Aluminum Composite Material Market Size, Share, Trends, Growth 2034

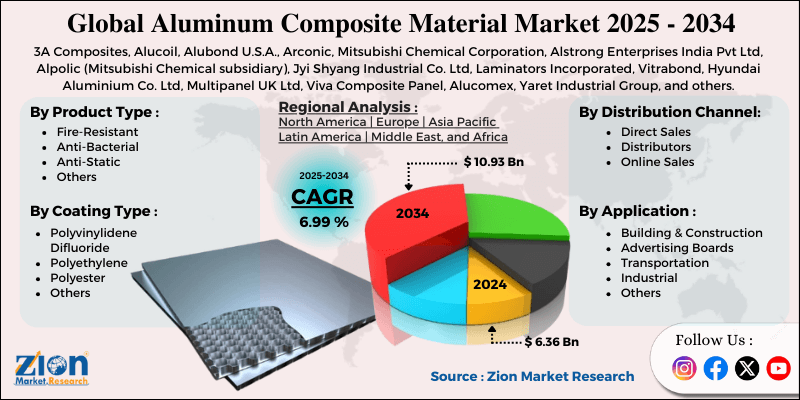

Aluminum Composite Material Market By Product Type (Fire-Resistant, Anti-Bacterial, Anti-Static, and Others), By Coating Type (Polyvinylidene Difluoride, Polyethylene, Polyester, and Others), By Application (Building & Construction, Advertising Boards, Transportation, Industrial, and Others), By Distribution Channel (Direct Sales, Distributors, Online Sales), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

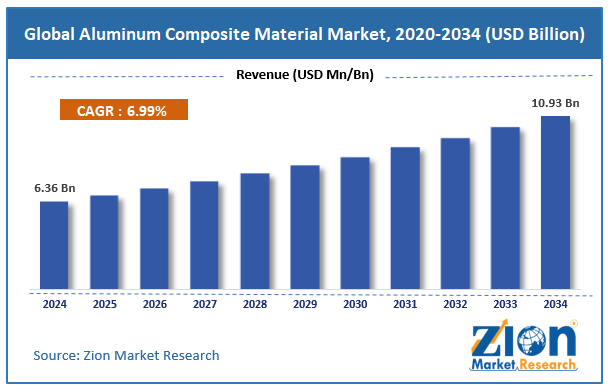

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.36 Billion | USD 10.93 Billion | 6.99% | 2024 |

Aluminum Composite Material Industry Perspective:

The global aluminum composite material market size was worth around USD 6.36 billion in 2024 and is predicted to grow to around USD 10.93 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.99% between 2025 and 2034.

Aluminum Composite Material Market: Overview

Aluminum composite material is a lightweight, versatile, and durable panel composed of two thin aluminum sheets bonded to a non-aluminum core, usually made of fire-retardant material or polyethylene. It is extensively used in building facades, interior applications, transportation, and signage because of its optimal strength-to-weight ratio, aesthetic flexibility, and corrosion resistance. The global aluminum composite material market is poised for notable growth owing to the growing adoption in modern architecture, the progressing automotive and transport industry, and energy efficiency and sustainability issues. The trend towards sleek, innovative, and energy-efficient architectural designs has driven the use of aluminum composite materials.

Aluminum composite panels offer durability, flexibility, and design aesthetics, which are supportive of modern architecture needs for green buildings and smart cities. ACM is primarily used in trucks, buses, and trains for lightweighting, enhancing fuel efficacy, and improving visual appeal. The automotive lightweight material sector is anticipated to exceed $120 billion by 2030, indirectly driving the ACM demand. ACM panels with thermal insulation properties aid in reducing power consumption in buildings. Green building certifications like BREEAM and LEED are encouraging the use of ACM because of their ability to reduce heating and cooling costs and their recyclable nature.

Nevertheless, the global market faces limitations due to factors such as environmental concerns, recycling issues, and high initial costs of installation. While aluminum is recyclable, the polyethylene core in several ACM panels poses challenges to complete recyclability, which discourages environmental groups.

Moreover, ACM panels are more expensive than traditional cladding materials, which can prevent their adoption in budget-conscious markets. Still, the global aluminum composite material industry benefits from several favorable factors, such as green building and smart cities initiatives, technological improvements in surface coatings, and growth in the automotive EV industry. Government programs for eco-friendly construction and smart cities offer tremendous growth potential for ACM manufacturers. Self-cleaning surfaces and nanotechnology are gaining traction in premium construction segments. Furthermore, the rising electric vehicle market needs lightweight materials to enhance efficacy, thus offering a fresh market for ACM.

Key Insights:

- As per the analysis shared by our research analyst, the global aluminum composite material market is estimated to grow annually at a CAGR of around 6.99% over the forecast period (2025-2034)

- In terms of revenue, the global aluminum composite material market size was valued at around USD 6.36 billion in 2024 and is projected to reach USD 10.93 billion by 2034.

- The aluminum composite material market is projected to grow significantly owing to the increasing use in transportation and automotive sectors, growth in remodeling and renovation activities, and growth of the signage and advertising industry.

- Based on product type, the fire-resistant segment is expected to lead the market, while the anti-bacterial segment is expected to grow considerably.

- Based on coating type, the polyvinylidene difluoride segment is the dominating segment, while the polyester segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the building & construction segment dominates the market, while the advertising boards segment is anticipated to witness substantial growth over the coming years.

- Based on the distribution channel, the direct sales segment is expected to lead the market compared to the distributors segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Aluminum Composite Material Market: Growth Drivers

How is aesthetic & customization flexibility driving the aluminum composite material market growth?

ACM's broad palette of finishes, like (stone-look, custom prints, metallic, woodgrain), plus post-forming and perforation choices, allows architects to realize different design intents while keeping installation and production comparatively standard. This aesthetic flexibility keeps ACM appealing for retail facades, corporate branding, interior feature walls, and transit hubs – industries where repeatability reduces cost and visual identity matters. This flexibility, fueling architecture’s choice, substantially propels the global aluminum composite material market.

How is the global aluminum composite material market fueled by low maintenance, durability, and lifecycle cost advantages?

High-quality polyester and PVDF-coated ACM panels provide longer service life, corrosion resistance, and color retention – translating to lower whole life costs than with paint systems, some metals, or stone. For building owners, easier panel replacement and lower maintenance cycles decrease operating expenses, increasing the preference for renovation-retrofits and the new builds market.

Aluminum Composite Material Market: Restraints

Recycling and environmental challenges hamper the global market progress

Even though ACM manufacturers encourage recycled aluminum use, separating skins from polyethylene cores at the end-of-life remains costly and complicated, restricting full recyclability. Several local facilities lack the ecosystem to process ACM panels, resulting in environmental criticisms and waste management concerns. Increasing environmental norms and green building certifications now pressure manufacturers to present enhanced sustainability performance in the product lifecycle. This challenge has forced suppliers to explore closed-loop recycling programs or substitute core materials, adding operational and R&D expenses.

Aluminum Composite Material Market: Opportunities

How is the expansion of non-building applications impacting the aluminum composite material market growth?

While building facades dominate the ACM demand, growth in transportation, advertising signage, and modular furniture industries offers new opportunities for manufacturers. These segments value aluminum composite materials for their lightweight structure, aesthetic appeal, and high rigidity at a comparatively low price compared to solid metals. Retail branding and outdoor advertising projects are powerful growth propellers, mainly in North America and the Asia Pacific. This expansion ultimately fuels the aluminum composite material industry.

Aluminum Composite Material Market: Challenges

Volatility in raw material prices restricts the growth of the market

Aluminum prices remain high and unstable due to supply disturbances, geopolitical issues, and rising energy costs. A significant increase in aluminum costs drives up ACM panel costs, reducing affordability for contractors and developers. Manufacturers face pressure to either risk losing industry share or absorb expenses, particularly in highly competitive regions such as APAC. In recent years, aluminum costs have varied directly, affecting ACM production margins.

Aluminum Composite Material Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aluminum Composite Material Market |

| Market Size in 2024 | USD 6.36 Billion |

| Market Forecast in 2034 | USD 10.93 Billion |

| Growth Rate | CAGR of 6.99% |

| Number of Pages | 212 |

| Key Companies Covered | 3A Composites, Alucoil, Alubond U.S.A., Arconic, Mitsubishi Chemical Corporation, Alstrong Enterprises India Pvt Ltd, Alpolic (Mitsubishi Chemical subsidiary), Jyi Shyang Industrial Co. Ltd, Laminators Incorporated, Vitrabond, Hyundai Aluminium Co. Ltd, Multipanel UK Ltd, Viva Composite Panel, Alucomex, Yaret Industrial Group, and others. |

| Segments Covered | By Product Type, By Coating Type, By Application, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aluminum Composite Material Market: Segmentation

The global aluminum composite material market is segmented based on product type, coating type, application, distribution channel, and region.

Based on product type, the global aluminum composite material industry is divided into fire-resistant, anti-bacterial, anti-static, and others. The fire-resistant ACM panels hold leadership in the market because of their extensive use in building, public infrastructure, and high-rise constructions, where fire safety compliance is compulsory.

Conversely, the anti-bacterial panels are the second-leading segment, driven by growing demand in laboratories, healthcare facilities, and cleanrooms, primarily following the COVID-19 pandemic.

Based on coating type, the global market is segmented into polyvinylidene difluoride, polyethylene, polyester, and others. The polyvinylidene difluoride-coated ACM panels hold a leading market share because of their superior weather resistance, durability, and UV stability, increasing their suitability for exterior applications like curtain walls and building facades.

On the other hand, the polyester-coated ACM panels segment ranks second since it is largely used in signage, interior applications, and low-cost projects.

Based on application, the global aluminum composite material market is segmented into building & construction, advertising boards, transportation, industrial, and others. ACM panels are widely used in building & construction for cladding, interiors, roofing, and facades due to their lightweight nature, durability, and design flexibility.

However, ACM panels are mainly preferred in advertising boards due to their smooth surface, weather resistance, and durability, which make them suitable for outdoor and indoor signage.

Based on distribution channel, the global market is segmented into direct sales, distributors, and online sales. The direct sales segment held a dominating share of the market since it is widely preferred by infrastructure developers, large construction firms, and automotive manufacturers, who need bulk orders, technical support, and customization.

Nonetheless, the distributors segment is also expected to grow progressively in the coming years due to localized inventory and flexibility, thereby increasing the accessibility of ACM panels in areas where manufacturers have a restricted presence.

Aluminum Composite Material Market: Regional Analysis

What gives the Asia Pacific a competitive edge in the global Aluminum Composite Material Market?

Asia Pacific is projected to maintain its dominant position in the global aluminum composite material market, driven by the speedy construction boom and urbanization, the rising adoption of green buildings and modern architecture, and the progression of the transportation and automotive market. Asia Pacific is experiencing unparalleled urbanization, with India and China dominating global construction spending. China alone registers for approximately 25% of global construction output, while India's construction sector is anticipated to hit $1.4 trillion by 2030. This rise in infrastructure projects fuels strong demand for ACM panels in cladding, facades, and roofing applications. Asia Pacific is leveraging contemporary architecture and energy-efficient building materials, driven by smart city initiatives.

For instance, China's Green Building Action Plan aims for 50% of new urban construction to be green by 2030, while the green building footprint in India is progressing at 20% yearly. ACM panels, being lightweight and thermally efficient, are highly suitable for these sustainable construction trends.

Additionally, the region's automotive production accounts for more than 50% of the worldwide vehicle manufacturing, with India, China, and Japan being the primary contributors. ACM panels are largely used in commercial buses, trains, and vehicles for design flexibility and lightweighting. With the APAC EV market projected to hit $616 billion by 2030, the demand for ACM in automotive applications is set to grow remarkably.

Europe maintains its position as the second-leading region in the global aluminum composite material industry due to the strong demand for sustainable and energy-efficient buildings, strict fire safety regulations fueling FR-grade ACM demand, and advanced manufacturing capabilities. Europe has stringent regulations encouraging green and energy-efficient building, like the EU Energy Performance Buildings Directive, all of which require new buildings and construction to be zero-energy by 2030.

The European Green Deal aims to reduce greenhouse gas emissions by 55% by 2030, thereby promoting the adoption of aluminum composite material panels for sustainability and thermal insulation. This regulatory environment propels steady demand in the region. Furthermore, after incidents like the Grenfell Tower fire in the United Kingdom, Europe has adopted stringent fire safety regulations, resulting in high demand for FR-grade and A2 ACM panels.

Economies like the UK, Germany, and France have made non-combustible cladding compulsory for high-rise buildings, primarily driving the adoption of fire-resistant ACM. Europe also boasts a strong presence of premium ACM manufacturers, along with significant investments in research and development for fire-retardant, recyclable, and antimicrobial panels. Companies focus on innovative and eco-friendly products, supporting the EU sustainability objectives. The region also focuses on circular economy practices, offering opportunities for ACM recycling solutions.

Aluminum Composite Material Market: Competitive Analysis

The leading players in the global aluminum composite material market are:

- 3A Composites

- Alucoil

- Alubond U.S.A.

- Arconic

- Mitsubishi Chemical Corporation

- Alstrong Enterprises India Pvt Ltd

- Alpolic (Mitsubishi Chemical subsidiary)

- Jyi Shyang Industrial Co. Ltd

- Laminators Incorporated

- Vitrabond

- Hyundai Aluminium Co. Ltd

- Multipanel UK Ltd

- Viva Composite Panel

- Alucomex

- Yaret Industrial Group

Aluminum Composite Material Market: Key Market Trends

Growing adoption in energy-efficient and green buildings:

The push for sustainable construction and green building certifications like BREEAM and LEED is fueling the use of ACM because of its thermal insulation, lightweight structure, and recyclability. The worldwide green building materials industry is anticipated to hit $670 billion by 2030, driving ACM demand.

Technological advancements in surface and coatings treatments:

Innovations like nanotechnology-based coatings, self-cleaning panels, and anti-bacterial surfaces are gaining popularity. These advanced coatings enhance durability, hygiene, and UV resistance, increasing the suitability of ACM for transportation, healthcare, and high-end architectural projects.

The global aluminum composite material market is segmented as follows:

By Product Type

- Fire-Resistant

- Anti-Bacterial

- Anti-Static

- Others

By Coating Type

- Polyvinylidene Difluoride

- Polyethylene

- Polyester

- Others

By Application

- Building & Construction

- Advertising Boards

- Transportation

- Industrial

- Others

By Distribution Channel

- Direct Sales

- Distributors

- Online Sales

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aluminum composite material is a lightweight, versatile, and durable panel composed of two thin aluminum sheets bonded to a non-aluminum core, usually made of fire-retardant material or polyethylene. It is extensively used in building facades, interior applications, transportation, and signage because of its optimal strength-to-weight ratio, aesthetic flexibility, and corrosion resistance.

The global aluminum composite material market is projected to grow due to the growing demand for lightweight construction materials, technological advancements in composite material manufacturing, and increasing recyclability and sustainability initiatives.

According to study, the global aluminum composite material market size was worth around USD 6.36 billion in 2024 and is predicted to grow to around USD 10.93 billion by 2034.

The CAGR value of the aluminum composite material market is expected to be around 6.99% during 2025-2034.

Technological advancements are driving the ACM market by enabling fire-resistant cores, self-cleaning surfaces, nanocoatings, and improved durability for high-performance and sustainable applications.

The direct sales segment holds the leading share in the aluminum composite material market, fueled by bulk orders from infrastructure and construction projects.

Asia Pacific is expected to lead the global aluminum composite material market during the forecast period.

Investment and partnership opportunities lie in developing fire-resistant ACM panels, expanding production in the developing regions, and associating with construction firms for sustainable building projects.

The key players profiled in the global aluminum composite material market include 3A Composites, Alucoil, Alubond U.S.A., Arconic, Mitsubishi Chemical Corporation, Alstrong Enterprises India Pvt Ltd, Alpolic (Mitsubishi Chemical subsidiary), Jyi Shyang Industrial Co., Ltd, Laminators Incorporated, Vitrabond, Hyundai Aluminium Co., Ltd, Multipanel UK Ltd, Viva Composite Panel, Alucomex, and Yaret Industrial Group.

The report examines key aspects of the aluminum composite material market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed