Aircraft Seating Market Size, Trends, Share, Global Report 2032

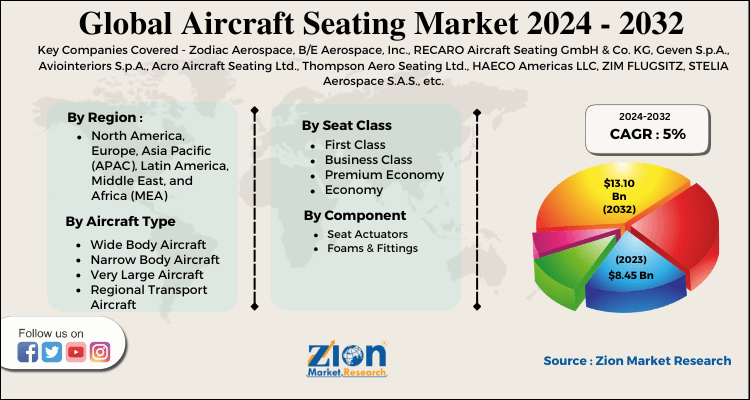

Aircraft Seating Market By Aircraft Type (Wide Body Aircraft, Narrow Body Aircraft, Very Large Aircraft, and Regional Transport Aircraft), Seat Class (First Class, Business Class, Premium Economy, and Economy), By Component (Seat Actuators, Foams & Fittings, Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

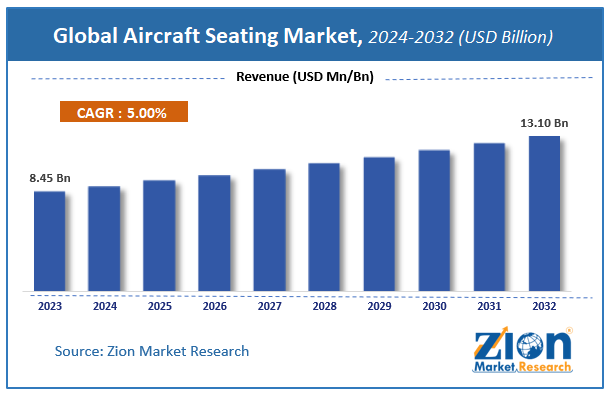

| USD 8.45 Billion | USD 13.10 Billion | 5% | 2023 |

Aircraft Seating Market Insights

According to Zion Market Research, the global Aircraft Seating Market was worth USD 8.45 Billion in 2023. The market is forecast to reach USD 13.10 Billion by 2032, growing at a compound annual growth rate (CAGR) of 5% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Aircraft Seating Market industry over the next decade.

Aircraft seat actuation systems are used to provide comfortable seating for passengers in commercial and private aircrafts. These seat actuation systems are automated and can let the passengers adjust their seating position as per their comfort level. This demand is in return creating a demand for commercial aircrafts. The seat actuation systems are one of the essential components of aircraft cabins. Growing popularity for seat actuators is expected to bolster the growth of the aircraft seating market across the globe.

The ergonomic seat designs also help the pilots to operate the aircraft efficiently. In addition, the ergonomic seat designs include a skull and lower back support. Furthermore, the rising demand for premium air travel is also creating a demand for advanced seat actuation systems.

COVID-19 Impact Analysis:

The global Aircraft Seating market has witnessed a decrease in the number of units due to the lockdown enforcement placed by governments to contain COVID-19 spreading. The restrictions imposed by various nations to contain COVID had stopped the travelling resulting in a disruption across the whole travel industry. However, the world markets are slowly opening to their full potential and theirs a surge in demand for Aircraft Seating. The market will remain bullish in the upcoming year.

Aircraft Seating Market: Growth Factors

Increasing demand for the aircraft interiors market is also an important factor fueling the aircraft seating market demand over the forecast period. While a higher number of aircraft leasing by major airline carriers, frequent refurbishment of aircraft interiors in order to keep the aircraft fleet appealing and an increasing number of long flight travels prompting the adoption of improved interior components are other drivers driving the growth of the market. The market is mainly driven by factors such as the increasing air traffic, aircraft deliveries, and up-gradation of aircraft programs.

Bridging the gap between economy seating and business seating called premium economy seating and implementation of in-flight entertainment systems in all classes of seating are major emerging trends observed in the aircraft seating market. Components that make up the aircraft cabin interior range from windows to seats, and are assembled in such as way within the aircraft fuselage that it can be fitted and withdrawn easily. In terms of value, the global Aircraft Seating market is projected to ascend at a growth rate of 3.2% over the forecast period.

Aircraft Seating Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aircraft Seating Market |

| Market Size in 2023 | USD 8.45 Billion |

| Market Forecast in 2032 | USD 13.10 Billion |

| Growth Rate | CAGR of 5% |

| Number of Pages | 210 |

| Key Companies Covered | Zodiac Aerospace, B/E Aerospace, Inc., RECARO Aircraft Seating GmbH & Co. KG, Geven S.p.A., Aviointeriors S.p.A., Acro Aircraft Seating Ltd., Thompson Aero Seating Ltd., HAECO Americas LLC, ZIM FLUGSITZ, STELIA Aerospace S.A.S., etc. |

| Segments Covered | By Aircraft Type, By Seat Class, By Component, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aircraft Seating Market: Segmentation Analysis

On the basis of aircraft type, the aircraft seating market is segmented into wide-body aircraft, narrow-body aircraft, very large aircraft, and regional transport aircraft. The wide-body aircraft segment is expected to account for the major revenue share in the aircraft seating market over the forecast period. Narrow-body aircraft and regional transport aircraft segments are followed by the wide-body aircraft segment in terms of revenue share.

Among the aircraft type segment, the wide-body aircraft segment is expected to dominate the global aircraft seating market with a 35.6% value share by 2023. However, the aircraft seating market for the narrow-body aircraft segment is gaining more importance in the market and is expected to grow with a relatively higher CAGR.

Based on seat class, aircraft seating is categorized into first class, business class, premium economy, and economy. Among the aforementioned segments, the economy segment accounted for the relative revenue share in the aircraft seating market. The growth of the business class segment is attributed to the increasing working population and increasing per capita income.

By the component, aircraft seating is categorized into seat actuators, foams & fittings, and others. Among all component segmentation, others segment accounted for the largest market share, followed by foams & fittings sweetener. However, seat actuators segment is expected to expand at a substantial growth rate, owing to increasing demand for aircraft seating with advanced actuators.

Aircraft Seating Market: Competitive Analysis

Some of the major players in the global Aircraft Seating market include:

- Zodiac Aerospace

- B/E Aerospace, Inc.

- RECARO Aircraft Seating GmbH & Co. KG

- Geven S.p.A.

- Aviointeriors S.p.A.

- Acro Aircraft Seating Ltd.

- Thompson Aero Seating Ltd.

- HAECO Americas LLC

- ZIM FLUGSITZ

- STELIA Aerospace S.A.S.

The global Aircraft Seating market is segmented as follows:

By Aircraft Type

- Wide Body Aircraft

- Narrow Body Aircraft

- Very Large Aircraft

- Regional Transport Aircraft

By Seat Class

- First Class

- Business Class

- Premium Economy

- Economy

By Component

- Seat Actuators

- Foams & Fittings

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global Aircraft Seating market size was worth around USD 8.45 billion in 2023 and is expected to reach USD 13.10 billion by 2032.

The global Aircraft Seating market is expected to grow at a CAGR of 5% during the forecast period.

Some of the key factors driving the global Aircraft Seating market growth are expanding passenger air traffic, growing airline industry worldwide, advanced technologies, retrofit aircraft seats, the surge in demand for customized fighter aircraft ejector seats, and helicopter seats.

Asia Pacific region is expected to dominate the Aircraft Seating market over the forecast period.

The key dominant player’s operative in global Aircraft Seating market includes Zodiac Aerospace, B/E Aerospace, Inc., RECARO Aircraft Seating GmbH & Co. KG, Geven S.p.A., Aviointeriors S.p.A., Acro Aircraft Seating Ltd., Thompson Aero Seating Ltd., HAECO Americas LLC, ZIM FLUGSITZ, STELIA Aerospace S.A.S.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed