, and a strong focus on technological advancements. North America holds a strong base of aerospace, automotive, general manufacturing, and oil & gas, all heavy users of industrial coatings. In 2023, the United States automotive industry alone registered more than 10.6 million vehicles, fueling steady demand for refinish coating and OEM.

In addition, advanced manufacturing in equipment and machinery sustains continuous demand. The United States is the leading producer, with aerospace exports surpassing $104 billion in 2023. Industrial coatings are essential for UV stability, corrosion resistance, and thermal protection in defense and aircraft equipment.

The rising need for specialty and high-performing coatings significantly impacts regional demand. North American coating producers are forerunners in R&D, launching advanced products like anti-microbial, self-healing, and high-efficiency powder coatings. Companies like Sherwin-Williams and PPG Industries are heavily investing in low-VOC and sustainable solutions. This advancement-driven industry approach supports the adoption of high-value products across various industries.

Industrial Coatings Market: Competitive Analysis

The leading players in the global industrial coatings market are:

- AkzoNobel N.V.

- PPG Industries Inc.

- Sherwin-Williams Company

- Axalta Coating Systems Ltd.

- BASF SE

- Nippon Paint Holdings Co. Ltd.

- Kansai Paint Co. Ltd.

- Hempel A/S

- RPM International Inc.

- Beckers Group

- Masco Corporation

- Sika AG

- Teknos Group

- Carpoly Chemical Group Co. Ltd.

- Berger Paints India Ltd.

Industrial Coatings Market: Key Market Trends

Growth of functional and smart coatings:

Smart coatings with anti-microbial, self-healing, corrosion-sensing, and anti-fouling properties are gaining prominence, mainly in marine, aerospace, and infrastructure sectors. These advanced coatings increase asset life and decrease maintenance costs with enhanced functionality.

Increasing adoption of powder coatings:

Powder coatings are gaining popularity because of their low environmental footprint, durability, and efficacy in applications. They offer optimal chemical and corrosion resistance, increasing their suitability for appliances, automotive, and general industrial applications.

The global industrial coatings market is segmented as follows:

By Product

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyesters

- Others

By Technology

- Solvent Borne

- Water Borne

- Powder Based

- Others

By End-Use

- General Industrial

- Marine

- Automotive & Vehicle Refinish

- Electronics

- Aerospace

- Oil & Gas

- Mining

- Power Generation

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial coatings comprise specialized paints and coatings prepared to protect surfaces like plastics, concrete, and metals from corrosion, chemicals, wear, and environmental damage while improving performance and appearance. They are broadly used in diverse industries and use technologies like high-performing fluoropolymers, powder coatings, and waterborne systems.

The global industrial coatings market is projected to grow due to improvements in coating formulations, inclination towards low-VOC and eco-friendly coatings, and speedy industrialization in the developing economies.

Emerging trends in the industrial coatings market include the rapid adoption of low-VOC and eco-friendly waterborne and powder coatings driven by stringent environmental regulations. Advancements like smart coatings with anti-microbial, self-healing, and conductive properties are also transforming application possibilities across sectors.

According to study, the global industrial coatings market size was worth around USD 93.63 billion in 2024 and is predicted to grow to around USD 126.18 billion by 2034.

The CAGR value of the industrial coatings market is expected to be around 3.80% during 2025-2034.

Asia Pacific is expected to lead the global industrial coatings market during the forecast period.

China is a key contributor to the global industrial coatings market, fueled by its rapid infrastructure development and significant manufacturing base. Moreover, the country’s growing electronics and automotive industries further propel demand for advanced industrial coatings.

Significant growth opportunities in the industrial coatings market are expected in the automotive (essentially EVs), infrastructure, and aerospace sectors due to surging demand for lightweight, durable, and eco-friendly coatings.

The key players profiled in the global industrial coatings market include AkzoNobel N.V., PPG Industries, Inc., Sherwin-Williams Company, Axalta Coating Systems Ltd., BASF SE, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Hempel A/S, RPM International Inc., Beckers Group, Masco Corporation, Sika AG, Teknos Group, Carpoly Chemical Group Co., Ltd., and Berger Paints India Ltd.

The report examines key aspects of the industrial coatings market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed