Outpatient Care Market Size, Share, Trends, Growth & Forecast 2034

Outpatient Care Market By Service Type (Ambulatory Surgical Centers (ASCs), Diagnostic Imaging Centers, Specialty Clinics, Urgent Care Centers, Family Planning Centers, Outpatient Mental Health, Primary Care Clinics, and Others), By Application (Hospitals, Ambulatory Surgical Centers, and Others), By Expenditure Type (Public and Private), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

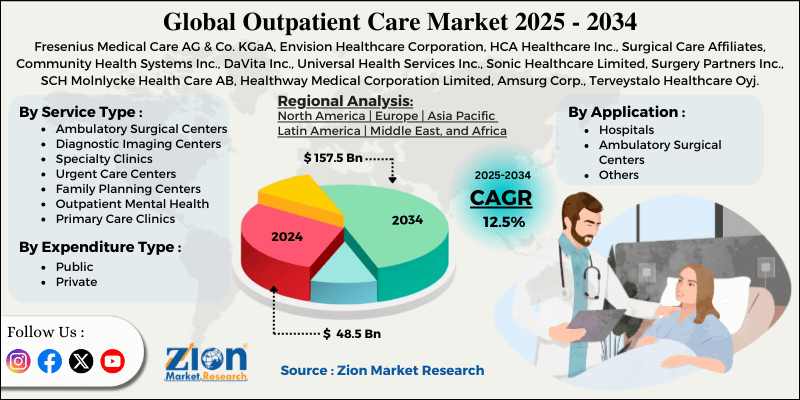

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 48.5 Billion | USD 157.5 Billion | 12.5% | 2024 |

Outpatient Care Industry Perspective:

What will be the size of the global outpatient care market during the forecast period?

The global outpatient care market size was worth around USD 48.5 billion in 2024 and is predicted to grow to around USD 157.5 billion by 2034, with a compound annual growth rate (CAGR) of roughly 12.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global outpatient care market is estimated to grow annually at a CAGR of around 12.5% over the forecast period (2025-2034).

- In terms of revenue, the global outpatient care market size was valued at around USD 48.5 billion in 2024 and is projected to reach USD 157.5 billion by 2034.

- Increasing preference for convenience, cost-effectiveness, and quicker access to healthcare services is expected to drive the outpatient care market over the forecast period.

- Based on the service type, the urgent care centers segment is expected to dominate the market over the projected period.

- Based on the application, the hospitals segment held the largest market share of 38% in 2024.

- Based on the expenditure type, the private segment held the largest revenue share in 2024 of more than 50%.

- Based on region, North America is expected to dominate the market during the forecast period.

Outpatient Care Market: Overview

People who obtain outpatient care don't have to spend the night in the hospital. This covers medical care, diagnostic tests, preventive care, and minor surgical procedures. They can get these services at many places, such as hospital outpatient departments, ambulatory surgery centers, doctors' offices, specialty clinics, urgent care facilities, and, more recently, telehealth platforms. With outpatient treatment, patients can get medical care quickly and go home the same day. This includes follow-up visits, consultations, regular exams, diagnostic imaging and lab tests, day surgeries, rehabilitation therapies, and the management of chronic illnesses. This kind of care prioritizes accessibility, cost-effectiveness, and convenience. It is also important to reduce the number of patients in hospitals and to promote ongoing, patient-centered treatment.

Outpatient Care Market Dynamics

Growth Drivers

Why does the rapid expansion of telehealth & digital care pathways propel the growth of the outpatient care market?

The quick growth of telehealth and digital care pathways is helping the outpatient care sector thrive by making healthcare delivery easier, faster, and more scalable, especially for outpatient treatment. Telehealth enables physicians to see more patients without regard to location or office space. They can achieve this by offering online consultations, remote triage, and email follow-ups. This reduces wait times for appointments, lowers no-show rates, and shifts much routine and follow-up care out of hospitals, making the system as a whole more efficient. Digital care pathways, such as remote patient monitoring, e-prescriptions, AI-assisted diagnostics, and integrated electronic health records, help keep therapy going by enabling clinicians to share data in real time and prevent diseases from worsening, especially for long-term illnesses.

Telehealth makes each visit cheaper for both doctors and patients, aligning with payers' goals of reducing hospital stays and emergency room visits. As smartphones become more popular and internet infrastructure improves, more individuals are also accepting virtual care. This has accelerated the adoption of virtual care worldwide among people of all ages. These factors work together to improve healthcare by making it more efficient, more patient-focused, and less expensive. This makes outpatient treatment and the healthcare services industry as a whole move forward faster.

Restraints

How do the workforce shortages & labor costs impede the outpatient care industry’s growth?

Shortages of workers and rising labor costs make it harder for the healthcare industry to thrive, as they directly limit providers' capacity, efficiency, and financial stability, especially in outpatient services. Clinics and ambulatory centers can only see a limited number of patients, even when demand is strong, because there aren't enough doctors, nurses, anesthetists, and other health professionals. This means longer wait times and less service availability.

At the same time, increased competition for skilled healthcare workers has led to higher pay, overtime pay, and higher hiring costs. This has greatly increased the costs of running outpatient facilities, which already have smaller profit margins than hospitals. These cost pressures make it less profitable, push back on growth plans, and make people less likely to invest in additional outpatient locations or service lines. Also, worker fatigue and excessive turnover make it hard to keep services running and make them less productive, leading to waste and higher training costs. A shortage of workers and rising labor costs constitute a structural barrier that impedes the outpatient care sector's growth and its ability to meet the needs of more patients.

Opportunities

Will the rising collaboration offer a potential opportunity for the outpatient care market?

The increasing collaboration is expected to offer a potential opportunity to the outpatient care market over the analysis period. For instance, in October 2025, Provider Partners Connect Care started a new value-based care (VBC) project that gives nursing home owners direct access to programs and services. Provider Partners Connect Care is one of only 14 nationally recognized High-Needs ACO REACH organizations. It is also the second-largest provider of value-based care products for long-term care patients in nursing homes. This program enables operators to begin using value-based care, in line with the Centers for Medicare & Medicaid Services' aim to move all Medicare patients to a VBC model by 2030. This is especially important because nursing homes are still having trouble with regulations and staffing.

Challenges

High capital investment requirements pose a major challenge to market expansion

High capital requirements make it challenging for the market to flourish, as they make it hard for both new and established outpatient care providers to secure the funding they need to thrive. It costs substantial upfront capital to establish or expand outpatient facilities, such as ambulatory surgical centers, diagnostic imaging centers, and specialty clinics. This is because they require advanced medical equipment, digital health infrastructure, and facilities that must be built or renovated and that comply with safety and accreditation standards. These high costs raise financial risk and slow the return on investment, especially when prices and reimbursements are low.

Smaller, independent providers sometimes have few ways to raise money, which makes it harder for them to adopt new technology or offer more services. But larger hospital systems and private equity-backed chains with stronger financials do gain. This is why high capital requirements make it tougher for new enterprises to enter the market, reduce the number of rivals, and slow growth in the outpatient care industry as a whole.

Outpatient Care Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Outpatient Care Market |

| Market Size in 2024 | USD 48.5 Billion |

| Market Forecast in 2034 | USD 157.5 Billion |

| Growth Rate | CAGR of 12.5% |

| Number of Pages | 213 |

| Key Companies Covered | Fresenius Medical Care AG & Co. KGaA, Envision Healthcare Corporation, HCA Healthcare Inc., Surgical Care Affiliates, Community Health Systems Inc., DaVita Inc., Universal Health Services Inc., Sonic Healthcare Limited, Surgery Partners Inc., SCH Molnlycke Health Care AB, Healthway Medical Corporation Limited, Amsurg Corp., Terveystalo Healthcare Oyj, Sutter Health, Quest Diagnostics Incorporated, and others. |

| Segments Covered | By Service Type, By Application, By Expenditure Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Outpatient Care Market: Segmentation

Service Type Insights

The urgent care centers segment is expected to dominate the market over the projected period. Their growth has been spurred by their ability to offer fast, easy, and affordable medical care outside traditional hospital settings. Urgent care centers are between general care doctors and emergency rooms. They handle problems that aren't life-threatening, like minor accidents, infections, diagnostic needs, and acute diseases. They usually have extended hours and don't require an appointment. As a result, the number of patients visiting urgent care centers has steadily increased, thereby immediately increasing the profits of urgent care operators, as they have lower treatment costs and shorter wait times than emergency rooms.

Application Insights

The hospitals segment held the largest market share of 38% in 2024. They carefully expand their outpatient departments and ambulatory services to keep up with changes in how healthcare is delivered. One of the main reasons for this rise is the shift of treatments and consultations from hospitals to outpatient settings. This is happening because payers are pushing for it, costs are being cut, and new minimally invasive technologies that allow for same-day release are being developed. By moving elective surgeries, diagnostics, chronic disease management, and follow-up treatment to outpatient hospital settings, hospitals can increase patient volume, reduce length of stay and operational costs, and increase revenue.

Expenditure Type Insights

The private segment accounted for the largest share of revenue in 2024, exceeding 50%. The rise is due to their flexibility, efficiency, and alignment with what patients and payers desire. One of the main reasons for this growth is that private outpatient providers can deliver care faster and for less money than hospitals. They are wonderful choices for elective operations, tests, and regular checkups. Their lean business models enable them to see more patients in less time and for less money, which helps drive segment growth.

Regional Insights

What factors will enable North America to dominate the outpatient care market?

North America leads the market with a revenue share of over 35%. There are many reasons regions are growing, such as more patients seeking easy-to-reach treatments, new medical technologies that enable complex procedures outside hospitals, and changes in reimbursement laws that encourage value-based care. In 2024, health care spending in the United States is predicted to rise by 8.2%. This is because people are using more health care services and goods, and outpatient services constitute a big component of this growth.

However, the Asia Pacific is expected to grow at the highest CAGR during the projected period. The growing number of chronic diseases that need ongoing treatment, the growing middle class with greater funds to spend, better healthcare infrastructure, and government efforts to promote primary and community-based care. Countries in the region are investing substantial resources to facilitate access to treatment outside large institutions.

Outpatient Care Market: Competitive Analysis

The global outpatient care market is dominated by players like:

- Fresenius Medical Care AG & Co. KGaA

- Envision Healthcare Corporation

- HCA Healthcare Inc.

- Surgical Care Affiliates

- Community Health Systems Inc.

- DaVita Inc.

- Universal Health Services Inc.

- Sonic Healthcare Limited

- Surgery Partners Inc.

- SCH Molnlycke Health Care AB

- Healthway Medical Corporation Limited

- Amsurg Corp.

- Terveystalo Healthcare Oyj

- Sutter Health

- Quest Diagnostics Incorporated

The global outpatient care market is segmented as follows:

By Service Type

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Imaging Centers

- Specialty Clinics

- Urgent Care Centers

- Family Planning Centers

- Outpatient Mental Health

- Primary Care Clinics

- Others

By Application

- Hospitals

- Ambulatory Surgical Centers

- Others

By Expenditure Type

- Public

- Private

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed