Healthcare Robotics-Surgical Robots Market Size, Share Report 2034

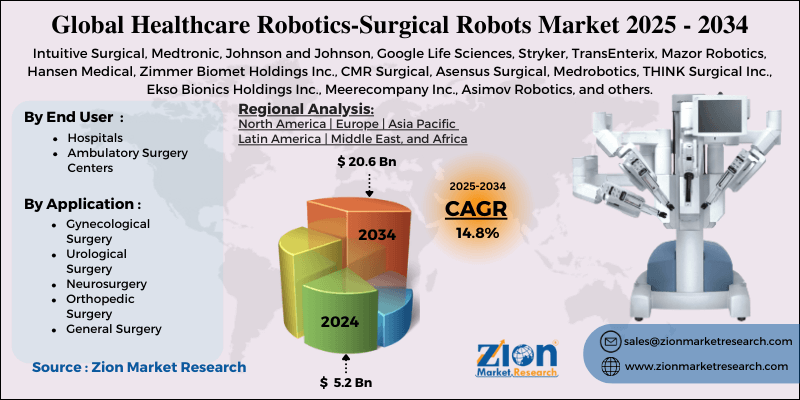

Healthcare Robotics-Surgical Robots Market By Application (Gynecological Surgery, Urological Surgery, Neurosurgery, Orthopedic Surgery, and General Surgery), By End-User (Hospitals and Ambulatory Surgery Centers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

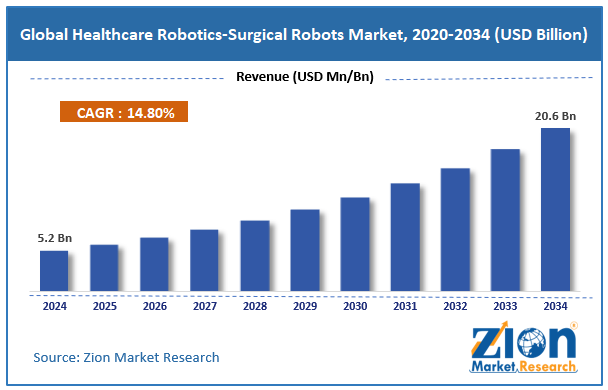

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.2 Billion | USD 20.6 Billion | 14.8% | 2024 |

Healthcare Robotics-Surgical Robots Industry Perspective:

The global healthcare robotics-surgical robots market size was worth around USD 5.2 billion in 2024 and is predicted to grow to around USD 20.6 billion by 2034, with a compound annual growth rate (CAGR) of roughly 14.8% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global healthcare robotics-surgical robots market is estimated to grow annually at a CAGR of around 14.8% over the forecast period (2025-2034).

- In terms of revenue, the global healthcare robotics-surgical robots market size was valued at around USD 5.2 billion in 2024 and is projected to reach USD 20.6 billion by 2034.

- The rising demand for minimally invasive surgery is expected to drive the healthcare robotics-surgical robots market over the forecast period.

- Based on the application, the orthopedic surgery segment is expected to capture the largest market share over the projected period.

- Based on the end user, the hospitals segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Healthcare Robotics-Surgical Robots Market: Overview

Healthcare robots are a big step forward in modern surgery. These new robotic tools make procedures easier and more accurate, enabling surgeons to perform them better than before. Surgical robots offer superior imaging and less-invasive tools, enabling treatments with fewer cuts than traditional procedures. Healthcare robots are making surgery safer for patients, more precise, and less invasive. Many types of therapy, such as laparoscopic surgery, robotic-assisted prostatectomies, and gynecological surgery, use surgical robots. All of these surgeries are minimally invasive. Healthcare robots could make surgery more precise, quicker, and safer for patients in the future. As technology improves, surgical robots become wiser. They now use machine learning and AI to support surgeons during complex surgeries.

Healthcare Robotics-Surgical Robots Market Dynamics

Growth Drivers

Why does the rising demand for Minimally Invasive Surgeries (MIS) drive the healthcare robotics-surgical robots market growth?

There are numerous primary reasons why the healthcare robotics-surgical robots market is growing. One of the important factors includes the increasing population demand for minimally invasive operations (MIS). Compared to regular open surgery, MIS has fewer cuts, less trauma, less pain, faster recovery times, and a lower risk of complications. Because of these benefits, more patients are seeking less invasive treatments to heal faster. This directly leads to the development of robotic surgical systems that make these surgeries more precise and improve outcomes.

Robotic surgical instruments enhance minimally invasive surgery (MIS) by offering surgeons greater freedom, improved visualization, and greater accuracy during complex procedures. This leads to fewer difficulties, shorter hospital stays, and cheaper healthcare costs. This need is also growing since more people are getting chronic diseases, the population is getting older, and more outpatient (ambulatory) surgical clinics are opening that prefer robotic-assisted operations. Surgical robots are becoming increasingly valuable worldwide due to new technologies such as AI integration, 3D imaging, and improved haptic feedback.

Restraints

High cost of robotic systems impedes market growth

The high cost of robotic surgical systems makes it hard for the market to grow. This is because buying them requires a significant upfront investment in advanced robotics technology, AI and machine learning integration, and high-quality surgical equipment. Also, ongoing costs such as maintenance, software upgrades, specialized training for surgeons and operating room staff, and the need for a complex operating room setup add to the total cost. These high prices make it hard for many healthcare providers to buy robotic systems. This is especially true for mid-sized hospitals and facilities in low- and middle-income areas. This stops broad use even when there are therapeutic benefits. Thus, it hampered the growth of the healthcare robotics-surgical robots market growth.

Opportunities

Do technological advancements offer a potential opportunity for the healthcare robotics-surgical robots industry growth?

The surgical robotics market has significant growth potential driven by technological advances that make surgeries more accurate, safe, and efficient. Robotic technologies may now provide real-time information, support preoperative planning, and assist with decision-making during surgery. This reduces human error and improves results. Advanced imaging technologies such as high-resolution 3D visualization, augmented reality (AR), and virtual reality make it easier for surgeons to navigate during surgery and perform more complex procedures more accurately.

For instance, in October 2025, Johnson & Johnson MedTech, a world leader in surgical technologies and solutions, announced that it was making progress on developing the company's robotics systems with physical artificial intelligence (AI) technologies that make fake environments to speed up future product development, make clinical workflows more efficient, and improve training for clinical teams.

Challenges

Will high procedural costs for patients pose a major challenge to the healthcare robotics-surgical robots market expansion?

The high cost of procedures for patients is a significant obstacle to the growth of the surgical robotics company, as it makes robotic-assisted surgeries less available and less affordable to a broader range of people. These operations usually cost more than traditional ones because robotic technology, disposable tools, and longer operating times all increase healthcare costs. Patients, especially those living in low- and middle-income areas or without full insurance coverage, may have to pay out of pocket, which reduces their likelihood of receiving robotic surgery. Therefore, the above factor poses a major challenge to the healthcare robotics-surgical robots market.

Healthcare Robotics-Surgical Robots Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Healthcare Robotics-Surgical Robots Market |

| Market Size in 2024 | USD 5.2 Billion |

| Market Forecast in 2034 | USD 20.6 Billion |

| Growth Rate | CAGR of 14.8% |

| Number of Pages | 215 |

| Key Companies Covered | Intuitive Surgical, Medtronic, Johnson and Johnson, Google Life Sciences, Stryker, TransEnterix, Mazor Robotics, Hansen Medical, Zimmer Biomet Holdings Inc., CMR Surgical, Asensus Surgical, Medrobotics, THINK Surgical Inc., Ekso Bionics Holdings Inc., Meerecompany Inc., Asimov Robotics, and others. |

| Segments Covered | By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Healthcare Robotics-Surgical Robots Market: Segmentation

The global healthcare robotics-surgical robots industry is segmented based on application, end-user, and region.

Based on the application, the global healthcare robotics-surgical robots market is bifurcated into gynecological surgery, urological surgery, neurosurgery, orthopedic surgery, and general surgery. The orthopedic surgery segment is expected to dominate the market. Robotic technologies offer enhanced precision, superior outcomes, and less invasive approaches for complex orthopedic procedures, such as joint replacements and spinal surgery. As orthopedic problems, including osteoarthritis, fractures, and degenerative bone diseases, become more common, the need for surgery grows. This speeds up the use of robotic-assisted surgeries, which minimize recovery periods and complications.

Based on the end-user, the global healthcare robotics-surgical robots industry is bifurcated into hospitals and ambulatory surgery centers. The hospitals segment holds the major market share because it requires high-precision surgical solutions that improve patient outcomes, reduce complications, shorten recovery times, and enhance operational efficiency. Factors such as increasing healthcare infrastructure, regulatory approvals, and reimbursement policies also support market expansion.

Healthcare Robotics-Surgical Robots Market: Regional Analysis

What helps North America dominate the healthcare robotics-surgical robots market over the projected period?

The North America region is expected to dominate the healthcare robotics-surgical robots market. This is primarily due to its excellent healthcare system, rapid adoption of new medical technologies, and significant investments in research and development. The area boasts a well-established network of tier-I hospitals and medical facilities that are the first to deploy the newest surgical robotic equipment. In addition, the presence of significant industry players, a friendly regulatory framework, and high healthcare spending all help the market grow faster.

However, the Asia Pacific is expected to grow at the fastest rate over the projected period, driven by healthcare infrastructure investment and the increasing adoption of surgical robots. For instance, according to the International Federation of Robotics (IFR), the number of deployed medical robots in Asia increased by 28% in 2020, with China accounting for 41% of the total. Thus, the above stats offer a potential opportunity for market growth in the area.

Healthcare Robotics-Surgical Robots Market: Competitive Analysis

The global healthcare robotics-surgical robots market is dominated by players like:

- Intuitive Surgical

- Medtronic

- Johnson and Johnson

- Google Life Sciences

- Stryker

- TransEnterix

- Mazor Robotics

- Hansen Medical

- Zimmer Biomet Holdings Inc.

- CMR Surgical

- Asensus Surgical

- Medrobotics

- THINK Surgical Inc.

- Ekso Bionics Holdings Inc.

- Meerecompany Inc.

- Asimov Robotics

The global healthcare robotics-surgical robots market is segmented as follows:

By Application

- Gynecological Surgery

- Urological Surgery

- Neurosurgery

- Orthopedic Surgery

- General Surgery

By End User

- Hospitals

- Ambulatory Surgery Centers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Healthcare robots are a big step forward in modern surgery. These new robotic tools make procedures easier and more accurate, enabling surgeons to perform them better than before. Surgical robots offer superior imaging and less-invasive tools, enabling treatments with fewer cuts than traditional procedures.

The key drivers for the healthcare robotics-surgical robots market include the rising demand for minimally invasive surgeries, which offer benefits such as shorter recovery times and fewer complications.

The healthcare robotics-surgical robots market faces challenges such as the high capital cost of purchasing and maintaining robotic systems, which limits adoption, especially in smaller hospitals and developing countries.

Based on the end user, the hospitals segment is expected to dominate the healthcare robotics-surgical robots market growth during the projected period.

The growing technological collaboration and R&D investment pose a major impact factor for the healthcare robotics-surgical robots industry's growth over the projected period.

Regulatory factors significantly shaping the healthcare robotics-surgical robots market include stringent safety and efficacy requirements by agencies such as the U.S. FDA, which mandates extensive clinical trials and approvals before new robotic systems can enter the market.

To stay competitive in the healthcare robotics-surgical robots market, stakeholders should adopt strategies focused on innovation, collaboration, and market expansion. They should invest in continuous R&D to develop next-generation robotic systems with enhanced precision, AI integration, improved visualization, and flexible instrument options that address unmet surgical needs.

According to the report, the global healthcare robotics-surgical robots market size was worth around USD 5.2 billion in 2024 and is predicted to grow to around USD 20.6 billion by 2034.

The global healthcare robotics-surgical robots market is expected to grow at a CAGR of 14.8% during the forecast period.

The global healthcare robotics-surgical robots industry growth is expected to be led by North America over the forecast period.

The global healthcare robotics-surgical robots market is dominated by players like Intuitive Surgical, Medtronic, Johnson and Johnson, Google Life Sciences, Stryker, TransEnterix, Mazor Robotics, Hansen Medical, Zimmer Biomet Holdings, Inc., CMR Surgical, Asensus Surgical, Medrobotics, THINK Surgical, Inc., Ekso Bionics Holdings Inc., Meerecompany Inc., and Asimov Robotics, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed