Oleochemical Market Size, Share, Trends, Growth 2032

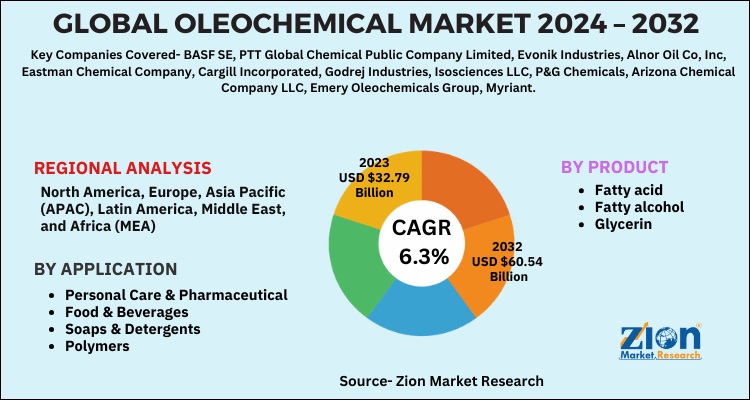

Oleochemical Market: By Application (Personal Care & Pharmaceutical, Food & Beverages, Soaps & Detergents, Polymers, Others), By Product (Fatty Acid, Fatty Alcohol, Glycerin, Others), and By Region - Global Industry Analysis, Size, Share, Growth, Latest Trends, Regional Outlook, and Forecast 2024 - 2032

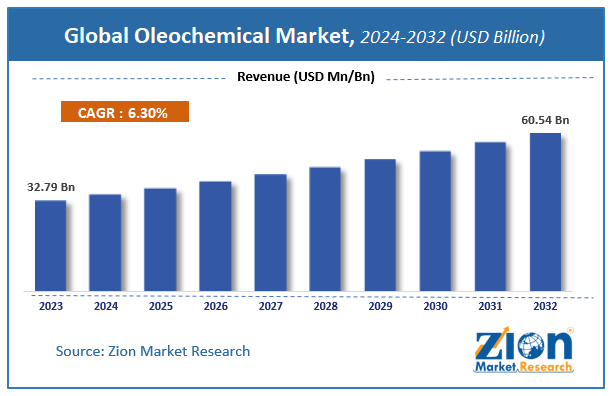

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 32.79 Billion | USD 60.54 Billion | 6.3% | 2023 |

Global Oleochemical Market Insights

Zion Market Research has published a report on the global Oleochemical Market, estimating its value at USD 32.79 Billion in 2023, with projections indicating that it will reach USD 60.54 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 6.3% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Oleochemical Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Oleochemical Market Overview

Oleochemicals are used primarily within the care industry for the manufacturing of varied lotions, creams, and so on. Oleochemicals are replacing many petroleum-based products as their properties help build a product that is best for the environment and which may be manufactured from renewable raw materials. Rising consumption of sustainable, renewable, and bio-based chemicals in care & cosmetics, pharmaceuticals, food & beverages, and other industries is expected to drive the product demand over the forecast period.

Also, the high costs of petrochemical products and shifting preference for eco-friendly products will improve the product demand further. The consumption of oleochemicals within the sort of fatty acids, used for the assembly of soaps & detergents, surfactants, lubricants, varnishes, and pharmaceuticals, is also predictable to propel the market growth over the approaching years.

Growth Factors

Growing preference for biodegradable products alongside the necessity for reducing the consumption of petrochemicals is probably going to elevate the expansion of the oleochemicals market within the years ahead,” says the author of this study. aside from this, a plethora of applications in care products, soaps & detergents, food & beverages, and pharmaceuticals will further impel the oleochemicals market scope over the following years. Tough competition from petroleum-based chemicals, however, is projected to prove a key hurdle within the growth of the oleochemicals market soon.

Nevertheless, ample use of the merchandise witnessed in various industries within the sort of biosurfactants, lubricants, and biopolymers as substitutes for petroleum products will create new growth avenues for the oleochemicals market within a span of the next few years, thereby normalizing the impact of hindrances on the oleochemicals market.

Oleochemicals include short, medium, and long chained fatty alcohols, fatty acids, and glycerin together with other types of chemicals derived from plants and animal fats. Oleochemicals are used primarily in personal care, soaps & detergents, surfactants, and food additives among others. In pharmaceutical applications, oleochemicals are primarily utilized to manufacture a variety of pharmaceuticals and personal care products such as cleansing lotions, skin creams, deodorants, body lotions, medicated cosmetics, bath oils, depilatories, shampoos, hair products, and perfumed products among others.

Growing biodegradable products demand on account of decreasing dependency on petrochemicals is expected to remain a major factor driving growth over the next eight years. Furthermore, increasing demand for bio-based products from various end-use industries such as soaps & detergents, pharmaceuticals, and personal care is expected to fuel the market growth in coming years. However, the high competition from the petroleum based chemicals is the key challenge witnessed in the global market. Moreover, various novel applications of oleochemicals such as biosurfactants, biopolymers, and lubricants are emerging as an alternative of petroleum based products creating new growth opportunities in the oleochemicals market.

Global Oleochemical Market: Segmentation

The study provides a decisive view of the Oleochemical Market by segmenting the market based on by application, by product and by region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

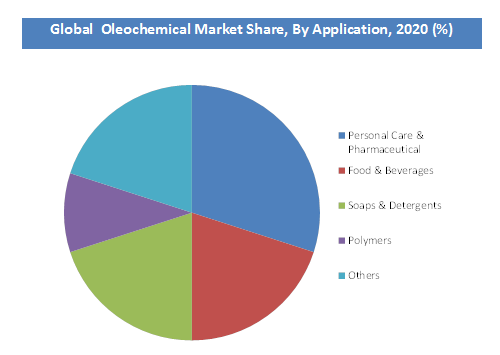

By application segment analysis includes personal care & pharmaceutical, food & beverages, soaps & detergents, polymers, others. The personal care & cosmetics segment is estimated to account for the very best revenue share by 2028 growing at the fastest CAGR over the forecast years. This growth is often credited to the shift in the consumer demand for eco-friendly and natural products. To cater to the rising demand for cosmetics and to satisfy the regulatory frameworks, care manufacturers have come up with upgraded and innovative technologies.

By product type segment analysis includes fatty acid, fatty alcohol, glycerin, others. Fatty alcohols are getting used in pharmaceuticals and cosmetics due to their specific properties, like emollients. The foremost commonly used product, Cetyl alcohol, is vital in shaving creams, lipsticks, and hair lotions. Cetyl and stearyl alcohol bring similar properties, which are mainly utilized in dermatologic bases, bath preparations, and antihistamine creams, among others. Moreover, fatty alcohols provide the start line for the chemicals used as emulsion stabilizers, defoamers, metalworking lubricants, inks, perfumes, corrosion inhibitors, and fire retardants, among others.

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Oleochemical Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Oleochemical Market |

| Market Size in 2023 | USD 32.79 Billion |

| Market Forecast in 2032 | USD 60.54 Billion |

| Growth Rate | CAGR of 6.3% |

| Number of Pages | 110 |

| Key Companies Covered | BASF SE, PTT Global Chemical Public Company Limited, Evonik Industries, Alnor Oil Co, Inc, Eastman Chemical Company, Cargill Incorporated, Godrej Industries, Isosciences LLC, P&G Chemicals, Arizona Chemical Company LLC, Emery Oleochemicals Group, Myriant, |

| Segments Covered | By Application, By Product and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

To know more about this report, request a sample copy.

Oleochemical Market Regional Analysis Preview

Regionally, Asia Pacific has been leading the worldwide oleochemicals market and is expected to continue in the dominant position in the years to come. High production & usage of the product in the region is the main factor behind the dominance of the Asia Pacific oleochemicals market. Also, the availability of raw materials at ease and government policies favoring the use of bio-based materials is an alternative significant factor that is supporting the growth of the oleochemicals market in the region. Growing environmental concerns in the countries such as China and India are forecast to favor the expansion of oleochemicals market in the near future.

Asia Pacific was the leading regional segment in the oleochemicals market in 2018. In addition, the region is also the leading producer of oleochemicals. The growth in the region is mainly attributed by the presences of a large number of manufacturers in the region. China, Japan, and India are the key countries with a huge demand for oleochemicals. Oleochemicals market in Europe is expected to witness significant growth in the forecast period owing to growing importance for biodiesel as an alternative to petroleum-based fuels. Volatile petroleum prices and favorable guidelines are expected to drive the biodiesel demand, which in turn is expected to positively impact the European oleochemicals market in future.

Global Oleochemical Market: Competitive Players

The major players that are comprised in Oleochemical market are

- BASF SE

- PTT Global Chemical Public Company Limited

- Evonik Industries

- Alnor Oil Co, Inc

- Eastman Chemical Company

- Cargill Incorporated

- Godrej Industries

- Isosciences LLC

- P&G Chemicals

- Arizona Chemical Company LLC

- Emery Oleochemicals Group

- Myriant

The global Oleochemical Market is segmented as follows:

By Application

- Personal Care & Pharmaceutical

- Food & Beverages

- Soaps & Detergents

- Polymers

- Others

By Product

- Fatty acid

- Fatty alcohol

- Glycerin

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Oleochemical Market was valued at USD 32.79 billion in 2023.

The global Oleochemical Market is expected to reach USD 60.54 billion by 2032, growing at a CAGR of 6.3% between 2024 to 2032.

Growing preference for biodegradable products along with the need for reducing the consumption of petrochemicals is likely to elevate the growth of oleochemicals market in the years ahead.

Asia Pacific in 2023 ruled the Oleochemical market and was believed to be the highest income-generating area all over the globe.

The major players that are comprised in Oleochemical market are BASF SE, PTT Global Chemical Public Company Limited, Evonik Industries, Alnor Oil Co, Inc., Eastman Chemical Company, Cargill Incorporated, Godrej Industries, Isosciences LLC, P&G Chemicals, Arizona Chemical Company LLC, Emery Oleochemicals Group, and Myriant are some of the key players in the oleochemicals market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed