Asset Backed Securities Market Size, Share, Value, Forecast 2034

Asset Backed Securities Market By Maturity (Short-Term [less than 1 year], Medium-Term [1 to 5 years], Long-Term [more than 5 years]), By Credit Rating (AAA, AA, A, BBB, BB, B, CCC, CC, C, D), By Security Structure (Pass-Through Securities, Collateralized Mortgage Obligations [CMOs], Collateralized Debt Obligations [CDOs], Structured Investment Vehicles [SIVs], Asset-Backed Commercial Paper [ABCP]), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

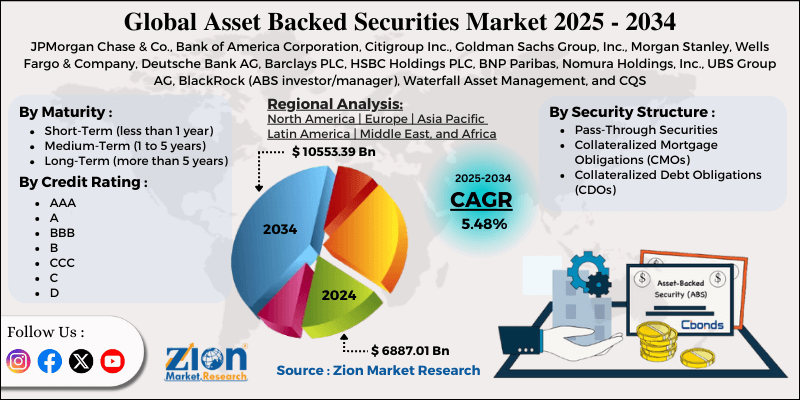

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6887.01 Billion | USD 10553.39 Billion | 5.48% | 2024 |

Asset Backed Securities Industry Prospective

The global asset backed securities market size was worth around USD 6887.01 billion in 2024 and is predicted to grow to around USD 10553.39 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.48% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global asset backed securities market is estimated to grow annually at a CAGR of around 5.48% over the forecast period (2025-2034)

- In terms of revenue, the global asset backed securities market size was valued at around USD 6887.01 billion in 2024 and is projected to reach USD 10553.39 billion by 2034.

- The asset backed securities market is projected to grow significantly owing to increased securitization of non-performing assets, regulatory reforms promoting structured finance, and rising demand for alternative investment instruments.

- Based on maturity, the medium-term (1 to 5 years) segment is expected to lead the market, while the long-term (more than 5 years) segment is expected to grow considerably.

- Based on credit rating, the AAA segment is the dominating segment, while the AA segment is projected to witness sizeable revenue over the forecast period.

- Based on the security structure, the pass-through securities segment is expected to lead the market compared to the Collateralized Debt Obligations (CDOs)segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Asset Backed Securities Market: Overview

Asset-backed securities are financial instruments created by pooling income-generating assets, such as student loans, auto loans, or leases, and selling the resulting cash flows to investors. These securities allow lenders to convert illiquid assets into tradable investments, providing liquidity, while investors receive returns based on payments made on the underlying assets. The global asset backed securities market is likely to expand rapidly, fueled by the growing consumer and commercial credit demand, liquidity, and capital relief for originators, and investor demand for yield and diversification. Surging demand for business and consumer loans boosts the volume of receivables available for securitization. This directly supports high ABS issuance. Expanding credit markets strengthen the total ABS infrastructure. Moreover, ABS allows lenders to convert illiquid assets into immediate funding. This enhances balance-sheet efficacy and frees regulatory capital. Hence. Originators can increase lending activities. Furthermore, investors seek ABS for stable cash flows away from conventional bonds. This sustained demand backs market expansion.

Despite growth, the global market is constrained by factors such as credit and default risks, structural complexity, and macroeconomic uncertainty. ABS performance depends on borrower repayment behavior. Growing defaults can decrease cash flows to investors. This raises perceived risk during economic stress. ABS transactions involve cash flow and complex legal structures. Investors need advanced modeling expertise. Complexity may restrict participation from small investors. Likewise, economic downturns increase delinquencies and decrease borrowing. Interest-rate volatility affects performance and valuation. This may hamper issuance volume. Nonetheless, the global asset backed securities industry stands to gain from a few key opportunities, like the growth of digital lending, emerging asset classes, and the growth of Green ABS and ESG.

Online lending platforms generate scalable loan portfolios. These assets are ideal for securitization. Fintech growth increases ABS supply. New receivables, such as solar leases and EV loans, offer diversification. These assets appeal to specialized investors. They support innovation-led industry growth. Sustainable investing augments demand for green ABS. Assets tied to clean energy and social affect gain prominence. ESG alignment increases investor appeal.

Asset Backed Securities Market Dynamics

Growth Drivers

How does the institutional demand for yield in low‑yield environments boost the asset backed securities market?

Institutional investors, such as pension funds, asset managers, and insurance companies, are increasingly turning to ABS for attractive yield spreads relative to conventional fixed-income instruments. With government bond yields compressed in several leading economies, ABS products offer improved returns while carrying varied risk profiles that can be tailored to investment mandates. This persistent search for yield keeps demand strong, even as macroeconomic volatility impacts other credit markets. Hence, ABS remains a go-to vehicle for institutional yield-enhancement tactics.

How are technological improvements and digital securitization notably fueling the asset backed securities market growth?

Improvements in financial technology, including digital platforms and blockchain, are simplifying ABS issuance, secondary-market trading, and settlement by reducing operational frictions and enhancing transparency. Digital securitization enables rapid origination and highly efficient cash-flow tracking, thereby making ABS products more accessible to a broader array of investors worldwide. These tech-driven innovations also support the tokenization of real-world assets, thereby expanding the universe of tradable ABS. As efficiency and traceability enhance, asset backed securities market participation and liquidity are projected to rise.

Restraints

Market liquidity and secondary market limitations hamper the market’s progress

ABS are usually less liquid than conventional bonds, especially in non-standardized or niche asset classes. Limited secondary industry activity may create challenges for trading during periods of stress and lead to price volatility. Investors may demand higher yields to compensate for illiquidity, thereby raising issuers' funding costs. During financial turbulence, liquidity constraints may tighten, reducing the appeal of ABS products. Reduced liquidity may hence limit investor participation and overall market growth.

Opportunities

How is innovation in non-traditional asset classes presenting favorable prospects for the asset backed securities market expansion?

ABS backed by non-traditional assets like intellectual property, royalties, renewable energy projects, and subscription revenues is gaining popularity. These esoteric ABS structures offer distinguished risk-return profiles and appeal to specialized investors. These innovation enables issuers to monetize niche or illiquid cash flows. Expanding the spectrum of scrutinized assets improves the appeal and resilience of the asset backed securities industry. This diversification represents a major opportunity for investor engagement and product innovation.

Challenges

High operational and structuring costs restrict the market growth

Issuing, designing, and managing ABS deals comprises major legal, advisory, and accounting costs. Complex structures with multiple tranches, risk mitigation, and credit enhancements further raise expenses. Elevated operational costs can make small deals economically challenging, restricting industry participation. Moreover, these costs may be passed on to investors through lower yields. Maintaining cost-effectiveness while ensuring strong structuring is a key challenge for the industry.

Asset Backed Securities Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Asset Backed Securities Market Research Report |

| Market Size in 2024 | USD 6887.01 Billion |

| Market Forecast in 2034 | USD 10553.39 Billion |

| Growth Rate | CAGR of 5.48% |

| Number of Pages | 220 |

| Key Companies Covered | JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., Goldman Sachs Group, Inc., Morgan Stanley, Wells Fargo & Company, Deutsche Bank AG, Barclays PLC, HSBC Holdings PLC, BNP Paribas, Nomura Holdings, Inc., UBS Group AG, BlackRock (ABS investor/manager), Waterfall Asset Management, and CQS |

| Segments Covered | By Maturity, By Credit Rating, By Security Structure And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Asset Backed Securities Market: Segmentation

The global asset backed securities market is segmented based on maturity, credit rating, security structure, and region.

Based on maturity, the global asset backed securities industry is divided into short-term (less than 1 year), medium-term (1 to 5 years), and long-term (more than 5 years). The medium-term (1 to 5 years) segment registers a dominating share (68-70%). This is backed by the highest maturity for the majority of ABS in this range, which balances investor risk and cash-flow predictability.

On the other hand, the long-term (more than 5 years) segment holds a second-leading market share (nearly 25-30%). This growth is fueled due to lower issuance volumes and limited investor appetite for short maturities.

Based on credit rating, the global asset backed securities market is segmented into AAA, AA, A, BBB, BB, B, CCC, CC, C, and D. The AAA-rated segment registers a leading market share, with nearly 50-60%. A majority of ABS are structured with credit enhancements to achieve the maximum rating for senior tranches.

Conversely, the AA-rated segment holds second place at 20-25%, denoting slightly lower-risk-adjusted tranches that still appeal to conservative institutional investors.

Based on security structure, the global market is segmented into Pass-Through Securities, Collateralized Mortgage Obligations (CMOs), Collateralized Debt Obligations (CDOs), Structured Investment Vehicles (SIVs), and Asset-Backed Commercial Paper (ABCP). The pass-through securities segment holds approximately 45-50% market leadership. This growth is supported by their simple structure, in which cash flows from underlying assets are passed directly to investors, making them predictable and transparent.

Nonetheless, the Collateralized Debt Obligations (CDOs) segment ranks second, with 20-25%. They offer pooled debt with tranches of varying risk and return profiles, appealing to investors seeking tailored exposure and higher yields.

Asset Backed Securities Market: Regional Analysis

What gives North America a competitive edge in the global Asset Backed Securities Market?

North America is anticipated to retain its leading role in the global asset backed securities market, with a 6.8% CAGR. This dominance is fueled by a sophisticated financial and regulatory infrastructure, deep capital markets, and technological and analytical advancements. The region benefits from a well-developed securitization framework with transparent legal systems and investor protections. Regulatory oversight and standardized disclosure improve market stability and confidence. This mature infrastructure encourages issuers and investors to actively participate in the ABS markets. Moreover, North America has well-developed capital markets with a large institutional investor base, comprising insurance companies, asset managers, and pension funds.

The active secondary market efficiently trades ABS instruments and provides liquidity. Strong institutional engagement supports sustained growth and industry resilience. Advanced credit scoring, risk modeling, and data analytics enhance asset monitoring and evaluation. These technologies reduce investment uncertainty and increase transparency. Enhances the appeal of analytics to mature investors and facilitates more complex, larger ABS structures.

Europe ranks as the second-leading region in the global asset backed securities industry, with a 7.5% CAGR. This growth is supported by the industry's significant size and issuance, a regulatory framework and investor protection, and well-developed capital markets. Europe holds a leading share of global ABS issuance, with robust activity in auto loan and mortgage-backed securities. Economies like Germany, the UK, and France account for the largest issuance volumes. This steady issuance maintains Europe’s rank as the second-leading ABS industry worldwide. The European ABS market benefits from common guidelines, such as the EU Securitization Regulation, which ensure risk disclosure and transparency.

Clear rules and investor safeguards improve confidence in ABS investments. This regulatory sophistication backs stable industry growth. Additionally, Europe has well-established capital markets with active participation by institutional investors, including insurance companies, banks, and pension funds. Sufficient liquidity in secondary markets allows efficient trading of ABS. These factors raise investor trust and long-term industry stability.

Asset Backed Securities Market: Competitive Analysis

The leading players in the global asset backed securities market are

- JPMorgan Chase & Co

- Bank of America Corporation

- Citigroup Inc

- Goldman Sachs Group Inc

- Morgan Stanley

- Wells Fargo & Company

- Deutsche Bank AG

- Barclays PLC

- HSBC Holdings PLC

- BNP Paribas

- Nomura Holdings Inc

- UBS Group AG

- BlackRock (ABS investor/manager)

- Waterfall Asset Management

- CQS

Asset Backed Securities Market: Key Market Trends

Growth of green and ESG‑linked ABS:

Issuance of ESG-linked and green ABS is growing as investors progressively seek sustainable investment options. These securities are backed by socially impactful or environmentally friendly assets, such as energy-efficient mortgages or energy loans. This trend widens the investor base and aligns ABS with global sustainability objectives.

Increased role of fintech and alternative lending originations:

Digital lending and fintech platforms continue to supply securitizable loan portfolios, increasing the ABS supply beyond conventional bank originations. These substitute sources contribute to broader asset diversification and meet demand for structured products. Their participation also fosters innovation in structuring and credit assessment.

The global asset backed securities market is segmented as follows:

By Maturity

- Short-Term (less than 1 year)

- Medium-Term (1 to 5 years)

- Long-Term (more than 5 years)

By Credit Rating

- AAA

- AA

- A

- BBB

- BB

- B

- CCC

- CC

- C

- D

By Security Structure

- Pass-Through Securities

- Collateralized Mortgage Obligations (CMOs)

- Collateralized Debt Obligations (CDOs)

- Structured Investment Vehicles (SIVs)

- Asset-Backed Commercial Paper (ABCP)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed