Automotive Night Vision System Market Size, Share, Trends, Growth 2034

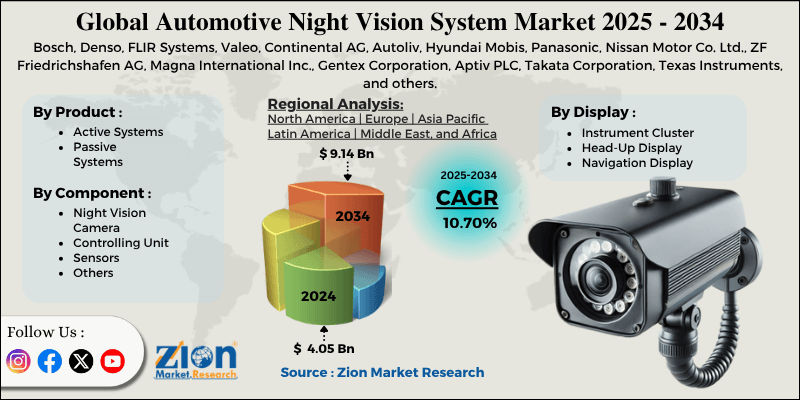

Automotive Night Vision System Market By Product (Active Systems, Passive Systems), By Component (Night Vision Camera, Controlling Unit, Sensors, Others), By Display (Instrument Cluster, Head-Up Display, Navigation Display), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

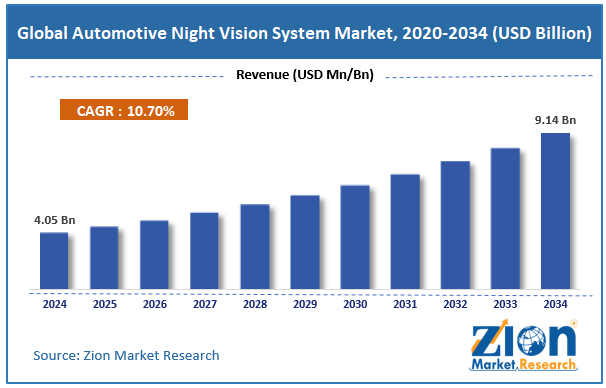

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.05 Billion | USD 9.14 Billion | 10.70% | 2024 |

Automotive Night Vision System Industry Perspective:

The global automotive night vision system market size was approximately USD 4.05 billion in 2024 and is projected to reach USD 9.14 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive night vision system market is estimated to grow annually at a CAGR of around 10.70% over the forecast period (2025-2034)

- In terms of revenue, the global automotive night vision system market size was valued at around USD 4.05 billion in 2024 and is projected to reach USD 9.14 billion by 2034.

- The automotive night vision system market is projected to grow significantly, driven by rising focus on vehicle safety and accident prevention, technological advancements in infrared and thermal imaging sensors, and increasing consumer awareness of nighttime driving hazards.

- Based on product, the active systems segment is expected to lead the market, while the passive systems segment is expected to grow considerably.

- Based on component, the night vision camera segment is the largest, while the sensors segment is projected to record sizeable revenue over the forecast period.

- Based on the display, the head-up display segment is expected to lead the market, followed by the instrument cluster segment.

- By region, Europe is projected to dominate the global market during the forecast period, followed by North America.

Automotive Night Vision System Market: Overview

The automotive night vision system is a modern safety technology designed to improve driver visibility in nighttime and low-light conditions. With thermal imaging cameras or infrared sensors, the system detects animals, pedestrians, and obstacles beyond the reach of standard headlights, displaying the information on the head-up display or the dashboard. The global automotive night vision system market is projected to grow substantially, driven by rising demand for ADAS, heightened road safety awareness, and technological advancements in thermal and infrared imaging. ANVS is progressively integrated with ADAS features like collision avoidance and lane departure warning.

According to reports (2024), more than 45% of new luxury vehicles now feature thermal imaging or night vision, driving industry-wide adoption. Moreover, NGOs and governments worldwide are raising awareness of nighttime road accidents. ANVS helps reduce pedestrian accidents and fatalities on poorly lit roads, augmenting OEMs' efforts to integrate these systems across more vehicle segments. Furthermore, continuous enhancements in thermal cameras, infrared sensors, and image processing algorithms have improved detection accuracy and range, making automotive night vision systems more cost-effective and reliable for mass-market adoption.

Although drivers exist, the global market is challenged by factors such as high system costs, integration complexity, and dependence on vehicle segments. Infrared sensors and thermal cameras are expensive, limiting adoption to the luxury and premium vehicle segments and slowing penetration in the mid-segment market. Assimilating ANVS with displays and other vehicle electronics requires improved engineering, increasing development costs and time for OEMs. Likewise, most ANVS systems are targeted at luxury automobiles; mass-market penetration remains low due to perceived necessity and cost, which impacts overall industry scalability.

Even so, the global automotive night vision system industry is well-positioned due to cost reductions enabled by advancements, integration with EVs, and collaborations with technology providers. Ongoing R&D on low-cost infrared sensors and thermal imaging can make ANVS affordable for mid-range vehicles, expanding the industry's reach. EV manufacturers are progressively adopting advanced safety systems, and incorporating ANVS can enhance their competitive benefit in the safety-conscious industry segment. Additionally, collaborations between tech companies and OEMs to advance sensor technologies and software can accelerate ANVS adoption and improve performance.

Automotive Night Vision System Market Dynamics

Growth Drivers

How is the automotive night vision system market augmented by increasing nighttime driving and urban traffic?

Increasing urban traffic and growing nighttime driving congestion are augmenting the demand for ANVS to prevent low-light accidents. According to INRIX, nighttime traffic accidents increased by 12% in 2023-24, underscoring the need for better visibility. ANVS helps detect pedestrians, stray animals, and cyclists often missed by headlights, enhancing road safety. Pilot programs in cities like London and Los Angeles, along with rising consumer awareness, are fueling higher adoption in commercial and passenger vehicles.

How are technological improvements in infrared and thermal imaging sensors fueling the automotive night vision system market?

Advancements in thermal imaging and infrared technology have significantly improved ANVS performance, enabling the detection of animals and pedestrians at greater distances. Modern thermal cameras can detect objects up to 300 meters away, compared to 100-150 meters in older systems.

In 2025, FLIR Systems introduced a high-resolution, compact automotive thermal sensor, improving integration and reducing false alerts. Hence, automakers such as Lexus and Audi are increasingly offering ANVS in premium models, thereby widening global adoption of automotive night vision systems. These efforts are ultimately boosting the automotive night vision system market.

Restraints

Limited consumer awareness and perceived necessity hamper the market progress

Several consumers are still unfamiliar with the benefits of night vision systems, particularly in regions with low nighttime traffic risks. According to a 2024 survey, only 28% of vehicle buyers in APAC considered night vision as a key purchase factor. Even in developed markets, users may perceive ANVS as a luxury feature rather than a safety necessity. This lack of consumer awareness slows demand and demotivates automakers from making it a standard in non-premium vehicles. Industry campaigns and demonstrations are ongoing, but industry education is still a challenge.

Opportunities

How do technological innovation and AI-based enhancements offer favorable prospects for the automotive night vision system market?

Machine learning and AI integration are enabling smarter night vision that can more accurately recognize pedestrians, obstacles, and animals. In 2024, Bosch launched AI-assisted thermal imaging for night vision, enhancing detection rates by 20%. These innovations facilitate adaptive alerts and predictive warnings, improving driver confidence. Continuous R&D in sensor miniaturization and high-resolution thermal imaging increases opportunities for broader adoption, augmenting the automotive night vision system industry. OEMs are increasingly viewing AI-driven ANVS as a differentiator in competitive markets.

Challenges

Environmental and operational constraints limit the market growth

ANVS effectiveness can be reduced in heavy rain, fog, or snow, restricting reliability in some geographies. According to AutoTech Insights, the detection range can drop by nearly 15% under adverse weather conditions in 2024. These restrictions may reduce driver confidence and perceived value. Constant technological upgrades are required to mitigate these environmental challenges. Until these issues are resolved, ANVS adoption remains a challenge across all climates.

Automotive Night Vision System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Night Vision System Market |

| Market Size in 2024 | USD 4.05 Billion |

| Market Forecast in 2034 | USD 9.14 Billion |

| Growth Rate | CAGR of 10.70% |

| Number of Pages | 213 |

| Key Companies Covered | Bosch, Denso, FLIR Systems, Valeo, Continental AG, Autoliv, Hyundai Mobis, Panasonic, Nissan Motor Co. Ltd., ZF Friedrichshafen AG, Magna International Inc., Gentex Corporation, Aptiv PLC, Takata Corporation, Texas Instruments, and others. |

| Segments Covered | By Product, By Component, By Display, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Night Vision System Market: Segmentation

The global automotive night vision system market is segmented based on product, component, display, and region.

Based on product, the global automotive night vision system industry is divided into active and passive systems. The active systems segment holds a dominating share of the market due to its superior detection capabilities, mainly in the luxury and premium vehicle segments. The segmental dominance is also backed by continuous technological improvements worldwide. Active ANVS use infrared light sources to illuminate the road ahead and detect objects with near-infrared or thermal cameras. They offer enhanced accuracy in detecting animals and pedestrians at longer distances than passive systems.

Based on component, the global automotive night vision system market is segmented into night vision camera, controlling unit, sensors, and others. The night vision camera segment held a leading market share due to advances in long-range and high-resolution capabilities, particularly in premium and luxury vehicles. OEMs continue to invest in camera advancements, strengthening the segment's dominance. The night vision camera is the core component of ANVS, capturing thermal and infrared imagery to detect animals, pedestrians, and obstacles. Its crucial role in system performance makes it the leading revenue-generating component.

Based on the display, the global market is segmented into instrument cluster, head-up display, and navigation display. The head-up display segment was anticipated to display night-vision information directly on the windshield, enabling drivers to view obstacles without taking their eyes off the road. Its safety and convenience benefits make it the highly preferred display option in luxury and premium vehicles. Constant innovations in augmented reality HUDs are further augmenting their adoption worldwide.

Automotive Night Vision System Market: Regional Analysis

What enables Europe to have a strong foothold in the global Automotive Night Vision System Market?

Europe is likely to sustain its leadership in the automotive night vision system market due to strict vehicle safety regulations, high penetration of premium and luxury vehicles, and technological advancements and R&D. Europe has the most stringent safety standards worldwide, including mandatory pedestrian detection and advanced driver assistance systems in modern cars.

According to the European Commission, more than 60% of road-safety-related regulations promote the adoption of collision-avoidance and night-vision technologies. These regulations motivate OEMs to integrate ANVS into European vehicles more quickly than in other regions.

Moreover, European markets, especially France, Germany, and the UK, have robust demand for premium and luxury vehicles, which mainly comprise ANVS as standard or optional equipment. In 2024, luxury vehicle sales in the region surpassed 4 million units, significantly boosting ANVS adoption. This high penetration promises that Europe holds the leading industry for night vision systems. European hosts key automotive technology hubs, with companies investing heavily in thermal imaging and infrared R&D.

For instance, Continental and Bosch, European leaders in automotive safety, spend billions each year on night vision technology and ADAS development. This continuous advancement promises European vehicles will feature cutting-edge ANVS, maintaining regional dominance.

North America continues to hold the second-highest share in the automotive night vision system industry, driven by the rising adoption of premium and luxury vehicles, a focus on reducing accidents and improving road safety, and increasing consumer awareness of and safety preferences. North America, especially the United States, has a high demand for premium and luxury vehicles, which are often equipped with ANVS as standard or optional features. In 2024, luxury vehicle systems in the United States surpassed 3.2 million units, creating a robust market for night vision systems. This segment accounts for a significant share of ANVS manufacturers' revenue in the region.

Furthermore, given the high rates of nighttime road accidents, North American consumers and regulators prioritize safety technologies. The National Highway Traffic Safety Administration reported that approximately 50% of fatal crashes in the region occur at night, underscoring the need for advanced night-vision and pedestrian-detection systems. ANVS adoption is hence incentivized by both regulatory support and safety concerns.

Additionally, consumers in North America are increasingly aware of the advantages of ANVS, especially its ability to reduce wildlife and pedestrian collisions at night. According to the surveys, more than 65% of vehicle buyers consider advanced safety systems a key purchasing factor, motivating OEMs to include night vision features in more models.

Automotive Night Vision System Market: Competitive Analysis

The leading players in the global automotive night vision system market are:

- Bosch

- Denso

- FLIR Systems

- Valeo

- Continental AG

- Autoliv

- Hyundai Mobis

- Panasonic

- Nissan Motor Co. Ltd.

- ZF Friedrichshafen AG

- Magna International Inc.

- Gentex Corporation

- Aptiv PLC

- Takata Corporation

- Texas Instruments

Automotive Night Vision System Market: Key Market Trends

Shift toward active infrared systems:

There is a growing preference for active night vision systems over passive ones due to their longer detection range and greater accuracy. Active systems use infrared illumination to more effectively identify pedestrians, obstacles, and animals, particularly in rural or poorly lit environments.

Augmented Reality Head-Up Displays (AR-HUDs):

Automakers are adopting AR-based HUDs to display night-vision information directly on the windshield. This trend enhances driver convenience and reaction time by allowing them to keep their eyes on the road while accessing crucial information.

The global automotive night vision system market is segmented as follows:

By Product

- Active Systems

- Passive Systems

By Component

- Night Vision Camera

- Controlling Unit

- Sensors

- Others

By Display

- Instrument Cluster

- Head-Up Display

- Navigation Display

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The automotive night vision system is a modern safety technology designed to improve driver visibility in nighttime and low-light conditions. With thermal imaging cameras or infrared sensors, the system detects animals, pedestrians, and obstacles beyond the reach of standard headlights, displaying the information on the head-up display or the dashboard.

The global automotive night vision system market is projected to grow due to increasing demand for advanced driver-assistance systems (ADAS), growing adoption of luxury and premium vehicles, and expansion of automotive electronics and smart vehicle systems.

According to a study, the global automotive night vision system market size was around USD 4.05 billion in 2024 and is expected to reach USD 9.14 billion by 2034.

The CAGR value of the automotive night vision system market is expected to be around 10.70% during 2025-2034.

The value chain of the global Automotive Night Vision System industry includes R&D and technology development, component manufacturing (cameras, sensors, displays), system integration by OEMs, vehicle assembly, distribution and sales, after-sales service and maintenance.

Europe is expected to lead the global automotive night vision system market during the forecast period.

The key players profiled in the global automotive night vision system market include Bosch, Denso, FLIR Systems, Valeo, Continental AG, Autoliv, Hyundai Mobis, Panasonic, Nissan Motor Co., Ltd., ZF Friedrichshafen AG, Magna International Inc., Gentex Corporation, Aptiv PLC, Takata Corporation, and Texas Instruments.

The competitive landscape of the automotive night vision system market is dominated by key OEMs and technology providers, which are focusing on strategic partnerships, innovation, and regional expansion to gain market share.

Investment and partnership opportunities in the automotive night vision system market include collaborations between OEMs, sensor/camera manufacturers, and tech firms to develop cost-effective, advanced, and integrated night vision solutions.

The report examines key aspects of the automotive night vision system market, including a detailed analysis of current growth factors and restraints, as well as future growth opportunities and challenges.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed