Venous Stents Market Size, Share, Trends, Growth and Forecast 2034

Venous Stents Market By Technology (Iliac Vein Stent Technology, Wallstent Technology), By Disease (Acute DVT, Chronic DVT/PTS, NIVL/MTS, and Others), By Application (Leg, Chest, Abdomen, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

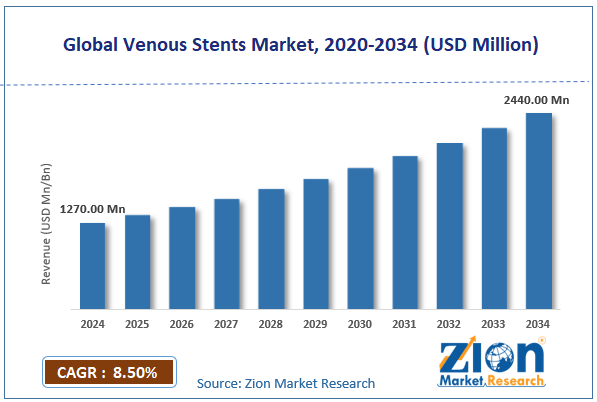

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

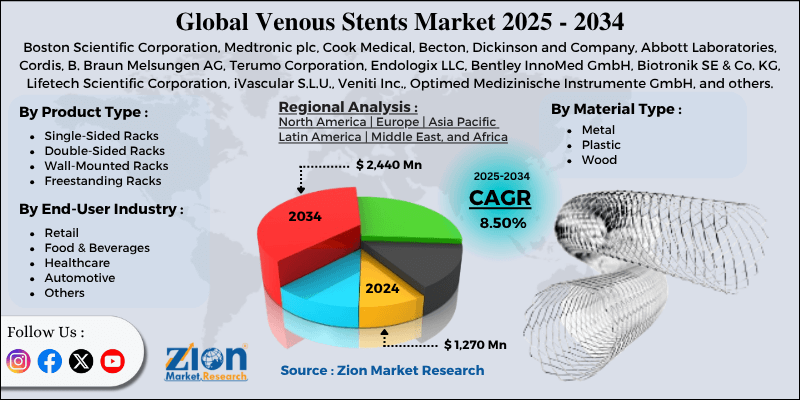

| USD 1,270 Million | USD 2,440 Million | 8.50% | 2024 |

Venous Stents Industry Perspective:

The global venous stents market size was worth around USD 1,270 million in 2024 and is predicted to grow to around USD 2,440 million by 2034, with a compound annual growth rate (CAGR) of roughly 8.50% between 2025 and 2034.

Venous Stents Market: Overview

Venous stents are mesh-like small devices that treat chronic venous obstructions by keeping blocked or narrowed veins open, particularly in the femoral and iliac veins. These stents are commonly used in patients with DVT (deep vein thrombosis), May-Thurner syndrome, or post-thrombotic syndrome. It helps restore normal blood flow and alleviate symptoms such as pain, leg ulcers, and swelling.

The global venous stents market is driven by the increasing prevalence of chronic venous disorders, a surging preference for less invasive procedures, and technological advancements in stent design. Chronic venous diseases like post-thrombotic syndrome and DVT are prevalent worldwide, affecting millions of people yearly. These disorders demand stent-based intervention to restore correct blood flow. Hence, the demand for venous stents is continuously rising in clinical settings.

Moreover, providers and patients are increasingly inclined towards less invasive methods to reduce surgical risks and improve recovery times. Venous stenting offers a non-surgical option for complicated vein blockages, increasing its preference. This trend is mainly strong in ambulatory and outpatient settings.

In addition, new-generation stents offer high radial force, compatibility, and better flexibility with tortuous venous anatomy. Modernizations, such as nitinol self-expanding stents, have enhanced clinical safety and outcomes. These improvements are improving patient outcomes and motivating physicians to adopt them.

However, the global market is facing hindrances due to the significantly priced venous stent procedures and the risk of in-stent thrombosis and restenosis. Stents and related interventional procedures are expensive, especially in countries lacking access to global healthcare or proper insurance coverage. This notably limits access for a majority of patients. Despite rare complexes like thrombosis post-stent placement or re-occlusion, they pose clinical issues, impacting patient acceptance and physicians' confidence.

Still, the global venous stents industry is expected to progress remarkably over the coming years, driven by the development of bio-absorbable venous stents and the integration of artificial intelligence in stent placement and vascular imaging.

Research on biodegradable stents that eventually dissolve is gaining traction. These stents may eliminate long-term risks associated with permanent implants. These advancements may dramatically revolutionize paradigms and offer new commercial prospects.

Also, AI and ML are improving diagnostic accuracy and procedural planning. AI-based imaging may help in stent sizing, outcome prediction, and positioning. This incorporation may decrease the rate of complications and enhance clinical workflows.

Key Insights:

- As per the analysis shared by our research analyst, the global venous stents market is estimated to grow annually at a CAGR of around 8.50% over the forecast period (2025-2034)

- In terms of revenue, the global venous stents market size was valued at around USD 1,270 million in 2024 and is projected to reach USD 2,440 million by 2034.

- The venous stents market is projected to grow significantly due to the increasing incidence of chronic venous disorders, advancements in stent design, and supportive reimbursement policies in developed regions.

- Based on technology, the iliac vein stent technology segment is expected to lead the market, while the Wallstent technology segment is expected to grow considerably.

- Based on disease, the chronic DVT/PTS is the dominant segment, while the NIVL/MTS segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the leg segment is expected to lead the market compared to the abdomen segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Venous Stents Market: Growth Drivers

Screening programs and growing awareness positively impact the market progress

There has been a significant growth in physician and public awareness regarding venous disorders and their possible complications. Organizations such as Vein Care Centers of America, World Thrombosis Day, and the American Venous Forum have strengthened their efforts to educate clinicians and patients about the early symptoms, treatment options, and risk factors associated with venous disease.

New global screening programs were introduced in South Africa, India, and Eastern Europe, aiming to identify CVI and DVT early in 2024. Private and government healthcare chains are partnering to deliver duplex ultrasound screenings, primarily in high-risk occupational groups such as miners, airline crews, and sedentary office workers.

Technological improvements in imaging and stent design propel the market

Modern stents are now designed to be self-expanding, vein-specific, and flexible, overcoming earlier restrictions related to arterial stents used off-label for venous conditions. Firms like BD, Boston Scientific, and Medtronic have heavily invested in R&D to improve the radial strength, biocompatibility, and fatigue resistance of venous stents. These developments will fuel the demand and will contribute to the growth of the venous stents market.

A remarkable development was presented in early 2024, when Boston Scientific declared the launch of the VICI VENOUS STENT ® System in APAC and European regions, denoting strong clinical outcomes in the VIRTUS and ABRE.

In addition, the incorporation of IVUS (intravascular ultrasound) with stenting procedures enables better visualization, resulting in enhanced placement accuracy and improved patient outcomes.

Venous Stents Market: Restraints

Risk of stent failures and postoperative complications unfavorably impact market growth

Despite improvements, venous stenting still poses risks, including stent migration, restenosis, and in-stent thrombosis. These complications may result in repeat procedures, litigation risks for providers, and low patient confidence.

The FDA issued a safety communication in December 2024 regarding the long-term failure rates of certain bare-metal stents used in venous applications. This urges clinicians to monitor patients for deferred complications and consider dual-antiplatelet therapy more carefully.

Venous Stents Market: Opportunities

The rise in outpatient and day-care venous interventions positively impacts market growth

There is a growing global trend toward ambulatory surgical centers and outpatient facilities for vascular interventions, which reduce hospitalization costs and improve patient throughput. This move creates a significant opportunity for producers to develop stents dedicated to outpatient procedures, offering low-profile delivery systems, compatibility, and faster deployment with portable imaging solutions. It also provides opportunities for training programs and portable interventional platforms for rural outreach. This is a key opportunity in the venous stents industry.

Venous Stents Market: Challenges

Challenges in proving cost-effectiveness to payers limit the market growth

Payers typically require health economics and long-term outcome data modeling to justify the coverage of novel medical technologies. Venous stents face a challenging task in proving their cost-effectiveness when compared to conservative management or pharmacological therapies.

Although stents offer clear quality-of-life enhancements, the lack of large-scale economic studies demonstrating reduced total lifetime costs or rehospitalizations has led to a decline in their inclusion in average reimbursement protocols.

Venous Stents Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Venous Stents Market |

| Market Size in 2024 | USD 1,270 Million |

| Market Forecast in 2034 | USD 2,440 Million |

| Growth Rate | CAGR of 8.50% |

| Number of Pages | 211 |

| Key Companies Covered | Boston Scientific Corporation, Medtronic plc, Cook Medical, Becton, Dickinson and Company, Abbott Laboratories, Cordis, B. Braun Melsungen AG, Terumo Corporation, Endologix LLC, Bentley InnoMed GmbH, Biotronik SE & Co. KG, Lifetech Scientific Corporation, iVascular S.L.U., Veniti Inc., Optimed Medizinische Instrumente GmbH, and others. |

| Segments Covered | By Product Type, By Material Type, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Venous Stents Market: Segmentation

The global venous stents market is segmented based on technology, disease, application, and region.

Based on technology, the global venous stents industry is divided into iliac vein stent technology and wall stent technology. The iliac vein stent technology segment accounted for a significant market share due to its targeted use in treating obstructions in the iliac veins, particularly in cases of post-thrombotic syndrome and May-Thurner Syndrome. These stents are precisely designed with high flexibility and radial strength, making them ideal for the anatomical complexity of the iliac vein. Their clinical success, rising preference among vascular surgeons, and broad adoption all contribute to increasing segmental dominance.

Based on disease, the global venous stents market is segmented into acute DVT, chronic DVT/PTS, NIVL/MTS, and others. The DVT/PTS segment accounted for a maximum market share. Venous stents are used to recanalize chronically blocked veins, primarily in the femoral and iliac segments, thereby enhancing venous outflow and alleviating debilitating symptoms. The disease's chronic nature, along with high recurrence rates, makes it deficient in conservative treatments, thus increasing dependency on stenting. Hence, the segment dominates the global market, especially in the geriatric population and those with a history of post-thrombosis.

Based on application, the global market is segmented into leg, chest, abdomen, and others. The leg segment is the leading segment in the market, driven by the increasing number of cases of venous obstructions in the femoral, iliac, and popliteal veins. Conditions like post-thrombotic, May-Thurner, and chronic DVT mainly affect the lower extremities, resulting in symptoms like pain, swelling, and skin ulcers. Venous stents are broadly used in these areas to reduce venous hypertension and restore blood flow. The leg segment registers a larger share due to a higher incidence of lower limb venous disorders.

Venous Stents Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is projected to hold a dominant share in the global venous stents market, backed by the increasing number of cases of venous disorders, a well-developed healthcare infrastructure, and supportive reimbursement policies.

North America, mainly the United States, registers a growing burden of venous disorders like post-thrombotic syndrome and DVT. Nearly 9,00,000 individuals in the United States are affected by PE and DVT per year, according to the CDC. A majority of these individuals develop chronic complications. This creates a significant demand for venous stenting as an enduring therapeutic solution.

The region also boasts a well-developed healthcare system featuring interventional radiology units and modernized vascular centers. These facilities perform complex procedures, such as IVC stenting and iliac procedures, with precision and safety. The availability of modern imaging and trained vascular surgeons further drives procedural volumes.

In addition, regional healthcare systems, primarily private insurers and Medicare, offer supportive reimbursement for venous stent procedures, thereby notably reducing out-of-pocket expenses. This motivates patients and providers to choose advanced venous interventions. Therefore, the stenting rate is higher in this region than in other developing markets.

The Asia Pacific region held a larger share of the venous stents industry, accounting for the second-largest share. This growth is attributed to the expanding healthcare infrastructure, the rising adoption of less invasive technologies, and the growing trend of cross-border care and medical tourism.

Nations such as South Korea, China, and India are investing significantly in interventional care and hospital infrastructure. These advancements have allowed broader adoption of minimally invasive procedures and vascular imaging. Hence, venous stenting is growing more accessible in tertiary and urban centers.

Moreover, there is a growing demand for minimally invasive vascular treatments in the APAC region, driven by increasing clinical training and patient awareness. Nations such as Singapore and Japan have incorporated stenting into their routine care. This shift is enhancing industry penetration and amplifying procedural volumes.

Malaysia, Thailand, and India have become prominent destinations for vascular procedures due to their quality care and cost-effectiveness. Venous stenting is widely performed for foreign patients who prefer affordable treatment. This drives market revenues, mainly in corporate and private hospital chains.

Venous Stents Market: Competitive Analysis

The leading players in the global venous stents market are:

- Boston Scientific Corporation

- Medtronic plc

- Cook Medical

- Becton

- Dickinson and Company

- Abbott Laboratories

- Cordis

- B. Braun Melsungen AG

- Terumo Corporation

- Endologix LLC

- Bentley InnoMed GmbH

- Biotronik SE & Co. KG

- Lifetech Scientific Corporation

- iVascular S.L.U.

- Veniti Inc.

- Optimed Medizinische Instrumente GmbH

Venous Stents Market: Key Market Trends

Move toward dedicated venous stent designs:

Manufacturers are increasingly shifting their focus from using arterial stents for venous applications to opting for dedicated venous stents, which are modified to accommodate vein anatomy. These stents offer higher radial strength, fatigue resistance, and flexibility to manage venous compression and flow.

Clinical trials and regulatory approvals improving confidence:

The venous stent industry is experiencing growth, driven by high-profile clinical trial data and regulatory approvals. Trials like ABRE (Abbott) and VERNACULAR (Venovo) have demonstrated strong safety and efficacy, leading to broader adoption among physicians. These studies are influencing clinical guidelines and increasing the number of on-label indications for venous stents.

The global venous stents market is segmented as follows:

By Product Type

- Single-Sided Racks

- Double-Sided Racks

- Wall-Mounted Racks

- Freestanding Racks

By Material Type

- Metal

- Plastic

- Wood

- Others

By End-User Industry

- Retail

- Food & Beverages

- Healthcare

- Automotive

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Venous stents are mesh-like small devices that treat chronic venous obstructions by keeping blocked or narrowed veins open, particularly in the femoral and iliac veins. These stents are commonly used in patients with DVT (deep vein thrombosis), May-Thurner syndrome, or post-thrombotic syndrome, which help restore normal blood flow and relieve symptoms like pain, leg ulcers, and swelling.

The global venous stents market is projected to grow due to the increasing preference for less invasive procedures, early diagnosis, rising awareness, and a growing geriatric population.

According to study, the global venous stents market size was worth around USD 1,270 million in 2024 and is predicted to grow to around USD 2,440 million by 2034.

The CAGR value of the venous stents market is expected to be approximately 8.50% from 2025 to 2034.

North America is expected to lead the global venous stents market during the forecast period.

The key players profiled in the global venous stents market include Boston Scientific Corporation, Medtronic plc, Cook Medical, Becton, Dickinson and Company, Abbott Laboratories, Cordis, B. Braun Melsungen AG, Terumo Corporation, Endologix LLC, Bentley InnoMed GmbH, Biotronik SE & Co. KG, Lifetech Scientific Corporation, iVascular S.L.U., Veniti Inc., and Optimed Medizinische Instrumente GmbH.

The report examines key aspects of the venous stents market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that influence the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed