Adaptive Driving Beam (ADB) Headlights Market Size, Share, Value 2034

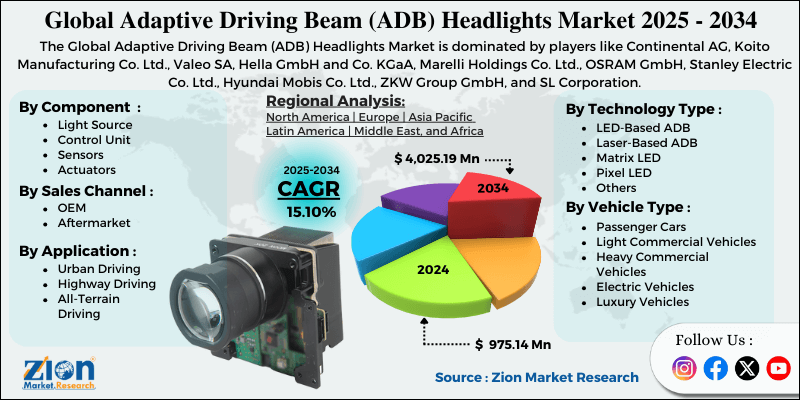

Adaptive Driving Beam (ADB) Headlights Market By Technology Type (LED-Based ADB, Laser-Based ADB, Matrix LED, Pixel LED, and Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles, Luxury Vehicles), By Sales Channel (OEM, Aftermarket), By Application (Urban Driving, Highway Driving, All-Terrain Driving), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

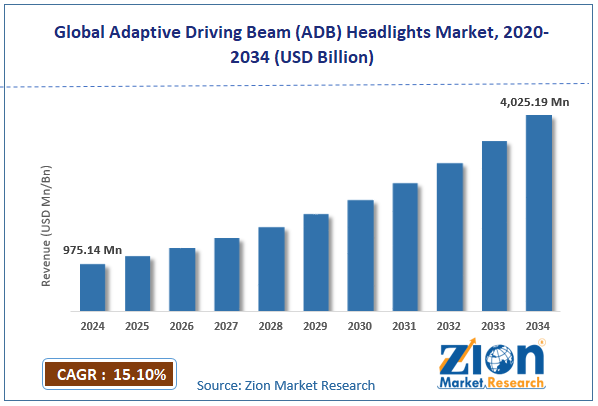

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 975.14 Million | USD 4,025.19 Million | 15.10% | 2024 |

Adaptive Driving Beam (ADB) Headlights Industry Perspective

The global adaptive driving beam headlights market size was worth approximately USD 975.14 million in 2024 and is projected to grow to around USD 4,025.19 million by 2034, with a compound annual growth rate (CAGR) of roughly 15.10% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global adaptive driving beam headlights market is estimated to grow annually at a CAGR of around 15.10% over the forecast period (2025-2034).

- In terms of revenue, the global adaptive driving beam headlights market size was valued at approximately USD 975.14 million in 2024 and is projected to reach USD 4,025.19 million by 2034.

- The adaptive driving beam headlights market is projected to grow significantly due to the rising vehicle safety standards, increasing consumer demand for advanced features, growing electric vehicle production, and expanding regulatory approvals across global markets.

- Based on technology type, the LED-based ADB segment is expected to lead the adaptive driving beam headlights market, while the pixel LED segment is anticipated to experience significant growth.

- Based on vehicle type, the passenger cars segment is expected to lead the adaptive driving beam headlights market, while the electric vehicles segment is anticipated to witness notable growth.

- Based on sales channel, the OEM segment is the dominating segment, while the aftermarket segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the highway driving segment is expected to lead the market compared to the urban driving segment.

- Based on region, Europe is projected to dominate the global adaptive driving beam headlights market during the estimated period, followed by the Asia Pacific.

Adaptive Driving Beam (ADB) Headlights Market: Overview

Adaptive driving beam headlights are advanced vehicle lighting systems designed to automatically adjust the shape and direction of the light beam in real time to improve road visibility while preventing glare for other road users. These systems rely on cameras, sensors, and processing units to detect vehicles, pedestrians, and surrounding conditions, then modify the beam to keep the road illuminated without causing visual discomfort or safety risks. Unlike traditional headlights that require drivers to choose between bright high beams or limited low beams, adaptive technology maintains strong illumination on open road areas while dimming sections aimed at detected road users. Matrix and pixel LED designs use many individually controlled light segments to create highly precise patterns, and laser-based systems provide extremely long-range lighting in compact designs.

Control algorithms analyze camera input, GPS data, and vehicle movement to adjust lighting continuously. The result is improved night visibility, reduced driver fatigue, greater safety, and increasing global adoption as regulations evolve. The growing emphasis on vehicle safety and increasing adoption of advanced driver assistance systems are expected to drive growth in the adaptive driving beam headlights market throughout the forecast period.

Adaptive Driving Beam (ADB) Headlights Market Dynamics

Growth Drivers

Safety regulations and consumer demands

The adaptive driving beam headlights market is growing quickly as safety agencies introduce stricter lighting rules and consumers prioritize reliable safety features when choosing vehicles. European safety rating programs give higher scores to vehicles with advanced lighting systems, encouraging manufacturers to include ADB technology for better performance. Recent regulatory changes in the United States allowed adaptive headlights after many years, creating a major North American opportunity for companies supplying these systems. Insurance providers acknowledge safety advantages and may offer lower premiums for vehicles with advanced lighting features, giving consumers financial motivation to choose ADB-equipped models.

Consumer awareness of nighttime accident risks increases as campaigns explain how limited visibility contributes to severe collisions during darkness. Premium vehicle brands intensify competition by adding sophisticated lighting features that strengthen product identity through distinctive design. Technology-focused buyers continue to seek innovative systems, creating strong interest in vehicles offering advanced illumination improvements that enhance overall driving confidence.

How are the proliferation of electric vehicles and the integration of design features driving the adaptive driving beam headlights market's growth?

The global adaptive driving beam headlights market is growing quickly as electric vehicle production increases worldwide and creates strong demand for advanced lighting solutions. Electric vehicle design freedom, free from engine layout limitations, allows manufacturers to create distinctive front profiles in which innovative lighting becomes an important styling element. Energy-efficient priorities in electric vehicles align well with LED and laser ADB systems using far less power than older lighting technologies.

Premium positioning of many early electric vehicles supports the adoption of advanced headlights, which strengthen the refined image presented to buyers. Lower heat generation in battery platforms simplifies the management of LED components requiring steady cooling for consistent lighting performance across varied driving conditions. Digital architecture in electric vehicles enables the seamless integration of complex lighting controls with navigation, camera systems, and driver-assistance features. Software-defined platforms also support future updates, improving lighting behavior and adding useful functions that enhance long-term ownership value.

Restraints

How are high costs and affordability challenges limiting the adaptive driving beam headlights market’s penetration?

A major challenge for the adaptive driving beam headlights market is the high cost premium these systems add to vehicle prices, which restricts widespread adoption across many segments. Component expenses, including LED arrays, camera modules, control electronics, and precision actuators, increase the overall system cost by several hundred dollars for each vehicle produced. Development requirements for manufacturers include engineering work, tooling preparation, and certification testing that must be distributed across expected production volumes. Integration complexity increases coordination needs between lighting suppliers, camera partners, control unit providers, and assembly operations, creating technical difficulties.

Insurance costs rise because repairing damaged adaptive headlight units after accidents requires expensive replacement parts, unlike simpler conventional headlights. Consumer price sensitivity in budget-oriented segments reduces willingness to invest in advanced lighting when basic headlights appear sufficient for daily driving. Value communication becomes difficult when explaining performance improvements to buyers unfamiliar with advanced lighting systems and unsure about higher purchase prices.

Opportunities

How is autonomous vehicle development creating new opportunities for the adaptive driving beam headlights market?

The adaptive driving beam headlights industry is gaining strong growth opportunities as autonomous vehicle development accelerates and requires reliable lighting support for many crucial functions. Camera perception systems in autonomous vehicles work more effectively with consistent illumination, improving object recognition and increasing overall detection accuracy in varied environments. Lidar systems also benefit from intelligent lighting that enhances visibility in targeted areas, creating smooth cooperation between multiple sensing technologies in real driving situations. Pedestrian communication improves when projected lighting signals vehicle intentions, helping build trust and improving safety in busy traffic environments with mixed road users.

Nighttime testing for autonomous platforms requires dependable lighting performance, ensuring sensors operate correctly across wide ranges of conditions during validation processes. Low-speed autonomous functions, including parking and tight-space maneuvering, operate more safely with precise illumination that adaptive lighting systems deliver during complex movements. Future regulations for autonomous mobility will likely require strong nighttime capabilities, with adaptive lighting demonstrating safe operation comparable to human driving.

Challenges

Regulatory fragmentation and standardization

The adaptive driving beam headlights industry faces major obstacles due to uneven global regulations and shifting standards, which create difficulties for product development and international vehicle distribution. Regional rule differences mean systems approved in Europe may require significant modifications for markets using separate compliance criteria, leading manufacturers to create multiple versions for different regions. Evolving United States regulations introduce new requirements that may diverge from existing international practices, increasing engineering work for companies supplying advanced lighting technology.

Testing procedures vary across countries, with distinct methods for assessing glare control, illumination range, beam accuracy, and long-term reliability, which increase the workload for validation teams across development cycles. Approval timelines also differ widely, with some regions allowing quick certification while others require lengthy evaluation periods that delay coordinated product launches. Performance standards include unique targets for acceptable glare limits, lighting distances, and response times that influence system design and calibration needs.

Adaptive Driving Beam (ADB) Headlights Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Adaptive Driving Beam (ADB) Headlights Market Research Report |

| Market Size in 2024 | USD 975.14 Million |

| Market Forecast in 2034 | USD 4,025.19 Million |

| Growth Rate | CAGR of 15.10% |

| Number of Pages | 220 |

| Key Companies Covered | Continental AG, Koito Manufacturing Co. Ltd., Valeo SA, Hella GmbH and Co. KGaA, Marelli Holdings Co. Ltd., OSRAM GmbH, Stanley Electric Co. Ltd., Hyundai Mobis Co. Ltd., ZKW Group GmbH, and SL Corporation |

| Segments Covered | By Technology Type, By Vehicle Type, By Sales Channel, By Application, By Component And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Adaptive Driving Beam (ADB) Headlights Market: Segmentation

The global adaptive driving beam headlights market is segmented based on technology type, vehicle type, sales channel, application, component, and region.

Based on technology type, the global adaptive driving beam headlights industry is divided into LED-based ADB, laser-based ADB, matrix LED, pixel LED, and others. LED-based ADB leads the market due to its mature technology, established supply chains, an excellent balance between performance and cost, and strong regulatory acceptance worldwide.

Based on vehicle type, the industry is classified into passenger cars, light commercial vehicles, heavy commercial vehicles, electric vehicles, and luxury vehicles. Passenger cars are expected to lead the market during the forecast period due to massive global production volumes and increasing safety-feature content in mainstream segments.

Based on sales channel, the global adaptive driving beam headlights market is categorized into OEM and aftermarket. OEM holds the largest market share due to the integration complexity that requires factory installation and the regulatory certification tied to complete vehicle systems.

Based on application, the global market is segmented into urban driving, highway driving, and all-terrain driving. Highway driving holds the largest market share due to the maximum benefit from extended high-beam illumination on dark roads, which is the primary use case for which ADB systems are designed to optimize.

Based on component, the global market is segregated into light source, control unit, sensors, and actuators. The light source holds the largest market share due to its critical importance as the primary functional element and its substantial value compared to other components.

Adaptive Driving Beam (ADB) Headlights Market: Regional Analysis

Europe is the leader in the global market

Europe leads the adaptive driving beam headlights market because early regulatory approval, strong automotive innovation, high safety awareness, and premium vehicle demand created supportive conditions for rapid technology adoption. Germany hosts major manufacturers, including Mercedes-Benz, BMW, and Audi, which introduced early adaptive lighting features in luxury models and established strong technical leadership in advanced illumination. European Union regulations permitted adaptive lighting years before other regions, giving manufacturers extended development time and valuable real-world deployment experience across diverse road environments. Safety awareness in Europe is driving investment in accident-prevention features, as consumers show a willingness to pay for technologies that improve nighttime visibility and overall road security.

Lighting suppliers, including Hella, Valeo, and Marelli, maintain extensive European operations with engineering teams supporting automakers through research programs and coordinated production activities. Nighttime driving patterns across Europe include rural roads with limited illumination, frequent fog or rain, and busy cities with complex traffic, creating conditions where adaptive headlights provide measurable benefits. Premium vehicle presence in Europe supports high technology inclusion as advanced lighting systems appear as standard or widely available options in many upper-segment models.

Environmental regulations promoting energy efficiency align well with LED-based adaptive systems that deliver strong performance with reduced power consumption. Testing facilities across Europe, including proving grounds and road pilot programs, help manufacturers evaluate lighting behavior under realistic driving situations. Consumer familiarity with digital devices and camera-based technologies strengthens acceptance of adaptive automotive systems offering clear functional improvements. Professional drivers, including taxi and delivery operators, gain improved nighttime visibility, enhancing safety and efficiency during extended working hours. The United Kingdom retains a strong engineering capability supporting research and development in lighting technologies despite ongoing economic changes.

What factors are contributing to the Asia Pacific’s rapid expansion in the adaptive driving beam headlights market?

Asia Pacific shows strong adaptive driving beam headlights market growth as regional automakers adopt advanced technologies, and rising consumer expectations increase demand for premium features across vehicle categories. Japan hosts major automotive innovators, including Toyota, Honda, and Nissan, which integrate adaptive lighting into domestic vehicles and export models serving competitive global markets. Japanese suppliers such as Koito Manufacturing maintain leading positions in automotive lighting with significant research programs supporting progress in adaptive illumination systems. Chinese regulators permit adaptive lighting in local vehicles while manufacturers develop systems suitable for export regions, including Europe, which require advanced illumination features. China’s strong electric vehicle production creates natural opportunities, as new platforms can integrate modern lighting without the constraints of older vehicle designs.

Luxury vehicle demand is rising across the Asia Pacific, including China, Japan, and developing markets, expanding the customer base for adaptive headlights in premium segments. South Korea’s automotive industry, led by Hyundai and Kia, develops competitive global vehicles where advanced lighting supports brand growth and technology leadership goals. Technology-friendly consumer groups across Asia, especially younger buyers, create supportive conditions for innovative features where adaptive lighting provides clear, visible benefits. Major Asian cities with high urban density present complex lighting transitions where adaptive systems help manage rapid shifts between bright zones and darker suburbs. Infrastructure improvement across developing Asian regions increases nighttime travel, strengthening the need for enhanced illumination offered by adaptive driving beam systems.

Recent Developments

- In November 2025, Koito Manufacturing Co. Ltd. introduced a compact laser-based adaptive driving beam system designed specifically for electric vehicles, offering extended range illumination while reducing weight and energy consumption compared to previous generations.

Adaptive Driving Beam (ADB) Headlights Market: Competitive Analysis

The leading players in the global adaptive driving beam headlights market are

- Continental AG

- Koito Manufacturing Co Ltd

- Valeo SA

- Hella GmbH and Co KGaA

- Marelli Holdings Co Ltd

- OSRAM GmbH

- Stanley Electric Co Ltd

- Hyundai Mobis Co Ltd

- ZKW Group GmbH

- SL Corporation

The global adaptive driving beam headlights market is segmented as follows:

By Technology Type

- LED-Based ADB

- Laser-Based ADB

- Matrix LED

- Pixel LED

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- Luxury Vehicles

By Sales Channel

- OEM

- Aftermarket

By Application

- Urban Driving

- Highway Driving

- All-Terrain Driving

By Component

- Light Source

- Control Unit

- Sensors

- Actuators

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed