Digital Lending Platforms Market Size, Share, Trends, Growth and Forecast 2032

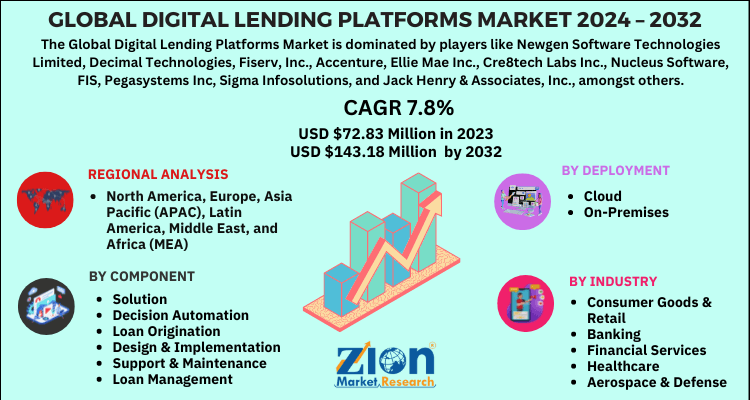

Digital Lending Platforms Market By component (solution, decision automation, services, consulting, loan origination, design & implementation, support & maintenance, loan management, and others), By deployment (cloud and on-premises), By industry (consumer goods & retail, banking, financial services, & insurance (BFSI), healthcare, aerospace & defense, energy & utilities, telecommunication, manufacturing, and others) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

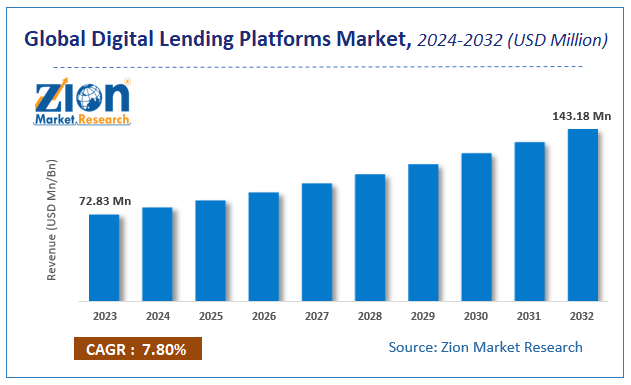

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 72.83 Million | USD 143.18 Million | 7.8% | 2023 |

Description

Global Digital Lending Platforms Market: Insights

According to the report published by Zion Market Research, the global Digital Lending Platforms Market size was valued at USD 72.83 Million in 2023 and is predicted to reach USD 143.18 Million by the end of 2032. The market is expected to grow with a CAGR of 7.8% during the forecast period. The report analyzes the global Digital Lending Platforms Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Digital Lending Platforms industry.

Key Insights:

- As per the analysis shared by our research analyst, the digital lending platforms market is anticipated to grow at a CAGR of 7.8% during the forecast period (2024-2032).

- The global digital lending platforms market was estimated to be worth approximately USD 72.83 billion in 2023 and is projected to reach a value of USD 143.18 billion by 2032.

- The growth of the digital lending platforms market is being driven by rising demand for quick, transparent, and accessible lending solutions.

- Based on the component, the solution segment is growing at a high rate and is projected to dominate the market.

- On the basis of deployment, the cloud segment is projected to swipe the largest market share.

- In terms of industry, the consumer goods & retail segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Global Digital Lending Platforms Market: Overview

Digital lending platforms have revolutionized the financial landscape across the world. Digital lending platforms offer a strong impetus to financial inclusions. Digital lending platforms provide and renew loans using online technology so that quick access to capital can be gained by the business and the individuals. It usually relies on technology entirely to validate business loans as well as implement credit evaluations via digital apps and online platforms. The process of digital lending is similar to the process of face-to-face traditional lending with the major difference of reduction of waiting time as credit and financial statements can be obtained in a few minutes by use of technology.

Global Digital Lending Platforms Market: Growth Factors

The increasing trend of digitalization in financial organizations, the rising number of initiatives undertaken by the government, and an increasing number of smartphone users are some of the major factors spurring the growth of the global digital lending platforms market. Moreover, the rapid adoption of advanced technologies such as blockchain, machine learning, and the artificial intelligence-based digital lending platform is also contributing to the growth of the market. Additionally, digital lending platforms have several benefits including easy capture of applicant's information, optimization of the process of loan underwriting, enables fast decision making, and does not rely on credit scores for disbursing loans.

Moreover, one of the distinct advantages of digital lending is quicker approval of credit, especially, for small-ticket credits. Owing to all these benefits of digital lending platforms, there is an upsurge in the growth of the market. In addition to this, novel business models, lean organizations, and responsive processes are fostering the growth of the market. Furthermore, huge investments by fintech companies will fuel the growth of the market during the forecast period. However, major concerns regarding security and compliances will restrain the growth of the global digital lending platforms market.

Like many other industries, the lending industry also was severely hit by the covid-19 pandemic. It resulted in a global standstill with a drastic dropdown in the economy. This was attributed to the strict rules and regulations enforced by the government. The loan portfolios of NBFCs and banks are facing huge challenges due to disruption in salaries, economy, and businesses ultimately affecting the cash flow. However, with the unfolding of the impact of the pandemic on the lending industry, financial institutes, and banks are expected to observe a spike in non-performing assets ratio and credit costs. The fintech industries are leveraging automation, cloud-based processes, and tech solutions to improve the services and offer e-cards for credit or debit money and end-to-end contactless transactions. Thus, during the post-covid-19 era, the global digital lending platforms market will grow at a significant rate.

Recent Developmentst

- In 2025, Amazon finalized its acquisition of Axio, a Bengaluru-based fintech lender. The deal marks Amazon’s direct entry into the lending market in India.

- In 2024, Indian digital lender Moneyview acquired Jify, an employee benefits startup. The acquisition contributed to Moneyview achieving unicorn status, with an estimated valuation of approximately US$1.2 billion.

- In 2023, Lendingkart acquired Upwards, a digital lending platform, for around ₹100 crore, bolstering its presence in the personal loan segment.

- In 2025, Finwizz Financial Services merged with Wishfin, a digital lending marketplace, to create an omni-channel financial product distribution platform. The newly formed entity is preparing for an IPO within the next 24 months.

- In 2025, Zaggle, a fintech firm specializing in spend management, acquired Rio.Money, a Bengaluru-based startup focused on UPI payments and co-branded consumer credit cards. The acquisition supports Zaggle’s strategic expansion into consumer credit and card services.

- In 2024, Salesforce launched its “Digital Lending for India” platform, customized for the Indian regulatory and operational landscape. The solution incorporates Aadhaar-based identity verification, as well as income, employment, and account validation tools, enabling banks and lenders to accelerate loan origination and consolidate customer data.

Global Digital Lending Platforms Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Digital Lending Platforms Market |

| Market Size in 2023 | USD 72.83 Million |

| Market Forecast in 2032 | USD 143.18 Million |

| Growth Rate | CAGR of 7.8% |

| Number of Pages | 193 |

| Key Companies Covered | Newgen Software Technologies Limited, Decimal Technologies, Fiserv, Inc., Accenture, Ellie Mae Inc., Cre8tech Labs Inc., Nucleus Software, FIS, Pegasystems Inc, Sigma Infosolutions, and Jack Henry & Associates, Inc., amongst others |

| Segments Covered | By Component, By Deployment, By Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

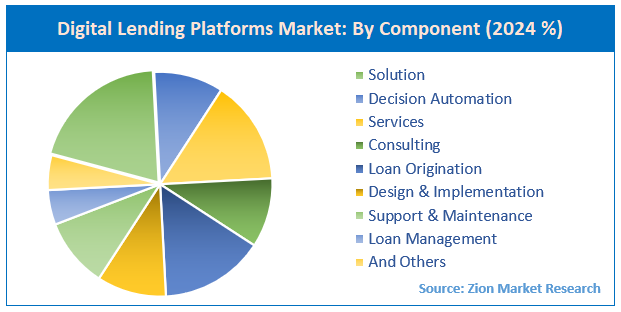

Global Digital Lending Platforms Market: Segmentation

The global digital lending platforms market is bifurcated based on component, deployment, industry, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on Component, the market is segmented into solution, decision automation, services, consulting, loan origination, design & implementation, support & maintenance, loan management, and others.

The Deployment Segment is divided into cloud and on-premises.

The Industry Segment is bifurcated into consumer goods & retail, banking, financial services, & insurance (BFSI), healthcare, aerospace & defense, energy & utilities, telecommunication, manufacturing, and others.

The Regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Digital Lending Platforms Market Dynamics

Key Growth Drivers

The digital lending platforms market is experiencing rapid growth driven by the increasing demand for fast, convenient, and accessible credit. The widespread adoption of smartphones and high-speed internet, particularly in developing economies, has made it possible for a larger population to access financial services from the comfort of their homes. These platforms bypass the lengthy and paper-intensive processes of traditional banks, offering quicker loan origination and disbursement. Furthermore, the use of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) enables lenders to leverage alternative data sources, such as social media behavior and mobile usage patterns, to assess the creditworthiness of underserved and "new-to-credit" populations, thereby fostering greater financial inclusion.

Restraints

Despite the robust growth, the digital lending platforms market faces several significant restraints. One of the primary challenges is data security and privacy concerns. As these platforms handle vast amounts of sensitive personal and financial data, they are a prime target for cyberattacks and data breaches. Building and maintaining consumer trust is critical, and any security lapse can have severe reputational and financial consequences. The lack of a uniform and clear regulatory framework across different countries and regions is another major restraint. The rapid pace of innovation in digital lending often outpaces legal and regulatory frameworks, creating a grey area that can expose both lenders and borrowers to risks and lead to regulatory uncertainty.

Opportunities

The digital lending platforms market is presented with significant opportunities through technological innovation and market expansion. The integration of blockchain technology offers a new avenue to enhance security, transparency, and efficiency in the lending process by creating a secure and decentralized ledger for transactions. The growing demand for specialized and niche lending products, such as "Buy Now, Pay Later" (BNPL) services, peer-to-peer (P2P) lending, and microloans for small and medium-sized enterprises (SMEs), creates a vast market opportunity for platforms to develop tailored solutions. Furthermore, the collaboration between traditional banks and fintech companies is a major opportunity, allowing traditional institutions to leverage the technology and agility of digital platforms to enhance their services and reach a broader customer base.

Challenges

The digital lending platforms market faces a number of complex challenges. A major challenge is balancing the need for speed with robust risk management. While consumers expect instant loan approvals, lenders must ensure that their automated credit assessment models are accurate and do not lead to high default rates. Algorithmic bias, where AI models inadvertently discriminate against certain demographic groups, is also a critical challenge that requires careful monitoring and ethical considerations. The market is also challenged by intense competition from a large number of fintech startups and established players, which can lead to price wars and thin profit margins. Lastly, financial illiteracy among some segments of the population can make them vulnerable to predatory lending practices, necessitating greater consumer education and protection measures.

Digital Lending Platforms Market: Regional Analysis

North America is expected to hold a major market share in the global digital lending platforms market over the forecast period. Factors such as the early adoption of digital lending platforms, the increasing digitalization of organizations, and the presence of a large number of vendors in this region are expected to contribute to the growth of this region. On the other side, the digital lending platforms market in the Asia Pacific region is anticipated to register rapid growth over the forecast period.

Global Digital Lending Platforms Market: Competitive Players

The key players operating in the global digital lending platforms market are:

- Newgen Software Technologies Limited

- Decimal Technologies, Fiserv, Inc.

- Accenture, Ellie Mae Inc.

- Cre8tech Labs Inc.

- Nucleus Software, FIS

- Pegasystems Inc

- Sigma Infosolutions

- Jack Henry & Associates, Inc., amongst others.

Global Digital Lending Platforms Market: Segmentation

The Global Digital Lending Platforms Market is segmented as follows:

By Component

- Solution

- Decision Automation

- Services

- Consulting

- Loan Origination

- Design & Implementation

- Support & Maintenance

- Loan Management

- And Others

By Deployment

- Cloud

- On-premises

By Industry

- Consumer Goods & Retail

- Banking

- Financial Services

- Insurance (BFSI)

- Healthcare

- Aerospace & Defense

- Energy & Utilities

- Telecommunication

- Manufacturing, And Others

Global Digital Lending Platforms Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

Digital lending platforms have revolutionized the financial landscape across the world. Digital lending platforms offer a strong impetus to financial inclusions. Digital lending platforms provide and renew loans using online technology so that quick access to capital can be gained by the business and the individuals. It usually relies on technology entirely to validate business loans as well as implement credit evaluations via digital apps and online platforms. The process of digital lending is similar to the process of face-to-face traditional lending with the major difference of reduction of waiting time as credit and financial statements can be obtained in a few minutes by use of technology.

The Digital Lending Platforms Market was valued at USD 72.83 Million in 2023.

The Digital Lending Platforms Market is expected to reach USD 143.18 Million by 2032, growing at a CAGR of of 7.8% between 2024 to 2032.

The increasing trend of digitalization in financial organizations, the rising number of initiatives undertaken by the government, and an increasing number of smartphone users are some of the major factors spurring the growth of the global digital lending platforms market. Moreover, the rapid adoption of advanced technologies such as blockchain, machine learning, and the artificial intelligence-based digital lending platform is also contributing to the growth of the market. Additionally, digital lending platforms have several benefits including easy capture of applicant's information, optimization of the process of loan underwriting, enables fast decision making, and does not rely on credit scores for disbursing loans.

Global Digital Lending Platforms Market players such as Newgen Software Technologies Limited, Decimal Technologies, Fiserv, Inc., Accenture, Ellie Mae Inc., Cre8tech Labs Inc., Nucleus Software, FIS, Pegasystems Inc, Sigma Infosolutions, and Jack Henry & Associates, Inc., amongst others.

The Regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed