Pension Fund Management Software Market Size & Share Report 2034

Pension Fund Management Software Market By Component (Software and Services), By Application (Android, Web-based, and iPhone), By Deployment Mode (Cloud, Hybrid, and On-Premise), By Functionality (Contribution Tracking, Benefit Calculation, Compliance & Reporting, Member Self-Service), By Enterprise Size (Small & Medium-sized firms and Large firms), By End-User (Banking, Credit Unions, and Financial Institutions), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2025 - 2034

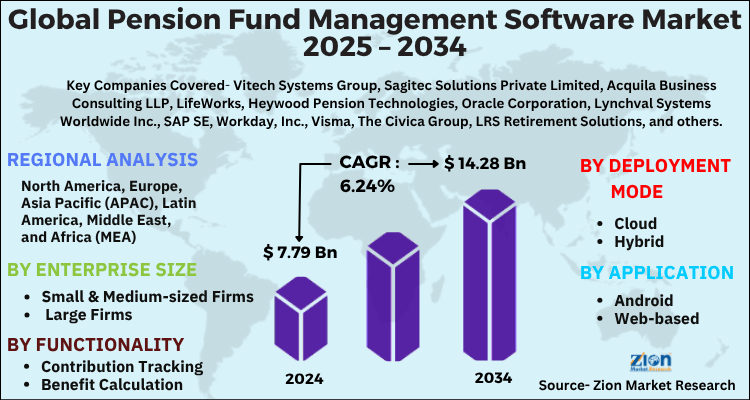

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.79 Billion | USD 14.28 Billion | 6.24% | 2024 |

Pension Fund Management Software Market: Industry Perspective

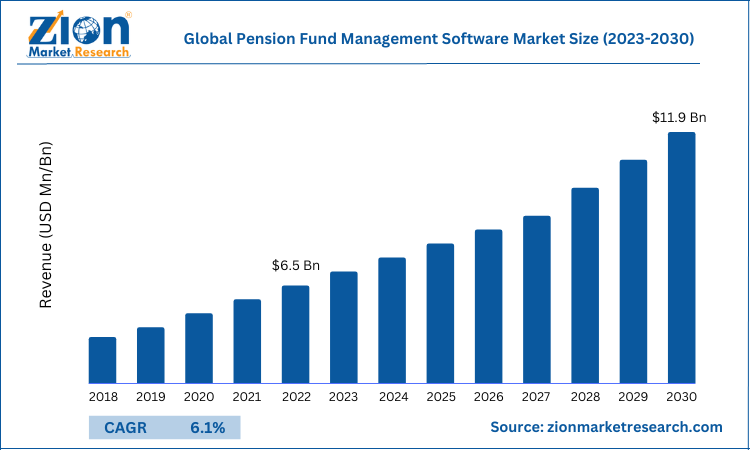

The global pension fund management software market size was worth around USD 7.79 Billion in 2024 and is predicted to grow to around USD 14.28 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.24% between 2025 and 2034. The report analyzes the global pension fund management software market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the pension fund management software industry.

Pension Fund Management Software Market: Overview

A pension fund management software is a completely integrated system that is designed for delivering upgraded asset, liability, and risk information on a regular basis. It helps the end-users in gaining in-depth management information in terms of pension and assists them in running their direct benefit pension scheme proficiently. Citing an instance, Asset Liability Suite, a powerful, web-based, and modular pension fund management software tool, provides end-users with upgraded asset & liability data daily. Moreover, the software has proven as an effective planning and decision-making tool for end-users who are under the growing pressure of minimizing the costs & risks of their defined benefit pension arrangements.

Key Insights

- As per the analysis shared by our research analyst, the global pension fund management software market is estimated to grow annually at a CAGR of around 6.24% over the forecast period (2025-2034).

- Regarding revenue, the global pension fund management software market size was valued at around USD 7.79 billion in 2024 and is projected to reach USD 14.28 billion by 2034.

- The pension fund management software market is projected to grow at a significant rate due to the rising need for real-time portfolio monitoring, regulatory compliance, and the digital transformation of financial services.

- In terms of application, the web-based segment is set to contribute lucratively towards the overall market revenue during the predicted timespan.

- Based on deployment mode, the cloud segment contributed to a major share of the global market in 2024

- On the basis of enterprise size, the large firms segment is growing at a high rate and is projected to dominate the global market.

- Based on end-user, the banking segment contributed to a major share of the global market in 2024

- Region-wise, the North American region is projected to be the key regional revenue driver of the global market during the forecast period.

Pension Fund Management Software Market: Growth Drivers

Massive penetration of cloud technology in the software development sector to accentuate the global market surge

Growing requirements for less workload, adaptation to online banking tools, less workforce needs, and low maintenance costs have boosted the growth of the global pension fund management software market. Furthermore, compliance with pension fund management software and adherence to software-compliant laws will boost the global market trends. The large-scale use of cloud technology in the software development sector will further enlarge the scope of the pension fund management software market across the globe. For instance, cloud hosting is used in pension administrative activities and service-level agreements. Moreover, it also eliminates the operating costs and risk management of software solutions. In addition, the product works on different operating systems of computers, including Windows and Mac.

Furthermore, the software provides real-time fund management analytics and offers precise and up-to-date information to the end users. Apart from this, it offers a seamless experience to the consumers. Escalating demand for proficient resource management tools to scale up the market space. All these aforementioned aspects will promote the growth of the global market. With the onset of the Industry 4.0 revolution, the market for pension fund management software is projected to gain traction in the years ahead.

Pension Fund Management Software Market: Hindrances

Oscillations in the government policies pertaining to pension funds to hinder the global industry expansion

Fluctuations in the pension fund policies and easy availability of substitute software products can hamper the expansion of the global pension fund management software industry.

Pension Fund Management Software Market: Opportunities

Rise in investment in software-automated products to open new vistas of growth for the global market

Surge in the allocation of funds for software automation and the launching of new products & growing use of smart sensor-embedded software products will create new growth avenues for the global market. Apart from this, massive penetration of AI, machine learning, metaverse, web 3.0, and cloud computing solutions will help the market explore new facets of growth in the forecasting years.

Pension Fund Management Software Market: Challenges

Surging data security concerns to pose a big challenge to the growth of global market

Growing data security concerns along with the integration of the product with various operating models can pose a huge challenge to the growth of the global market.

Pension Fund Management Software Market: Segmentation

The global pension fund management software market is sectored into component, application, deployment mode, functionality, enterprise size, end-user, and region.

In terms of components, the global pension fund management software market is divided into software and services.

On the basis of application, the global pension fund management software market is segmented into Android, web-based, and iPhone segments. Furthermore, the web-based segment, which contributed majorly towards the global market share in 2024, is projected to lead the segmental surge over 2025-2034. The segmental expansion over the forecast timespan can be due to a rise in the penetration of the internet across nooks and corners of the globe and even in remote regions. Moreover, online banking & other financial activities post-COVID-19 have increased and this has made web-based applications more popular globally. Furthermore, strong security & firewalls provided to these web-based applications will further boost the segmental growth in the upcoming years.

In terms of deployment mode, the global pension fund management software industry is divided into cloud, hybrid, and on-premise segments. Moreover, the cloud segment is set to record the fastest CAGR during the assessment timeline. The segmental expansion can be due to the increasing global presence of firms manufacturing cloud-based pension fund management software, along with upgrading their technologies to assist firms in seamlessly managing their large data set.

By functionality, the global pension fund management software market is split into contribution tracking, benefit calculation, compliance & reporting, and member self-service.

Based on the enterprise size, the global pension fund management software market is divided into small & medium-sized firms and large firms segments. Moreover, the large firms segment is predicted to contribute majorly towards the global market share over the forecast timeline, with giant software manufacturers adding new features to their products to help large firms continuously handle their big data.

Based on the end-user, the global pension fund management software market is sectored into banking, credit unions, and financial institutions segments. Furthermore, the banking segment, which accounted for the largest share of the global pension fund management software market in 2024, is likely to establish a dominant position even during the anticipated timespan. The segmental expansion will be attributed to a rise in the demand for pension fund management software in various private banks, with the rise in online banking activities.

Recent Developments

- In the second half of 2022, Milliman, a global actuarial and consulting company based in the U.S., launched Milliman Agile ALM, a new software package that makes asset & liability management as well as stochastic valuation, easily accessible to insurers. Apart from this, it helps insurers make quick business decisions along with fulfilling the reporting needs of the business. Moreover, the move will provide impetus to demand and growth of the pension fund management software market in the U.S. and across the North American sub-continent.

- In the third quarter of 2022, Smart, a key UK-based provider of retirement, savings, and investment technology across the globe, introduced a new technology tool, Keystone by Smart and has thus brought a paradigm shift in the $62 trillion retirement savings industry across the globe. Reportedly, the new tech tool will enable government and financial institutions to create workplace pension schemes for a large number of retired persons who want to save their earnings. The initiative will enhance the scope and demand for pension fund management software in the banking and financial sector in the UK.

Pension Fund Management Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pension Fund Management Software Market |

| Market Size in 2024 | USD 7.79 Billion |

| Market Forecast in 2034 | USD 14.28 Billion |

| Growth Rate | CAGR of 6.24% |

| Number of Pages | 215 |

| Key Companies Covered | Vitech Systems Group, Sagitec Solutions Private Limited, Acquila Business Consulting LLP, LifeWorks, Heywood Pension Technologies, Oracle Corporation, Lynchval Systems Worldwide Inc., SAP SE, Workday, Inc., Visma, The Civica Group, LRS Retirement Solutions, and others. |

| Segments Covered | By Component, By Application, By Deployment Mode, By Functionality, By Enterprise Size, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pension Fund Management Software Market: Regional Insights

North America Pension Fund Management Software Market To Retain Its Dominance Status During the Forecast Period

The Pension Fund Management Software market in North America is predicted to continue its domination even in the coming decade. The growth of the regional market from 2025 to 2034 can be attributed to the launch of the publicly funded Canada Pension Plan and the U.S. Social Security Programs, which provide benefits to older individuals who can receive support from these pension schemes. For the record, the U.S. government launched the Pension Protection Act in 2006 and thereafter, the use of automated software, such as pension fund management software, enabling pension fund management activities increased in the country.

Pension Fund Management Software Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the pension fund management software market on a global and regional basis.

The global pension fund management software market is dominated by players like:

- Vitech Systems Group

- Sagitec Solutions Private Limited

- Acquila Business Consulting LLP

- LifeWorks

- Heywood Pension Technologies

- Oracle Corporation

- Lynchval Systems Worldwide Inc.

- SAP SE

- Workday Inc.

- Visma

- The Civica Group

- and LRS Retirement Solutions.

The global pension fund management software market is segmented as follows;

By Component

- Software

- Services

By Application

- Android

- Web-based

- iPhone

By Deployment Mode

- Cloud

- Hybrid

- On-Premise

By Functionality

- Contribution Tracking

- Benefit Calculation

- Compliance & Reporting

- Member Self-Service

By Enterprise Size

- Small & Medium-sized Firms

- Large Firms

By End-User

- Banking

- Credit Unions

- Financial Institutions

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A pension fund management software is a completely integrated system that is designed for delivering upgraded asset, liability, and risk information on a regular basis. It helps the end-users in gaining in-depth management information in terms of pension and assists them in running their direct benefit pension scheme proficiently. Citing an instance, Asset Liability Suite, a powerful, web-based, and modular pension fund management software tool provides end-users with upgraded asset & liability data on daily basis.

The global pension fund management software market is projected to expand over 2023-2030 owing to the large-scale use of cloud technology in the software development sector. Apart from this, the growing requirement for less workload, adaption to online banking tools, less workforce needs, and low maintenance costs all boost the global market proceeds.

According to a study, the global pension fund management software market size was worth around USD 7.79 Billion in 2024 and is expected to reach USD 14.28 Billion by 2034.

The global pension fund management software market is expected to grow at a CAGR of 6.24% during the forecast period.

The North American pension fund management software industry is set to register humungous growth over the upcoming years owing to the launching of the publicly funded Canada Pension Plan and the U.S. Social Security Programs for old-age persons who can get the benefit from these old-age pension schemes.

Leading players in the global pension fund management software market include Vitech Systems Group, Sagitec Solutions Private Limited, Acquila Business Consulting LLP, LifeWorks, Heywood Pension Technologies, Oracle Corporation, Lynchval Systems Worldwide Inc., SAP SE, Workday, Inc., Visma, The Civica Group, and LRS Retirement Solutions., among others.

The report explores crucial aspects of the pension fund management software market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed