5G IoT Modules Market Size, Share, Value and Forecast 2034

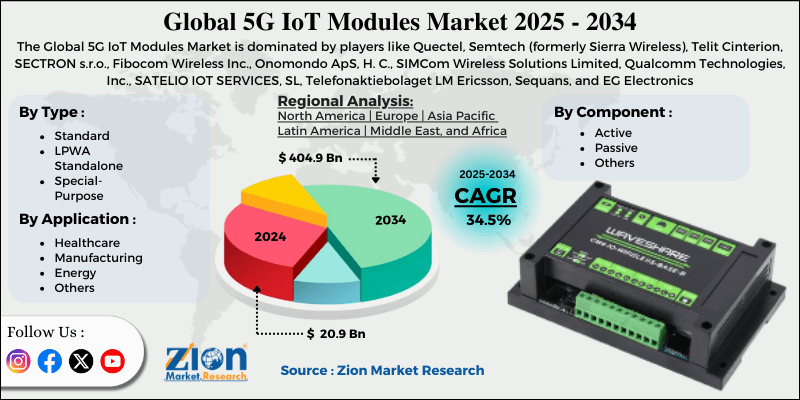

5G IoT Modules Market By Type (Standard, LPWA Standalone and Special-Purpose), By Component (Active, Passive, and Others), By Application (Healthcare, Manufacturing, Energy, and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 20.9 Billion | USD 404.9 Billion | 34.5% | 2024 |

5G IoT Modules Industry Prospective

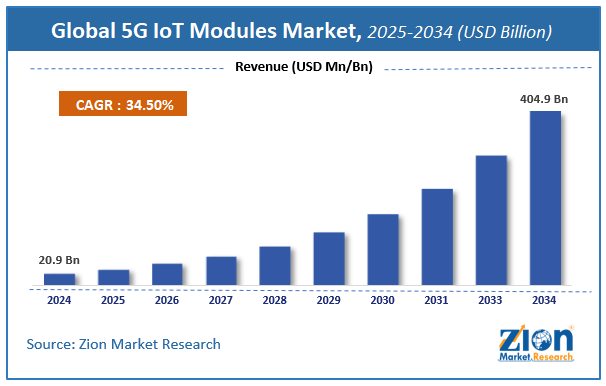

The global 5G IoT modules market size was worth around USD 20.9 billion in 2024 and is predicted to grow to around USD 404.9 billion by 2034, with a compound annual growth rate (CAGR) of roughly 34.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global 5G IoT Modules market is estimated to grow annually at a CAGR of around 34.5% over the forecast period (2025-2034).

- In terms of revenue, the global 5G IoT Modules market size was valued at around USD 20.9 billion in 2024 and is projected to reach USD 404.9 billion by 2034.

- Proliferation of connected devices is expected to drive the 5G IoT Modules market over the forecast period.

- Based on the type, the standard segment is expected to capture the largest market share over the projected period.

- Based on the component, the active segment is expected to capture the largest market share over the projected period.

- Based on the application, the healthcare segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

5G IoT Modules Market: Overview

5G IoT modules are small components of hardware that are inserted into IoT devices so they can connect to 5G networks. This makes them much faster and more reliable than 4 G or Wi-Fi, but slower than 4G or Wi-Fi. These modules include transceivers, antennas, and CPUs that enable features such as massive MIMO, beamforming, network slicing, and GNSS for accurate location tracking. There are many types, such as regular modules, special-purpose modules, LPWA standalone modules, and RedCap modules for programs that aren't too complex. 5G IoT modules can handle downlink speeds of up to 5.36 Gbps, uplink speeds of up to 900 Mbps, and latency of less than 10 ms for real-time apps like AR/VR and robotics.

It consumes up to 65% less energy than LTE Cat-4 because it includes a built-in IP stack, supports eSIM, and complies with 3GPP Release 17 standards, including SA/NSA modes. Two of the security features are enhanced protocols for mission-critical IoT and M.2 (52x30x2.3mm) form factors, which are well-suited to small devices such as sensors and industrial equipment.

5G IoT Modules Market Dynamics

Growth Drivers

How does the increasing demand for faster connectivity & better performance propel the 5G IoT modules industry growth?

The 5G IoT module market is growing as more people seek faster connections and greater performance. Next-generation IoT apps need data transmission speeds, ultra-low latency, and reliability that older cellular technologies can't always provide. As businesses start using real-time, data-intensive, and mission-critical apps such as smart surveillance, telemedicine, intelligent transportation systems, autonomous vehicles, and industrial automation, the problems with 4G and LPWAN solutions become increasingly clear.

5G technology increases the speed of data transfer, making response times almost instantaneous, and makes networks more stable. This enables IoT devices to perform real-time analytics, edge computing, AI-driven decision-making, and streaming high-definition video. Companies and device makers need to add 5G-enabled IoT modules to their hardware to achieve these performance boosts. This will expand the market for these modules. As IoT ecosystems shift from simple connections to performance-based systems, the need for faster, more reliable, and scalable connections is driving the adoption of 5G IoT modules across many industries, helping the market grow.

Restraints

High cost of 5G connectivity poses a major restraint to the market growth

The high cost of 5G connectivity is a significant reason the market for 5G IoT modules isn't growing. This is because it costs much more to move to 5G-enabled devices than to switch to traditional cellular technologies. The price of 5G IoT modules has increased because they require more powerful semiconductors, more complex RF designs, more antennas and bands, and greater computational power to deliver ultra-low latency and high data throughput. Companies also have to pay extra to set up networks, obtain spectrum licenses, certify devices, and connect to existing IoT infrastructure. Smart meters, asset trackers, and simple sensors are among IoT applications that are sensitive to cost and run on batteries. Higher 5G prices may offset the performance benefits. This could mean that people will keep using LTE or LPWAN. 5G connectivity isn't being used as much as it could be because it's so pricey. This is especially true in developing countries and in places where consumers are highly price-sensitive. This makes it harder for the 5G IoT module market as a whole to grow.

Opportunities

Does the innovative product launch offer a potential opportunity for the 5G IoT modules industry growth?

Innovative new products help the industry flourish by addressing problems that have previously slowed adoption, such as high costs, high power use, large size, and high complexity. The creation of low-cost, low-power 5G IoT modules, such as the 5G RedCap/NR-Light modules, is one instance. These modules enable a wider range of devices to connect to the internet, from high-end industrial and automotive applications to mid-range and mass-market IoT devices. These changes make it easier for industries like smart utilities, logistics tracking, healthcare monitoring, and smart city infrastructure to connect to 5G. For instance, Fibocom announced in February 2024 that it had successfully deployed and sold its 5G RedCap (Reduced Capability) modules for 5G IoT situations.

This decision was taken with the help of well-known customers, including Askey, Quanta Computer, and PLANET, all of which have significant market power in their respective vertical markets. The companies conducted extensive engineering testing and verification to ensure that the newest generation of 5G RedCap works seamlessly with client devices. This advancement will enable ultra-reliable data transfer and optimal network utilization in 5G networks, supporting many application scenarios, including residential, enterprise, and industrial-grade connectivity.

Challenges

Why does integration complexity with legacy IoT stacks pose a major challenge to the 5G IoT modules market expansion?

Integration complexity with legacy IoT stacks is an important obstacle to market growth because many businesses already have large, mission-critical IoT deployments based on older cellular technologies like 2G, 3G, 4G LTE, and LPWAN, as well as established device management platforms, protocols, and operational workflows. Moving these systems to 5G is not usually as simple as replacing the hardware; it often requires redesigning the devices, updating the firmware, migrating to new backend platforms, and ensuring they work with current apps, security frameworks, and data analytics tools. These changes increase the time to implementation, technical risk, and total deployment cost.

Also, legacy IoT ecosystems are deeply embedded in business processes, with long device lifecycles and a history of reliability. Businesses may not want to mess with systems that work well unless the advantages of 5G are considerably greater than the costs and risks of integration. Problems with interoperability, retraining technical staff, recertifying devices, and potential service outages all complicate decision-making. Because of this, the difficulty of connecting 5G IoT modules to existing IoT infrastructure delays upgrades, slows large-scale installations, and eventually inhibits market growth.

5G IoT Modules Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | 5G IoT Modules Market Research Report |

| Market Size in 2024 | USD 20.9 Billion |

| Market Forecast in 2034 | USD 404.9 Billion |

| Growth Rate | CAGR of 34.5% |

| Number of Pages | 220 |

| Key Companies Covered | Quectel, Semtech (formerly Sierra Wireless), Telit Cinterion, SECTRON s.r.o., Fibocom Wireless Inc., Onomondo ApS, H. C., SIMCom Wireless Solutions Limited, Qualcomm Technologies, Inc., SATELIO IOT SERVICES, SL, Telefonaktiebolaget LM Ericsson, Sequans, and EG Electronics |

| Segments Covered | By Type, By Component, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

5G IoT Modules Market: Segmentation

The global 5G IoT module market is segmented based on type, component, application and region.

By Type, the standard segment dominates the market. The 5G IoT module market complies with 3GPP standards such as Release 17 for 5G NR, which includes eMBB, URLLC, and mMTC, as well as IoT-specific protocols such as MQTT, CoAP, and LwM2M for data exchange and security via TLS/SSL. These provide interoperability, global compatibility across frequency bands, and connectivity with cloud platforms.

By Component, the active segment is expected to hold the largest revenue share over the projected period. The market for 5G IoT modules is experiencing revenue growth as more performance-critical and data-intensive IoT applications are adopted. Manufacturing, automotive, logistics, healthcare, and smart cities all require ultra-low latency, high reliability, and faster data transmission, which 5G can reliably provide. The expansion of 5G network coverage, combined with the introduction of unique, cost-effective modules, is propelling adoption beyond premium use cases and into mid-range and volume-driven IoT deployments.

By Application, the healthcare segment is expected to capture a substantial market share. The market is driven by the fast digital transformation of medical services and the need for reliable, real-time connections. The rise in linked medical devices, such as remote patient monitoring systems, wearable health trackers, smart diagnostic equipment, and connected imaging devices, is driving revenue growth. All of these devices need very fast communication speeds and very low latency. 5G IoT modules enable the transmission of large volumes of health data, such as high-resolution medical images and continuous vital signs, without issues. They also maintain low latency and high reliability, which is important for time-sensitive applications such as telemedicine, remote diagnostics, and emergency response.

5G IoT Modules Market: Regional Analysis

North America is expected to capture the largest share of the 5G IoT modules, at 45% over the forecast period, as it has created a very robust infrastructure, with telecommunications providers deploying 5G networks in substantial numbers across the region. Smart cities, manufacturing, healthcare, and logistics are among the sectors driving demand for 5G IoT modules in the region, owing to the region's established infrastructure. Furthermore, the region's robust technology environment and diverse industry verticals facilitate the rapid adoption of IoT modules.

Does the deployment of strong 5G infrastructure drive the US 5G IoT Modules market growth?

The expansion of the U.S. 5G IoT modules market is driven by the installation of strong 5G infrastructure, which makes it possible for large-scale IoT use. Widespread 5G coverage, made possible by statewide rollouts of both standalone (SA) and non-standalone (NSA) networks, enables ultra-low latency, huge data throughput, and reliable connectivity—all of which are necessary for advanced IoT applications. As U.S. telecom companies continue to densify their networks and expand mid-band and mmWave coverage, businesses are increasingly willing to invest in mission-critical IoT solutions. This increases the need for 5G-enabled modules.

5G IoT Modules Market: Competitive Analysis

The global 5G IoT Modules market is dominated by players like

- Quectel

- Semtech (formerly Sierra Wireless)

- Telit Cinterion

- SECTRON s r o

- Fibocom Wireless Inc

- Onomondo ApS H C

- SIMCom Wireless Solutions Limited

- Qualcomm Technologies Inc

- SATELIO IOT SERVICES

- SL

- Telefonaktiebolaget LM Ericsson

- Sequans

- EG Electronics

The global 5G IoT Modules market is segmented as follows:

By Type

- Standard

- LPWA Standalone

- Special-Purpose

By Component

- Active

- Passive

- Others

By Application

- Healthcare

- Manufacturing

- Energy

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed