Authentication and Brand Protection Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

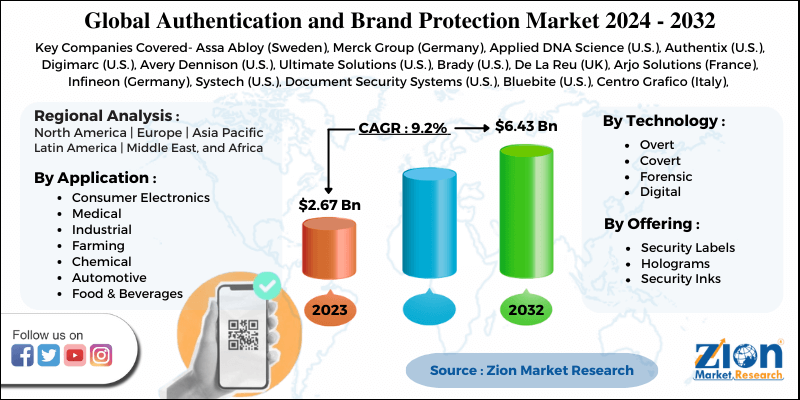

Authentication and Brand Protection Market Size - By Technology (Overt, Digital, Forensic, and Covert), By Offering (Security Labels, Holograms, and Security Inks), By Application (Automotive, Consumer Electronics, Medical, Industrial, Farming, Chemical, and Food & Beverages) And By Region- Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

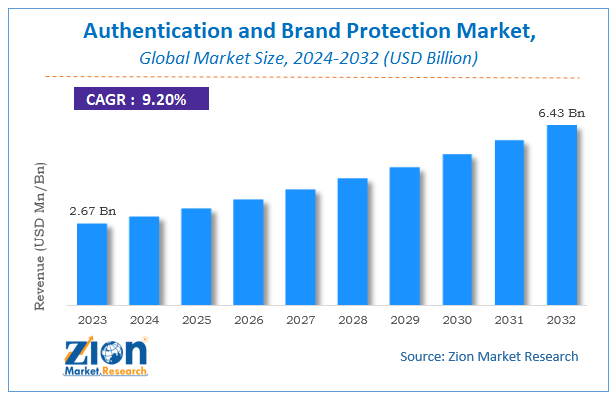

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.67 Billion | USD 6.43 Billion | 9.2% | 2023 |

Authentication and Brand Protection Market Insights

According to Zion Market Research, the global Authentication and Brand Protection Market was worth USD 2.67 Billion in 2023. The market is forecast to reach USD 6.43 Billion by 2032, growing at a compound annual growth rate (CAGR) of 9.2% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Authentication and Brand Protection Market industry over the next decade.

The report offers an assessment and analysis of the Authentication and Brand Protection market on a global and regional level. The study offers a comprehensive assessment of the market competition, constraints, revenue estimates, opportunities, evolving trends, and industry-validated data. The report provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion).

Authentication and Brand Protection Market: Overview

With the rise in multichannel retail shops, authentication, as well as the protection of brands, has become a key concern and this has led to the growing demand for authentication & security tools. This has enhanced the popularity of authentication & brand protection events across the globe. In addition to this, the increase in Cyber Security threats during the COVID pandemic has forced firms to allocate large amounts of funds to budgets for creating secured firewalls and strong software authentication software tools to protect the brand image.

Apart from this, the need for 2-factor authentication as well as background checks of the staff having access to key assets of the organizations due to identity thefts has translated into massive market demand in recent years. With the surge in counterfeit items and the need for protecting the copyrights of the content of the firms, it has become necessary for the firms to have secured authentication & brand protection software tools to be deployed on their premises. This, in turn, will result in a massive growth of authentication and brand protection businesses across the globe.

Authentication and Brand Protection Market: Growth Dynamics

High focus by organizations on maintaining brand integrity, ensuring product security, and retaining brand equity will steer the market size over the forecast timespan. In addition to this, strict enforcement of anti-counterfeiting legislation will embellish the business trends. Apparently, the thriving manufacturing sector will create lucrative growth avenues for the authentication and brand protection industry over the assessment period. With a large number of organizations implementing authentication & brand protection strategies like holograms, anti-counterfeiting labels, and tamper seals, the market is likely witness accelerated growth over the forecast timespan.

Furthermore, the increase in urbanization and Omnichannel retailing activities across the globe has resulted in a humungous market surge over the assessment period. The need for maintaining data integrity has resulted into a massive market surge in recent years. The large-scale use of RFID tools has culminated in large market penetration across the globe. However, a lack of data integration resulting in data loss along with equipment failure will obstruct the increment in the market expansion over the assessment period.

Authentication and Brand Protection Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Authentication and Brand Protection Market |

| Market Size in 2023 | USD 2.67 Billion |

| Market Forecast in 2032 | USD 6.43 Billion |

| Growth Rate | CAGR of 9.2% |

| Number of Pages | 130 |

| Key Companies Covered | Assa Abloy (Sweden), Merck Group (Germany), Applied DNA Science (U.S.), Authentix (U.S.), Digimarc (U.S.), Avery Dennison (U.S.), Ultimate Solutions (U.S.), Brady (U.S.), De La Reu (UK), Arjo Solutions (France), Infineon (Germany), Systech (U.S.), Document Security Systems (U.S.), Bluebite (U.S.), Centro Grafico (Italy), Sunchemicals (U.S.), Wisekey (Switzerland), Authentic Vision (Australia), Alpvision (Switzerland), CILS International (England), Advanced Labels (U.S.), Nosco (U.S.), Qlik Tag (U.S.), Visualead (Isreal), and Unica (Switzerland) |

| Segments Covered | By Technology, By Offering , By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Authentication and Brand Protection Market: Regional Insights

Asia Pacific To Account For Major Market Share Over 2024 – 2032

The growth of the authentication and brand protection industry in the Asia Pacific zone over a projected period can be credited to the rise in the number of industrial unit establishments in the sub-continent. Apart from this, thriving farming, vehicle manufacturing, fabric, pharmaceutical, consumer goods, and footwear sectors in the region will further create a need for authenticating & brand protecting software tools, thereby driving the regional market penetration in the region. The regional industry landscape will be further influenced by the rapid expansion of cloud computing and blockchain technologies. The rise in use of the authenticating tools by various reputed firms in the Asia Pacific has paved a way for the growth of the business in the sub-continent.

Authentication and Brand Protection Market: Competitive Landscape

Key players leveraging the market growth include

- Assa Abloy (Sweden)

- Merck Group (Germany)

- Applied DNA Science (U.S.)

- Authentix (U.S.)

- Digimarc (U.S.)

- Avery Dennison (U.S.)

- Ultimate Solutions (U.S.)

- Brady (U.S.)

- De La Reu (UK)

- Arjo Solutions (France)

- Infineon (Germany)

- Systech (U.S.)

- Document Security Systems (U.S.)

- Bluebite (U.S.)

- Centro Grafico (Italy)

- Sunchemicals (U.S.)

- Wisekey (Switzerland)

- Authentic Vision (Australia)

- AlpVision (Switzerland)

- CILS International (England)

- Advanced Labels (U.S.)

- Nosco (U.S.)

- Qlik Tag (U.S.)

- Visualead (Isreal)

- Unica (Switzerland).

The global Authentication and Brand Protection Market is segmented as follows:

By Application

- Consumer Electronics

- Medical

- Industrial

- Farming

- Chemical

- Automotive

- Food & Beverages

By Technology

- Overt

- Covert

- Forensic

- Digital

By Offering

- Security Labels

- Holograms

- Security Inks

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

High focus by firms on maintaining brand equity & brand value, ensuring product security, and retaining brand image will steer the industry size over forecast timeframe. Apart from this, strict enforcement of anti-counterfeiting legislations will embellish the business trends.

According to Zion market research report, the global Authentication and Brand Protection Market was worth USD 2.67 Billion in 2023. The market is forecast to reach USD 6.43 Billion by 2032, growing at a compound annual growth rate (CAGR) of 9.2% during the forecast period 2024-2032.

Asia Pacific will contribute lucratively towards the global market size over the estimated timeline. The regional market surge is owing to rise in the number of industrial unit establishments in the sub-continent. Apart from this, thriving farming, vehicle manufacturing, fabric, pharmaceutical, consumer goods, and footwear sectors in the region will further create a need for authenticating & brand protecting software tool, thereby driving the regional market penetration in the region.

The key market participants include Assa Abloy (Sweden), Merck Group (Germany), Applied DNA Science (U.S.), Authentix (U.S.), Digimarc (U.S.), Avery Dennison (U.S.), Ultimate Solutions (U.S.), Brady (U.S.), De La Reu (UK), Arjo Solutions (France), Infineon (Germany), Systech (U.S.), Document Security Systems (U.S.), Bluebite (U.S.), Centro Grafico (Italy), Sunchemicals (U.S.), Wisekey (Switzerland), Authentic Vision (Australia), Alpvision (Switzerland), CILS International (England), Advanced Labels (U.S.), Nosco (U.S.), Qlik Tag (U.S.), Visualead (Isreal), and Unica (Switzerland).

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed