Global Automotive Finance Market Size, Share, Growth Analysis Report - Forecast 2034

Automotive Finance Market By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Provider Type (Banks, OEMs, Credit Unions, Financial Institutions), By Purpose (Lease, Loan), By Finance Type (Direct, Indirect), By End-user (Personal, Commercial), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

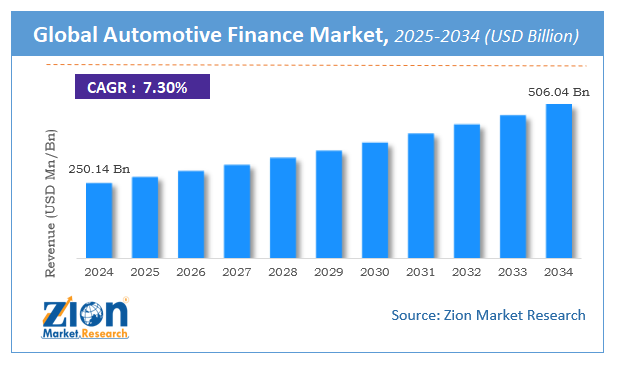

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 250.14 Billion | USD 506.04 Billion | 7.3% | 2024 |

Automotive Finance Industry Perspective:

The global automotive finance market size was worth around USD 250.14 Billion in 2024 and is predicted to grow to around USD 506.04 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.3% between 2025 and 2034. The report analyzes the global automotive finance market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the automotive finance industry.

The report analyzes the global automotive finance market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the automotive finance market.

Automotive Finance Market:

Automotive finance refers to the act or services that allow consumers to purchase automotive vehicles without having to pay the entire amount of the vehicle in one payment also known as outright payment. These services are inclusive of leases, loans, sales contracts, and retail installments. Automotive financing can be achieved from different types of service lending financial units including finance companies, and banks along with any service-rendering or captive finance companies that have an existing association with the vehicle manufacturer.

Furthermore, the global market size is also made of different types of insurance products like gap insurance and extended warranties which assist in preventing the buyer from any financial loss in case of loss of a vehicle or various types of physical damage. The global sales volume is highly dependent on various social and economic factors that reflect the state of the nation along with the overall demand for automobiles and the confidence found in the consumer. However, the automotive industry remains a significant contributor and without the growth in this segment, the demand for automotive financing is likely to be negatively impacted.

Key Insights

- As per the analysis shared by our research analyst, the global automotive finance market is estimated to grow annually at a CAGR of around 7.3% over the forecast period (2025-2034).

- Regarding revenue, the global automotive finance market size was valued at around USD 250.14 Billion in 2024 and is projected to reach USD 506.04 Billion by 2034.

- The automotive finance market is projected to grow at a significant rate due to increasing vehicle ownership, rising disposable income, availability of flexible loan and lease options, and the expansion of digital lending platforms.

- Based on Vehicle Type, the Passenger Vehicles segment is expected to lead the global market.

- On the basis of Provider Type, the Banks segment is growing at a high rate and will continue to dominate the global market.

- Based on the Purpose, the Lease segment is projected to swipe the largest market share.

- By Finance Type, the Direct segment is expected to dominate the global market.

- In terms of End-user, the Personal segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Automotive Finance Market: Growth Drivers

Growth in vehicle sales to propel market demand

The global automotive finance market is projected to grow owing to the rise in the number of sales in the automotive industry which is currently one of the largest growth propellers as automotive financing is highly dependent on how well the automotive industry is performing. As the demand for different types of automobiles will increase in the coming years, the global market is expected to follow the same trend.

Some of the major reasons why the automotive industry is booming include the growing income amongst consumers allowing them to spend on passenger vehicles, Furthermore, the players operating in the automotive industry have started manufacturing vehicles across the price range. Consumers have a variety of options to choose from since there is a presence of vehicles that fit across the price board. In addition to this, the growth in the electric vehicles (EVs) segment, which has spread to 2-wheelers and 3-wheeler sub-segments, with the 4-wheelers dominating the EVs sector, companies offering automotive financing has reached new heights in the last few years.

This is further encouraged by the growing collaboration between vehicle manufacturers and captive finance offering businesses. Since most of the finances are highly lucrative and beneficial to the consumer, they are likely to be more attracted to undertaking these services.

Automotive Finance Market: Restraints

Economic slowdown to restrict market expansion

The automotive finance industry is expected to face certain growth roadblocks and one of the greatest resistance can come from the overall economic slowdown which is already visible across many parts of the world. As per analysts, the global economies are very close to an oncoming recession period, the impact of which has started appearing in terms of various large-scale companies like Google and Microsoft laying off thousands of employees. This directly impacts the consumer’s confidence in purchasing vehicles or undertaking any financial services to buy a vehicle which many modern-age consumers consider a liability in the long term.

Automotive Finance Market: Opportunities

Growing economies to hold excellent growth opportunities

The global automotive finance market is expected to register the highest growth opportunities in the growing or upcoming economies, especially regions in Asia-Pacific and Africa. These areas are registering rapid growth with the increase in double-income families, overall improving employment rate, and rising standard of living.

The global automotive finance market players are expected to capitalize on the opportunities offered by the booming economies as they are currently in the best growth phase, especially for automotive manufacturing companies. Along with this, the world is registering a shift in focus directed toward more sustainable growth which is caused by an increase in fuel prices and rising awareness leading to more people opting for EVs.

Automotive Finance Market: Challenges

Fluctuating interest rate to challenge market growth

The automotive finance industry’s main factor is the interest rate it offers to consumers. Any change in the interest rate can lead to a substantial loss of consumers or impact the overall growth of the company offering the service. Hence it is important to always maintain a balance when deciding the interest rate since it should be beneficial to the company and the consumers.

Since the interest rate is highly volatile, the constantly fluctuating rate is a major challenge that can impact global market development. In case the number increases, the consumers are bound to lose interest causing a decrease in demand.

Automotive Finance Market: Segmentation

The global automotive finance market is segmented based on provider type, vehicle type, finance, and region

Based on type, the global market is segmented into OEMs, banks, and others

- In 2022, the automotive finance industry witnessed the highest growth in the banks segment which dominated almost 57.1% of the global market revenue

- The segmental growth was propelled by the speed at which the services are processed and the higher confidence that consumers have in banking institutions

- Furthermore, banks leveraged consumer trust by ramping up their services in terms of less documentation, providing added assistance, and constant follow-up, eventually becoming highly reliable and consumer-centric

- Initially, banks mostly provided assistance for 70% of the vehicle amount but the number has now reached 100%

Based on vehicle type, the global market is divided into passenger vehicles and commercial vehicles.

Based on finance, the global market is segmented into indirect and direct

- In 2022, the automotive finance industry registered the highest growth in the direct segment which generated almost 55.12% of the global market revenue

- Consumers have more access to information allowing them to access companies offering services that best meet the consumers’ requirement

- Furthermore, consumers now prefer to directly apply for loans instead of opting for external or third-party help since it allows them to eliminate the requirement of paying commissions, which was earlier an extra cost of the end-buyers

- It also offers higher control over the entire leasing or lending process and provides the consumer with more time

Recent Developments:

- In March 2022, Maruti Suzuki, an Indian automobile manufacturer, announced the launch of a new campaign which is called ‘Finance your car from anywhere’. With this launch, the company aimed to spread mass awareness amongst consumers on the benefits of the Smart Finance platform developed by the company which has managed to redefine the modern-age car purchase experience. Since its inception, the platform has dispersed more than INR 15,000 crore worth of loan amount

- In December 2022, Honda Cars India announced its collaboration with the Indian Bank. The latter will now provide financial assistance or loans to the consumers. This partnership is expected to ease the process of a loan while offering reasonable and affordable interest rates along with flexible policies, and special offers under a highly simplified process

Automotive Finance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Finance Market |

| Market Size in 2024 | USD 250.14 Billion |

| Market Forecast in 2034 | USD 506.04 Billion |

| Growth Rate | CAGR of 7.3% |

| Number of Pages | 204 |

| Key Companies Covered | Chase Auto Finance, Volkswagen Financial Services, Ally Financial, Daimler Financial Services, GM Financial Inc, Bank of America, Toyota Financial Services, Hitachi Capital, Ford Motor Credit Company, and Capital One., and others. |

| Segments Covered | By Vehicle Type, By Provider Type, By Purpose, By Finance Type, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Finance Market

North America to lead with the highest market share

The global automotive finance market registered the highest growth in North America in the previous years and could be a significant contributor during the forecast period. The US and Canada are the major revenue-generating economies in the region. The factors that positively influence regional growth are the large population that purchases vehicles and requires the help of financial assistance.

Furthermore, strong economic growth along with an already well-developed and strong automotive industry are also important factors determining the high influence of the region. Large financial institutions were the largest contributors to the expansion in the US country because they offered better and improved services along with a range of options to choose from.

The global market may also register significant growth in Asia-Pacific and Europe during the forecast period due to several positive factors. It is necessary that the companies operating in the segment are aware of what are the challenges that lie in each market along with the growth opportunities.

Automotive Finance Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the automotive finance market on a global and regional basis.

The global automotive finance market is dominated by players like:

- Chase Auto Finance

- Volkswagen Financial Services

- Ally Financial

- Daimler Financial Services

- GM Financial Inc

- Bank of America

- Toyota Financial Services

- Hitachi Capital

- Ford Motor Credit Company

- and Capital One.

The global automotive finance market is segmented as follows;

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Provider Type

- Banks

- OEMs

- Credit Unions

- Financial Institutions

By Purpose

- Lease

- Loan

By Finance Type

- Direct

- Indirect

By End-user

- Personal

- Commercial

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive finance refers to the act or services that allow consumers to purchase automotive vehicles without having to pay the entire amount of the vehicle in one payment also known as outright payment.

The global automotive finance market is expected to grow due to increasing vehicle ownership, rising disposable income, availability of flexible loan and lease options, and the expansion of digital lending platforms.

According to a study, the global automotive finance market size was worth around USD 250.14 Billion in 2024 and is expected to reach USD 506.04 Billion by 2034.

The global automotive finance market is expected to grow at a CAGR of 7.3% during the forecast period.

North America is expected to dominate the automotive finance market over the forecast period.

Leading players in the global automotive finance market include Chase Auto Finance, Volkswagen Financial Services, Ally Financial, Daimler Financial Services, GM Financial Inc, Bank of America, Toyota Financial Services, Hitachi Capital, Ford Motor Credit Company, and Capital One., among others.

The report explores crucial aspects of the automotive finance market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed