Dental Imaging System Market Size, Share, Analysis, Trends, Growth, 2032

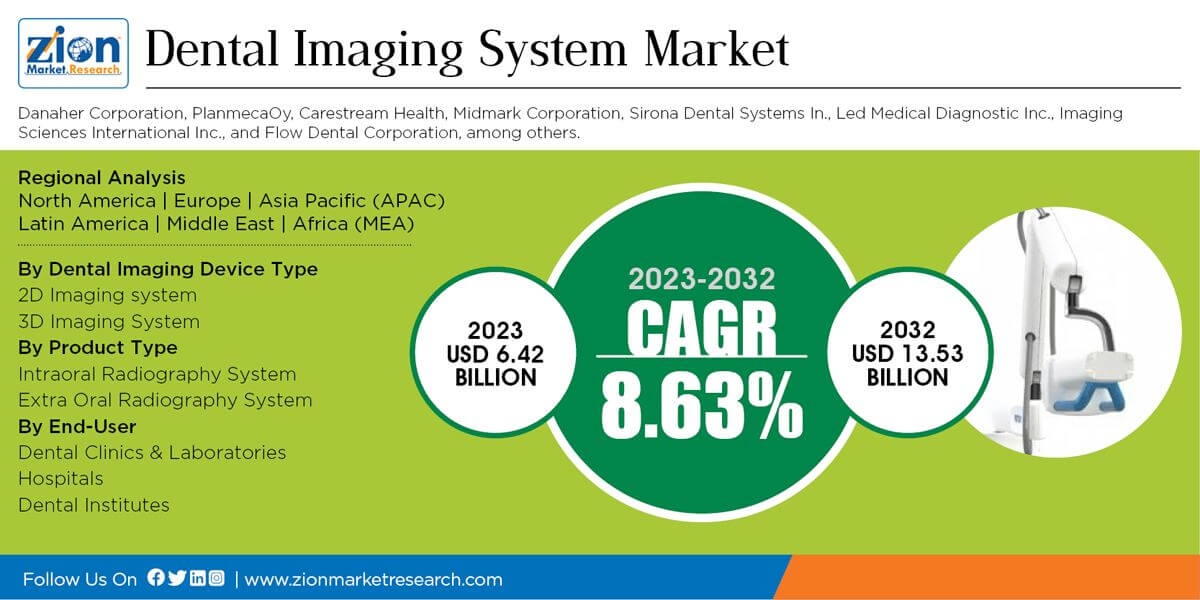

Dental Imaging System Market By Dental Imaging Device Type (2D And 3D Imaging System), Product Type (Intraoral And Extra Oral Radiography System) And By End Users (Dental Clinics & Laboratories, Hospitals, And Dental Institutes), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032

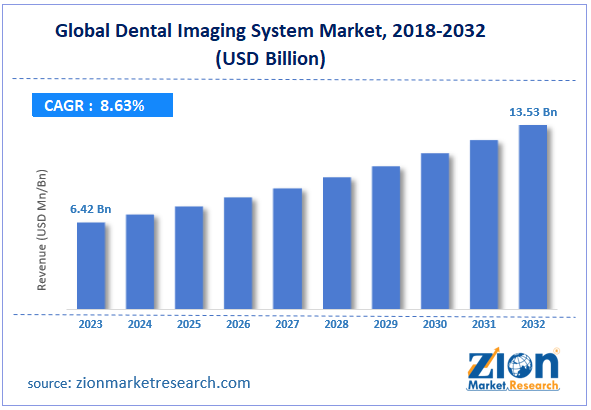

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.42 Billion | USD 13.53 Billion | 8.63% | 2023 |

Dental Imaging System Industry Perspective:

The global Dental Imaging System Market size was worth around USD 6.42 Billion in 2023 and is predicted to grow to around USD 13.53 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.63% between 2024 and 2032.

Key Insights

- As per the analysis shared by our research analyst, the dental imaging system market is anticipated to grow at a CAGR of 8.63% during the forecast period.

- The global dental imaging system market was estimated to be worth approximately USD 6.42 billion in 2023 and is projected to reach a value of USD 13.53 billion by 2032.

- The growth of the dental imaging system market is being driven by increasing demand for accurate diagnostics, early detection of oral diseases, and advanced treatment planning in dentistry.

- Based on the dental imaging device type, the 2d imaging system segment is growing at a high rate and is projected to dominate the market.

- On the basis of product type, the intraoral radiography system segment is projected to swipe the largest market share.

- In terms of end-user, the dental clinics & laboratories segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

The report analyzes the global Dental Imaging System Market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Dental Imaging System industry.

Dental Imaging System Market: Overview

The term "dental imaging system market" refers to the sector within the healthcare business that is responsible for the creation, production, and distribution of a variety of imaging technologies that are specifically tailored for dental purposes. Dental imaging systems are extremely important in the field of dentistry because they offer detailed visualizations of the oral and maxillofacial regions. These visualizations have a significant impact on the diagnosis, treatment planning, and monitoring of a variety of dental problems. Intraoral cameras, panoramic X-rays, cone-beam computed tomography (CBCT), and digital radiography are some of the imaging devices that are included in this category.

The market is comprised of a diverse assortment of various products and services that are provided by businesses that are engaged in the production of dental imaging equipment, software solutions, and accessories that are associated with it. Dental practitioners, dental clinics, imaging centers, and producers of dental imaging technologies are among the most important stakeholders in this market. In recent years, the market for dental imaging systems has witnessed major developments, including a transition from traditional film-based imaging to digital technology. These advancements have resulted in better diagnostic accuracy, efficiency, and patient comfort. Several reasons have an impact on the market, including technical advancements, the growing incidence of dental problems, and the general trend toward digitalization in the healthcare industry.

The report covers forecasts and analysis for the dental imaging system market on a global and regional level. The study provides historical data from 2018 along with forecasts from 2023 – 2032 based on the revenue (USD Million). The study includes drivers and restraints for the dental imaging system market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the dental imaging system market on a global level.

To give the users of this report a comprehensive view of the dental imaging system market, we have included a competitive landscape and analysis of Porter’s Five Forces model for the market study. The study encompasses a market attractiveness analysis, where product type, dental imaging device type, and end-user segments are benchmarked based on the market size, growth rate, and general attractiveness.

The report provides a company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including mergers & acquisitions, the launch of new technology, agreements, partnerships, collaboration & joint ventures, and technology, and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers price trend analysis, and the product portfolio of various companies according to the region.

Dental Imaging System Market: Growth Factors

Several important aspects have contributed to the substantial expansion that the dental imaging system market has enjoyed. The diagnostic precision of imaging technologies, such as digital radiography and cone-beam computed tomography (CBCT), has significantly improved, and the amount of radiation exposure has been significantly lowered, as a result of technological improvements. A growing awareness of the need for early detection, in conjunction with the rising prevalence of dental problems, has led to an increase in the demand for advanced imaging technologies. An additional factor that has contributed to the growth of the market is the increasing prevalence of dental problems among the world's elderly population.

As a result of the widespread adoption of digital dentistry and the incorporation of artificial intelligence (AI) and machine learning (ML) into imaging systems, diagnostic capabilities, and treatment planning have been significantly improved, which has contributed to the expansion of the industry. In addition, the use of dental imaging equipment has been driven in large part by measures taken by the government, the growing trend of dental tourism, and the preference for least invasive operations. Additionally, the trajectory of the market is impacted by the expansion of the economy, the enhancement of the healthcare infrastructure, and the growing awareness among patients regarding the need to maintain regular dental treatments.

Dental Imaging System Market: Restraints

The market for dental imaging systems is seeing substantial expansion; however, it is also facing various restrictions that could potentially impair its trajectory. The high initial cost that is involved with the acquisition and implementation of advanced imaging technologies is one of the key challenges that must be overcome. This can be a challenge, especially for dental offices that are on the smaller side or those that are located in areas with limited economic resources. In addition, worries over radiation exposure continue to be a barrier, even though contemporary technology has helped to lower the risk of radiation exposure. Some patients and practitioners are concerned about the long-term effects of radiation exposure. Several factors can limit wider adoption, including the difficulty of incorporating new technologies into preexisting processes and the requirement that healthcare personnel receive specialized training.

There is a possibility that market participants would experience uncertainty as a result of regulatory obstacles and differing reimbursement policies in different locations. Additionally, in many emerging nations, there is a lack of understanding regarding the advantages of modern dental imaging systems, and there is also a general lack of access to quality healthcare facilities. Both of these factors present hurdles to the expansion of the market. As the industry works to overcome these limitations, strategic initiatives and innovations will be essential to overcoming these obstacles and ensuring that the market continues to expand sustainably.

Recent Development

- In March and June 2025, Planmeca launched multiple new products and a major software upgrade. Planmeca reinforced its position as an innovation leader by launching the Planmeca Romexis 7 software, which features integrated AI automation.

- In 2023, 3Shape made key advancements, including the acquisition of lab management software provider LabStar in January and an expanded workflow integration with Dentsply Sirona in September, which connected TRIOS/Unite with the DS Core platform for scan-to-lab workflows.

- In January 2022, 3Shape announced a partnership with Colgate-Palmolive to integrate the 3Shape Unite platform for personalized tooth whitening.

- In January 2021, Dentsply Sirona acquired Datum Dental, adding the innovative OSSIX® regenerative product line and bolstering its Implants segment. This was a positive step toward becoming a leader in dental regeneration.

Dental Imaging System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dental Imaging System Market Research Report |

| Market Size in 2023 | USD 6.42 Billion |

| Market Forecast in 2032 | USD 13.53 Billion |

| Growth Rate | CAGR of 8.63% |

| Number of Pages | 255 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Danaher Corporation, PlanmecaOy, Carestream Health, Midmark Corporation, Sirona Dental Systems In., Led Medical Diagnostic Inc., Imaging Sciences International Inc., and Flow Dental Corporation, among others. |

| Segments Covered | By Product Type, By Dental Imaging Device Type, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dental Imaging System Market: Segmentation

The study provides a decisive view of the dental imaging system market by segmenting it based on the product type, dental imaging device type, end users, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024– 2032. Based on product type, the market is segmented into intraoral and extraoral radiography systems. Dental imaging device types include 2D and 3D imaging systems. End users segment include dental clinics & laboratories, hospitals, and dental institutes. The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America with its further bifurcation into major countries including the U.S., Canada, Germany, France, the UK, China, Japan, India, Brazil, and Argentina. This segmentation includes demand for dental imaging systems based on the individual product type, dental imaging device type, and end users in all regions and countries.

Dental Imaging System Market: Competitive Space

The report also includes detailed profiles of key players such as

- Danaher Corporation

- PlanmecaOy

- Carestream Health

- Midmark Corporation

- Sirona Dental Systems In.

- Led Medical Diagnostic Inc.

- Imaging Sciences International Inc.

- Flow Dental Corporation

- among Others

This report segments the global dental imaging market as follows:

By Dental Imaging Device Type

- 2D Imaging system

- 3D Imaging System

By Product Type

- Intraoral Radiography System

- Extra Oral Radiography System

By End-User

- Dental Clinics & Laboratories

- Hospitals

- Dental Institutes

Global Dental Imaging Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Dental imaging systems use technology and equipment to capture detailed oral and maxillofacial images. Intraoral cameras, panoramic X-rays, CBCT, and digital radiography are examples. Dental imaging technologies increase accuracy, efficiency, and patient comfort over film-based approaches for diagnosing and planning treatments.

Technological advances, rising dental disorders, adoption of digital dentistry, integration of AI and ML, aging population, government initiatives, economic development, and the trend toward minimally invasive procedures drive dental imaging system market growth. These factors drive need for improved imaging systems, driving dental imaging system market expansion.

According to a study, the global dental imaging system industry size was $6.42 billion in 2023 and is projected to reach $13.53 billion by the end of 2032.

The global dental imaging system market is anticipated to record a CAGR of nearly 8.63% from 2024 to 2032.

North America is likely to dominate the market because of its strong healthcare infrastructure, high adoption of innovative dental technology, well-established dental care industry, and strong research and development focus.

The report also includes detailed profiles of key players such as Danaher Corporation, PlanmecaOy, Carestream Health, Midmark Corporation, Sirona Dental Systems In., Led Medical Diagnostic Inc., Imaging Sciences International Inc., and Flow Dental Corporation, among others.

The global dental imaging system market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

List of Contents

Industry Perspective:Key InsightsOverviewGrowth FactorsRestraintsRecent DevelopmentReport ScopeSegmentationCompetitive SpaceThis report segments the global dental imaging market as follows:By Dental Imaging Device TypeByProduct TypeBy End-UserGlobal Dental Imaging Regional Segment AnalysisRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed