Automotive Rocker Panel Market Size, Share, Trends, Growth 2034

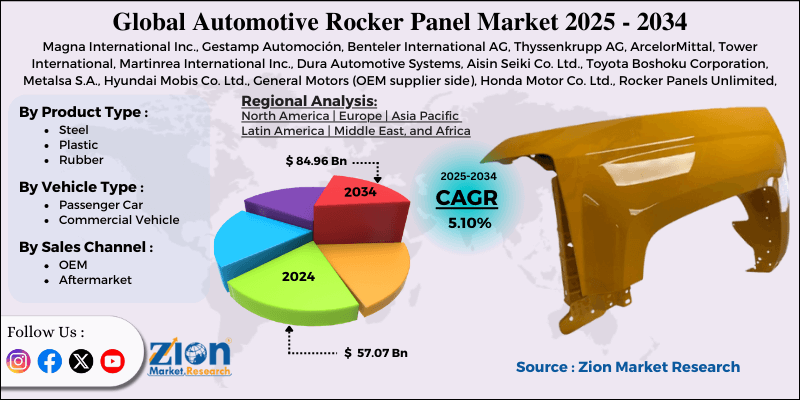

Automotive Rocker Panel Market By Product Type (Steel, Plastic, Rubber), By Vehicle Type (Passenger Car, Commercial Vehicle), By Sales Channel (OEM, Aftermarket), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

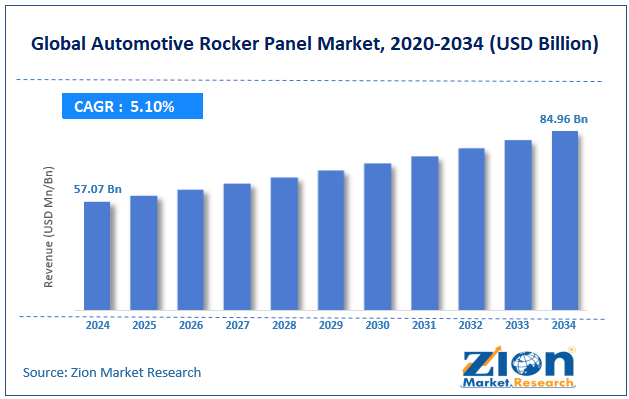

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 57.07 Billion | USD 84.96 Billion | 5.10% | 2024 |

Automotive Rocker Panel Industry Perspective:

The global automotive rocker panel market size was approximately USD 57.07 billion in 2024 and is projected to reach around USD 84.96 billion by 2034, with a compound annual growth rate (CAGR) of approximately 5.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive rocker panel market is estimated to grow annually at a CAGR of around 5.10% over the forecast period (2025-2034)

- In terms of revenue, the global automotive rocker panel market size was valued at around USD 57.07 billion in 2024 and is projected to reach USD 84.96 billion by 2034.

- The automotive rocker panel market is projected to grow significantly due to rising demand for lightweight materials, stringent vehicle safety regulations, and increasing consumer preference for crossovers and SUVs.

- Based on product type, the steel segment is expected to lead the market, while the plastic segment is expected to grow considerably.

- Based on vehicle type, the passenger car segment is the largest, while the commercial vehicle segment is projected to experience significant revenue growth over the forecast period.

- Based on sales channel, the OEM segment is expected to lead the market compared to the aftermarket segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Automotive Rocker Panel Market: Overview

An automotive rocker panel is a structural component located alongside the vehicle, positioned between the rear and front wheel wells, just below the doors. It serves as a vital strengthening element that improves the body's rigidity, safeguards the undercarriage from road debris, and contributes to passenger safety in side-impact crashes. The global automotive rocker panel market is expected to expand rapidly, driven by increasing safety regulations, the adoption of lightweight materials, and the growing demand for crossovers and SUVs. Governments worldwide are implementing stringent crash safety and side-impact protection standards. Rocker panels play a key role as a safety barrier, absorbing impact and safeguarding passengers, increasing their significance for compliance.

Hence, automakers are heavily investing in advanced rocker panel designs and materials. The sector is shifting towards advanced high-strength steel (AHSS), composites, and aluminum to reduce vehicle weight. Lightweight rocker panels enhance fuel efficacy and EV range. This trend is fueling advancements in rocker panel manufacturing solutions.

Moreover, crossovers and SUVs, known for their larger rocker panels and improved ground clearance, are experiencing a surge in worldwide demand. The segment's growth increases the demand for rocker panels, which offer improved aesthetic appeal and enhanced durability. Manufacturers are scaling up production for this high-growth vehicle class.

Despite the growth, the global market is hindered by factors such as complex manufacturing processes, durability, and corrosion challenges. Producing a rocker panel with advanced materials and accuracy comprises expensive stamping, coating, and welding solutions. Small manufacturers often find these processes financially challenging, which limits their entry into the industry and competition. Likewise, despite innovations, rocker panels remain vulnerable to impact damage and rust, particularly in extreme climates. Frequent replacements impact customer confidence and raise maintenance costs. These durability concerns hamper long-term industry growth.

Nonetheless, the global automotive rocker panel industry stands to gain from a few key opportunities, such as the rise of the hybrid and EV segments and customization and aesthetic upgrades. As EV adoption accelerates, rocker panels should be redesigned to offer enhanced safety. Companies that emphasize EV-specific panel solutions can hold a significant market share. This creates opportunities for advancements and associations with EV manufacturers. The rising trend of vehicle personalization produces opportunities for sporty and stylish rocker panel designs. Manufacturers offering customizable rocker panels will appeal to younger consumers who prefer unique appearances.

Automotive Rocker Panel Market Dynamics

Growth Drivers

How is the global automotive rocker panel market fueled by the growing popularity of crossovers and SUVs?

The growing worldwide demand for crossovers and SUVs is a key driver of growth, as these vehicle segments require more durable and larger rocker panels due to their structural design and higher ground clearance. Companies like Hyundai, Toyota, and Volkswagen are expanding their SUV portfolios, intensifying competition in this lucrative segment. Rocker panels for SUVs serve not only as protective elements but also as styling enhancers, offering the vehicle a sharp appeal. With SUV sales anticipated to grow further in the Asia Pacific, North America, the Middle East, and Africa, the global market is expected to benefit significantly from this trend.

How is the electrification of the automotive industry driving the automotive rocker panel market?

The rapid growth of EVs is transforming demand patterns in the global automotive rocker panel market, as EVs typically require modified structural components for underbody integration and battery protection. EV designs usually integrate rocker panels with side-protection structures or battery housings, creating fresh opportunities for advancements in design and materials. For example, BYD and Tesla are developing rocker panels with integrated strength enhancements for battery enclosures. The growing global EV push, backed by infrastructure growth and government subsidies, is expected to significantly fuel the automotive rocker panel market in the coming years.

Restraints

Pricing pressure and intense competition negatively impact market progress

The global market is highly fragmented, with intense competition among tier-1 OEMs, aftermarket providers, and suppliers. Price wars are common, especially in developing markets, as companies strive to maintain a substantial market share. Recent news highlights that suppliers like Hyundai Mobis and Valeo are focusing on cost-efficient solutions without compromising quality, but margin pressure still exists. This intense competition restricts manufacturers' ability to invest in research and development for advanced, lightweight rocker panels.

Opportunities

How do innovations in lightweight materials create promising avenues for the automotive rocker panel industry's growth?

The adoption of magnesium alloys, aluminum, and composites allows suppliers to produce rocker panels that enhance fuel efficiency and reduce vehicle weight. Transportation registers for 25% of the worldwide CO2 emissions, according to the IEA, driving automakers to adopt lightweight solutions. Recent news indicates that companies like Magna International and Gestamp are investing in composite rocker panel technology. These advancements not just meet regulatory needs, but also create a competitive advantage for suppliers. Lightweight panels also attract EV manufacturers seeking a longer battery range, which impacts the growth of the automotive rocker panel industry.

Challenges

Environmental and regulatory compliance restricts the market growth

Strict regulations on emissions, sustainability, and recyclability raise production costs and complexity. The EU mandates that 85% of recyclable materials by weight be used in vehicles, necessitating adjustments in the materials used for rocker panels. Compliance adds to research and development expenses for manufacturers. Companies are heavily investing in eco-friendly materials, but standardization in certain regions presents challenges. Regulatory barriers may slow down advancement and industry adoption, particularly in developing regions.

Automotive Rocker Panel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Rocker Panel Market |

| Market Size in 2024 | USD 57.07 Billion |

| Market Forecast in 2034 | USD 84.96 Billion |

| Growth Rate | CAGR of 5.10% |

| Number of Pages | 214 |

| Key Companies Covered | Magna International Inc., Gestamp Automoción, Benteler International AG, Thyssenkrupp AG, ArcelorMittal, Tower International, Martinrea International Inc., Dura Automotive Systems, Aisin Seiki Co. Ltd., Toyota Boshoku Corporation, Metalsa S.A., Hyundai Mobis Co. Ltd., General Motors (OEM supplier side), Honda Motor Co. Ltd. (OEM supplier side), Rocker Panels Unlimited, and others. |

| Segments Covered | By Product Type, By Vehicle Type, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Rocker Panel Market: Segmentation

The global automotive rocker panel market is segmented based on product type, vehicle type, sales channel, and region.

Based on product type, the global automotive rocker panel industry is divided into steel, plastic, and rubber. The steel segment held a leading market share due to its superior rigidity, strength, and crash protection, thereby increasing its significance for side-impact safety. It is cost-efficient and widely available, ensuring its adoption in commercial vehicles and mass markets. Advanced high-strength steel (AHSS) enables manufacturers to reduce weight while maintaining compliance with fuel efficiency, durability, and emission regulations.

Based on vehicle type, the global automotive rocker panel market is segmented into passenger car and commercial vehicle. The passenger car segment held a dominant share due to its sheer production volume and extensive global demand. Rocker panels play a vital role in enhancing structural rigidity, overall vehicle aesthetics, and side-impact protection. The growing demand for SUVs, hatchbacks, and sedans, especially in the APAC and European regions, propels the segment's dominance.

Based on sales channel, the global market is segmented into OEM and aftermarket. The OEM segment holds a leadership position in the market, as new vehicle production fuels the primary demand for factory-installed and high-quality components. Automakers prioritize durability, safety, and design when sourcing rocker panels, promising strong adoption of plastic, steel, and composite materials. The constant growth in worldwide vehicle production, mainly in Europe and APAC, strengthens OEM dominance.

Automotive Rocker Panel Market: Regional Analysis

What enables the Asia Pacific to have a strong foothold in the global Automotive Rocker Panel Market?

Asia Pacific is anticipated to retain its leading role in the global automotive rocker panel market as a result of speedy vehicle production, rising demand for SUVs and passenger cars, and the growth of EVs. APAC holds a leadership position in vehicle production, accounting for more than 50% of the worldwide commercial vehicle and passenger car output in 2024. Nations like India, China, and Japan are the leaders for domestic exports and consumption. High vehicle production has a remarkably significant impact on the demand for rocker panels, increasing the regional dominance of OEM suppliers.

Moreover, surging disposable incomes and growing urbanization in the APAC region are propelling the demand for passenger cars, especially crossover and SUVs, which feature more durable and larger rocker panels. For example, SUV sales in China surpassed 13 million vehicles in 2024, augmenting OEM needs for advanced rocker panels and boosting regional leadership. Likewise, the APAC region is the leading EV market worldwide, with China alone accounting for more than 60% of the global EV sales in 2024. Electric vehicles require strengthened rocker panels to protect battery packs, thereby increasing the demand for composite and steel panels. This EV growth significantly contributes to the region's prominence.

Europe ranks as the second-largest region in the global automotive rocker panel industry, driven by a robust manufacturing base, high demand for luxury and premium vehicles, and stringent emission and safety regulations. Europe is home to some of the world's leading automotive manufacturers, including BMW, Volkswagen, Mercedes-Benz, and Stellantis. In 2024, Europe manufactured over 16 million vehicles, contributing to its regional leadership. This high production volume fuels continuous demand for high-class rocker panels in commercial and passenger cars.

Additionally, Europe holds a leading market for luxury and premium vehicles, which require aesthetically refined rocker panels and advanced materials. Luxury car production, led by Mercedes-Benz and BMW, accounted for more than 30% of the overall European vehicle output in 2024, driving demand for corrosion-resistant and lightweight panels. These vehicles typically feature rocker panels made of steel, composite, and aluminum to meet safety and design standards. The region has some of the most stringent automotive safety and emission regulations in the world, including Euro NCAP crash safety standards. These regulations ensure that automakers continually invest in high-quality rocker panels, sustaining regional growth and dominance.

Automotive Rocker Panel Market: Competitive Analysis

The leading players in the global automotive rocker panel market are:

- Magna International Inc.

- Gestamp Automoción

- Benteler International AG

- Thyssenkrupp AG

- ArcelorMittal

- Tower International

- Martinrea International Inc.

- Dura Automotive Systems

- Aisin Seiki Co. Ltd.

- Toyota Boshoku Corporation

- Metalsa S.A.

- Hyundai Mobis Co. Ltd.

- General Motors (OEM supplier side)

- Honda Motor Co. Ltd. (OEM supplier side)

- Rocker Panels Unlimited

Automotive Rocker Panel Market: Key Market Trends

Shift to lightweight materials:

Automakers are primarily adopting high-strength steel, composite materials, and aluminum to reduce vehicle weight and enhance fuel efficiency. This trend is mainly fueled by hybrid vehicles and EVs, where lighter rocker panels add to extended battery range and improved performance.

Customization and aesthetic enhancements:

Consumer preference for personalized and stylish vehicles is fueling the development of rocker panels with color options and sleek designs. Automakers are incorporating rocker panels as design and functional elements, mainly in crossovers, SUVs, and premium cars.

The global automotive rocker panel market is segmented as follows:

By Product Type

- Steel

- Plastic

- Rubber

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An automotive rocker panel is a structural component located alongside the vehicle, positioned between the rear and front wheel wells, just below the doors. It serves as a vital strengthening element that improves the body's rigidity, safeguards the undercarriage from road debris, and contributes to passenger safety in side-impact crashes.

The global automotive rocker panel market is projected to grow due to rising global vehicle production, improvements in manufacturing technologies, and increasing focus on aesthetics and vehicle durability.

According to study, the global automotive rocker panel market size was worth around USD 57.07 billion in 2024 and is predicted to grow to around USD 84.96 billion by 2034.

The CAGR value of the automotive rocker panel market is expected to be approximately 5.10% from 2025 to 2034.

Market trends and consumer preferences are evolving toward corrosion-resistant, lightweight, and aesthetically appealing rocker panels, especially for SUVs, EVs, and personalized vehicles.

Macroeconomic factors, such as fluctuating vehicle production, rising raw material costs, and economic growth in emerging markets, will directly influence pricing, demand, and investment in the market.

The value chain of the global automotive rocker panel industry includes raw material sourcing, OEM assembly, component manufacturing, aftermarket sales and services, and distribution.

Asia Pacific is expected to lead the global automotive rocker panel market during the forecast period.

The key players profiled in the global automotive rocker panel market include Magna International Inc., Gestamp Automoción, Benteler International AG, Thyssenkrupp AG, ArcelorMittal, Tower International, Martinrea International Inc., Dura Automotive Systems, Aisin Seiki Co., Ltd., Toyota Boshoku Corporation, Metalsa S.A., Hyundai Mobis Co., Ltd., General Motors (OEM supplier side), Honda Motor Co., Ltd. (OEM supplier side), and Rocker Panels Unlimited.

The report examines key aspects of the automotive rocker panel market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed