Aerosol Disinfectants Market Size, Share, Trends, Growth & Forecast 2034

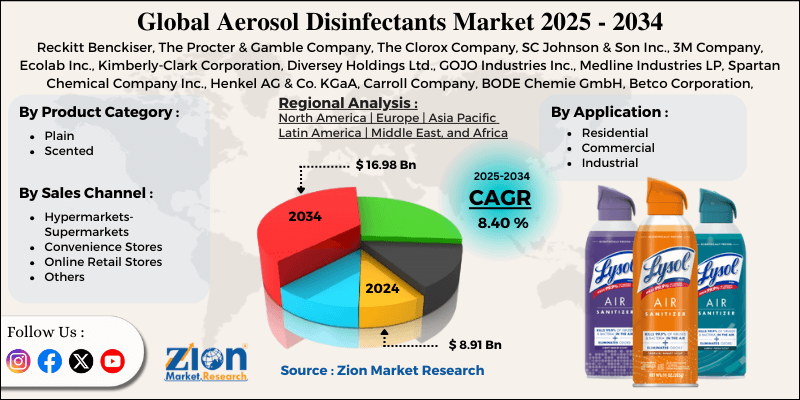

Aerosol Disinfectants Market By Product Category (Plain, Scented), By Sales Channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, and Others), By Application (Residential, Commercial, Industrial), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

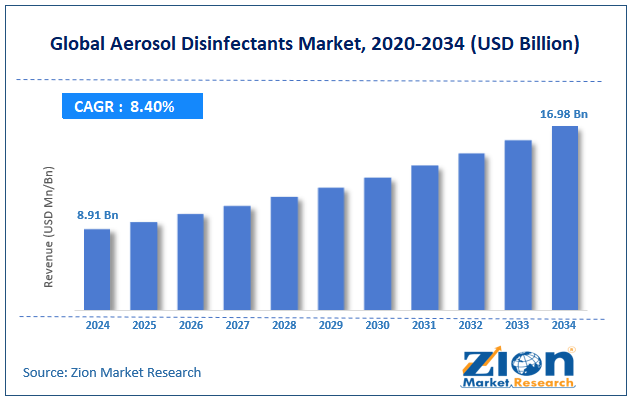

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.91 Billion | USD 16.98 Billion | 8.40% | 2024 |

Aerosol Disinfectants Industry Perspective:

The global aerosol disinfectants market size was worth around USD 8.91 billion in 2024 and is predicted to grow to around USD 16.98 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.40% between 2025 and 2034.

Aerosol Disinfectants Market: Overview

Aerosol disinfectants are spray-form chemical solutions dedicated to reducing or eliminating harmful microorganisms in the air and on surfaces. They are extensively used in commercial, household, and healthcare settings, offering convenient and quick sanitation, particularly in hard-to-reach places. The global aerosol disinfectants market is projected to witness substantial growth driven by rising hospital-acquired infections, growing residential cleaning product use, and rising airborne disease transmission. The increasing number of HAIs is forcing hospitals to adopt stringent sterilization regulations. Aerosol disinfectants are preferred for their efficacy in covering larger areas swiftly. This is mainly vital in isolation wards, ICUs, and emergency units.

Moreover, there is a growing trend in DIY home cleaning, especially in urban regions. Consumers prefer aerosol disinfectants for their multipurpose, speed, and convenience. This shift is majorly strong in some parts of Europe and North America. Additionally, concerns regarding airborne pathogens like RSV and influenza fuel the use of disinfectants that can be sprayed in settings. Aerosol formats are highly suitable for disinfecting enclosed spaces without human effort. Offices, schools, and transit systems are the leading adopters.

Although drivers exist, the global market is challenged by factors such as storage and flammability issues, as well as regulatory barriers and approvals. Most aerosol disinfectants are flammable and alcohol-based, requiring careful storage and transport. Regulatory limitations on shipping like goods raise logistics intricacies. This mainly impacts bulk and international distribution. Also, stringent norms from bodies like the REACH and EPA need comprehensive testing before product approval. Delays in certifications may hamper time-to-market for new players. This substantially limits regional growth and hinders advancement.

Even so, the global aerosol disinfectants industry is well-positioned due to improvements in dispensing and packaging technology and product customization for specific sectors. Aerosol cans with continuous spray valves, dual-nozzle systems, or refillable options may differentiate products. Advancements in child-safe and ergonomic designs also enhance consumer safety. Packaging improvements may fuel repeat purchases. Brands may develop tailor-made disinfectants for industries like food processing, aviation, and education. Sector-specific formulations offer better compliance and high efficiency. This customization approach creates a niche market for revenue.

Key Insights:

- As per the analysis shared by our research analyst, the global aerosol disinfectants market is estimated to grow annually at a CAGR of around 8.40% over the forecast period (2025-2034)

- In terms of revenue, the global aerosol disinfectants market size was valued at around USD 8.91 billion in 2024 and is projected to reach USD 16.98 billion by 2034.

- The aerosol disinfectants market is projected to grow significantly owing to the rising demand from commercial and residential sectors, increasing use in packaging and food processing industries, and improvements in aerosol formulations.

- Based on product category, the scented segment is expected to lead the market, while the plain segment is expected to grow considerably.

- Based on sales channel, the hypermarkets/supermarkets segment is the dominating segment, while the online retail stores segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the residential segment is expected to lead the market compared to the commercial segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Aerosol Disinfectants Market: Growth Drivers

Which is the leading propeller in the global aerosol disinfectants market?

The worldwide surge in seasonal flu cases, new zoonotic outbreaks, and foodborne illnesses continues to propel the global aerosol disinfectants market remarkably. Southeast Asia experienced multiple influenza outbreaks and a surge in norovirus infections, triggering elevated sanitation protocols. Aerosol disinfectants are the leading solutions in controlling fomite transmission during such outbreaks.

As per the WHO's Disease Surveillance Bulletin in May 2025, flu incidences in Southeast Asia increased by 28% compared to the same period in 2023. This prompted panic-buying of disinfectants, mainly surface cleaners and sprays, in nations like Indonesia, Thailand, and the Philippines.

How are R&D advancements in multi-surface and eco-friendly formulations fueling the aerosol disinfectants market?

Advancements in aerosol technology have led to non-flammable, low-VOC, and biodegradable formulations. There is a rising demand for natural ingredients like essential oils and plant-based alcohols, as well as allergen-free disinfectants. These items are highly demanded in pet-friendly households, schools, and health-conscious populations.

Recent product launches like Seventh Generation’s USDA-approved BioSpray and Lysol’s Eco Spray (2025) have gained positive consumer response and regulatory support.

Aerosol Disinfectants Market: Restraints

Increasing competition from alternative disinfection technologies hinders the market progress

The growth of non-aerosol disinfectant solutions, such as electrostatic sprayers, biodegradable wipes, UV-C sterilizers, and hydrogen peroxide vaporizers, is registering a significant market share. These substitutes are usually believed to be long-lasting, safer, and eco-friendly.

Large corporations and many governments, comprising Hilton Hotels and Apple, have invested in ozone-based room and touchless sanitization systems, sidelining conventional aerosol techniques. This technological displacement offers a growing risk to the aerosol format. According to the reports, UV-C-based surface disinfectant devices increased at a 18.7% CAGR between 2020 and 2024, highly adopted by offices and hospitals.

Aerosol Disinfectants Market: Opportunities

How is product diversification for specific use-cases favorable for the aerosol disinfectants market?

Customizing aerosol disinfectants for specific applications, such as pet areas, electronics, automotive, food-contact surfaces, and automotive interiors, as well as gyms, is fueling traction. This segmentation enables companies to create premium stock-keeping units and penetrate the industry with distinguished value propositions. Such diversification notably impacts the growth of the aerosol disinfectants industry.

Reckitt Benckiser introduced Lysol Pro-Tech, a product line formulated mainly for disinfecting touchscreens and electronic devices, in 2024. Likewise, Dettol launched a baby-safe disinfectant spray in specific Asian markets with mild fragrances and low alcohol content.

Aerosol Disinfectants Market: Challenges

Consumer perception issues regarding chemical safety restrict the market growth

There is a growing concern among users regarding chemical-based aerosol disinfectants, particularly those containing flammable alcohols, synthetic fragrances, and harsh active ingredients. Issues regarding respiratory distress, skin irritation, and toxicity are shifting some users away from traditional sprays.

Social media content and influencer-led campaigns have augmented fears, especially among eco-conscious households and parents. Leading companies like Clorox and Lysol face the challenge of rebuilding user trust while ensuring regulatory efficiency.

Aerosol Disinfectants Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerosol Disinfectants Market |

| Market Size in 2024 | USD 8.91 Billion |

| Market Forecast in 2034 | USD 16.98 Billion |

| Growth Rate | CAGR of 8.40% |

| Number of Pages | 212 |

| Key Companies Covered | Reckitt Benckiser, The Procter & Gamble Company, The Clorox Company, SC Johnson & Son Inc., 3M Company, Ecolab Inc., Kimberly-Clark Corporation, Diversey Holdings Ltd., GOJO Industries Inc., Medline Industries LP, Spartan Chemical Company Inc., Henkel AG & Co. KGaA, Carroll Company, BODE Chemie GmbH, Betco Corporation, and others. |

| Segments Covered | By Product Category, By Sales Channel, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerosol Disinfectants Market: Segmentation

The global aerosol disinfectants market is segmented based on product category, sales channel, application, and region.

Based on product category, the global aerosol disinfectants industry is divided into plain and scented. The scented aerosol disinfectants dominate the worldwide market owing to their dual-purpose attraction, offering a pleasant aroma and sanitation. Users are extensively favoring these products for use in public spaces, homes, hotels, and offices, where fragrance adds to a clean and fresh ambiance. Prominent scents like lavender, citrus, and eucalyptus have broader-market appeal, improving consumer experience. The ability to mask chemical odors while delivering efficient disinfection sustains the steady demand for scented variants.

Based on sales channel, the global aerosol disinfectants market is segmented as hypermarkets/supermarkets, convenience stores, online retail stores, and others. The hypermarkets/supermarkets segment holds leadership in the market due to their broader reach, instant product availability, and in-store visibility. Consumers prefer stores for disinfectant purchases as they can check labels, compare brands, and choose their product based on size or scent. These retail chains usually bundle deals and offer promotions that appeal to bulk buyers. The convenience of one-stop shopping for hygiene and cleaning products helps the segmental dominance.

Based on application, the global market is segmented into residential, commercial, and industrial. The residential segment registers a substantial share in the market owing to the extensive use of aerosol disinfectants in homes for air sanitation and surfaces. Consumers use these disinfectants in bathrooms, kitchens, and living spaces for daily hygiene, particularly following the COVID-19 pandemic. Their ease of use, convenience, and availability in scented options increase their appeal for household uses. Growing awareness of frequent cleaning habits and indoor hygiene continues to fuel the segment's prominence.

Aerosol Disinfectants Market: Regional Analysis

Which key factors are fueling the dominance of the Asia Pacific in the aerosol disinfectants market?

Asia Pacific is likely to sustain its leadership in the aerosol disinfectants market due to a large population, expanding e-commerce and retail infrastructure, and growing health awareness post-pandemic. Asia Pacific houses more than 4.7 billion individuals, accounting for 60% of the global population. High population density in nations like India and China fuels hygiene product consumption, comprising aerosol disinfectants. Urban regions face elevated demand owing to disease transmission risks and crowded living conditions. Asia Pacific has experienced speedy growth in digital and retail commerce. Improving product accessibility.

Nations such as those in Southeast Asia and India have experienced more than 25% yearly growth in hygiene sales and online grocery. Convenience stores, hypermarkets, and e-commerce platforms all help aerosol disinfectants move to a broader consumer base. Moreover, following the pandemic, awareness of disinfection and cleanliness increased in the region. According to the McKinsey report, more than 80% of Asian consumers are more hygiene-aware than before 2020. This inclination in lifestyle habits is majorly fueling sustained demand for aerosol sanitizers and disinfectants.

North America continues to secure the second-highest share in the aerosol disinfectants industry owing to high hygiene awareness, growing cases of infectious allergies and diseases, and regulatory focus on workplace hygiene. North America holds the highest hygiene standards across the globe, with users prioritizing cleanliness in commercial and residential spaces. More than 90% of the United States households use sanitization and disinfectant sprays daily, according to the American Cleaning Institute. This culture of routine disinfection propels the rising demand for aerosol-based products.

Moreover, the United States has experienced a rising number of RSV outbreaks, flu seasons, and mold-related allergies. This led to the regular disinfection of offices, homes, and schools. Aerosol disinfectants are usually chosen for their ease of surface and air application in such conditions.

Furthermore, agencies like the CDC and OSHA set stringent cleanliness regulations for institutions and businesses. Regular disinfection with EPA-licensed products is demanded in restaurants, offices, and public facilities. This regulatory support propels the demand in commercial applications.

Aerosol Disinfectants Market: Competitive Analysis

The prominent players in the global aerosol disinfectants market include:

- Reckitt Benckiser

- The Procter & Gamble Company

- The Clorox Company

- SC Johnson & Son Inc.

- 3M Company

- Ecolab Inc.

- Kimberly-Clark Corporation

- Diversey Holdings Ltd.

- GOJO Industries Inc.

- Medline Industries LP

- Spartan Chemical Company Inc.

- Henkel AG & Co. KGaA

- Carroll Company

- BODE Chemie GmbH

- Betco Corporation

Aerosol Disinfectants Market: Key Market Trends

Growing prominence of dual-function and multi-surface sprays:

Manufacturers are introducing aerosol disinfectants that can simulate both surfaces and air in a single application. These dual-function sprays attract consumers seeking versatility and convenience, mainly in residential settings. This multifunctional trend is gaining prominence in all key retail channels.

Integration with IoT and smart dispensers:

There is a rising trend of aerosol disinfectants being incorporated in IoT-controlled systems or automated dispensers for commercial and public spaces. Malls, airports, and hospitals are adopting sensor-based touchless aerosol systems for constant sanitization. This denotes the intersection of smart technology and hygiene in the industry.

The global aerosol disinfectants market is segmented as follows:

By Product Category

- Plain

- Scented

By Sales Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Retail Stores

- Others

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aerosol disinfectants are spray-form chemical solutions dedicated to reducing or eliminating harmful microorganisms in the air and on surfaces. They are extensively used in commercial, household, and healthcare settings, offering convenient and quick sanitation, particularly in hard-to-reach places.

The global aerosol disinfectants market is projected to grow due to surging demand for quick and convenient disinfection methods, government regulations mandating disinfection standards, and the growth of e-commerce distribution channels.

According to study, the global aerosol disinfectants market size was worth around USD 8.91 billion in 2024 and is predicted to grow to around USD 16.98 billion by 2034.

The CAGR value of the aerosol disinfectants market is expected to be around 8.40% during 2025-2034.

Asia Pacific is expected to lead the global aerosol disinfectants market during the forecast period.

Emerging trends in the aerosol disinfectants market include the development of non-toxic formulations, eco-friendly products, and the use of bio-based propellants. Advancements like automated aerosol dispensers and smart packaging are also gaining prominence for enhanced user convenience.

The offline segment, particularly hypermarkets/supermarkets and convenience stores, is expected to lead the aerosol disinfectants market by 2034. This is backed by consumer preference for immediate purchase, bulk buying options, and product testing.

The aerosol disinfectants market is witnessing moderate price variations fueled by supply chain dynamics and raw material costs. Moreover, premium pricing is emerging for specialty and eco-friendly formulations targeting health-conscious consumers.

The key players profiled in the global aerosol disinfectants market include Reckitt Benckiser, The Procter & Gamble Company, The Clorox Company, SC Johnson & Son, Inc., 3M Company, Ecolab Inc., Kimberly-Clark Corporation, Diversey Holdings, Ltd., GOJO Industries, Inc., Medline Industries, LP, Spartan Chemical Company, Inc., Henkel AG & Co. KGaA, Carroll Company, BODE Chemie GmbH, and Betco Corporation.

The report examines key aspects of the aerosol disinfectants market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed