Railway Construction Technology Market Size, Share, Trends, Growth 2034

Railway Construction Technology Market By Technology (Construction Machinery and Equipment, Tunneling and Excavation Equipment, Track Laying and Maintenance Equipment, Signaling and Communication Systems, and Others), By Rail Type (Metro, Light Rail, and Bullet Train Or High-Speed Rail (HSR)), By Application (New Railway Construction and Railway Renovation & Modernization), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

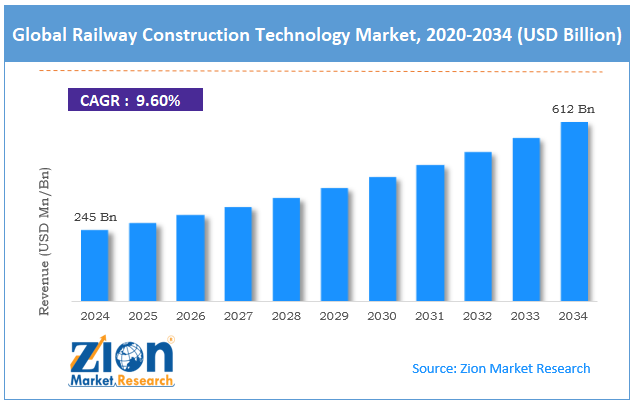

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 245 Billion | USD 612 Billion | 9.6% | 2024 |

Railway Construction Technology Industry Perspective:

The global railway construction technology market size was worth around USD 245 billion in 2024 and is predicted to grow to around USD 612 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.6% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global railway construction technology market is estimated to grow annually at a CAGR of around 9.6% over the forecast period (2025-2034).

- In terms of revenue, the global railway construction technology market size was valued at around USD 245 billion in 2024 and is projected to reach USD 612 billion by 2034.

- The rising government investments in public infrastructure are expected to drive the railway construction technology market over the forecast period.

- Based on the technology, the construction machinery and equipment segment is expected to capture the largest market share over the projected period.

- Based on the rail type, the light rail segment is expected to capture the largest market share over the projected period.

- Based on the application, the railway renovation and modernization segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Railway Construction Technology Market: Overview

Railway construction technology is a branch of civil and railway engineering that deals with all stages of building and improving rail transportation systems. This includes surveying routes, building earthworks, laying tracks, electrifying them, signaling them, and keeping the structures in good shape. It uses heavy construction equipment, mechanized track-laying machines, advanced materials such as concrete, steel, and geosynthetics, and digital tools such as the Internet of Things (IoT), Artificial Intelligence (AI), and remote sensing to build safe, long-lasting, and efficient railway infrastructure. The growth of high-speed rail networks, government spending on public infrastructure, the adoption of digital construction technology, urbanization, and the need for mass transit are all factors driving the industry. But the substantial initial investment is an enormous challenge for the sector's expansion.

Railway Construction Technology Market Dynamics

Growth Drivers

How does the expansion of High-Speed Rail (HSR) networks drive the railway construction technology market growth?

The growth of High-Speed Rail (HSR) networks has had an enormous impact on the railway construction technology market. It needs new infrastructure solutions that improve operations, making them faster, safer, and more efficient. High-speed rail (HSR) projects require specialized track-building technologies, such as slab track systems, which reduce vibration and help tracks last longer than conventional ballasted tracks. This means that more precise construction tools and materials are needed. The use of modern signaling and control systems, such as levels 2 and 3 of the European Train Control System (ETCS), makes it easier for different systems to work together and ensures real-time safety oversight. This leads to more money being spent on complicated digital railway technologies.

Governments and corporate leaders see high-speed rail as a way to boost trade, jobs, and access, leading to significant investments and large high-tech railway construction projects worldwide. HSR extensions also encourage the use of automation, the Internet of Things (IoT), artificial intelligence (AI), and modular building techniques. These measures increase productivity while lowering long-term operating costs, leading to more innovation and market growth. As developing economies overcome their initial regulatory and cost challenges, they become essential growth markets that drive global demand for new railway construction technologies.

Restraints

High initial capital investment impedes market growth

The rail construction technology business has struggled to grow because it requires significant upfront investment to build railway infrastructure, especially for high-speed rail (HSR) projects. These projects require considerable planning, land purchases, and legal fees, which might cost 10% or more of the overall investment to be ready. Construction costs include things like earthworks, viaducts, bridges, tunnels, and intricate rail systems. These costs can range from 15% to 50% of the total, and they can occasionally be far higher than expected. It's challenging to secure project financing because investors and governments are taking significant financial risks and don't know what will happen in the long term without firm long-term funding commitments. Long project schedules and delays raise the expenses of labor, equipment, and materials. This makes it less likely that private enterprises will get engaged because they don't perceive a favorable return on their investment.

Also, significant challenges with land rights, the environment, and regulations make things more expensive and take longer to complete. These issues with finances, management, and operations make it harder to build railroads and bring innovative technologies to market. There is significant long-term demand and strategic interest in modernizing train infrastructure, but this impedes short-term expansion.

Opportunities

Will the rising company expansion offer a potential opportunity for the railway construction technology industry growth?

The growing company expansion is expected to offer a potential opportunity to the railway construction technology market. For instance, in August 2025, Frauscher Sensortechnik began construction of its largest production hub in Mysore, India, as part of its long-term ambition to improve global supply chains and support modernization projects worldwide.

An official ceremony on August 7, 2025, marked the commencement of work on the industrial facility. The company wants to finish this cutting-edge factory by October 2026. It will be an essential part of its global production network. The two-story manufacturing cluster, which occupies approximately 14,400 square meters (155,000 square feet), is strategically planned to increase the production of sensors and boards while also promoting job growth and technical innovation in the area. There will be offices, an R&D center, and two centers of excellence on the first level. The production operations will be on the ground floor.

Challenges

Why do the complex regulatory and safety standards pose a major challenge to the railway construction technology market expansion?

Complicated rules and safety regulations make it hard for the railway construction technology industry to flourish, as they lengthen and increase the cost of the approval process, slowing project start-ups and completions. Regulatory frameworks require strict adherence to safety, environmental, land-acquisition, and operational standards, as well as comprehensive testing, certification, and regular inspections throughout the construction process. Many government agencies are involved in granting permission and overseeing matters, which makes the process more complicated and could lead to delays and higher administrative costs. Not following these rules can lead to hefty fines, project shutdowns, or legal fights, which can cost the parties a lot of money.

Also, establishing safety standards and environmental rules requires ongoing changes to technology and project processes, making things less predictable and costing more money. Planning and carrying out plans is harder due to different municipal zoning restrictions, land-use rights, and community engagement requirements. These problems make railway projects less flexible, reduce people's willingness to invest, and delay project delivery, slowing overall market growth even though there is a strong need for new rail infrastructure.

Railway Construction Technology Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Railway Construction Technology Market |

| Market Size in 2024 | USD 245 Billion |

| Market Forecast in 2034 | USD 612 Billion |

| Growth Rate | CAGR of 9.6% |

| Number of Pages | 213 |

| Key Companies Covered | Alstom, Siemens AG, Bombardier Transportation, ABB Group, CRRC Corporation Limited, Hitachi Ltd., Thales Group, Bechtel Corporation, Balfour Beatty plc, VINCI Group, Ansaldo STS (now part of Hitachi Rail), Strukton Rail, Wabtec Corporation (formerly Westinghouse Air Brake Technologies Corporation), CAF Group (Construcciones y Auxiliar de Ferrocarriles), Plasser & Theurer, and others. |

| Segments Covered | By Technology, By Rail Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Railway Construction Technology Market: Segmentation

The global railway construction technology industry is segmented based on technology, rail type, application, and region.

Based on technology, the global railway construction technology market is bifurcated into construction machinery and equipment, tunneling and excavation equipment, track laying and maintenance equipment, signaling and communication systems, and others. The construction machinery and equipment segment is expected to capture the largest market share over the projected period. The main driver of development is increased spending on expanding and upgrading railway infrastructure.

As more people move to cities and more factories open, the need for efficient mass transit and freight transportation is growing. This is leading to more railway projects worldwide. To finish projects faster and more accurately, it requires contemporary construction tools, including mechanized track-laying machines, earthmoving equipment, tunnel boring machines, and automated maintenance technologies.

Based on rail type, the global railway construction technology industry is bifurcated into Metro, Light Rail, and Bullet Train or High-Speed Rail (HSR). The light rail segment holds the major market share. More people are moving to cities, which increases the need for efficient, eco-friendly public transportation systems. Light rail systems are a long-term, cost-effective way to reduce traffic and carbon emissions in growing cities. Government and local investments in developing and improving light rail networks make it easier for people to get around and to engage with one another.

Based on the application, the global railway construction technology market is bifurcated into new railway construction and railway renovation & modernization. The railway renovation and modernization is expected to capture the largest market share over the forecast period, driven by increasing investments to upgrade aging rail infrastructure and enhance safety, efficiency, and capacity.

Railway Construction Technology Market: Regional Analysis

Why does North America dominate the railway construction technology market over the projected period?

The North America region is expected to dominate the railway construction technology market. The region's growth is being driven by large sums of government and private-sector funding for expanding, upgrading, and modernizing train infrastructure. High-speed rail projects, better track electrification, and the expansion of freight and passenger rail networks to increase capacity and efficiency are all major growth drivers. The use of cutting-edge digital technologies such as IoT, AI, improved signaling, and automation is making rail networks more efficient, safer, and better at predicting when repairs are needed. This is boosting the need for new construction technologies and equipment.

In addition, national infrastructure bills, such as the US government's multibillion-dollar rail infrastructure expenditure, fund big projects and research and development initiatives. The US and Canada have large rail companies and integrated supply chains that enable the development of contemporary construction tools and materials tailored to the needs of each location. The market is growing as there is a greater focus on sustainable transportation and on expanding train lines in cities and between cities.

Railway Construction Technology Market: Competitive Analysis

The global railway construction technology market is dominated by players like:

- Alstom

- Siemens AG

- Bombardier Transportation

- ABB Group

- CRRC Corporation Limited

- Hitachi Ltd.

- Thales Group

- Bechtel Corporation

- Balfour Beatty plc

- VINCI Group

- Ansaldo STS (now part of Hitachi Rail)

- Strukton Rail

- Wabtec Corporation (formerly Westinghouse Air Brake Technologies Corporation)

- CAF Group (Construcciones y Auxiliar de Ferrocarriles)

- Plasser & Theurer

The global railway construction technology market is segmented as follows:

By Technology

- Construction Machinery and Equipment

- Tunneling and Excavation Equipment

- Track Laying and Maintenance Equipment

- Signaling and Communication Systems

- Others

By Rail Type

- Metro

- Light Rai

- Bullet Train Or High-Speed Rail (HSR)

By Application

- New Railway Construction

- Railway Renovation and Modernization

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Railway construction technology is a branch of civil and railway engineering that deals with all stages of building and improving rail transportation systems. This includes surveying routes, building earthworks, laying tracks, electrifying them, signaling them, and keeping the structures in good shape.

The growth of high-speed rail networks, government spending on public infrastructure, the adoption of digital construction technology, urbanization, and the need for mass transit are all factors driving the industry.

High initial capital investment poses a major challenge to the expansion of the railway construction technology industry.

Based on the application, the railway renovation and modernization segment is expected to dominate the railway construction technology market growth during the projected period.

The growing investment in advanced railway infrastructure poses a major impact factor for the railway construction technology industry's growth over the projected period.

According to the report, the global railway construction technology market size was worth around USD 245 billion in 2024 and is predicted to grow to around USD 612 billion by 2034.

The global railway construction technology market is expected to grow at a CAGR of 9.6% during the forecast period.

The global railway construction technology industry growth is expected to be driven by the North America region. It is currently the world’s highest-revenue-generating market due to significant investment in advanced railway technology.

The global railway construction technology market is dominated by players like Alstom, Siemens AG, Bombardier Transportation, ABB Group, CRRC Corporation Limited, Hitachi Ltd., Thales Group, Bechtel Corporation, Balfour Beatty plc, VINCI Group, Ansaldo STS (now part of Hitachi Rail), Strukton Rail, Wabtec Corporation (formerly Westinghouse Air Brake Technologies Corporation), CAF Group (Construcciones y Auxiliar de Ferrocarriles), and Plasser & Theurer, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed