Global Tug Boat Market Size, Trends Analysis, Report 2034

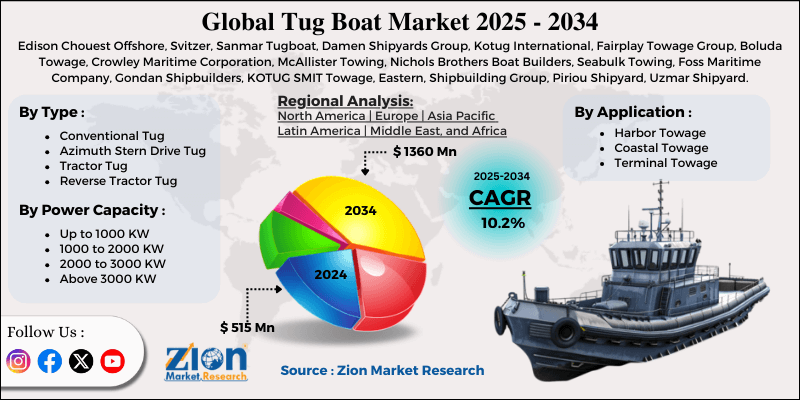

Tug Boat Market By Type (Conventional Tug, Azimuth Stern Drive Tug, Tractor Tug, Reverse Tractor Tug, and Others), By Power Capacity (Up to 1000 KW, 1000 to 2000 KW, 2000 to 3000 KW, and Above 3000 KW), By Application (Harbor Towage, Coastal Towage, and Terminal Towage), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

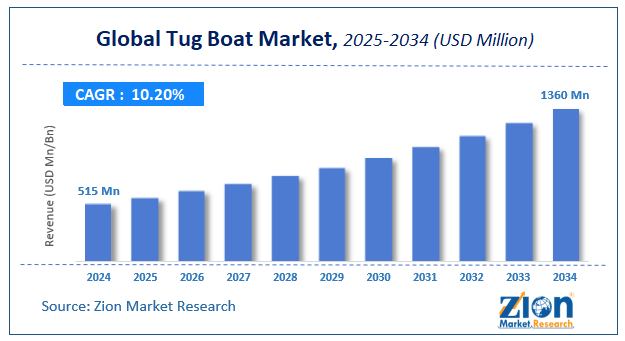

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 515 Million | USD 1360 Million | 10.2% | 2024 |

Tug Boat Industry Prospective:

The global tug boat market size was worth around USD 515 million in 2024 and is predicted to grow to around USD 1360 million by 2034, with a compound annual growth rate (CAGR) of roughly 10.2% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global tug boat market is estimated to grow annually at a CAGR of around 10.2% over the forecast period (2025-2034).

- In terms of revenue, the global tug boat market size was valued at around USD 515 million in 2024 and is projected to reach USD 1360 million by 2034.

- Increasing maritime trade is expected to drive the tug boat market over the forecast period.

- Based on the type, the conventional tug segment is expected to capture the largest market share over the projected period.

- Based on the power capacity, the 1000 to 2000 KW segment is expected to capture the largest market share over the projected period.

- Based on the application, the harbor towage segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Tug Boat Market: Overview

A tug boat, often called a tug, is a small but powerful watercraft that can move larger ships and buildings by pushing or towing them, either directly or via tow lines. This is helpful when ships can't move under their own power, such as in busy harbors, narrow canals, or when assisting barges, disabled boats, log rafts, or oil platforms. Tugboats are well-suited for assisting large ships in docking and undocking, hauling barges and other non-propelled vessels, providing escort services through channels, and performing emergency work such as icebreaking in cold weather, firefighting, oil spill response, and salvage. Ocean-going tugs pull objects across long distances across open seas, whereas salvage tugs are adept at saving people in emergencies. Their ability to adapt supports global marine trade by making sure that products can safely move through congested or hazardous waters.

Tug Boat Market Dynamics

Growth Drivers

Why does the rising maritime trade and strategic collaboration drive the tug boat industry growth?

Maritime trade is increasing, leading to lower shipping costs for clients worldwide. The shipping industry's prosperity depends on greater efficiency in ship placement and berthing, as well as on a more open economy. By 2025, Arctic shipping is expected to see traffic on the Northern Sea Route rise to 80 million tons of commodities each year. This rapid growth raises economic, environmental, political, and social issues that many countries need to address. There has been a significant rise in the market for tug boats in recent years, driven by increased demand in Asian and Indian waterways. For instance, in February 2022, the Indian Ministry of Shipping advised all major ports to buy or rent tugboats manufactured only in India. The new "Make in India" Order requires that all large port purchases comply with the rules. The contract for manufacturing 50-ton Bollard Pull Tugs was finished, and M/s Hindustan Shipyard Ltd delivered the last four tugs on January 24, 2022. So, the tug boat industry is expected to grow over the next few years due to increased marine traffic and government plans to expand ports.

Restraints

Why does the high capital cost of tugboats hamper the tug boat market growth?

The high cost of tugboats impedes market growth by limiting investment from smaller port operators, regional shipping companies, and new market entrants with limited access to capital. This slows down fleet expansion and modernization even though global trade demand is rising. Standard harbor tugboats cost between $5 and $10 million, while advanced ocean-going models cost more than $20 million. This is because they have powerful engines, specialized propulsion systems such as Z-drives or azimuth thrusters, high-strength materials, and integrated technologies like dynamic positioning, radar, and eco-friendly systems, all of which are needed to meet strict emission standards. All of these factors make the cost of buying a tugboat too high for many operators with thin profit margins. This high level of capital makes matters even more complicated in areas where adoption is slow or infrastructure is underdeveloped. High costs, along with ongoing expenses like insurance, maintenance, and fuel volatility, make it harder for the market to grow, for fleets to be replaced, and for scalability to happen.

Opportunities

Does growing product launch offer a potential opportunity for the tug boat industry’s growth?

The growing number of product launches in the market offers a positive outlook for the tugboat sector over the analysis period. For instance, in April 2025, Japan's first tugboat with a hydrogen-powered internal combustion engine (ICE) was built by TSUNEISHI SHIPBUILDING Co., Ltd. The TSUNEISHI Factory launched this ship on March 28, 2025. The ship has a high-power-output, dual-fueled hydrogen ICE and a high-pressure hydrogen gas storage system with plenty of space and supply. It also employed "JGreeX" green steel for all of its steel plates. JFE Steel Corporation made this type of steel. We will make boats that are better for the environment and help the world become less carbon-intensive by using green steel and hydrogen fuel.

Challenges

Shortage of skilled crew & tug masters poses a major challenge to market expansion

The tug boat industry is struggling to grow because there aren't enough skilled crew members and tug masters. This causes operational bottlenecks that limit fleet use, delay the deployment of new vessels, and raise labor costs as demand from growing maritime trade rises. Secondary research indicates an 8% overall crew shortfall and a projected deficit of nearly 90,000 officers across the sector by 2026. Tug operations require highly specialized skills in precise maneuvering, dynamic positioning, and adherence to safety protocols in high-stress situations, such as crowded ports or adverse weather. However, an aging workforce, post-pandemic attrition, and competition from shore-based jobs exacerbate the shortage, particularly for tug masters, who require years of sea time and certifications. This limits scalability, as newbuild deliveries alone exceeded 180 units in H1 2025. Because of this talent gap, services are less reliable, smaller operators can't compete for talent, and they have to rely on less-experienced workers who are more likely to make mistakes. This makes it harder for the market to grow, even though trade volumes are substantial, and forces operators to spend more on training or automation.

Tug Boat Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Tug Boat Market |

| Market Size in 2024 | USD 515 Million |

| Market Forecast in 2034 | USD 1360 Million |

| Growth Rate | CAGR of 10.2% |

| Number of Pages | 270 |

| Key Companies Covered | Edison Chouest Offshore, Svitzer, Sanmar Tugboat, Damen Shipyards Group, Kotug International, Fairplay Towage Group, Boluda Towage, Crowley Maritime Corporation, McAllister Towing, Nichols Brothers Boat Builders, Seabulk Towing, Foss Maritime Company, Gondan Shipbuilders, KOTUG SMIT Towage, Eastern, Shipbuilding Group, Piriou Shipyard, Uzmar Shipyard, Cheoy Lee Shipyards, Keppel Singmarine, and Med Marine, among others. |

| Segments Covered | By Type, By Power Capacity, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America,The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Tug Boat Market: Segmentation

The global tug boat industry is segmented based on type, power capacity, application, and region.

Based on type, the global market is bifurcated into conventional tug, azimuth stern drive tug, tractor tug, reverse tractor tug, and others. The conventional tug segment is expected to dominate the market. The growth is driven by their reliability in standard harbor and riverine operations.

Based on power capacity, the global tug boat industry is bifurcated into up to 1000 kw, 1000 to 2000 kw, 2000 to 3000 kw, and above 3000 kw. The 1000 to 2000 kw segment holds a significant market share. The segment's growth is attributable to its optimal combination of power, low cost, and adaptability for key port operations. These mid-range tugs have sufficient bollard pull to escort, tow barges, and move medium-sized vessels in busy ports, terminals, and inland waterways without consuming excessive fuel or incurring high costs, making them well-suited for operators seeking to reduce costs amid rising maritime trade and port modernization.

Based on application, the global tug boat market is bifurcated into harbor towage, coastal towage, and terminal towage. The harbor towage segment holds a significant market share. The segment growth is fueled by escalating demand for precise vessel maneuvering in congested ports amid surging maritime trade volumes.

Tug Boat Market: Regional Analysis

Will North America dominate the tug boat market over the projected period?

North America dominates the tug boat sector. The region's growth relies on its strong marine sector, which will add $476 billion to US GDP in 2022 and support 2.4 million jobs through increased maritime trade, improved port facilities, and modernized fleets. Key ports like Houston, Los Angeles, New York, and Seattle are seeing more ships come and go due to offshore oil and gas activities in the Gulf of Mexico, container expansions under programs like America's Maritime Strategy, and strict EPA Tier IV emissions rules. All of these factors create a need for compliant, high-power tugs that can handle ultra-large carriers amid congestion. Government subsidies for eco-friendly retrofits and new builds, as well as large companies like Foss Maritime and Kirby Corporation, which consistently handle inland waterway logistics and coastal operations, are driving this growth even further. These companies make sure that harbor assistance is always available, even in a mature market.

Tug Boat Market: Competitive Analysis

The global tug boat market is dominated by players like-

- Edison Chouest Offshore

- Svitzer

- Sanmar Tugboat

- Damen Shipyards Group

- Kotug International

- Fairplay Towage Group

- Boluda Towage

- Crowley Maritime Corporation

- McAllister Towing

- Nichols Brothers Boat Builders

- Seabulk Towing

- Foss Maritime Company

- Gondan Shipbuilders

- KOTUG SMIT Towage

- Eastern

- Shipbuilding Group

- Piriou Shipyard

- Uzmar Shipyard

- Cheoy Lee Shipyards

- Keppel Singmarine

- Med Marine

- among others.

The global tug boat market is segmented as follows:

By Type

- Conventional Tug

- Azimuth Stern Drive Tug

- Tractor Tug

- Reverse Tractor Tug

- Others

By Power Capacity

- Up to 1000 KW

- 1000 to 2000 KW

- 2000 to 3000 KW

- Above 3000 KW

By Application

- Harbor Towage

- Coastal Towage

- Terminal Towage

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed