Brewing Ingredients Market Share & Size, Growth, Trends Report 2034

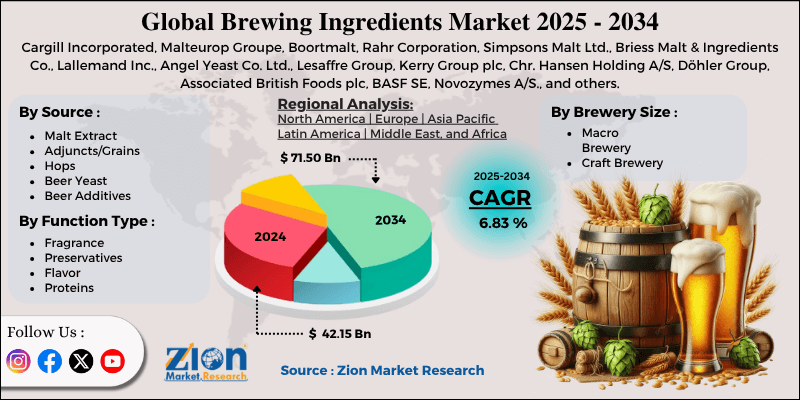

Brewing Ingredients Market By Source (Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, Beer Additives), By Brewery Size (Macro Brewery, Craft Brewery), By Function Type (Fragrance, Preservatives, Flavor, Proteins), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

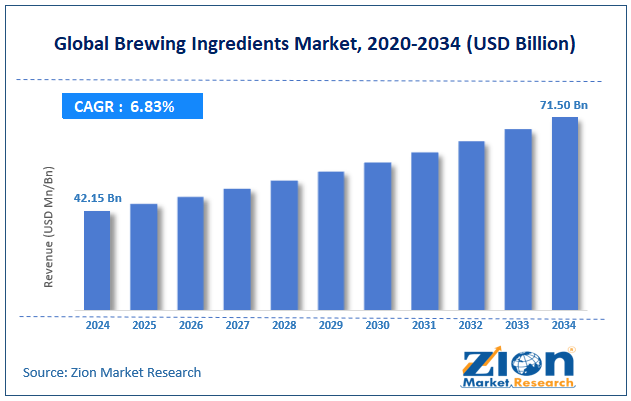

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 42.15 Billion | USD 71.50 Billion | 6.83% | 2024 |

Brewing Ingredients Industry Perspective:

The global brewing ingredients market size was approximately USD 42.15 billion in 2024 and is projected to reach around USD 71.50 billion by 2034, with a compound annual growth rate (CAGR) of approximately 6.83% between 2025 and 2034.

Brewing Ingredients Market: Overview

Brewing ingredients are the essential raw materials used in the making of beer and other fermented beverages. The key ingredients comprise malted grains (mainly barley), water, yeast, and hops. Malt offers the sugars vital for fermentation. Yeast ferments the sugars, producing carbon dioxide. Hops add aroma and bitterness, and water serves as the key solvent. The global brewing ingredients market is expected to expand rapidly, driven by increasing global beer consumption, the rising popularity of artisanal and craft beer, and advancements in brewing ingredients. Beer is the highly consumed alcoholic beverage worldwide, accounting for nearly 30% of total alcohol consumption. Regions in Latin America and APAC are showing increasing demand due to the growing middle-class population and urbanization.

Additionally, the global growth in craft breweries is surging demand for high-quality and specialty ingredients. According to the Brewers Association, as of 2024, the United States alone has registered over 9,700 craft breweries, representing a growth rate of more than 5% higher than the past year. Craft brewers utilize exceptional malt and hop varieties, thereby creating a premium segment in the market. Moreover, ingredient advancements such as organic hops, genetically improved yeast strains, and gluten-free malt are appealing to niche and health-conscious consumers. Companies are actively investing in research and development to create distinctive beer profiles, thereby driving demand for specialty ingredients.

Despite the growth, the global market is hindered by factors such as fluctuations in raw material prices and stringent government regulations. Geopolitical, supply chain disturbances, and climate change primarily impact the prices of hops, barley, and other ingredients. Droughts in Europe and the United States in 2023 majorly impacted barley harvests, resulting in uncertainty and price hikes of ingredient availability. In addition, regulations on alcohol labeling, advertising, and production are relatively lax in nations such as Southeast Asia, the Middle East, and India, thereby restricting market expansion and creating complex compliance issues for ingredient suppliers.

Nonetheless, the global brewing ingredients industry stands to gain from several key opportunities, including the rise of functional beers and the growth of the homebrewing industry. Functional beers infused with electrolytes, vitamins, and botanicals are gaining prominence. Brewing these beverages requires specialized ingredients, such as adaptogenic herbs or stevia for sweetness, thereby broadening horizons. Additionally, the home-brewing trend, primarily in North America and Europe, is driving demand for packaged brewing ingredients and kits. Platforms like Etsy and Amazon have seen a surge in sales of home brewing ingredient kits and machines, primarily following the pandemic.

Key Insights:

- As per the analysis shared by our research analyst, the global brewing ingredients market is estimated to grow annually at a CAGR of around 6.83% over the forecast period (2025-2034)

- In terms of revenue, the global brewing ingredients market size was valued at around USD 42.15 billion in 2024 and is projected to reach USD 71.50 billion by 2034.

- The brewing ingredients market is projected to grow significantly due to increasing global beer consumption, rising demand for non-alcoholic or low-alcohol beers, and advancements in brewing processes.

- According to the source, the malt extract segment is expected to lead the market, while the hops segment is anticipated to experience significant growth.

- Based on brewery size, the macro brewery is the dominant segment, while the craft brewery segment is projected to witness sizable revenue growth over the forecast period.

- Based on function type, the flavor segment is expected to lead the market compared to the fragrance segment.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Brewing Ingredients Market: Growth Drivers

Increasing consumer preference for organic and natural ingredients propels market growth

Consumers are becoming increasingly aware of the ingredients in their beverages, thereby fueling demand for clean-label, organic, and natural brewing inputs. This inclination is prompting breweries to prefer non-GMO hops, organic malted barley, natural flavorings, and preservative-free enzymes, thus impacting the growth of the brewing ingredients market. The EU's increasing regulatory support for organic authorized labeling and ingredient standards is motivating producers to source from certified organic farms. Additionally, hop farms in the United States, Germany, and New Zealand are expanding their organic acreage.

Rising popularity of low-alcohol and non-alcoholic beers notably fuels the market growth

With the rising demand and increasing health awareness for low-calorie beverages, the NAB (non-alcoholic beer) segment is progressing, resulting in an increased demand for specialized brewing ingredients.

The production of NAB, or non-alcoholic beer, requires advanced brewing methods and ingredients, including special enzymes to reduce the alcohol content, flavoring agents to preserve the taste, and functional additives to compensate for the losses incurred during fermentation.

This trend is also progressing in Asia, where companies like Kirin and Asahi are developing non-alcoholic beers using functional yeast strains and rice malt, thereby fueling advancements in brewing inputs modified for alcohol-free formulations.

Brewing Ingredients Market: Restraints

Stringent regulations on alcoholic beverages and taxation negatively impact market progress

Alcohol is a highly regulated product in almost every nation. Brewing ingredients, mainly yeast, enzymes, and flavor enhancers, often face regulatory scrutiny and delays. The compliance pressure for breweries, such as labeling and tax requirements, directly impacts how they use and source ingredients.

In North Africa and the Middle East, Islamic law severely restricts alcohol production, which limits the potential market size and decreases the marketable demand for ingredients. Even in parts of the U.S., alcohol excise taxes rise, such as those passed in 2023 in Oregon. These are projected to lower overall consumption and limit the expansion of craft brewing.

Brewing Ingredients Market: Opportunities

Smart brewing innovation and technological integration are favorable for the market growth

The integration of digital brewing systems, AI-based brewing software, and biotechnology is revolutionizing the demand for innovative brewing ingredients that can adapt to data-driven and automated systems. Tools like digital malt profiling, fermentation monitoring, and precision yeast propagation systems require highly traceable, consistent, and programmable ingredients.

This technology revolution is an opportunity for ingredient businesses operating in the brewing ingredients industry to offer lab-grown flavoring compounds, engineered yeasts, and digitally traceable malts that support advanced brewing platforms.

Brewing Ingredients Market: Challenges

Technological adaptation barriers and the lack of skilled labor limit the growth of market

As the brewing industry advances, there is a surging need for technically skilled professionals who can efficiently handle improved brewing systems, fermentation science, and ingredient profiling. Nonetheless, several regions, primarily rural or developing markets, face a severe shortage of specialized brewers, fermentation specialists, and food technologists.

This talent gap presents a significant challenge to the adoption and innovation of ingredients. Breweries lacking skilled staff may be hesitant to experiment with brewing methods and novel ingredients that require technical oversight.

Brewing Ingredients Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Brewing Ingredients Market |

| Market Size in 2024 | USD 42.15 Billion |

| Market Forecast in 2034 | USD 71.50 Billion |

| Growth Rate | CAGR of 6.83% |

| Number of Pages | 214 |

| Key Companies Covered | Cargill Incorporated, Malteurop Groupe, Boortmalt, Rahr Corporation, Simpsons Malt Ltd., Briess Malt & Ingredients Co., Lallemand Inc., Angel Yeast Co. Ltd., Lesaffre Group, Kerry Group plc, Chr. Hansen Holding A/S, Döhler Group, Associated British Foods plc, BASF SE, Novozymes A/S., and others. |

| Segments Covered | By Source, By Brewery Size, By Function Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Brewing Ingredients Market: Segmentation

The global brewing ingredients market is segmented based on source, brewery size, function type, and region.

According to the source, the global brewing ingredients industry is categorized into malt extract, adjuncts/grains, hops, beer yeast, and beer additives. The malt extract segment registered a substantial share of the market. It serves as a key source of fermentable sugars in beer production and is essential for developing color, flavor, and aroma. Its broader use in home-brewing kits and commercial breweries drives its dominance. In the previous year, malt extract registered for over 40% of the total market share, aided by the rising demand for specialty and craft beers worldwide.

Based on brewery size, the global brewing ingredients market is segmented into macro brewery and craft brewery. The macrobreweries segment holds a leading market share due to their large-scale production capacities and extensive global distribution networks. These breweries, such as Heineken and AB InBev, produce high volumes of beer using standardized recipes, which drives demand for core ingredients like hops, yeast, and malt.

Based on function type, the global market is segmented into fragrance, preservatives, flavor, and proteins. The flavor segment is the dominating functional segment due to its over 40% functional use in brewing. Beer's total attraction is primarily driven by its taste profile, which is derived from hops, malted grains, the fermentation process, and adjuncts. Consumers are increasingly demanding diverse flavor experiences, ranging from fruity and malty to hoppy and bitter, primarily in the craft beer segment.

Brewing Ingredients Market: Regional Analysis

Europe to witness significant growth over the forecast period

Europe is expected to maintain its leading position in the global brewing ingredients market, driven by its strong brewing heritage, the presence of numerous key global breweries, and extensive cultivation of hops and barley. Europe boasts a deep-seated beer culture, with nations such as the Czech Republic, Germany, and Belgium leading the way in per capita beer consumption.

The average beer consumption per person in the European Union was 70 liters, according to the Brewers of Europe (2023), with the Czech Republic alone registering at 136 liters annually. This consistent demand fuels large-scale production and ingredient consumption on the continent. In addition, Europe hosts some larger ingredient manufacturers and companies, such as Boortmalt (Belgium), Carlsberg (Denmark), and Heineken (Netherlands). These companies export ingredients worldwide and operate high-volume breweries, propelling the region's dominance.

The region's supply chain integration and advancement hubs drive both market share and ingredient development. Europe is a leading cultivator of hops and barley, the primary ingredients used in brewing. Germany is the world's key producer of hops, while the UK and France are key exporters of barley. The availability of quality raw materials in the region reduces import dependency, aiding domestic production and advancements in brewing ingredients.

The Asia Pacific ranks as the second-leading region in the global brewing ingredients industry, driven by a high volume of beer consumption, rising disposable incomes, and an increasing craft beer culture in urban areas. The Asia Pacific region houses the largest population worldwide, with economies such as India and China demonstrating rising beer consumption trends. China is the largest beer-consuming nation by volume, with annual consumption exceeding 36 billion liters. This vast consumer base fuels primary demand for brewing ingredients in the region.

Furthermore, urban lifestyle shifts and economic growth are leading to rising alcohol consumption among young and middle-class consumers. In nations such as Thailand, Vietnam, and the Philippines, beer consumption has increased steadily, contributing to an annual 5-7% rise in disposable income. This growing affluence drives demand for both premium and mainstream beer, fueling the use of high-quality ingredients. Moreover, cities such as Seoul, Tokyo, Shanghai, and Bangalore are witnessing an explosive growth in microbrewery culture and craft beer. Craft brewing motivates the use of superior quality specialty ingredients, driving rising value and volume in the regional market.

Brewing Ingredients Market: Competitive Analysis

The prominent players in the global brewing ingredients market are:

- Cargill Incorporated

- Malteurop Groupe

- Boortmalt

- Rahr Corporation

- Simpsons Malt Ltd.

- Briess Malt & Ingredients Co.

- Lallemand Inc.

- Angel Yeast Co. Ltd.

- Lesaffre Group

- Kerry Group plc

- Chr. Hansen Holding A/S

- Döhler Group

- Associated British Foods plc

- BASF SE

- Novozymes A/S.

Brewing Ingredients Market: Key Market Trends

Innovation in functional and flavored beers:

There is a rise in the use of spices, fruit extracts, botanicals, and functional additives like adaptogens, vitamins, and CBD. These ingredients attract the health-conscious and younger drinkers who prefer wellness experiences or unique sensory experiences. Therefore, breweries are actively sourcing non-traditional ingredients to differentiate in the competitive market.

Technology-based ingredient optimization:

Ingredient manufacturers and breweries are embracing lab-based strain development, AI, and precision agriculture to enhance yield, consistency, and sustainability. For example, climate-resilient barley strains and AI-based yeast selection methods are being developed to improve performance. Technology is now a key enabler in the advancement of next-generation brewing ingredients.

The global brewing ingredients market is segmented as follows:

By Source

- Malt Extract

- Adjuncts/Grains

- Hops

- Beer Yeast

- Beer Additives

By Brewery Size

- Macro Brewery

- Craft Brewery

By Function Type

- Fragrance

- Preservatives

- Flavor

- Proteins

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Brewing ingredients are the essential raw materials used in the making of beer and other fermented beverages. The key ingredients comprise malted grains (mainly barley), water, yeast, and hops. Malt offers the sugars vital for fermentation. Yeast ferments the sugars, producing carbon dioxide. Hops add aroma and bitterness, and water serves as the key solvent.

The global brewing ingredients market is projected to grow due to the expansion of craft breweries, advancements in styles and flavors, and a focus on organic and natural ingredients.

According to study, the global brewing ingredients market size was worth around USD 42.15 billion in 2024 and is predicted to grow to around USD 71.50 billion by 2034.

The CAGR value of the brewing ingredients market is expected to be approximately 6.83% from 2025 to 2034.

Europe is expected to lead the global brewing ingredients market during the forecast period.

The key players profiled in the global brewing ingredients market include Cargill Incorporated, Malteurop Groupe, Boortmalt, Rahr Corporation, Simpsons Malt Ltd., Briess Malt & Ingredients Co., Lallemand Inc., Angel Yeast Co., Ltd., Lesaffre Group, Kerry Group plc, Chr. Hansen Holding A/S, Döhler Group, Associated British Foods plc, BASF SE, and Novozymes A/S.

The report examines key aspects of the brewing ingredients market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed