Aerospace Foam Market Size, Share, Industry Report 2034

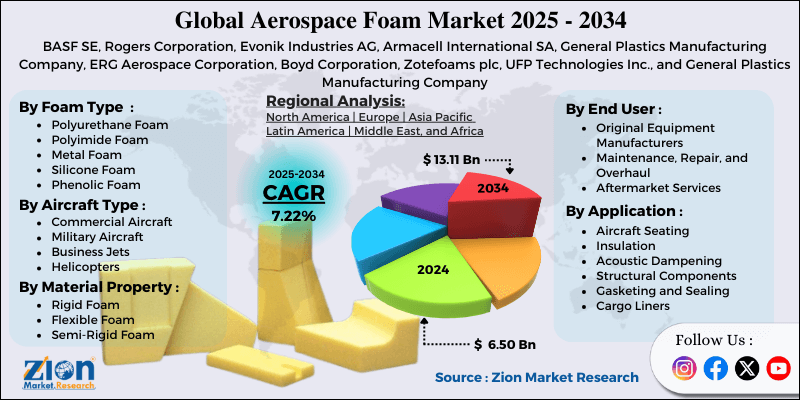

Aerospace Foam Market By Foam Type (Polyurethane Foam, Polyimide Foam, Metal Foam, Silicone Foam, Phenolic Foam, and Others), By Application (Aircraft Seating, Insulation, Acoustic Dampening, Structural Components, Gasketing and Sealing, Cargo Liners), By Aircraft Type (Commercial Aircraft, Military Aircraft, Business Jets, Helicopters, Unmanned Aerial Vehicles), By End-User (Original Equipment Manufacturers, Maintenance Repair and Overhaul, Aftermarket Services), By Material Property (Rigid Foam, Flexible Foam, Semi-Rigid Foam), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

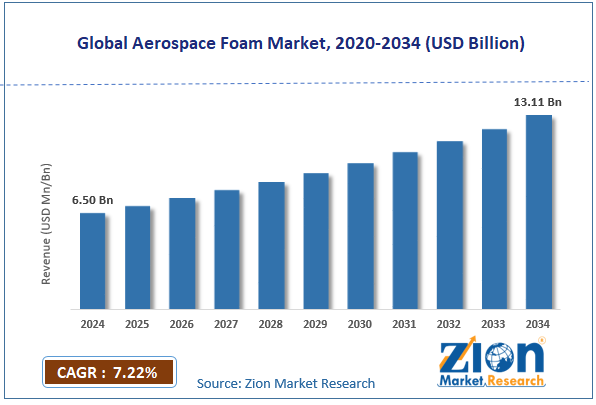

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.50 Billion | USD 13.11 Billion | 7.22% | 2024 |

Aerospace Foam Industry Perspective

The global aerospace foam market size was worth approximately USD 6.50 billion in 2024 and is projected to grow to around USD 13.11 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.22% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global aerospace foam market is estimated to grow annually at a CAGR of around 7.22% over the forecast period (2025-2034).

- In terms of revenue, the global aerospace foam market size was valued at approximately USD 6.50 billion in 2024 and is projected to reach USD 13.11 billion by 2034.

- The aerospace foam market is projected to grow significantly due to the increasing aircraft production rates, rising demand for lightweight materials to improve fuel efficiency, and growing emphasis on passenger comfort and safety in aviation.

- Based on foam type, the polyurethane foam segment is expected to lead the aerospace foam market, while the polyimide foam segment is anticipated to experience significant growth.

- Based on application, the aircraft seating segment is expected to lead the aerospace foam market, while the insulation segment is anticipated to witness notable growth.

- Based on aircraft type, the commercial aircraft segment is the dominating segment, while the unmanned aerial vehicles segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the original equipment manufacturers segment is expected to lead the market compared to the aftermarket services segment.

- Based on material property, the global market is expected to be led by the flexible aerospace foam segment.

- Based on region, North America is projected to dominate the global aerospace foam market during the estimated period, followed by Europe.

Aerospace Foam Market: Overview

Aerospace foam materials are lightweight engineering materials used in aircraft to provide strength, safety, insulation, and comfort without adding unnecessary weight. These foams offer high strength-to-weight ratios that help reduce aircraft mass while supporting structural stability and meeting strict aviation safety regulations. Polyurethane foams are used in passenger seats for cushioning and comfort while meeting flammability and durability standards. Polyimide foams tolerate extremely high temperatures, making them suitable for insulation near engines and other heat-exposed areas. Metal foams provide strong energy absorption for structural reinforcement and impact protection. Silicone foams resist heat, chemicals, and environmental stress, making them useful for sealing and preventing air or fluid leakage.

Acoustic foams reduce cabin noise from engines and airflow, improving comfort. Structural foams form the core of lightweight panels used in walls and flooring. Fire-resistant and closed-cell foams enhance safety and prevent moisture absorption, while advanced manufacturing ensures consistent quality.The growing demand for fuel-efficient aircraft and increasing focus on passenger comfort are expected to drive growth in the aerospace foam market throughout the forecast period.

Aerospace Foam Market Dynamics

Growth Drivers

How are fuel efficiency requirements and weight reduction initiatives driving the aerospace foam market growth?

The aerospace foam market is growing quickly as aircraft manufacturers focus on reducing weight to improve fuel efficiency and lower operating costs across aviation. Every kilogram removed from an aircraft contributes to long-term fuel savings that support airlines working with narrow profit margins. Rising fuel prices create strong motivation to use lighter materials that reduce aircraft weight while preserving structural strength and passenger safety. Environmental rules push the industry toward lower carbon emissions by encouraging designs that improve fuel efficiency through weight reduction.

Foam materials offer excellent strength-to-weight performance compared to metals and dense plastics used in older aircraft designs. Interior elements such as seat cushions, insulation panels, ceiling panels, and storage compartments offer opportunities to reduce weight through advanced foam solutions. Composite structures with foam cores create rigid panels that weigh much less than solid alternatives while meeting structural needs during flight. Lighter foam components help airlines extend aircraft range on long routes while improving overall operational efficiency across daily flight schedules.

Growing aircraft production and expanding global aviation market

The global aerospace foam market is growing steadily as aircraft production rises to meet increasing passenger demand and large-scale fleet replacement across commercial aviation. Commercial aircraft orders remain high as airlines expand fleets to serve emerging markets and replace older planes with efficient new models offering better performance. Boeing and Airbus hold long production backlogs that support consistent demand for foam materials used across aircraft interiors and structural components. Regional manufacturers in China, Russia, and Brazil are developing aviation industries that require reliable foam suppliers to expand production lines. Business aviation growth among corporate users and private owners increases demand for premium foam materials used in luxury cabins and custom aircraft layouts. Military modernization around the world drives the procurement of new jets, transport aircraft, and helicopters that incorporate advanced foam solutions across many systems and components in multiple applications.

Restraints

Stringent regulatory requirements and certification complexities

A major challenge for the aerospace foam market is the strict regulatory compliance and long certification processes governing material use across aircraft applications worldwide. Aviation authorities, including the Federal Aviation Administration and the European Union Aviation Safety Agency, enforce demanding material standards requiring extensive testing before approval. Fire, smoke, and toxicity evaluations require foams to show controlled burning behavior, limited smoke output, and minimal harmful gas release during combustion events. Certification processes often take several years and involve significant investment in testing, documentation, and validation by foam manufacturers. Each aircraft company maintains internal specifications requiring suppliers to meet multiple overlapping standards across programs. Changes in certified materials create recertification requirements that reduce innovation and delay the introduction of improved formulations. High testing costs create barriers for smaller producers entering aviation markets. International variations in regulatory rules increase complexity and require additional testing for acceptance across regions.

Opportunities

How is the development of advanced foam formulations creating new opportunities for the aerospace foam industry?

The aerospace foam market is gaining strong growth opportunities as advancements in material science support new formulations with improved performance for demanding aviation applications across multiple aircraft systems. High-temperature polyimide foams handle extreme conditions in engine areas where traditional materials fail, creating new possibilities for expanded usage. Nanotechnology integration produces foams with improved mechanical strength, thermal stability, and fire resistance by dispersing nanoparticles that enhance overall material behavior. Bio-based formulations made from renewable resources support sustainability goals while meeting aviation performance needs for responsible manufacturing. Self-extinguishing chemistries reduce fire risks without halogenated additives, facing environmental restrictions in global markets. Acoustic metamaterial foams use engineered structures to deliver superior noise control and improve passenger comfort during long flights. Multifunctional foams combine insulation, structural support, and shielding abilities in a single material, helping simplify aircraft designs and reduce part counts across interior components. Shape-adaptive foam technologies support innovative aircraft concepts by allowing components to adjust to varying loads while maintaining reliable performance across flight conditions.

Challenges

How are raw material costs and supply chain vulnerabilities creating challenges for the aerospace foam industry?

The aerospace foam industry faces several obstacles, including volatile raw material prices, supply chain disruptions, and reliance on specialized chemical feedstocks, which influence production costs and overall reliability for manufacturers. Polyurethane production depends on petroleum-based inputs whose prices shift with crude oil markets, creating unstable cost conditions across foam operations worldwide. Aerospace-grade formulations require high-purity ingredients that cost more than those used in general industries, adding financial pressure on producers. Limited supplier availability for specialty chemicals increases vulnerability when production issues arise or when suppliers withdraw from important markets. Long-term contracts with aircraft manufacturers create fixed pricing structures that tighten margins during periods of rising input costs across global chemical markets. Geopolitical tensions interrupt supply chains for essential feedstocks, delaying foam production schedules and slowing aircraft manufacturing activity. Environmental regulations requiring material reformulation add further challenges for maintaining consistent production in the aerospace foam industry.

Aerospace Foam Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerospace Foam Market Research Report |

| Market Size in 2024 | USD 6.50 Billion |

| Market Forecast in 2034 | USD 13.11 Billion |

| Growth Rate | CAGR of 7.22% |

| Number of Pages | 220 |

| Key Companies Covered | BASF SE, Rogers Corporation, Evonik Industries AG, Armacell International SA, General Plastics Manufacturing Company, ERG Aerospace Corporation, Boyd Corporation, Zotefoams plc, UFP Technologies Inc., and General Plastics Manufacturing Company |

| Segments Covered | By Foam Type, By Application, By Aircraft Type, By End User, By Material Property And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerospace Foam Market: Segmentation

The global aerospace foam market is segmented based on foam type, application, aircraft type, end-user, material property, and region.

Based on foam type, the global aerospace foam market is divided into polyurethane foam, polyimide foam, metal foam, silicone foam, phenolic foam, and others. Polyurethane foam leads the market due to its excellent cushioning properties for seating applications, good balance of performance and cost, and established certification status with aircraft manufacturers.

Based on application, the industry is classified into aircraft seating, insulation, acoustic dampening, structural components, gasketing and sealing, and cargo liners. Aircraft seating leads the market due to the large volume of seats required per aircraft, and frequent replacement cycles driven by wear and tear.

Based on aircraft type, the global aerospace foam market is segmented into commercial aircraft, military aircraft, business jets, helicopters, and unmanned aerial vehicles. Commercial aircraft are expected to lead the market during the forecast period, driven by high production volumes and strong growth in global passenger aviation, which will drive fleet expansion.

Based on end-user, the global aerospace foam industry is segregated into original equipment manufacturers, maintenance, repair, and overhaul, and aftermarket services. Original equipment manufacturers hold the largest market share due to their consumption of foam materials in new aircraft production and to long-term supply agreements that provide revenue stability.

Based on material property, the global market is categorized into rigid foam, flexible foam, and semi-rigid foam. Flexible foam holds the largest market share due to dominant use in seating applications and versatility across multiple aircraft interior components.

Aerospace Foam Market: Regional Analysis

What factors are contributing to North America's dominance in the global aerospace foam market?

North America leads the aerospace foam market due to major aircraft manufacturers, strong supply chains, advanced material capabilities, and a large commercial and military aviation base supporting continuous demand across many applications. The United States hosts Boeing, an industry leader whose commercial and defense aircraft production creates significant requirements for aerospace foam materials used throughout multiple systems. Established aerospace clusters in Seattle, Southern California, Texas, and the Southeast United States concentrate manufacturing activity and supplier networks supporting efficient material distribution and technical cooperation. Military aviation spending through the U.S. Department of Defense funds the development of advanced aircraft using innovative foam technologies across insulation, structural, and safety systems. General aviation and business jet manufacturing centered in Kansas and nearby regions creates additional opportunities for foam suppliers serving diverse aircraft platforms. NASA and defense research agencies support material innovation through funding programs encouraging new foam formulations and manufacturing improvements.

Strong intellectual property protections motivate foam producers to invest in proprietary technologies supporting performance needs across aviation markets. Established supply chain relationships allow foam manufacturers to collaborate closely with aircraft companies on qualification processes and ongoing technical support. Composite aircraft production on Boeing programs uses foam-core materials in sandwich structures to support lightweight construction. North American maintenance facilities generate steady demand for replacement components, while business aviation activity drives interest in premium interior foams. Canada contributes through Bombardier production and supply chain roles supporting overall regional industry integration. Regional universities and research centers strengthen industry capabilities by providing advanced testing facilities and supporting the continuous development of improved aerospace foam materials.

Europe is experiencing significant growth.

Europe is experiencing strong expansion in the aerospace foam market, as a well-established aviation manufacturing base and advanced technological capabilities support ongoing material innovation across the region. Airbus has its headquarters in France and major production sites across Germany, Spain, and the United Kingdom, creating strong demand for aerospace foam materials used throughout aircraft interiors and structures. Military aircraft programs, including the Eurofighter Typhoon and Rafael, require high-performance foam solutions meeting strict defense standards across multiple systems. Regional aircraft production by ATR increases foam use in turboprop platforms serving short-haul routes across many global markets. Business aviation manufacturing by Dassault supports worldwide demand for luxury cabin interiors, using premium foam materials across seating and insulation systems. Helicopter production by Airbus Helicopters and Leonardo serves civil and military customers requiring specialized foam solutions for rotorcraft performance. European Union research programs encourage collaborative development of new foam formulations supporting improved sustainability and advanced material behavior.

Strong environmental regulations in Europe drive interest in bio-based foams, offering reduced reliance on petroleum-derived feedstocks. Advanced composite expertise across European aerospace companies supports widespread use of foam core materials in composite sandwich structures. Maintenance operations for European airlines generate steady aftermarket demand for foam replacement components used during routine service. Aerospace material suppliers in Germany, France, and the United Kingdom maintain strong engineering capabilities supporting ongoing advances in polymer science. Growing investment in green aviation initiatives further boosts demand for advanced aerospace foam solutions.

Recent Developments

- In September 2025, Rogers Corporation launched a new polyurethane foam product called PORON 40V0, offering UL 94 V-0 flame-resistance and soft, compressible properties suitable for cushioning, sealing, or gap-filling applications, signaling advanced foam material solutions for demanding industries.

Aerospace Foam Market: Competitive Analysis

The leading players in the global aerospace foam market are

- BASF SE

- Rogers Corporation

- Evonik Industries AG

- Armacell International SA

- General Plastics Manufacturing Company

- ERG Aerospace Corporation

- Boyd Corporation

- Zotefoams plc

- UFP Technologies Inc

- General Plastics Manufacturing Company

The global aerospace foam market is segmented as follows:

By Foam Type

- Polyurethane Foam

- Polyimide Foam

- Metal Foam

- Silicone Foam

- Phenolic Foam

- Others

By Application

- Aircraft Seating

- Insulation

- Acoustic Dampening

- Structural Components

- Gasketing and Sealing

- Cargo Liners

By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- Business Jets

- Helicopters

- Unmanned Aerial Vehicles

By End User

- Original Equipment Manufacturers

- Maintenance, Repair, and Overhaul

- Aftermarket Services

By Material Property

- Rigid Foam

- Flexible Foam

- Semi-Rigid Foam

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed